Life Insurance For 60 And Over

As we navigate the later stages of life, financial planning becomes an essential aspect of ensuring a secure and comfortable future. Life insurance, often associated with younger adults, can still play a vital role for individuals aged 60 and over. However, the landscape of life insurance for this demographic is unique and offers specific advantages and considerations. In this comprehensive guide, we will delve into the world of life insurance for individuals aged 60 and above, exploring the options, benefits, and factors to keep in mind when making this important decision.

Understanding Life Insurance for Seniors

The concept of life insurance for seniors might seem unconventional, but it serves a crucial purpose. Life insurance policies for individuals aged 60 and over are designed to provide financial protection and peace of mind during a period when financial responsibilities may still exist and the need for long-term care planning becomes more prominent.

For seniors, life insurance can offer a range of benefits, including:

- Funeral and Burial Costs: One of the primary purposes of life insurance is to cover the expenses associated with end-of-life arrangements. This can alleviate the financial burden on loved ones during an already emotional time.

- Debt Repayment: Life insurance can be used to pay off any outstanding debts, such as mortgages or credit card balances, ensuring that family members are not left with unexpected financial obligations.

- Legacy and Estate Planning: A life insurance policy can be a strategic tool for seniors to leave a legacy and ensure their assets are distributed as intended. It can provide liquidity to an estate, allowing for efficient estate settlement and potential tax benefits.

- Long-Term Care: Certain life insurance policies offer riders or additional benefits that can be utilized for long-term care expenses. This is particularly valuable for seniors who may require assistance with daily activities or nursing home care.

Types of Life Insurance for 60 and Over

When considering life insurance as a senior, it's essential to understand the different types of policies available and their specific features. Here's an overview of the primary options:

Term Life Insurance

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It is often more affordable than permanent life insurance, making it a suitable choice for seniors who want temporary coverage to cover specific financial obligations. For instance, a 65-year-old individual might opt for a 10-year term policy to ensure their mortgage is paid off in the event of their passing.

| Term Length | Coverage Amount | Monthly Premium |

|---|---|---|

| 10 years | $100,000 | $45 |

| 20 years | $250,000 | $80 |

| 30 years | $500,000 | $150 |

💡 Note: Term life insurance premiums tend to increase with age, so it's advisable to secure coverage as early as possible within the senior years.

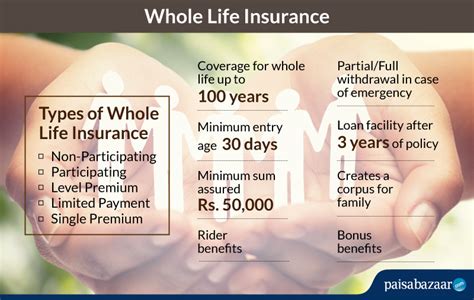

Permanent Life Insurance

Permanent life insurance, including whole life and universal life policies, offers lifetime coverage and builds cash value over time. While it can be more expensive than term life, it provides a death benefit guarantee and the potential for growth. For seniors, permanent life insurance can be a valuable asset for long-term financial planning and legacy building.

| Policy Type | Coverage Amount | Monthly Premium |

|---|---|---|

| Whole Life | $200,000 | $250 |

| Universal Life | $300,000 | $320 |

💡 Permanent life insurance policies may offer flexible premium payments and the ability to access cash value through loans or withdrawals.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance policies are designed for individuals who may have health conditions or a history of medical issues. These policies do not require a medical exam and provide a simplified application process. While they typically have lower coverage amounts and higher premiums, they can be a viable option for seniors who have been denied traditional life insurance due to health reasons.

| Coverage Amount | Monthly Premium |

|---|---|

| $10,000 | $65 |

| $20,000 | $120 |

Factors to Consider When Choosing Life Insurance

When navigating the world of life insurance as a senior, several factors come into play. Here are some key considerations:

Health and Lifestyle

Your health and lifestyle can significantly impact the type of life insurance policy you can obtain and the associated costs. Medical conditions, smoking habits, and other factors may influence the availability and affordability of certain policies. It’s essential to be transparent about your health status during the application process.

