Medicare Health Insurance Plans

Medicare, a cornerstone of the American healthcare system, is a federally funded health insurance program primarily designed for individuals aged 65 and older. However, it also caters to younger individuals with certain disabilities and specific medical conditions. With its comprehensive coverage options, Medicare plays a vital role in ensuring accessible healthcare for a significant portion of the population.

This article delves into the intricacies of Medicare health insurance plans, exploring their types, benefits, and eligibility criteria. By understanding these plans, individuals can make informed decisions about their healthcare coverage, ensuring they receive the necessary medical services without financial strain.

Understanding Medicare Health Insurance Plans

Medicare health insurance plans are categorized into several types, each offering distinct benefits and coverage options. These plans are designed to cater to the diverse healthcare needs of the Medicare-eligible population. Understanding these plans is essential for individuals to choose the most suitable option for their specific medical requirements.

Original Medicare (Parts A and B)

Original Medicare, often referred to as Medicare Part A and Part B, is the traditional fee-for-service health insurance program provided by the federal government. Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. On the other hand, Part B covers outpatient medical services, including doctor visits, lab tests, durable medical equipment, and preventive care.

Original Medicare offers a broad network of healthcare providers, allowing beneficiaries to choose from a wide range of doctors and hospitals. However, it typically requires beneficiaries to pay deductibles, copayments, and coinsurance for covered services. To fill these gaps in coverage, many individuals opt for Medigap (Medicare Supplement Insurance) plans.

| Medicare Part | Coverage |

|---|---|

| Part A | Inpatient hospital care, skilled nursing facility care, hospice care, and some home healthcare services. |

| Part B | Outpatient medical services, doctor visits, lab tests, durable medical equipment, and preventive care. |

Medicare Advantage Plans (Part C)

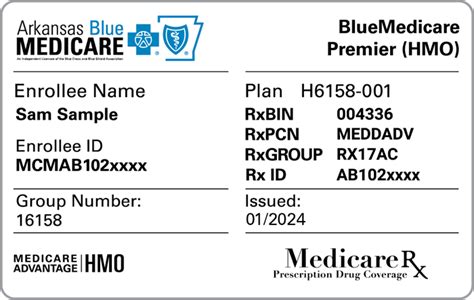

Medicare Advantage Plans, also known as Medicare Part C, are an alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare. Medicare Advantage Plans typically include Part A and Part B coverage, often with additional benefits such as prescription drug coverage, dental, vision, and hearing services.

One of the key advantages of Medicare Advantage Plans is their coordination of care. These plans provide a more integrated approach to healthcare, often including additional wellness programs and disease management services. However, it's important to note that Medicare Advantage Plans may have a more limited network of providers compared to Original Medicare.

| Medicare Part C | Coverage and Benefits |

|---|---|

| Medicare Advantage Plans | Includes Part A and Part B coverage, often with additional benefits like prescription drugs, dental, vision, and hearing services. Offers coordination of care and may include wellness programs. |

Medicare Prescription Drug Plans (Part D)

Medicare Prescription Drug Plans, or Medicare Part D, are designed to help Medicare beneficiaries manage the costs of prescription medications. These plans are offered by private insurance companies and can be added to Original Medicare or Medicare Advantage Plans. Part D plans typically cover both brand-name and generic drugs, with varying levels of coverage depending on the specific plan.

Medicare beneficiaries can choose a stand-alone Part D plan or a Medicare Advantage Plan that includes prescription drug coverage. It's essential to review the specific drugs covered by each plan, as well as the costs associated with different tiers of medications.

| Medicare Part D | Coverage |

|---|---|

| Prescription Drug Plans | Covers brand-name and generic drugs, with varying levels of coverage depending on the plan. Available as stand-alone plans or as part of Medicare Advantage Plans. |

Eligibility and Enrollment for Medicare Health Insurance Plans

Understanding the eligibility criteria and enrollment process for Medicare health insurance plans is crucial for individuals to ensure they receive the coverage they need at the right time.

Eligibility Criteria

The primary eligibility criterion for Medicare is age. Individuals who are 65 years or older and have been legal residents of the United States for at least 5 years are generally eligible for Medicare. However, younger individuals with certain disabilities or specific medical conditions, such as end-stage renal disease, may also qualify for Medicare.

Additionally, individuals who are receiving Social Security retirement benefits or Railroad Retirement Board benefits are automatically enrolled in Medicare Part A and Part B. Those who are not automatically enrolled can apply for Medicare during the Initial Enrollment Period, which begins 3 months before their 65th birthday and ends 3 months after their birthday month.

Enrollment Process

The enrollment process for Medicare health insurance plans varies depending on the type of plan. For Original Medicare (Part A and Part B), individuals can enroll online through the Social Security website, by phone, or in person at a local Social Security office. It’s important to note that Part B requires monthly premiums, and late enrollment may result in a permanent late enrollment penalty.

For Medicare Advantage Plans (Part C) and Medicare Prescription Drug Plans (Part D), enrollment typically occurs during the Medicare Annual Enrollment Period, which runs from October 15th to December 7th each year. During this period, beneficiaries can switch plans, add or drop coverage, or make other changes to their Medicare coverage.

