Liability Insurance For Car Rental

Navigating the world of car rentals often entails a myriad of considerations, one of which is liability insurance. This form of coverage, designed to protect you in the event of an accident, is an essential aspect of the rental process. However, understanding the intricacies of liability insurance and ensuring you have adequate coverage can be a complex task. This comprehensive guide aims to unravel the complexities, providing you with the knowledge to make informed decisions when renting a car.

Understanding Liability Insurance

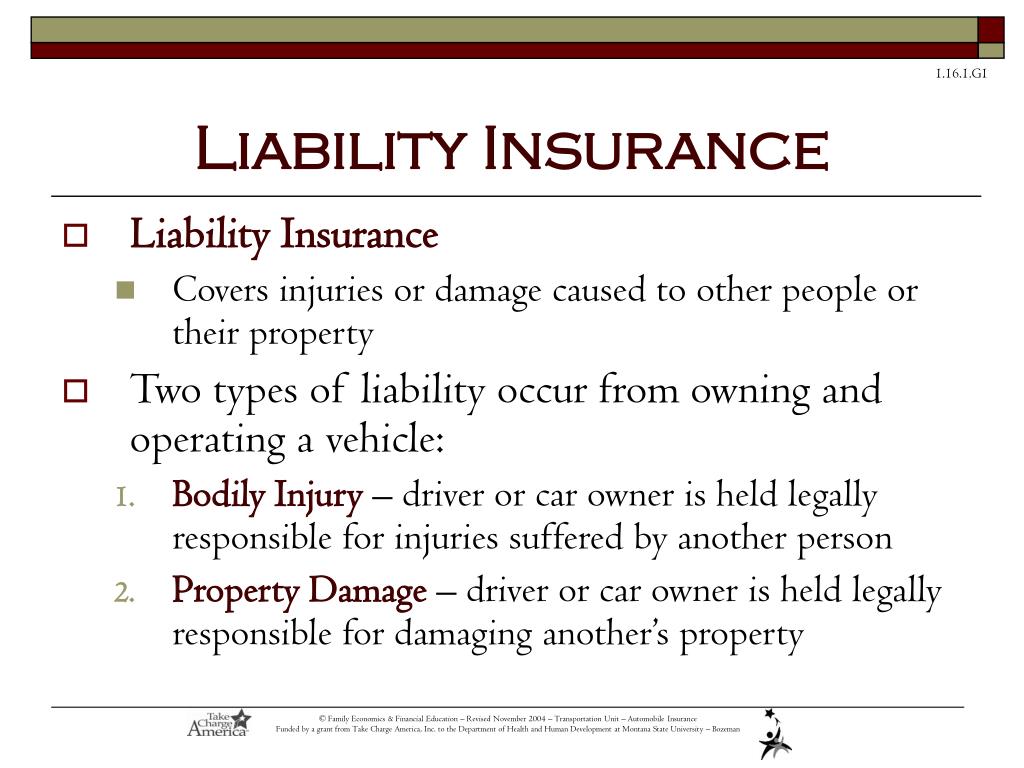

Liability insurance, in the context of car rentals, is a type of coverage that protects the renter against claims arising from bodily injury or property damage caused to others in an accident. It is a crucial aspect of car rental agreements, providing a safety net against potentially devastating financial consequences. Understanding the specifics of liability insurance is key to making the right choices when renting a vehicle.

What Does Liability Insurance Cover?

Liability insurance primarily covers two main areas: bodily injury liability and property damage liability. Bodily injury liability provides coverage for medical expenses, lost wages, and pain and suffering claims made by injured parties in an accident. Property damage liability, on the other hand, covers the cost of repairing or replacing vehicles and other property damaged in an accident. These coverages are designed to safeguard renters from substantial financial burdens that may arise from an at-fault accident.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses, lost wages, and pain and suffering claims of injured parties. |

| Property Damage Liability | Pays for the repair or replacement of vehicles and other property damaged in an accident. |

Limitations and Deductibles

Like most insurance policies, liability insurance for car rentals comes with certain limitations and deductibles. Limitations refer to the maximum amount the insurance company will pay for a covered claim. Deductibles, on the other hand, are the amount the renter must pay out of pocket before the insurance coverage kicks in. Understanding these limitations and deductibles is crucial when choosing liability insurance for a car rental, as they can significantly impact the financial implications of an accident.

