Medical Insurance Iowa

In the state of Iowa, healthcare coverage is an essential aspect of ensuring access to quality medical services for its residents. Understanding the medical insurance landscape in Iowa is crucial for individuals and families seeking affordable and comprehensive healthcare options. This comprehensive guide will delve into the intricacies of medical insurance in Iowa, providing a detailed overview of the available plans, their features, and the steps to navigate the process effectively.

Understanding the Medical Insurance Landscape in Iowa

Iowa’s healthcare system offers a range of medical insurance plans tailored to meet the diverse needs of its population. These plans are designed to provide financial protection and access to essential healthcare services, ensuring that individuals can receive the medical attention they require without incurring significant financial burdens.

The state of Iowa actively promotes the availability of healthcare coverage, recognizing its importance in maintaining the well-being of its citizens. As such, various initiatives and programs are in place to support individuals and families in securing suitable medical insurance plans.

Key Players in Iowa’s Medical Insurance Market

Several prominent insurance providers operate in Iowa, offering a wide array of healthcare plans. Some of the major players in the Iowa medical insurance market include:

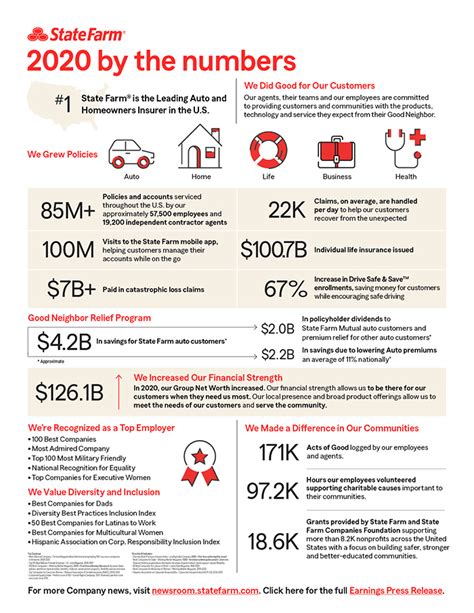

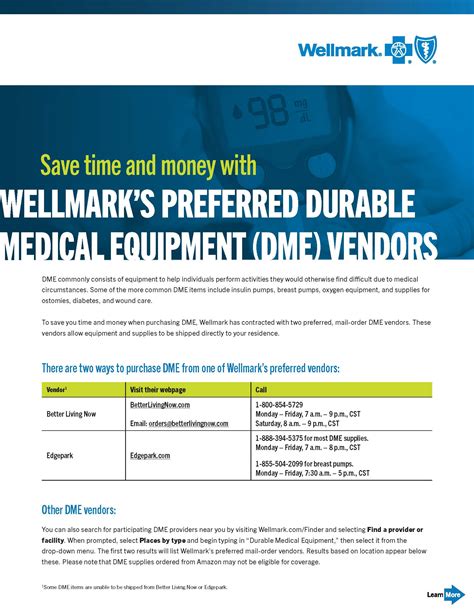

- Wellmark Blue Cross and Blue Shield of Iowa: A leading health insurance company, Wellmark offers a comprehensive range of plans, catering to individuals, families, and employers. Their plans cover a wide network of healthcare providers, ensuring accessibility and choice for policyholders.

- UnitedHealthcare: UnitedHealthcare is a prominent national insurer with a strong presence in Iowa. They provide a variety of health plans, including employer-sponsored coverage and individual market options, ensuring flexibility and personalized care.

- Aetna: Aetna, a well-established health insurance provider, offers a comprehensive portfolio of health plans in Iowa. Their plans are designed to meet the diverse needs of individuals, families, and businesses, focusing on accessibility and cost-effectiveness.

- Coventry Health Care: Coventry is another significant player in Iowa’s medical insurance market. They provide a range of health plans, including Medicare Advantage plans and individual market options, ensuring specialized care and support for different demographics.

These insurance providers, along with others operating in Iowa, offer a diverse range of plans, including:

- Individual and family health plans

- Employer-sponsored group health plans

- Medicare and Medicaid plans

- Supplemental health insurance plans

Features and Benefits of Iowa's Medical Insurance Plans

Iowa's medical insurance plans offer a comprehensive set of features and benefits designed to meet the unique healthcare needs of its residents. Here are some key aspects to consider:

- Comprehensive Coverage: Iowa's health plans typically offer coverage for a wide range of medical services, including doctor visits, hospital stays, prescription medications, preventive care, and specialty treatments. This ensures that policyholders have access to the care they need when they need it.

- Flexible Plan Options: Insurance providers in Iowa offer a variety of plan types, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). These plans cater to different preferences and healthcare needs, allowing individuals to choose the option that best suits their circumstances.

