No Fault Auto Insurance States

In the United States, the concept of No Fault Auto Insurance has been a topic of discussion and implementation for several decades. As of my last update in January 2023, 12 states and the District of Columbia have adopted some form of no-fault auto insurance system. This system aims to streamline the process of dealing with car accidents by providing financial coverage for policyholders regardless of who is at fault in the incident.

The no-fault system is designed to reduce litigation and expedite the claims process, ensuring that injured parties receive prompt medical attention and financial compensation. However, it also comes with its own set of complexities and potential drawbacks. Let's delve into the specifics of no-fault auto insurance, exploring its advantages, challenges, and the states that have implemented this system.

Understanding No Fault Auto Insurance

No fault auto insurance, also known as personal injury protection (PIP) or first-party benefits, is a type of car insurance coverage that provides benefits to the policyholder and their passengers regardless of who caused the accident. This system differs from the traditional tort or at-fault insurance model, where the person responsible for the accident is held liable for the damages and injuries sustained by others involved.

Under a no-fault system, each driver's insurance company pays for the medical expenses, lost wages, and other related costs for their own policyholders, even if the accident was not their fault. This approach aims to reduce the number of car accident lawsuits and expedite the claims process, ensuring that those involved in accidents receive necessary medical care and financial support promptly.

Advantages of No Fault Auto Insurance

No fault auto insurance offers several advantages that make it an appealing option for many drivers and policymakers.

Swift Claims Processing

One of the primary benefits of no-fault insurance is the speed of claims processing. Unlike the tort system, which often involves lengthy legal battles to determine fault and liability, no-fault insurance allows policyholders to receive benefits quickly. This ensures that injured individuals can access medical treatment and financial support without having to wait for a legal resolution.

For instance, imagine a scenario where a driver is involved in an accident and sustains injuries. Under a no-fault system, they can file a claim with their own insurance provider, who will promptly cover their medical expenses and lost wages, regardless of who caused the accident. This streamlined process can significantly reduce the stress and financial burden associated with car accidents.

Reduced Litigation

The no-fault system is designed to minimize litigation and the associated costs. By shifting the focus from determining fault to providing coverage for all involved parties, no-fault insurance reduces the number of lawsuits and legal disputes. This not only benefits drivers by avoiding lengthy court battles but also helps to keep insurance premiums more stable and affordable.

In states with no-fault insurance, insurance companies often encourage their policyholders to resolve disputes through mediation or arbitration, further reducing the need for costly and time-consuming litigation.

Focus on Medical Care

No fault insurance prioritizes medical care for injured individuals. Under this system, policyholders have access to prompt and comprehensive medical treatment, ensuring that their health and well-being are taken care of first and foremost. This approach is particularly beneficial in cases of severe accidents, where quick medical attention can make a significant difference in the victim’s recovery.

Additionally, no-fault insurance often covers a wider range of medical expenses, including not only hospital visits and surgeries but also rehabilitation, chiropractic care, and even mental health services related to the accident.

Challenges and Considerations

While no-fault auto insurance has its advantages, it also presents certain challenges and considerations that policymakers and drivers should be aware of.

Fraud and Abuse

One of the primary concerns with no-fault insurance is the potential for fraud and abuse. Since policyholders can file claims without regard to fault, there is a risk that some individuals may exploit the system by filing false or exaggerated claims. This can lead to increased insurance costs for all policyholders and strain the insurance system as a whole.

To address this issue, many states with no-fault insurance have implemented strict fraud prevention measures and enhanced verification processes. These measures aim to ensure that only legitimate claims are paid out, protecting the integrity of the system.

Limited Tort Options

In some states, no-fault insurance systems come with limited tort options. This means that policyholders may have restrictions on their ability to sue for non-economic damages, such as pain and suffering, unless their injuries meet a certain threshold of severity. While this limitation aims to reduce frivolous lawsuits, it can also limit the compensation received by severely injured individuals.

However, some states have implemented reforms to address this concern, allowing policyholders to opt for full tort coverage or providing exceptions for specific types of injuries.

Impact on Insurance Premiums

The implementation of no-fault insurance can impact insurance premiums in various ways. On one hand, the reduced litigation and focus on medical care can lead to more stable and affordable premiums over time. On the other hand, the initial transition to a no-fault system may result in higher premiums as insurance companies adjust their rates to account for the new coverage requirements.