Financial Goals and Needs

Assess your financial goals and the specific needs you aim to address with life insurance. Do you want to cover funeral expenses, repay debts, or provide a financial cushion for your loved ones? Understanding your objectives will guide your choice of policy type and coverage amount.

Long-Term Care Planning

For many seniors, the prospect of long-term care is a significant concern. Some life insurance policies offer riders or additional benefits that can be utilized for long-term care expenses. Exploring these options can be a strategic way to prepare for potential healthcare needs.

Policy Features and Flexibility

Review the features and benefits of different life insurance policies. Consider factors such as the ability to increase coverage, access cash value, or make policy adjustments as your needs evolve. Flexibility can be a valuable asset in ensuring your life insurance policy remains relevant throughout your senior years.

Obtaining Life Insurance as a Senior

Securing life insurance as a senior may involve a few additional steps compared to younger adults. Here’s what you can expect during the application process:

Medical Exam or Health Questionnaire

Most life insurance companies will require a medical exam or health questionnaire to assess your eligibility. The exam is typically conducted by a licensed paramedic and involves a physical assessment and blood and urine samples. Alternatively, some companies offer simplified issue policies that rely on a health questionnaire instead of an exam.

Application and Underwriting

The application process involves providing detailed information about your health, lifestyle, and financial situation. Underwriters will review your application and determine your risk level, which influences the premium you pay. It’s crucial to be honest and thorough in your application to avoid issues with policy issuance or claims in the future.

Policy Acceptance and Premium Payment

Once your application is approved, you will receive a policy contract outlining the terms and conditions of your coverage. Review the policy carefully and ensure it aligns with your expectations. After accepting the policy, you will need to set up premium payments, which can be done through various methods, including automatic withdrawals or credit card payments.

The Benefits of Seeking Professional Guidance

Navigating the complex world of life insurance as a senior can be challenging. Seeking the guidance of a qualified insurance professional or financial advisor can provide valuable insights and ensure you make informed decisions. Here’s how a professional can assist you:

Policy Comparison and Personalized Advice

An insurance professional can assess your needs and goals and provide tailored recommendations based on your specific circumstances. They can compare different policies, explain the features and benefits, and help you understand the trade-offs between cost and coverage.

Expertise in Senior-Specific Policies

Insurance professionals who specialize in senior life insurance have in-depth knowledge of the unique policies and options available to this demographic. They can guide you toward policies that offer the best value and align with your long-term financial and healthcare goals.

Assistance with the Application Process

Completing life insurance applications can be complex, especially for seniors who may have health concerns or limited mobility. An insurance professional can guide you through the application process, ensure all necessary information is provided, and advocate on your behalf with the insurance company.

Conclusion: Empowering Seniors with Financial Protection

Life insurance for individuals aged 60 and over is a powerful tool for ensuring financial security and peace of mind during the later stages of life. Whether it’s covering funeral expenses, repaying debts, or providing a legacy for loved ones, life insurance policies offer a range of benefits tailored to the unique needs of seniors.

By understanding the different types of policies, considering individual factors, and seeking professional guidance, seniors can make informed decisions about their financial future. Life insurance empowers seniors to protect their loved ones, plan for long-term care, and navigate the complexities of estate planning with confidence.

What is the maximum age limit for life insurance policies?

+The maximum age limit for life insurance policies can vary depending on the insurance company and the type of policy. Some term life insurance policies may have age limits ranging from 65 to 80 years old, while permanent life insurance policies often have no age limit, allowing individuals to maintain coverage throughout their lives.

Are there any tax benefits associated with life insurance for seniors?

+Yes, life insurance policies can offer tax advantages. For instance, the death benefit from a life insurance policy is typically income tax-free for beneficiaries. Additionally, the cash value growth in certain permanent life insurance policies may offer tax-deferred benefits. It’s important to consult a tax professional for specific advice.

Can I add my spouse or partner as a beneficiary to my life insurance policy?

+Absolutely! You have the flexibility to designate beneficiaries of your choice, including your spouse or partner. It’s crucial to review and update your beneficiary designations regularly, especially after significant life events such as marriage, divorce, or the birth of children.