- Network of Healthcare Providers: Iowa's medical insurance plans often come with a network of healthcare providers, including hospitals, clinics, and individual practitioners. Policyholders can access these providers for covered services, ensuring convenience and potentially lower out-of-pocket costs.

- Cost-Sharing Options: Plans in Iowa may offer different cost-sharing structures, such as deductibles, copayments, and coinsurance. These features allow policyholders to manage their healthcare expenses and choose plans that align with their budget and healthcare utilization expectations.

- Preventive Care Benefits: Many Iowa health plans prioritize preventive care, offering coverage for services such as annual check-ups, screenings, and immunizations. These benefits help individuals maintain their health and identify potential issues early on, potentially reducing the need for more extensive and costly treatments in the future.

Navigating the Process: Choosing and Enrolling in a Medical Insurance Plan

Selecting and enrolling in a medical insurance plan in Iowa involves a few key steps to ensure a smooth and informed process:

- Assess Your Healthcare Needs: Begin by evaluating your healthcare requirements, considering factors such as your current health status, the frequency of doctor visits, the need for specialized treatments, and any existing medical conditions. This assessment will help you identify the type of coverage you require.

- Research Available Plans: Explore the various health plans offered by insurance providers in Iowa. Compare their features, benefits, and costs to find the plan that best aligns with your needs and budget. Consider factors such as the provider network, coverage limits, and any additional benefits or perks offered.

- Seek Professional Guidance: If you find the process overwhelming, consider seeking assistance from a licensed insurance agent or broker. These professionals can provide personalized advice, answer your questions, and guide you through the enrollment process. They can also help you understand the nuances of different plans and ensure you make an informed decision.

- Compare Premiums and Out-of-Pocket Costs: When comparing plans, pay close attention to the premiums (the amount you pay monthly) and the out-of-pocket costs (deductibles, copayments, and coinsurance). Balancing these costs is crucial to finding a plan that fits your budget and healthcare utilization expectations.

- Enroll During Open Enrollment: Iowa, like most states, has an annual Open Enrollment Period for individual and family health plans. This is typically a set timeframe during which anyone can enroll in a new plan or make changes to their existing coverage. It's important to mark your calendar and ensure you enroll during this period to avoid any gaps in coverage.

- Special Enrollment Periods: In certain situations, such as losing your job, getting married, or having a baby, you may qualify for a Special Enrollment Period outside of the regular Open Enrollment timeframe. During these periods, you can enroll in a new plan or make changes to your existing coverage. It's essential to understand the qualifying events and the associated deadlines for these special enrollment opportunities.

Understanding Iowa's Healthcare System and Resources

Iowa's healthcare system is supported by a network of hospitals, clinics, and healthcare professionals dedicated to providing quality care to its residents. Understanding the key aspects of Iowa's healthcare landscape can further assist individuals in navigating their medical insurance options and accessing appropriate care.

Iowa boasts a robust network of healthcare facilities, including major medical centers, community hospitals, and specialized clinics. These facilities offer a range of services, from primary care and emergency treatment to specialized procedures and advanced medical technologies. Some of the prominent healthcare institutions in Iowa include:

- University of Iowa Hospitals and Clinics: This nationally recognized academic medical center provides comprehensive healthcare services, including primary care, specialty care, and advanced medical procedures. It is known for its cutting-edge research and innovative treatments.

- MercyOne: MercyOne is a large healthcare system with multiple hospitals and clinics across Iowa. They offer a wide range of healthcare services, including primary care, urgent care, and specialized medical services. MercyOne is known for its patient-centric approach and community-focused care.

- Iowa Health System: Iowa Health System, now part of UnityPoint Health, operates a network of hospitals and clinics across the state. They provide a comprehensive range of healthcare services, including primary care, emergency care, and specialized medical services. Iowa Health System is committed to delivering high-quality, accessible care to Iowa's communities.

In addition to these larger healthcare systems, Iowa is home to numerous smaller clinics, urgent care centers, and specialty practices. These facilities often provide convenient and personalized care, catering to the unique healthcare needs of local communities.

To further support its residents' healthcare needs, Iowa has implemented various initiatives and programs. These include:

- Iowa Medicaid: Iowa's Medicaid program provides healthcare coverage to eligible low-income individuals and families. It covers a wide range of medical services, including doctor visits, hospital stays, prescription medications, and specialized treatments. Iowa Medicaid aims to ensure that vulnerable populations have access to essential healthcare services.

- Iowa Medicare: Iowa residents who are 65 years or older, have certain disabilities, or have End-Stage Renal Disease (ESRD) are eligible for Medicare coverage. Iowa Medicare offers various plans, including Original Medicare (Parts A and B), Medicare Advantage plans, and Medicare Part D prescription drug coverage. These plans provide comprehensive healthcare coverage for eligible individuals.