Types of Liability Insurance for Car Rentals

There are several types of liability insurance options available for car rentals, each offering different levels of coverage and benefits. Understanding these options can help you choose the most suitable coverage for your needs.

Standard Liability Insurance

Standard liability insurance is the most basic form of coverage offered by car rental companies. It typically provides the minimum level of coverage required by law in the state or country where the rental is taking place. While it may be adequate for some renters, it often has lower limits of liability and may not provide sufficient protection for more severe accidents.

Enhanced Liability Insurance

Enhanced liability insurance, also known as supplemental liability insurance, offers higher limits of liability than standard coverage. This type of insurance is particularly beneficial for renters who want additional protection beyond the minimum legal requirements. It can provide peace of mind by offering more comprehensive coverage for bodily injury and property damage claims.

Excess Liability Insurance

Excess liability insurance, sometimes referred to as an umbrella policy, provides an additional layer of protection on top of the standard or enhanced liability insurance. It kicks in when the limits of the primary liability insurance have been reached. This type of coverage is ideal for renters who want maximum protection and can afford the higher premiums associated with it.

Factors Affecting Liability Insurance Costs

The cost of liability insurance for car rentals can vary significantly based on several factors. Being aware of these factors can help renters make more informed decisions about their coverage and potentially save money.

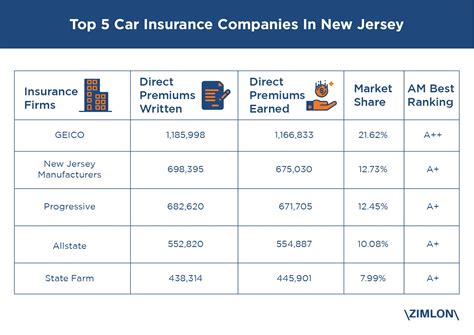

Rental Location

The location where you rent the car can impact the cost of liability insurance. Rental locations in urban areas or those with higher accident rates may have higher insurance premiums. Additionally, certain states or countries may have different legal requirements for liability coverage, which can influence the cost.

Vehicle Type

The type of vehicle you rent can also affect the cost of liability insurance. More expensive or luxury vehicles may have higher insurance premiums due to their higher replacement value and the potential for more severe damage in an accident. Additionally, certain vehicle types, such as sports cars or SUVs, may have higher insurance costs due to their performance capabilities or size.

Driver’s Age and Experience

The age and driving experience of the primary driver can influence the cost of liability insurance. Younger drivers, particularly those under 25, often face higher insurance premiums due to their perceived higher risk of being involved in an accident. Similarly, drivers with a history of accidents or traffic violations may also see increased insurance costs.

Tips for Choosing the Right Liability Insurance

Selecting the appropriate liability insurance for your car rental can be a complex decision. Here are some tips to help you choose the right coverage:

- Review the liability limits offered by the rental company. Ensure they meet or exceed the minimum requirements of the state or country where you're renting.

- Consider your personal financial situation and the potential impact of an at-fault accident. Choose a liability insurance option that provides adequate coverage for your needs.

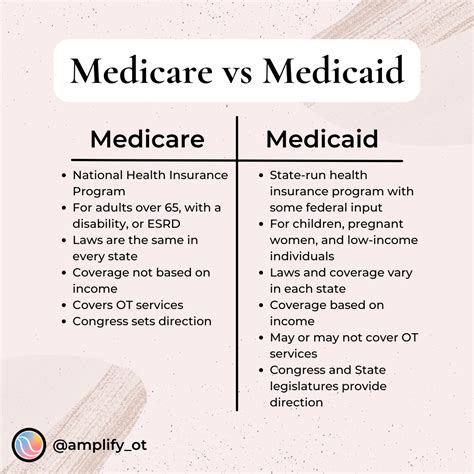

- If you have personal auto insurance, check if your policy extends to rental cars. This can sometimes provide primary or secondary coverage, reducing the need for additional liability insurance.

- Compare the costs and coverage of different liability insurance options. Look for the best balance between adequate coverage and affordable premiums.

- Read the fine print of the rental agreement and liability insurance policy. Understand the exclusions and limitations to ensure you're fully aware of what's covered and what's not.