Benefits and Coverage of Medicare Health Insurance Plans

Medicare health insurance plans offer a range of benefits and coverage options, designed to meet the diverse healthcare needs of the Medicare-eligible population. Understanding these benefits is crucial for individuals to make informed decisions about their healthcare coverage.

Benefits of Original Medicare (Parts A and B)

Original Medicare (Part A and Part B) provides a comprehensive set of benefits, covering a wide range of healthcare services. Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. This coverage is particularly beneficial for individuals who require extended hospital stays or long-term care.

Part B, on the other hand, covers outpatient medical services, including doctor visits, lab tests, durable medical equipment, and preventive care. This coverage is essential for individuals who require regular medical care and preventive screenings. Original Medicare also offers flexibility in choosing healthcare providers, as it typically does not restrict beneficiaries to specific networks.

Benefits of Medicare Advantage Plans (Part C)

Medicare Advantage Plans (Part C) offer a more integrated approach to healthcare, often including additional benefits beyond what Original Medicare covers. These plans typically include Part A and Part B coverage, as well as prescription drug coverage (Part D). Additionally, Medicare Advantage Plans may offer dental, vision, and hearing services, which are not covered by Original Medicare.

One of the key advantages of Medicare Advantage Plans is their coordination of care. These plans provide a single point of contact for beneficiaries, ensuring that their healthcare needs are managed effectively. Medicare Advantage Plans may also include additional wellness programs and disease management services, promoting a proactive approach to healthcare.

Benefits of Medicare Prescription Drug Plans (Part D)

Medicare Prescription Drug Plans (Part D) are designed to help Medicare beneficiaries manage the costs of prescription medications. These plans cover both brand-name and generic drugs, with varying levels of coverage depending on the specific plan. By enrolling in a Part D plan, beneficiaries can access discounted medications, reducing their out-of-pocket expenses.

Medicare Prescription Drug Plans may also offer pharmacy networks, providing beneficiaries with access to a network of preferred pharmacies. These networks can offer additional cost savings and convenience, as beneficiaries can fill their prescriptions at a designated network pharmacy.

Comparing Medicare Health Insurance Plans

When comparing Medicare health insurance plans, it’s essential to consider various factors to find the plan that best aligns with an individual’s healthcare needs and budget. Each plan type has its own set of advantages and potential drawbacks, and understanding these differences is crucial for making an informed decision.

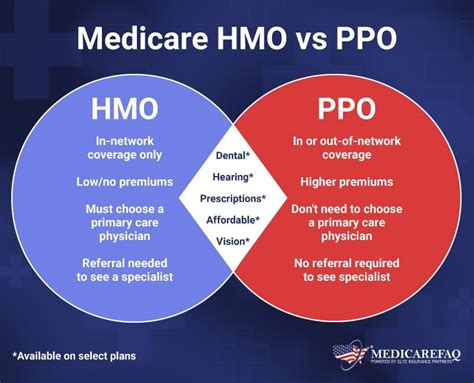

Original Medicare vs. Medicare Advantage Plans

Original Medicare (Part A and Part B) offers a traditional fee-for-service approach, providing beneficiaries with a broad network of healthcare providers. This flexibility allows beneficiaries to choose their doctors and hospitals without restrictions. However, Original Medicare typically requires beneficiaries to pay deductibles, copayments, and coinsurance for covered services, which can result in higher out-of-pocket costs.

On the other hand, Medicare Advantage Plans (Part C) offer a more comprehensive and coordinated approach to healthcare. These plans often include additional benefits, such as prescription drug coverage, dental, vision, and hearing services. Medicare Advantage Plans may also have lower out-of-pocket costs, as they typically include a set monthly premium and may offer additional cost-sharing arrangements.

However, it's important to note that Medicare Advantage Plans may have a more limited network of providers compared to Original Medicare. Beneficiaries should carefully review the network of providers offered by each plan to ensure their preferred doctors and hospitals are included.

Medicare Advantage Plans vs. Medigap (Medicare Supplement Insurance)

Medicare Advantage Plans (Part C) and Medigap (Medicare Supplement Insurance) plans serve different purposes and have distinct features. Medicare Advantage Plans are offered by private insurance companies and provide an alternative to Original Medicare, often including additional benefits and coordinated care. Medigap plans, on the other hand, are designed to supplement Original Medicare, filling gaps in coverage and reducing out-of-pocket costs.

Medicare Advantage Plans typically have a set monthly premium and may offer additional cost-sharing arrangements, such as copayments or coinsurance. These plans often include prescription drug coverage and may offer additional benefits like dental, vision, and hearing services. However, beneficiaries may have to use specific providers within the plan's network.

Medigap plans, on the other hand, are designed to cover the gaps in Original Medicare coverage. These plans do not offer additional benefits beyond what Original Medicare covers, but they can help reduce out-of-pocket costs by covering deductibles, copayments, and coinsurance. Medigap plans do not have networks, allowing beneficiaries to use any doctor or hospital that accepts Medicare.

