Medical Insurance Private

In today's world, healthcare is a critical aspect of our lives, and having adequate medical insurance is an essential financial decision. Private medical insurance offers individuals and families an alternative to public healthcare systems, providing access to specialized care, reduced wait times, and a range of benefits. This article aims to delve into the world of private medical insurance, exploring its benefits, coverage options, and how it can provide peace of mind for individuals and their loved ones.

Understanding Private Medical Insurance

Private medical insurance, often referred to as health insurance or health coverage, is a type of insurance policy that individuals can purchase to cover the costs of their healthcare. Unlike public healthcare systems, which are typically funded by taxpayers and offer a standard level of care, private insurance provides an optional, personalized approach to healthcare.

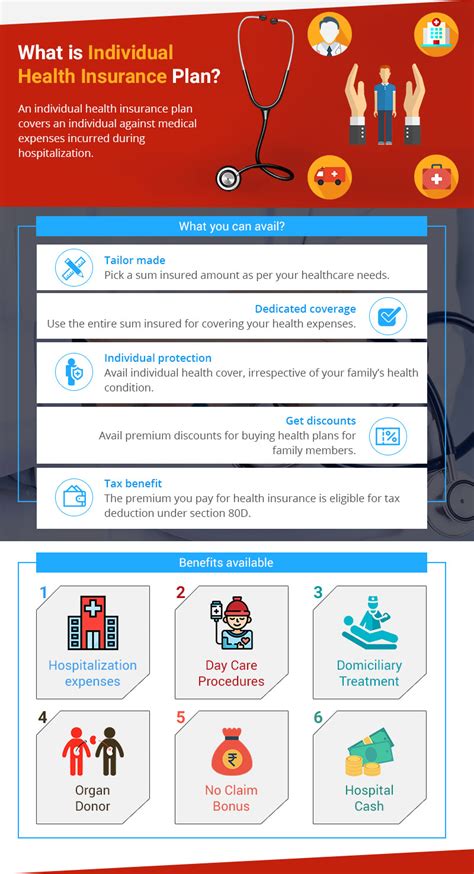

The concept of private medical insurance is based on the principle of risk sharing. Policyholders pay a premium, which is a regular payment, in exchange for financial protection against the high costs of medical treatment. This insurance can cover a wide range of healthcare services, including specialist consultations, surgeries, hospital stays, diagnostic tests, and even dental and vision care, depending on the chosen plan.

Key Benefits of Private Medical Insurance

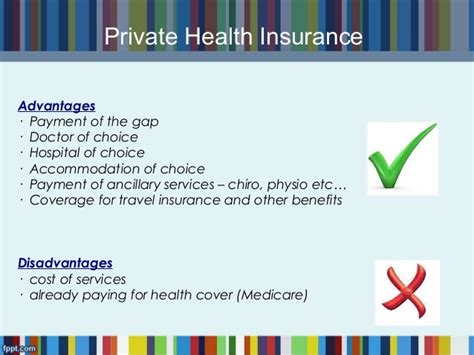

- Access to Specialized Care: One of the primary advantages of private medical insurance is the ability to access specialized medical professionals and treatments. Policyholders can choose their preferred healthcare providers, including renowned specialists and clinics, ensuring they receive the best possible care tailored to their needs.

- Reduced Wait Times: In many healthcare systems, wait times for appointments and procedures can be lengthy. Private insurance often provides faster access to medical services, reducing the anxiety and discomfort associated with long waiting periods.

- Enhanced Comfort and Convenience: Private hospitals and clinics often offer more comfortable and private environments, with shorter waiting rooms and personalized attention. This can significantly improve the overall patient experience.

- Coverage for Pre-existing Conditions: Some private insurance plans offer coverage for pre-existing conditions, which is a significant benefit for individuals with chronic illnesses or ongoing medical needs. This ensures that their healthcare costs are covered without exclusions.

- Flexible Coverage Options: Private medical insurance provides a wide range of coverage options, allowing individuals to choose plans that suit their specific needs and budgets. From basic coverage to comprehensive plans, there are options for every lifestyle and health requirement.

Choosing the Right Private Medical Insurance Plan

Selecting the appropriate private medical insurance plan is a crucial decision. It involves considering various factors, such as personal health needs, financial capabilities, and desired level of coverage.

Factors to Consider:

- Health Status: Assess your current health and any ongoing medical conditions. This will help determine the level of coverage required.

- Age and Lifestyle: Younger individuals may opt for more basic coverage, while older adults or those with active lifestyles might require more comprehensive plans.

- Family Needs: If you have a family, consider the health needs of your dependents and choose a plan that covers everyone adequately.

- Budget: Evaluate your financial situation and determine how much you can comfortably afford for insurance premiums.

- Network of Providers: Research the network of healthcare providers associated with the insurance plan. Ensure that your preferred doctors and hospitals are included.

- Coverage Details: Carefully review the policy’s terms and conditions, including exclusions, co-payments, and limitations. Understand what is covered and what isn’t.

