State Farm Quotes Car Insurance

State Farm is one of the leading insurance providers in the United States, offering a wide range of insurance products, including auto insurance. Obtaining car insurance quotes from State Farm is a straightforward process, allowing individuals to assess their coverage options and find the best policy for their needs. In this article, we will delve into the steps involved in obtaining State Farm car insurance quotes, explore the coverage options available, discuss the factors that influence premium costs, and provide valuable insights to help you make an informed decision.

Understanding State Farm’s Car Insurance Quoting Process

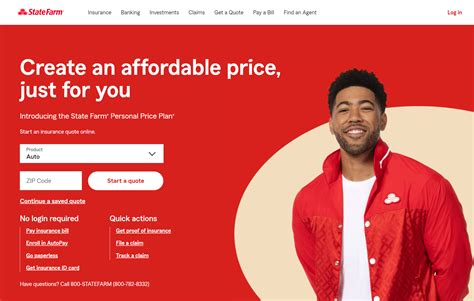

State Farm’s online quoting system is designed to be user-friendly and efficient. It allows prospective customers to input their information and receive personalized car insurance quotes quickly. The process typically involves the following steps:

Gathering Information

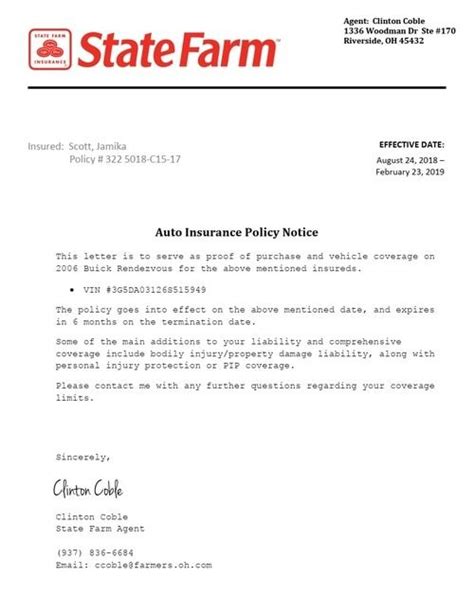

Before starting the quote process, it’s beneficial to have some key details readily available. This includes information about your vehicle(s), such as make, model, year, and mileage. Additionally, having details about your driving history, including any accidents or violations, will help ensure an accurate quote. Other relevant information includes your current insurance coverage (if any) and the desired coverage limits and deductibles.

Online Quote Form

State Farm’s website provides an online quote form that guides you through the process. You’ll be asked to provide personal information, such as your name, date of birth, and contact details. The form will then prompt you to input details about your vehicle(s) and driving history. It’s important to provide accurate information to ensure an accurate quote.

Selecting Coverage Options

During the quoting process, you’ll have the opportunity to choose the types of coverage you require. State Farm offers a comprehensive range of auto insurance coverages, including liability, collision, comprehensive, personal injury protection (PIP), medical payments, and uninsured/underinsured motorist coverage. Each coverage type provides different benefits, and understanding your specific needs is crucial to selecting the right options.

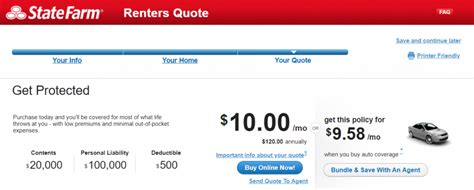

Personalized Quote

After completing the online quote form and selecting your desired coverage options, State Farm’s system will generate a personalized car insurance quote. This quote will outline the estimated premium costs based on the information you provided. It’s essential to review the quote carefully, ensuring that the coverage limits and deductibles align with your expectations.

Exploring State Farm’s Car Insurance Coverage Options

State Farm offers a comprehensive suite of auto insurance coverage options to cater to various needs. Here’s an overview of the key coverages available:

Liability Coverage

Liability coverage is a fundamental component of any car insurance policy. It protects you financially if you are found at fault in an accident, covering the costs of injuries and property damage sustained by others. State Farm provides different liability limits, allowing you to choose the level of coverage that suits your budget and desired level of protection.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for individuals injured in an accident caused by you. |

| Property Damage Liability | Provides coverage for damage to other people's property, such as vehicles or structures, in an accident caused by you. |

Collision and Comprehensive Coverage

Collision coverage helps cover the costs of repairing or replacing your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, provides protection for non-accident-related incidents, such as theft, vandalism, natural disasters, and animal collisions. These coverages are essential for ensuring your vehicle is adequately protected.

