Landlord Household Insurance

Landlord household insurance is a vital aspect of property ownership and management, offering protection and peace of mind to landlords and their tenants. In today's dynamic real estate market, understanding the intricacies of landlord insurance is crucial for ensuring the security and longevity of rental properties. This comprehensive guide aims to delve into the nuances of landlord insurance, exploring its benefits, coverage options, and real-world applications. By providing an in-depth analysis, we aim to empower landlords with the knowledge to make informed decisions, navigate potential risks, and maximize the benefits of this essential insurance coverage.

Understanding Landlord Insurance

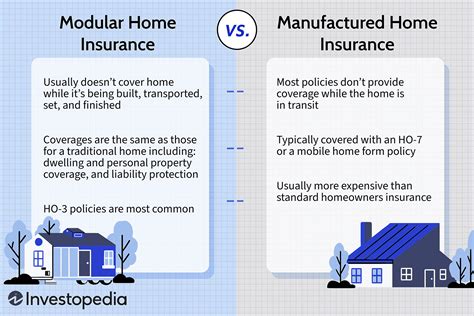

Landlord insurance, also known as rental property insurance, is a specialized form of insurance tailored to meet the unique needs of property owners who rent out their residential spaces. Unlike traditional homeowners’ insurance, landlord insurance is designed to address the specific risks and liabilities associated with renting properties. This comprehensive coverage provides protection against a wide range of potential issues, from property damage to legal liabilities, ensuring that landlords can manage their rental businesses with confidence and security.

Key Benefits of Landlord Insurance

The benefits of landlord insurance are extensive and far-reaching, offering a safety net for landlords and their tenants alike. One of the primary advantages is the protection against property damage. Whether it’s a burst pipe, a storm-related incident, or even malicious damage caused by tenants, landlord insurance can cover the costs of repairs, replacements, and renovations. This ensures that the property is maintained to a high standard, enhancing its value and attractiveness to prospective tenants.

Additionally, landlord insurance provides crucial liability coverage. In the event of accidents or injuries on the rental property, landlords can face significant legal and financial consequences. Landlord insurance steps in to protect the landlord's personal assets, covering legal fees and potential damages, thereby mitigating the financial burden and providing a layer of security against unexpected legal battles.

Another notable benefit is the protection against tenant-related issues. Landlord insurance can cover rent defaults, providing a financial safety net during periods when tenants are unable or unwilling to pay rent. Furthermore, it often includes coverage for eviction expenses, helping landlords navigate the complex and often costly process of removing problem tenants from their properties.

Coverage Options in Landlord Insurance

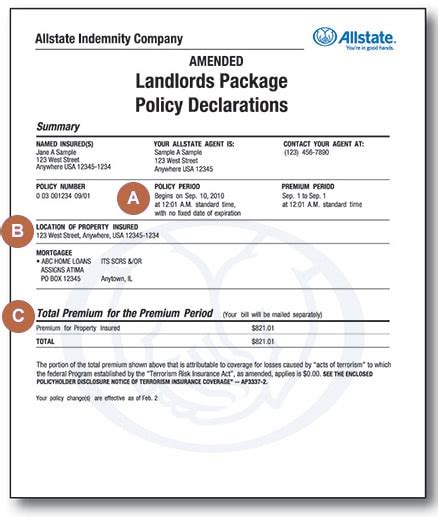

Landlord insurance offers a range of coverage options, allowing property owners to tailor their policies to meet the specific needs of their rental properties. One of the most critical aspects is property coverage, which protects the physical structure of the building and its contents. This includes coverage for the dwelling itself, as well as any outbuildings, fixtures, and fittings. Property coverage also extends to personal property owned by the landlord and located on the rental premises, such as appliances, furniture, and equipment.

Liability coverage is another crucial component of landlord insurance. It provides protection against claims arising from accidents or injuries on the rental property. This can include medical expenses, pain and suffering, and legal costs associated with defending against such claims. Liability coverage is especially important in high-risk areas or properties with common areas that attract a high volume of visitors.