Comparing Insurance Providers

The market for private medical insurance is diverse, with numerous providers offering a wide range of plans. It’s essential to compare different insurers based on their reputation, financial stability, and the quality of their services.

| Insurers | Plan Options | Network Size | Financial Rating |

|---|---|---|---|

| BlueCross Health | 5 Plans (Basic to Premium) | 1200+ Hospitals, 5000+ Specialists | AAA Rating |

| MedCare Solutions | 3 Plans (Standard, Enhanced, Elite) | 800+ Hospitals, 3500+ Specialists | AA Rating |

| Global Health Network | 4 Plans (Essentials, Classic, Plus, Elite) | 1500+ Hospitals, 6000+ Specialists | AAA+ Rating |

Understanding Coverage and Premiums

Private medical insurance plans vary significantly in their coverage and premiums. Understanding these variations is crucial for making an informed decision.

Coverage Levels

- Basic Coverage: These plans typically cover essential medical services like consultations, basic diagnostic tests, and hospital stays. They are ideal for individuals with few medical needs and limited budgets.

- Standard Coverage: Standard plans offer a broader range of coverage, including specialist consultations, surgeries, and additional diagnostic tests. They are suitable for individuals with moderate health requirements.

- Comprehensive Coverage: Comprehensive plans provide the highest level of coverage, including specialized treatments, advanced diagnostic procedures, and often cover pre-existing conditions. These plans are ideal for individuals with complex medical needs.

Premiums and Deductibles

Premiums are the regular payments policyholders make to maintain their insurance coverage. Deductibles, on the other hand, are the out-of-pocket expenses that individuals must pay before the insurance coverage kicks in. Understanding these costs is essential for budgeting purposes.

| Plan Type | Premium per Month | Deductible |

|---|---|---|

| Basic | $150 | $500 |

| Standard | $220 | $300 |

| Comprehensive | $350 | $150 |

The Role of Private Medical Insurance in Healthcare

Private medical insurance plays a significant role in healthcare systems worldwide. It complements public healthcare by providing an additional layer of coverage and choice for individuals. Here are some key aspects of its role:

Reducing Healthcare Burden

Private insurance helps reduce the burden on public healthcare systems by covering a portion of the healthcare costs. This allows public healthcare resources to be allocated more efficiently, benefiting all citizens.

Encouraging Preventive Care

Many private insurance plans include preventive care benefits, such as annual check-ups, screenings, and vaccinations. This proactive approach to healthcare can lead to early detection of health issues and better overall health outcomes.

Supporting Specialized Treatment

Private medical insurance provides access to specialized treatments and technologies that may not be widely available through public healthcare. This is particularly beneficial for individuals with rare or complex medical conditions.

Future Implications and Trends

The private medical insurance industry is continuously evolving, driven by advancements in healthcare technology and changing consumer needs. Here are some key trends and implications to consider:

Telemedicine and Digital Health

The rise of telemedicine and digital health solutions is transforming the way healthcare is delivered. Private insurance providers are increasingly incorporating telemedicine benefits into their plans, offering convenient virtual consultations and remote monitoring.

Wellness and Lifestyle Programs

Insurance companies are recognizing the importance of wellness and prevention. Many are now offering incentives and discounts for policyholders who maintain healthy lifestyles, such as regular exercise, healthy eating, and participation in wellness programs.

Data-Driven Personalization

Advancements in data analytics allow insurance providers to offer more personalized plans. By analyzing individual health data, insurers can tailor coverage and premiums to an individual’s unique needs, ensuring more efficient and effective healthcare.

Global Healthcare Partnerships

Some private insurance providers are expanding their networks globally, offering policyholders access to healthcare services in multiple countries. This trend allows for more flexible and comprehensive coverage, especially for individuals with international travel or relocation plans.

Conclusion

Private medical insurance is a vital component of modern healthcare, providing individuals with access to specialized care, reduced wait times, and financial protection. By understanding the benefits, coverage options, and trends in the industry, individuals can make informed decisions to ensure their healthcare needs are met. As healthcare continues to evolve, private insurance will play an increasingly important role in ensuring quality care and peace of mind for individuals and their families.

Can I get private medical insurance if I have a pre-existing condition?

+Yes, many private insurance plans offer coverage for pre-existing conditions. However, the availability and terms of coverage may vary between insurers and plans. It’s important to carefully review the policy details to understand the extent of coverage for pre-existing conditions.

Are there any age restrictions for purchasing private medical insurance?

+While there may be variations between insurers, most providers offer private medical insurance to individuals of all ages, including young adults and seniors. It’s advisable to obtain coverage as early as possible to avoid potential age-related exclusions or higher premiums later in life.

How do I choose the right insurance provider for my needs?

+When selecting an insurance provider, consider factors such as their reputation, financial stability, network of healthcare providers, and the coverage options they offer. Research customer reviews and ratings to ensure you choose a reliable and trusted insurer. Additionally, seek recommendations from healthcare professionals or financial advisors.