Low Cost Insurance Plans

In today's world, having insurance is an essential aspect of financial planning and risk management. However, the cost of insurance policies can often be a significant burden, especially for individuals and families on a tight budget. This article aims to delve into the world of low-cost insurance plans, exploring their benefits, availability, and how they can provide comprehensive coverage without breaking the bank.

Understanding Low-Cost Insurance Plans

Low-cost insurance plans are designed to offer affordable coverage options to individuals and families who may have limited financial resources or are seeking more budget-friendly alternatives to traditional insurance policies. These plans typically focus on providing essential benefits and coverage while keeping premiums within a reasonable range.

The concept of low-cost insurance is particularly relevant in today's economic climate, where many people are navigating financial challenges and seeking ways to reduce expenses without compromising their financial security. By understanding the landscape of low-cost insurance, individuals can make informed decisions to protect their health, assets, and livelihoods without straining their finances.

Key Characteristics of Low-Cost Insurance Plans

These plans often feature a combination of the following characteristics to achieve cost-effectiveness:

- Limited Coverage Options: Low-cost plans may offer a more restricted range of coverage compared to comprehensive policies. This could mean excluding certain benefits or services to keep premiums lower.

- Higher Deductibles and Out-of-Pocket Costs: To reduce premiums, these plans may require policyholders to pay higher deductibles and out-of-pocket expenses when accessing healthcare services.

- Network Restrictions: Some plans may have a narrower network of healthcare providers, which can limit the choice of doctors and hospitals but also contribute to lower costs.

- Focus on Essential Benefits: Instead of offering a wide range of perks, low-cost plans prioritize covering essential healthcare services like preventive care, hospitalization, and emergency treatment.

- Simplified Administration: These plans often have streamlined administrative processes, reducing overhead costs and passing on the savings to policyholders.

Types of Low-Cost Insurance Plans

The insurance industry offers a range of low-cost options across various sectors. Here’s an overview of some common types of low-cost insurance plans:

1. Health Insurance

Low-cost health insurance plans are designed to provide affordable access to essential healthcare services. These plans often have higher deductibles and may cover a more limited range of services compared to traditional health insurance. However, they can still offer valuable protection against unexpected medical expenses.

| Plan Type | Coverage |

|---|---|

| Catastrophic Health Insurance | Designed for young adults and those under 30, offering basic coverage for emergencies and a 30% coinsurance rate. |

| Short-Term Health Insurance | Temporary coverage lasting up to 364 days, ideal for those between jobs or seeking a more affordable alternative. |

| Health Savings Account (HSA) Plans | These plans pair a high-deductible health plan with a tax-advantaged savings account, allowing individuals to save for future medical expenses. |

2. Auto Insurance

Low-cost auto insurance plans provide liability coverage and may offer additional protection for a vehicle, depending on the policyholder’s needs and budget. These plans often have lower limits on liability coverage and may exclude comprehensive and collision coverage, which can be more expensive.

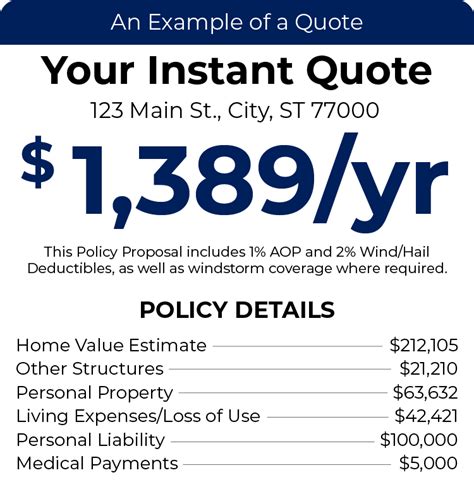

3. Homeowners/Renters Insurance

Low-cost options for homeowners and renters insurance typically provide basic coverage for the structure and personal belongings. These plans may have lower coverage limits and may not include additional perks like identity theft protection or liability coverage for personal injuries on the property.

4. Life Insurance

Term life insurance is a popular low-cost option for life insurance. These policies offer coverage for a specified period, typically ranging from 10 to 30 years, and provide a death benefit to beneficiaries in the event of the policyholder’s passing. Term life insurance is ideal for individuals seeking temporary coverage to protect their loved ones during their working years.

Benefits of Low-Cost Insurance Plans

Despite their cost-effectiveness, low-cost insurance plans offer several advantages that make them an appealing choice for many individuals and families:

Affordability

The most obvious benefit is the affordability of these plans. By prioritizing essential coverage and streamlining administrative processes, low-cost insurance providers can offer significantly lower premiums compared to traditional insurance policies. This makes insurance more accessible to a wider range of individuals, ensuring that even those with limited financial resources can protect themselves and their loved ones.