Loss of rental income is a significant concern for landlords, especially during periods of unexpected vacancy or when tenants default on rent payments. Landlord insurance often includes coverage for loss of rental income, providing a steady stream of income to cover mortgage payments, property taxes, and other expenses during these challenging times. This coverage ensures that landlords can maintain their financial stability even when faced with temporary rental income loss.

Additional Coverage Options

Landlord insurance policies can be further customized with additional coverage options to address specific needs and concerns. For instance, landlords can opt for coverage against water damage, which is particularly relevant in areas prone to flooding or heavy rainfall. This coverage can protect against the costs of repairing water damage, as well as the potential health hazards associated with mold and mildew.

Another valuable addition is coverage for personal property of tenants. While it is primarily the tenant's responsibility to insure their belongings, landlord insurance can offer an optional add-on to cover tenant's personal property in the event of theft, fire, or other covered perils. This additional coverage can enhance tenant satisfaction and loyalty, as it provides them with added peace of mind.

For landlords with multiple rental properties or those who manage properties on behalf of others, umbrella liability coverage is a prudent option. This coverage provides an extra layer of protection beyond the limits of the primary landlord insurance policy, offering enhanced liability protection for a wide range of potential claims.

| Coverage Type | Description |

|---|---|

| Property Coverage | Protects the physical structure and contents of the rental property. |

| Liability Coverage | Provides protection against claims arising from accidents or injuries on the property. |

| Loss of Rental Income | Covers income loss during periods of vacancy or tenant default. |

| Water Damage Coverage | Protects against costs of repairing water damage and associated health hazards. |

| Tenant's Personal Property Coverage | Covers tenant's belongings in the event of theft, fire, or other perils. |

| Umbrella Liability Coverage | Provides an extra layer of liability protection for landlords with multiple properties. |

Real-World Applications and Case Studies

To illustrate the practical benefits of landlord insurance, let’s explore a few real-world scenarios and case studies. These examples will highlight how landlord insurance can provide crucial support and protection in various situations.

Case Study 1: Natural Disaster

Imagine a landlord who owns a rental property in an area prone to hurricanes. Despite taking all necessary precautions, a powerful storm strikes, causing significant damage to the rental unit. The landlord’s property coverage in their landlord insurance policy kicks in, covering the costs of repairs and replacements. This allows the landlord to quickly restore the property to its pre-storm condition, minimizing disruption to tenants and ensuring a swift return to normalcy.

Case Study 2: Legal Liability

In another scenario, a landlord faces a legal liability claim after a tenant slips and falls on a poorly maintained staircase. The tenant sues the landlord for significant damages, including medical expenses and pain and suffering. Fortunately, the landlord’s liability coverage steps in to cover the legal fees and potential damages, shielding the landlord’s personal assets from financial ruin. This case study underscores the critical role of liability coverage in landlord insurance.

Case Study 3: Tenant-Related Issues

A landlord experiences a series of tenant-related challenges, including rent defaults and eviction expenses. The landlord’s landlord insurance policy includes coverage for rent defaults, providing a financial buffer during periods of non-payment. Additionally, the policy covers eviction expenses, helping the landlord navigate the legal process and recover possession of the property. This real-world example demonstrates how landlord insurance can provide comprehensive support in managing tenant-related issues.

Expert Insights and Best Practices

Based on our industry expertise and real-world experience, we’ve compiled a set of best practices and expert insights to help landlords maximize the benefits of their landlord insurance coverage.

Best Practices for Landlord Insurance

- Regularly Review and Update Policies: Landlord insurance policies should be reviewed annually to ensure they align with the changing needs and risks associated with the rental property. This includes updating coverage limits, adding new coverage options, and reflecting any changes in the property’s value or rental income.

- Conduct Thorough Property Inspections: Regular property inspections can help identify potential risks and maintenance issues. By addressing these proactively, landlords can minimize the likelihood of insurance claims and ensure the property remains in good condition.