Additionally, the specific design and regulations of each state's no-fault system can influence the premium amounts. States with more comprehensive coverage requirements or higher benefit limits may see higher premiums, while those with more limited benefits might have lower costs.

States with No Fault Auto Insurance

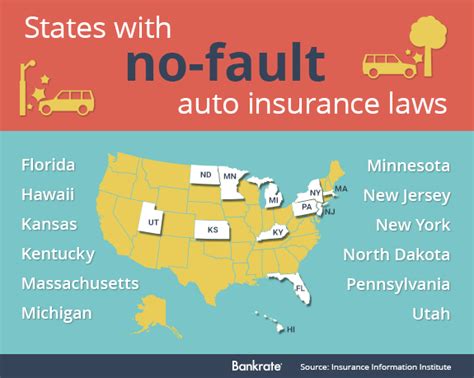

As of my last update, the following states and the District of Columbia have adopted some form of no-fault auto insurance system:

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Utah

- District of Columbia

Each of these states has its own unique set of regulations and requirements for no-fault insurance, including the types of coverage, benefit limits, and dispute resolution processes. It's important for drivers in these states to understand the specific details of their state's no-fault system to ensure they have adequate coverage.

Comparative Analysis: Fault vs. No Fault

Comparing the fault and no-fault systems of auto insurance reveals distinct advantages and disadvantages for each approach. The fault system, prevalent in many states, places responsibility on the at-fault driver to compensate the injured party. This system can lead to extensive legal battles and prolonged settlement processes, adding emotional and financial stress to those involved. However, it also provides a clear avenue for victims to seek compensation for their damages, including pain and suffering.

In contrast, the no-fault system, implemented in select states, prioritizes quick resolution and financial support for all involved, regardless of fault. This approach expedites the claims process, reduces litigation, and ensures prompt access to medical care. However, it may limit the compensation available to victims, especially for non-economic damages, and can lead to higher insurance premiums due to the increased coverage provided.

The choice between fault and no-fault systems is a delicate balance between ensuring fair compensation for victims and streamlining the claims process to provide timely support. It is a complex decision that requires careful consideration of various factors, including the state's legal framework, the needs of its residents, and the potential impact on insurance affordability and accessibility.

The Future of No Fault Auto Insurance

The landscape of no-fault auto insurance is constantly evolving as states reassess their systems and make adjustments based on practical experiences and changing circumstances. Some states, like Florida, have undergone significant reforms to address concerns about fraud and abuse, while others, like Michigan, have made changes to improve the affordability and accessibility of no-fault coverage.

Looking ahead, the future of no-fault auto insurance will likely be shaped by technological advancements, changing legal landscapes, and evolving consumer needs. The rise of autonomous vehicles and ride-sharing services, for instance, may necessitate a reevaluation of current insurance models. Additionally, ongoing efforts to reduce litigation and streamline claims processes will continue to influence the design and implementation of no-fault systems across the country.

As we navigate these changes, it is essential to maintain a focus on the core principles of no-fault insurance: providing timely and comprehensive support to those involved in car accidents, while also ensuring the system's integrity and financial sustainability. This delicate balance will require ongoing collaboration between policymakers, insurance providers, and the public to create a fair and efficient auto insurance landscape.

Conclusion

No fault auto insurance offers a unique approach to car accident compensation, prioritizing swift medical care and financial support for policyholders. While it presents advantages such as reduced litigation and expedited claims processing, it also comes with challenges like fraud prevention and potential limitations on compensation. As the auto insurance landscape continues to evolve, staying informed about the specific regulations and benefits of your state’s system is crucial for making informed decisions about your coverage.

What is no-fault auto insurance, and how does it work?

+No-fault auto insurance is a system where policyholders receive benefits from their own insurance provider after an accident, regardless of who caused it. This system aims to provide prompt medical care and financial support, reducing the need for lengthy legal battles.

Which states have adopted no-fault auto insurance?

+As of my last update, the states with no-fault auto insurance include Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, Utah, and the District of Columbia.

What are the advantages of no-fault insurance?

+No-fault insurance offers swift claims processing, reduced litigation, and a focus on medical care for injured individuals. It ensures prompt access to necessary medical treatment and financial support, reducing the stress and financial burden associated with car accidents.

What are some challenges associated with no-fault insurance?

+Challenges include the potential for fraud and abuse, limited tort options in some states, and the impact on insurance premiums. States with no-fault insurance have implemented measures to address these concerns, but they remain important considerations for policymakers and drivers.