Personal Injury Protection (PIP) and Medical Payments

PIP coverage, also known as no-fault insurance, provides benefits for medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident. Medical payments coverage supplements PIP, covering additional medical expenses for you and your passengers.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with a driver who has little or no insurance. It provides compensation for injuries and property damage, ensuring you’re not left financially burdened in such situations.

Factors Influencing State Farm’s Car Insurance Premiums

Several factors play a role in determining the cost of your State Farm car insurance premiums. Understanding these factors can help you anticipate and manage your insurance expenses effectively.

Vehicle Type and Usage

The type of vehicle you drive and how you use it significantly impact your insurance premiums. High-performance sports cars, luxury vehicles, and SUVs often carry higher premiums due to their increased repair costs and potential for accidents. Additionally, vehicles used for business purposes or as daily commuters may also result in higher premiums.

Driving History and Claims

Your driving record is a crucial factor in determining insurance premiums. A clean driving history with no accidents or violations can lead to more affordable rates. Conversely, multiple accidents, traffic violations, or DUI convictions can result in higher premiums or even policy denials.

Age and Gender

Statistically, younger drivers, especially those under 25, tend to have higher insurance premiums due to their perceived higher risk of accidents. Gender also plays a role, with male drivers often facing slightly higher premiums, particularly in certain age groups.

Credit Score

In many states, insurance companies use credit-based insurance scores to assess an individual’s risk level. A higher credit score can result in more favorable insurance rates, as it is often correlated with responsible financial behavior.

Location and Mileage

The area where you live and drive your vehicle can impact your insurance premiums. Urban areas with higher traffic volumes and crime rates often result in higher premiums. Additionally, the number of miles you drive annually can influence your rates, with higher mileage potentially leading to increased costs.

Tips for Optimizing Your State Farm Car Insurance Quote

To ensure you’re getting the most competitive and suitable car insurance quote from State Farm, consider the following tips:

- Compare Quotes: Obtain quotes from multiple insurance providers to ensure you're getting the best rate for your specific needs.

- Bundle Policies: State Farm offers discounts for customers who bundle multiple insurance policies, such as auto and home insurance.

- Review Coverage Limits: Ensure your coverage limits are adequate to protect your assets and provide sufficient financial protection.

- Explore Discounts: State Farm offers various discounts, including safe driver discounts, good student discounts, and loyalty rewards. Discuss these options with your agent to maximize your savings.

- Consider Usage-Based Insurance: State Farm's Drive Safe & Save program allows you to save on premiums by tracking your driving behavior. If you have a safe driving record, this program can be an excellent way to reduce your insurance costs.

Frequently Asked Questions

How can I get a more accurate car insurance quote from State Farm?

+

To obtain an accurate car insurance quote from State Farm, ensure you have all the necessary information about your vehicle, driving history, and desired coverage limits. Providing accurate details will result in a more precise quote. Additionally, consider discussing your specific needs and circumstances with a State Farm agent, who can guide you in selecting the appropriate coverage options.

Are there any discounts available for State Farm car insurance policies?

+

Yes, State Farm offers a variety of discounts to help customers save on their car insurance premiums. These discounts include safe driver discounts, good student discounts, loyalty rewards, and discounts for bundling multiple insurance policies. It’s worth discussing these options with your State Farm agent to determine which discounts you may be eligible for.

Can I customize my State Farm car insurance policy to fit my specific needs?

+

Absolutely! State Farm allows customers to customize their car insurance policies by selecting the coverage options that best suit their needs and budget. You can choose different liability limits, add optional coverages like rental car reimbursement or roadside assistance, and adjust deductibles to find the right balance between coverage and cost.

What happens if I need to make changes to my State Farm car insurance policy after obtaining a quote?

+

If you need to make changes to your State Farm car insurance policy after obtaining a quote, it’s important to contact your State Farm agent or customer service representative. They can assist you in making the necessary updates to your policy, ensuring that your coverage and premiums reflect your current needs and circumstances.

How can I pay my State Farm car insurance premiums?

+

State Farm offers various payment options for car insurance premiums. You can choose to pay your premiums in full or set up a monthly payment plan. Payment methods include online payments, phone payments, automatic bank drafts, and traditional checks or money orders. State Farm also provides flexible payment schedules to accommodate different financial situations.