Legal And General Insurance

Unveiling Legal & General's Comprehensive Insurance Solutions

Legal & General Insurance, a prominent player in the global insurance industry, offers a diverse range of products and services designed to protect individuals, businesses, and communities. With a rich history spanning decades, Legal & General has established itself as a trusted provider, ensuring financial security and peace of mind for its customers. In this comprehensive guide, we will delve into the world of Legal & General Insurance, exploring their offerings, expertise, and impact on various sectors.

The Legal & General Insurance Portfolio

Legal & General's insurance portfolio is vast and versatile, catering to a wide spectrum of needs. Let's explore some of their key offerings:

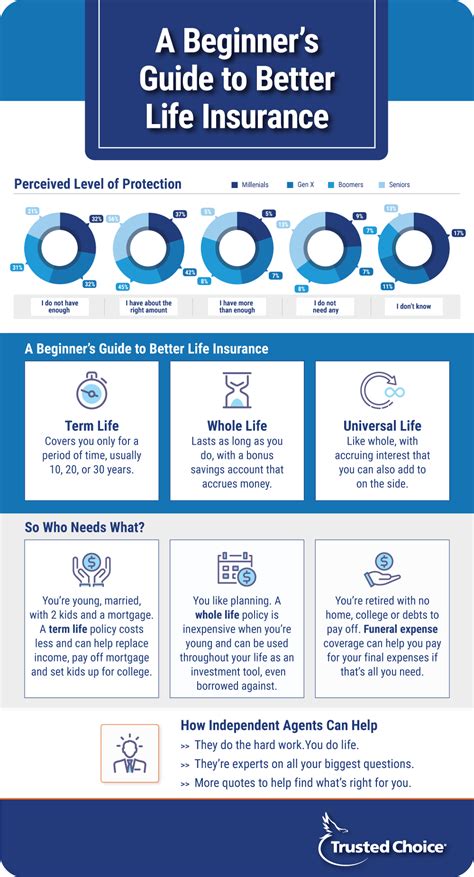

Life Insurance and Protection

Legal & General is renowned for its life insurance solutions, providing individuals and families with financial protection in the event of unforeseen circumstances. Their life insurance plans offer coverage for various needs, including term life insurance, whole life policies, and critical illness protection. With customizable options and competitive premiums, Legal & General ensures that customers can secure their loved ones’ futures.

One unique aspect of their life insurance plans is the focus on holistic protection. Legal & General offers riders and additional benefits that cover not just death but also disability, accidental injuries, and even critical illnesses. This comprehensive approach ensures that policyholders are prepared for a range of life events.

| Policy Type | Coverage Highlights |

|---|---|

| Term Life Insurance | Flexible terms, affordable premiums, and the option to convert to permanent coverage. |

| Whole Life Insurance | Lifetime coverage, cash value accumulation, and the potential for dividend payouts. |

| Critical Illness Cover | Protection against specific illnesses, with payouts to cover treatment costs and living expenses. |

Health and Medical Insurance

In the realm of health insurance, Legal & General offers a range of plans designed to meet the diverse needs of individuals and businesses. From comprehensive health coverage to specialized plans for specific conditions, their portfolio is extensive.

One standout feature is their focus on preventative care. Legal & General's health insurance plans often include incentives and discounts for policyholders who maintain healthy lifestyles. This encourages customers to take proactive steps towards their well-being, reducing the risk of chronic diseases and promoting overall health.

| Health Insurance Type | Key Benefits |

|---|---|

| Individual Health Plans | Customizable coverage, including options for dental, vision, and prescription drug benefits. |

| Group Health Insurance | Cost-effective plans for employers, with the option to tailor benefits to employee needs. |

| Travel Health Insurance | Coverage for medical emergencies and trip cancellations, ideal for frequent travelers. |

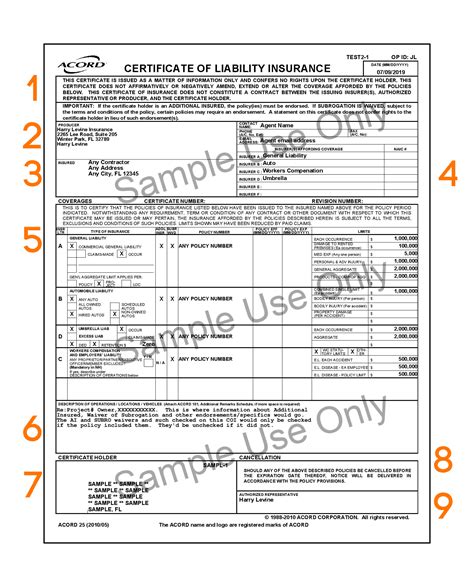

Property and Casualty Insurance

Legal & General’s property and casualty insurance division provides protection for homes, vehicles, and businesses. Their comprehensive policies ensure that customers are safeguarded against a wide range of risks, from natural disasters to theft and liability claims.