Choosing the Right Medicare Health Insurance Plan

Choosing the right Medicare health insurance plan is a critical decision that can significantly impact an individual’s healthcare experience and financial well-being. With a variety of plan types and options available, it’s essential to carefully consider personal healthcare needs, budget, and preferences to make an informed choice.

Evaluating Personal Healthcare Needs

The first step in choosing a Medicare health insurance plan is to evaluate personal healthcare needs. Consider the types of medical services that are likely to be required, such as inpatient hospital stays, outpatient medical care, prescription medications, and specialized services like dental, vision, or hearing care. Understanding these needs will help narrow down the most suitable plan options.

Assessing Budget and Cost Considerations

Budget and cost considerations are crucial factors in choosing a Medicare health insurance plan. Original Medicare (Part A and Part B) typically requires beneficiaries to pay deductibles, copayments, and coinsurance for covered services. Medicare Advantage Plans (Part C) and Medigap plans may have different cost structures, including monthly premiums, copayments, or coinsurance.

It's essential to review the specific costs associated with each plan, including premiums, deductibles, and out-of-pocket maximums. These costs can vary significantly between plans, so it's important to choose a plan that aligns with an individual's financial situation and ability to manage healthcare expenses.

Reviewing Plan Networks and Provider Choices

The network of providers and the freedom to choose doctors and hospitals are important considerations when choosing a Medicare health insurance plan. Original Medicare (Part A and Part B) typically offers a broad network of healthcare providers, allowing beneficiaries to choose from a wide range of doctors and hospitals. However, Medicare Advantage Plans (Part C) may have more limited networks, requiring beneficiaries to use specific providers within the plan’s network.

It's crucial to review the plan's network of providers to ensure that preferred doctors and hospitals are included. Beneficiaries should also consider the convenience of accessing healthcare services, such as the proximity of providers to their home or the availability of specialists in their area.

Tips for Navigating Medicare Health Insurance Plans

Navigating the complex world of Medicare health insurance plans can be daunting, but with the right approach and resources, individuals can make informed decisions about their healthcare coverage. Here are some tips to help simplify the process and ensure a smooth transition into Medicare.

Seeking Professional Guidance

The world of Medicare can be complex, with various plan types, coverage options, and enrollment periods. Seeking professional guidance from a licensed insurance agent or a Medicare expert can provide valuable insights and personalized advice. These professionals can help individuals understand their specific eligibility, review available plan options, and guide them through the enrollment process.

Using Medicare Plan Finders and Comparison Tools

Medicare.gov, the official U.S. government site for Medicare, offers a range of tools and resources to help individuals navigate Medicare health insurance plans. The Plan Finder tool allows beneficiaries to compare different plan options, view costs and benefits, and enroll online. Additionally, Medicare.gov provides a wealth of information about Medicare, including eligibility criteria, coverage details, and important dates.

Understanding Medicare Communication and Resources

Medicare communicates with beneficiaries through various channels, including mail, email, and phone calls. It’s important to understand these communication methods and the information they convey. Beneficiaries should review their Medicare Summary Notices (MSNs) to verify the accuracy of claims and understand their out-of-pocket costs.

Medicare also provides a range of resources, such as the Medicare & You handbook, which is mailed to all beneficiaries each year. This handbook contains valuable information about Medicare coverage, costs, and rights. Additionally, the Medicare.gov website offers a wealth of educational materials, including articles, videos, and webinars, to help beneficiaries understand their healthcare options.

Enrolling in the Right Plan and Staying Informed

Choosing the right Medicare health insurance plan is a critical decision, and it’s important to stay informed throughout the enrollment process. Beneficiaries should carefully review their plan options, considering their healthcare needs, budget, and provider preferences. It’s also essential to understand the enrollment timelines and deadlines to ensure a seamless transition into Medicare coverage.

Once enrolled, beneficiaries should stay informed about their plan's benefits and coverage. Regularly reviewing plan materials, attending plan-sponsored educational events, and staying up-to-date with Medicare news and updates can help beneficiaries make the most of their healthcare coverage and avoid potential pitfalls.

What is the difference between Original Medicare and Medicare Advantage Plans?

+

Original Medicare (Part A and Part B) is a traditional fee-for-service plan that offers flexibility in choosing healthcare providers but typically requires beneficiaries to pay deductibles, copayments, and coinsurance. Medicare Advantage Plans (Part C) are offered by private insurance companies and provide an alternative to Original Medicare, often including additional benefits and coordinated care. These plans may have a more limited network of providers.

How do I enroll in Medicare health insurance plans?

+

The enrollment process varies depending on the plan type. For Original Medicare (Part A and Part B), individuals can enroll online through the Social Security website, by phone, or in person at a local Social Security office. For Medicare Advantage Plans (Part C) and Medicare Prescription Drug Plans (Part D), enrollment typically occurs during the Medicare Annual Enrollment Period, which runs from October 15th to December 7th each year.

What is the Medicare Annual Enrollment Period?

+

The Medicare Annual Enrollment Period is a specific time frame, running from October 15th to December 7th each year, during which Medicare beneficiaries can make changes to their Medicare coverage. This period allows beneficiaries to switch plans, add or drop coverage, or make other adjustments to their healthcare options.