Flexibility

Low-cost insurance plans often provide a high degree of flexibility. Policyholders can choose the level of coverage they need, allowing them to tailor their insurance to their specific requirements and budget. This flexibility ensures that individuals can find a plan that suits their unique circumstances, whether they require comprehensive coverage or more basic protection.

Peace of Mind

Despite their cost-effectiveness, low-cost insurance plans still provide a vital safety net against unforeseen circumstances. Whether it’s an unexpected medical emergency, a car accident, or a natural disaster, having insurance coverage can offer peace of mind, knowing that financial protection is in place. This aspect is especially crucial for individuals and families who may not have the financial means to absorb significant losses.

Accessibility

Low-cost insurance plans have played a significant role in increasing insurance accessibility for underserved populations. These plans have been particularly beneficial for young adults, part-time workers, and those with pre-existing conditions who may face challenges in obtaining traditional insurance coverage. By offering more affordable options, low-cost insurance providers have helped bridge the insurance gap and ensure that more people have access to essential protection.

Choosing the Right Low-Cost Insurance Plan

When considering a low-cost insurance plan, it’s essential to assess your specific needs and budget. Here are some factors to keep in mind:

Assess Your Needs

Determine the type of coverage you require. For instance, if you’re young and healthy, a low-cost health insurance plan with a higher deductible may suffice. However, if you have a chronic condition or require specialized care, a more comprehensive plan might be necessary.

Compare Plans

Research and compare different low-cost insurance options. Look at the coverage limits, deductibles, and out-of-pocket costs. Ensure that the plan aligns with your budget and provides the necessary benefits. Online comparison tools and insurance brokers can be valuable resources in this process.

Consider Network Restrictions

Some low-cost plans may have a narrow network of healthcare providers. While this can save costs, it may limit your choice of doctors and hospitals. Assess whether the network restrictions are acceptable based on your healthcare needs and preferences.

Review Policy Details

Read the fine print of the insurance policy carefully. Understand the exclusions, limitations, and any additional fees or charges. Ensure that the policy provides the coverage you expect and that there are no hidden surprises that could impact your financial well-being.

Future Outlook and Innovations

The insurance industry is continuously evolving, and low-cost insurance plans are no exception. As technology advances and consumer needs change, we can expect to see further innovations and improvements in this sector.

Technological Advancements

The integration of technology in the insurance industry has already led to more efficient processes and cost savings. Telemedicine, for instance, has become increasingly popular, allowing individuals to access healthcare services remotely and reducing the need for in-person visits. This not only improves convenience but also contributes to cost reduction for both healthcare providers and insurance companies.

Customization and Personalization

Low-cost insurance plans are likely to become even more customizable, allowing policyholders to tailor their coverage to their unique needs. This could involve selecting specific benefits or opting for add-on coverage to enhance their protection. By offering greater personalization, insurance providers can better meet the diverse requirements of their customers.

Data-Driven Decisions

The insurance industry is increasingly leveraging data analytics and artificial intelligence to make more informed decisions. By analyzing vast amounts of data, insurance providers can identify trends, assess risks more accurately, and develop more efficient pricing models. This data-driven approach can lead to more competitive pricing for low-cost insurance plans, making them even more affordable for consumers.

Focus on Prevention

Low-cost insurance plans may also shift their focus towards preventive care and wellness programs. By encouraging policyholders to adopt healthier lifestyles and prevent illnesses, insurance providers can reduce the overall healthcare costs associated with their policies. This proactive approach not only benefits the insured individuals but also contributes to the sustainability of the insurance industry as a whole.

Conclusion

Low-cost insurance plans offer a valuable solution for individuals and families seeking affordable protection. By understanding the characteristics and benefits of these plans, consumers can make informed decisions to safeguard their health, assets, and livelihoods without straining their finances. As the insurance industry continues to innovate, low-cost options are likely to become even more accessible and tailored to the diverse needs of policyholders.

Can low-cost insurance plans provide comprehensive coverage?

+While low-cost insurance plans prioritize affordability, they may offer a more limited range of coverage compared to traditional plans. However, they can still provide essential protection against unexpected expenses and emergencies.

Are low-cost insurance plans suitable for everyone?

+Low-cost insurance plans are ideal for individuals and families seeking budget-friendly alternatives. However, those with specific healthcare needs or high-risk occupations may require more comprehensive coverage, which may come at a higher cost.

How can I find the best low-cost insurance plan for my needs?

+Research and compare different low-cost insurance options. Assess your specific needs, review policy details, and consider factors like coverage limits, deductibles, and network restrictions. Consulting with an insurance broker can also provide valuable guidance.