What sets Legal & General apart in this domain is their innovative use of technology. They leverage advanced analytics and risk assessment tools to offer highly accurate and personalized insurance quotes. This technology-driven approach ensures that customers receive fair and competitive premiums based on their unique circumstances.

| Property & Casualty Coverage | Notable Features |

|---|---|

| Homeowner's Insurance | Coverage for structural damage, personal belongings, and liability, with optional add-ons for flood and earthquake protection. |

| Auto Insurance | Comprehensive, collision, and liability coverage, with discounts for safe driving and vehicle safety features. |

| Business Insurance | Customizable plans for small businesses, covering property, liability, and business interruption risks. |

Specialty Insurance Solutions

Legal & General goes beyond traditional insurance products, offering specialty solutions tailored to unique needs. These include insurance for high-value items like jewelry and fine art, as well as coverage for specific industries such as agriculture, maritime, and energy.

For instance, their marine insurance division provides coverage for vessels, cargo, and maritime liability. This specialized insurance is essential for businesses involved in maritime trade, offering protection against the unique risks associated with ocean transportation.

Legal & General's Impact and Expertise

Legal & General Insurance's impact extends far beyond their comprehensive product offerings. They are known for their commitment to community engagement and sustainability. The company actively supports initiatives aimed at improving financial literacy, promoting healthy lifestyles, and fostering environmental responsibility.

Moreover, Legal & General's expertise in risk assessment and management has led to collaborations with governments and regulatory bodies. Their insights and data-driven approaches have shaped policies and regulations, contributing to a more robust and resilient insurance industry.

The Future of Insurance with Legal & General

As the insurance landscape continues to evolve, Legal & General remains at the forefront of innovation. They are investing heavily in technology, leveraging artificial intelligence and machine learning to enhance their underwriting processes and customer experiences.

One exciting development is their focus on parametric insurance. This innovative approach uses predefined triggers and parameters to provide rapid payouts in the event of a covered loss. By removing the need for lengthy claim assessments, parametric insurance offers a more efficient and reliable way to provide financial protection.

Furthermore, Legal & General is exploring the potential of blockchain technology to enhance insurance contracts and claim processes. This technology can improve transparency, reduce fraud, and streamline administrative tasks, ultimately benefiting both policyholders and insurers.

Conclusion: Navigating Life's Uncertainties with Legal & General

Legal & General Insurance stands as a trusted partner, offering a comprehensive suite of insurance solutions to navigate life's complexities. From life and health insurance to property protection and specialty coverage, their expertise and innovation ensure that customers can face the future with confidence.

With a focus on community impact, sustainability, and technological advancement, Legal & General is not just an insurance provider but a catalyst for positive change. As they continue to evolve, their commitment to financial security and well-being remains unwavering.

How can Legal & General’s life insurance plans benefit me and my family?

+Legal & General’s life insurance plans provide financial security and peace of mind. They offer customizable coverage to protect your loved ones in the event of your passing, disability, or critical illness. With affordable premiums and the option to add riders, you can tailor the plan to your specific needs, ensuring your family’s future is secure.

What makes Legal & General’s health insurance plans unique?

+Legal & General’s health insurance plans stand out for their focus on preventative care. They offer incentives and discounts for maintaining a healthy lifestyle, encouraging policyholders to take proactive steps towards their well-being. Additionally, their plans are highly customizable, allowing you to choose the coverage that best suits your needs.

How does Legal & General’s technology-driven approach benefit customers in property and casualty insurance?

+Legal & General’s advanced analytics and risk assessment tools enable them to offer highly accurate and personalized insurance quotes. This means customers receive fair and competitive premiums based on their unique circumstances. Additionally, their technology streamlines the underwriting process, providing a more efficient and seamless customer experience.

What specialty insurance solutions does Legal & General offer, and how do they benefit specific industries?

+Legal & General offers a range of specialty insurance solutions, including coverage for high-value items like jewelry and fine art, as well as industry-specific insurance for sectors like agriculture, maritime, and energy. These specialized policies ensure businesses in these sectors can operate with confidence, knowing they are protected against unique risks associated with their industry.