Real-World Scenarios and Case Studies

Understanding liability insurance in theory is one thing, but seeing how it plays out in real-world scenarios can provide valuable insights. Let’s explore a few case studies to illustrate the importance of adequate liability insurance when renting a car.

Case Study 1: Bodily Injury Liability

Imagine a renter, John, who was involved in an accident while driving a rental car. The accident resulted in serious injuries to the other driver and their passenger. John’s standard liability insurance, which included $100,000 in bodily injury liability coverage, was insufficient to cover all the medical expenses and lost wages of the injured parties. As a result, John had to pay out of pocket for the excess costs, which amounted to tens of thousands of dollars.

Case Study 2: Property Damage Liability

In another scenario, a renter, Sarah, accidentally backed into a luxury car while parking her rental. The damage to the other vehicle was extensive, and the repair costs exceeded 50,000. Sarah's enhanced liability insurance, which included 100,000 in property damage liability coverage, covered the full cost of the repairs, saving her from a significant financial burden.

Case Study 3: Excess Liability Insurance

Consider a renter, David, who opted for excess liability insurance with a $1 million limit. While driving his rental car, he was involved in a severe accident that resulted in multiple injuries and significant property damage. Fortunately, David’s excess liability insurance provided coverage beyond the standard and enhanced liability limits, ensuring he was fully protected from the financial consequences of the accident.

The Future of Liability Insurance for Car Rentals

As the car rental industry continues to evolve, so too will the landscape of liability insurance. With the rise of ride-sharing services and autonomous vehicles, the nature of car rentals and the associated risks are changing. This evolution will likely lead to new insurance products and coverage options to address these emerging risks.

Emerging Trends in Liability Insurance

One emerging trend in liability insurance for car rentals is the increasing focus on data-driven risk assessment. Insurance companies are leveraging advanced analytics and machine learning to more accurately predict and price risk. This shift towards data-driven insurance is expected to lead to more tailored and cost-effective coverage options for renters.

The Impact of Autonomous Vehicles

The introduction of autonomous vehicles into the car rental market is likely to have a significant impact on liability insurance. While self-driving cars have the potential to reduce accident rates, they also introduce new types of risks and liabilities. Insurance companies will need to adapt their policies and coverage to address these unique challenges, potentially leading to new forms of liability insurance for autonomous rental vehicles.

Conclusion

Liability insurance for car rentals is a critical component of the rental process, offering vital protection against the financial risks associated with accidents. By understanding the different types of liability insurance, the factors that influence costs, and the real-world implications of these coverages, renters can make informed decisions to ensure they have adequate protection. As the car rental industry continues to evolve, so too will the world of liability insurance, providing new opportunities for renters to secure the coverage they need.

How much does liability insurance typically cost for a car rental?

+The cost of liability insurance for a car rental can vary widely depending on several factors, including the rental location, vehicle type, and the driver’s age and experience. As a general guideline, standard liability insurance can range from 10 to 30 per day, while enhanced or excess liability insurance may cost 20 to 50 or more per day. It’s important to shop around and compare prices to find the best coverage at a reasonable cost.

Is liability insurance mandatory for car rentals?

+Yes, liability insurance is typically mandatory for car rentals. Rental companies often require renters to purchase at least the minimum level of liability insurance required by law in the state or country where the rental is taking place. This ensures that the renter has some level of protection in case of an accident. However, it’s important to review the rental agreement and understand the specific insurance requirements before finalizing the rental.

Can I use my personal auto insurance for a car rental instead of purchasing liability insurance?

+In many cases, your personal auto insurance policy may extend to cover rental cars. However, it’s crucial to review your policy and understand the specific terms and conditions. Some insurance providers may offer primary or secondary coverage for rental cars, while others may have limitations or exclusions. It’s always a good idea to contact your insurance provider to confirm the extent of your coverage for rental cars.

What happens if I’m involved in an accident while renting a car and don’t have adequate liability insurance coverage?

+If you’re involved in an accident while renting a car and don’t have adequate liability insurance coverage, you may be held financially responsible for any bodily injury or property damage claims. This can result in substantial out-of-pocket expenses, potentially exceeding thousands of dollars. It’s crucial to ensure you have sufficient liability insurance coverage to protect yourself from such financial burdens.