- Iowa Health Insurance Marketplace: The Iowa Health Insurance Marketplace, also known as the Affordable Care Act (ACA) Marketplace, is a platform where individuals and families can compare and enroll in qualified health plans. The Marketplace offers a range of plans from different insurance providers, providing options for those seeking coverage outside of employer-sponsored plans. It also provides financial assistance in the form of premium tax credits and cost-sharing reductions for eligible individuals and families.

Iowa's healthcare system and resources, along with the state's commitment to providing accessible and quality healthcare, make it a supportive environment for residents to navigate their medical insurance options and receive the care they need.

Making Informed Decisions: Weighing Coverage and Cost

When choosing a medical insurance plan in Iowa, striking the right balance between coverage and cost is crucial. Here are some factors to consider to make an informed decision:

- Evaluate Your Healthcare Needs: Assess your current and potential future healthcare requirements. Consider factors such as your age, existing medical conditions, prescription medication needs, and the frequency of doctor visits. Understanding your healthcare needs will help you choose a plan that provides adequate coverage without unnecessary expenses.

- Compare Plan Premiums: The premium is the amount you pay monthly for your health insurance coverage. Compare the premiums of different plans to find an affordable option that aligns with your budget. Keep in mind that lower premiums may be associated with higher out-of-pocket costs, such as deductibles and copayments.

- Assess Out-of-Pocket Costs: Out-of-pocket costs refer to the expenses you pay directly for healthcare services, including deductibles, copayments, and coinsurance. These costs can vary significantly between plans. Consider your expected healthcare utilization and choose a plan with manageable out-of-pocket expenses.

- Review Coverage Limits: Review the coverage limits of each plan, including the maximum out-of-pocket expenses, annual and lifetime limits, and any restrictions on specific services or treatments. Ensure that the plan covers the services you anticipate needing without imposing excessive financial burdens.

- Evaluate Additional Benefits: Some plans offer additional benefits, such as dental, vision, or wellness programs. Assess whether these benefits are valuable to you and whether they justify the added cost. Remember that plans with more comprehensive benefits may have higher premiums.

- Consider Network Providers: Examine the network of healthcare providers associated with each plan. Ensure that your preferred doctors, hospitals, and specialists are included in the network. Out-of-network care may result in higher costs or limited coverage.

- Review Prescription Drug Coverage: If you rely on prescription medications, carefully review the plan’s prescription drug coverage. Consider the cost of your medications and whether the plan covers them at a reasonable rate. Some plans may require you to use specific pharmacies or mail-order services for prescriptions.

- Understand Plan Limitations: Carefully read the plan’s summary of benefits and coverage to understand any limitations or exclusions. Plans may have restrictions on certain procedures, treatments, or pre-existing conditions. Ensure that the plan aligns with your healthcare needs and does not impose unnecessary limitations.

By thoroughly evaluating your healthcare needs, comparing plan premiums and out-of-pocket costs, and understanding the coverage and limitations of each plan, you can make an informed decision when choosing a medical insurance plan in Iowa. Remember to seek assistance from licensed professionals if needed, and take advantage of the resources available to ensure you select the most suitable plan for your circumstances.

Conclusion: Securing Quality Healthcare Coverage in Iowa

Iowa’s commitment to providing accessible and quality healthcare is evident through its diverse range of medical insurance plans and supportive initiatives. By understanding the key players in Iowa’s medical insurance market, the features and benefits of available plans, and the steps to navigate the enrollment process, individuals and families can make informed decisions to secure the healthcare coverage they need.

As Iowa continues to prioritize healthcare accessibility, residents can take advantage of the resources and support available to ensure they have the coverage and care they deserve. With a comprehensive understanding of Iowa's medical insurance landscape, individuals can navigate the system with confidence and make choices that align with their unique healthcare needs and financial circumstances.

What is the Open Enrollment Period for individual health plans in Iowa?

+The Open Enrollment Period for individual health plans in Iowa typically runs from November 1st to December 15th. During this time, anyone can enroll in a new plan or make changes to their existing coverage.

Can I enroll in a health plan outside of the Open Enrollment Period in Iowa?

+Yes, you can enroll in a health plan outside of the Open Enrollment Period if you qualify for a Special Enrollment Period. Qualifying events, such as losing your job, getting married, or having a baby, can trigger a Special Enrollment Period, allowing you to enroll in a new plan or make changes to your existing coverage.

Are there any financial assistance programs available for purchasing health insurance in Iowa?

+Yes, Iowa residents may be eligible for financial assistance when purchasing health insurance through the Iowa Health Insurance Marketplace. This assistance can take the form of premium tax credits and cost-sharing reductions, helping to make health insurance more affordable for eligible individuals and families.