- Maintain Detailed Records: Keeping accurate and up-to-date records of the rental property, including maintenance logs, lease agreements, and insurance documents, is essential. These records can provide valuable evidence in the event of an insurance claim, streamlining the claims process and ensuring a smoother resolution.

- Choose a Reputable Insurance Provider: Selecting a reputable and financially stable insurance provider is crucial. Research and compare different providers, considering their track record in handling claims, customer service reputation, and the breadth of coverage options they offer.

Future Implications and Industry Trends

As the real estate market continues to evolve, landlord insurance is poised to play an even more significant role in protecting rental properties and their owners. Here are some key future implications and industry trends to watch:

- Increasing Climate Risks: With the growing impact of climate change, landlords may face heightened risks from natural disasters such as hurricanes, floods, and wildfires. Landlord insurance policies will need to adapt to provide adequate coverage for these emerging risks, ensuring landlords can recover and rebuild in the aftermath of such events.

- Rising Legal Costs: The cost of legal fees and the complexity of legal processes are likely to increase, making liability coverage an even more critical component of landlord insurance. Landlords should carefully assess their liability coverage limits and consider additional protection through umbrella policies to safeguard against escalating legal expenses.

- Technological Advancements: The insurance industry is embracing technological innovations, and landlord insurance is no exception. From digital policy management and claims processing to the use of data analytics for risk assessment, technology will continue to enhance the efficiency and effectiveness of landlord insurance, providing better protection and a smoother customer experience.

Conclusion: Empowering Landlords with Knowledge

Landlord household insurance is a powerful tool in the hands of property owners, offering a comprehensive safety net against a wide range of risks and liabilities. By understanding the benefits, coverage options, and real-world applications of landlord insurance, landlords can make informed decisions, protect their investments, and provide a secure and attractive rental environment for their tenants.

This guide has provided an in-depth exploration of landlord insurance, highlighting its critical role in the real estate industry. As the market evolves, landlords who stay informed and adapt their insurance strategies will be better positioned to navigate the challenges and opportunities that lie ahead. With the right landlord insurance coverage, property owners can focus on growing their rental businesses with confidence and peace of mind.

How much does landlord insurance typically cost?

+

The cost of landlord insurance can vary significantly depending on factors such as the location of the property, the value of the property, the level of coverage required, and the insurer. On average, landlords can expect to pay anywhere from 500 to 2,000 annually for a basic policy. However, the cost can be higher or lower based on the specific circumstances and coverage needs of the rental property.

What is the difference between landlord insurance and traditional homeowners’ insurance?

+

Landlord insurance and traditional homeowners’ insurance differ in their primary purpose and scope of coverage. Homeowners’ insurance is designed to protect the policyholder’s personal residence, while landlord insurance is tailored to protect rental properties. Landlord insurance provides coverage for the physical structure, liability, and potential loss of rental income, making it more comprehensive for rental properties.

Can landlord insurance cover rental properties in high-risk areas, such as flood zones or wildfire-prone regions?

+

Yes, landlord insurance can cover rental properties in high-risk areas. However, it’s important to note that the coverage for specific risks like floods or wildfires may require additional endorsements or separate policies. Landlords should carefully assess the risks associated with their properties and work with their insurance providers to ensure they have adequate coverage for these unique challenges.

How often should landlords review and update their insurance policies?

+

Landlords should review their insurance policies annually to ensure they remain up-to-date and aligned with the changing needs and risks associated with their rental properties. Factors such as property value fluctuations, changes in rental income, or new risks that emerge over time may necessitate adjustments to the policy. Regular reviews help landlords maintain adequate coverage and avoid gaps in protection.

What steps can landlords take to mitigate insurance costs while maintaining adequate coverage?

+

Landlords can take several steps to reduce insurance costs while still maintaining adequate coverage. These include implementing property maintenance best practices to minimize the risk of claims, choosing a higher deductible to lower premiums, and bundling insurance policies (e.g., combining landlord insurance with personal auto or homeowners’ insurance) to potentially qualify for multi-policy discounts.