Online Insurance For Cars

The world of insurance is undergoing a digital transformation, and the auto insurance industry is no exception. With the rise of online platforms and changing consumer preferences, the traditional model of insurance is evolving. Online insurance for cars represents a significant shift in how drivers access and manage their auto insurance policies, offering convenience, customization, and cost-effectiveness. This article explores the various aspects of online car insurance, from its benefits and challenges to its future prospects.

The Rise of Online Insurance: A Game-Changer for Drivers

Online insurance has emerged as a disruptive force in the automotive industry, revolutionizing the way drivers purchase and manage their insurance policies. With just a few clicks, drivers can now compare policies, obtain quotes, and even purchase comprehensive coverage, all from the comfort of their homes. This digital shift has not only simplified the insurance process but has also introduced a new level of transparency and accessibility.

Benefits of Online Insurance

The advantages of online car insurance are manifold. Firstly, it offers unparalleled convenience. Drivers can access insurance services anytime, anywhere, without the need for physical visits to insurance offices. This is especially beneficial for those with busy schedules or those residing in remote areas.

Secondly, online insurance platforms provide an unbiased comparison of various policies. Drivers can easily evaluate different coverage options, premiums, and additional benefits, ensuring they make an informed decision. This transparency helps drivers identify the best value for their money.

Another significant benefit is customization. Online platforms often allow drivers to tailor their policies to their specific needs. Whether it’s adding roadside assistance, rental car coverage, or adjusting deductibles, online insurance provides the flexibility to create a personalized plan.

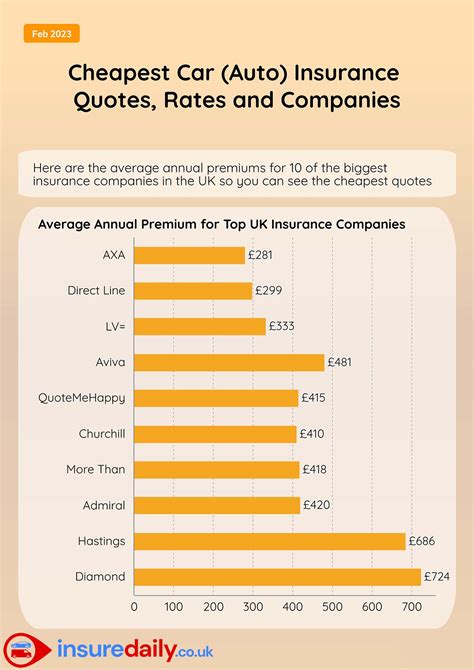

Furthermore, online insurance often translates to cost savings. Online platforms tend to have lower overhead costs, which can result in more competitive premiums. Additionally, the efficiency of online transactions and the reduced need for intermediaries can further drive down prices.

Challenges and Considerations

Despite its advantages, online car insurance also presents certain challenges. One of the primary concerns is data security. With the increasing reliance on digital platforms, the risk of data breaches and identity theft also rises. Insurance providers must invest in robust cybersecurity measures to protect customer information.

Another challenge is the digital divide. While online insurance offers convenience, not all drivers have equal access to digital technologies. Older individuals, those in rural areas with limited internet access, or individuals with disabilities may face barriers in accessing online insurance services.

Additionally, the personal touch of traditional insurance brokers may be missed by some. Brokers often provide personalized advice and assistance, especially in complex situations like claims or legal issues. Online insurance platforms may need to find ways to offer similar levels of support and guidance.

Understanding the Online Insurance Process

The process of obtaining online car insurance is straightforward and efficient. Here’s a step-by-step breakdown:

Research and Comparison

Drivers begin by researching various insurance providers and their offerings. Online comparison tools and websites provide detailed information on coverage, premiums, and customer reviews, allowing drivers to make informed choices.

Obtaining Quotes

Once drivers have identified potential providers, they can request quotes. This process typically involves filling out an online form with personal and vehicle details. The provider then generates a quote based on this information.

Policy Customization

Online insurance platforms often offer a range of customization options. Drivers can select the type and level of coverage they desire, add optional benefits, and even choose payment plans that suit their financial situation.

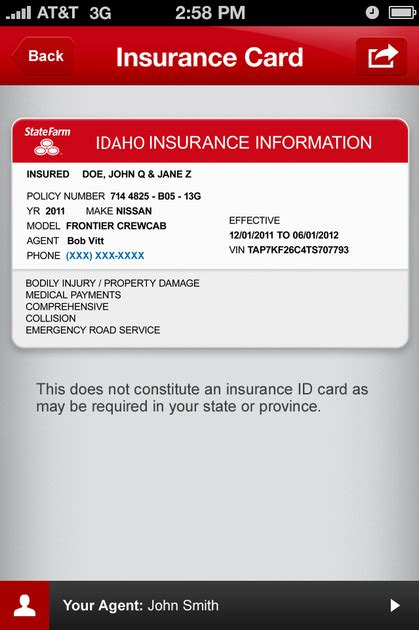

Purchase and Documentation

After selecting a policy, drivers can complete the purchase online. The provider will then send the necessary documentation, including the insurance certificate and policy details, either digitally or by mail.

Renewal and Updates

Renewing insurance online is usually a seamless process. Providers often send reminders before the policy expires, and drivers can renew with just a few clicks. Additionally, drivers can update their policies online if their circumstances change, such as a move to a new address or the addition of a new driver to their policy.

The Future of Online Car Insurance

The future of online car insurance looks promising, with several emerging trends and innovations shaping the industry.

Data-Driven Personalization

Advancements in data analytics and machine learning are enabling insurance providers to offer even more personalized policies. By analyzing vast amounts of data, including driving behavior, location, and vehicle usage patterns, providers can offer tailored coverage and premiums.

Telematics and Usage-Based Insurance

Telematics devices, which track driving behavior and vehicle usage, are gaining popularity. These devices provide real-time data on driving habits, allowing insurance providers to offer usage-based insurance. This model rewards safe drivers with lower premiums, creating a more equitable pricing structure.

Blockchain and Smart Contracts

The integration of blockchain technology into the insurance industry is expected to enhance security, transparency, and efficiency. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate certain insurance processes, such as claim settlements.

Artificial Intelligence for Claims Processing

AI-powered systems are being developed to streamline the claims process. These systems can analyze and process claims more efficiently, reducing the time and resources required. Additionally, AI can assist in fraud detection, ensuring fair and accurate claim settlements.

Enhanced Customer Support

Online insurance providers are recognizing the importance of providing robust customer support. This includes 24⁄7 live chat assistance, video conferencing for complex issues, and even AI-powered virtual assistants to guide customers through the insurance journey.

| Key Trend | Description |

|---|---|

| Data-Driven Personalization | Utilizing advanced data analytics to offer tailored policies. |

| Telematics and Usage-Based Insurance | Tracking driving behavior to reward safe drivers. |

| Blockchain and Smart Contracts | Improving security and efficiency through blockchain technology. |

| AI for Claims Processing | Automating and streamlining the claims process with AI. |

| Enhanced Customer Support | Providing round-the-clock assistance and guidance. |

How do I choose the right online car insurance provider?

+

Consider factors like coverage options, premiums, customer reviews, and the provider’s reputation. Use comparison tools and research thoroughly to make an informed decision.

Can I get better rates with online insurance?

+

Online insurance often offers competitive rates due to lower overhead costs. Additionally, the ability to customize your policy can help you find the best value for your needs.

What happens if I need to file a claim online?

+

Most online insurance providers have streamlined claim processes. You can typically file a claim online, providing details and supporting documentation. The provider will then guide you through the next steps, which may include inspections and settlements.