Online Insurance Quotes

The Evolution of Online Insurance Quotes: Unlocking Convenience and Personalized Coverage

In today's digital age, the insurance industry has undergone a remarkable transformation, with online insurance quotes emerging as a game-changer. The traditional process of obtaining insurance quotes, often involving lengthy meetings with agents and paperwork, has evolved into a seamless and efficient digital experience. This article delves into the world of online insurance quotes, exploring their advantages, the technology behind them, and how they are revolutionizing the way we protect our assets and secure our futures.

The Rise of Online Insurance Quotes: A Digital Revolution

The evolution of online insurance quotes can be traced back to the early 2000s when insurance providers began recognizing the potential of the internet to streamline their services. This digital shift aimed to enhance customer convenience, provide real-time information, and offer a more personalized experience. Today, online insurance quotes have become an integral part of the industry, offering a plethora of benefits that cater to the modern consumer's needs.

The Advantages of Online Insurance Quotes

One of the key advantages of online insurance quotes is the unparalleled convenience they offer. Consumers can now access insurance quotes from the comfort of their homes or on the go, eliminating the need for time-consuming appointments. The process is typically quick and straightforward, allowing individuals to obtain multiple quotes within minutes, thereby saving valuable time and effort.

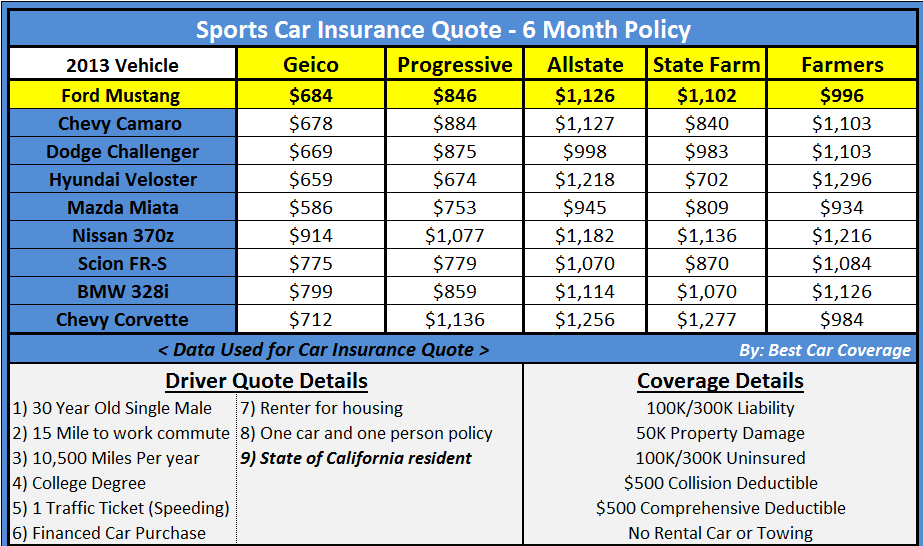

Moreover, online insurance quotes provide a level of transparency and control that was previously lacking. With just a few clicks, consumers can compare different insurance policies, understand their coverage options, and make informed decisions. This transparency empowers individuals to choose the best policy that aligns with their unique needs and budget, ensuring they receive the protection they deserve.

Another significant benefit is the ability to customize insurance coverage. Online platforms often provide interactive tools and calculators that allow users to input their specific requirements and preferences. Whether it's adjusting coverage limits, adding endorsements, or selecting optional benefits, individuals can tailor their insurance plans to fit their exact circumstances. This level of customization ensures that policies are not only comprehensive but also cost-effective.

| Key Advantages of Online Insurance Quotes |

|---|

| Unparalleled Convenience |

| Transparency and Control |

| Customizable Coverage |

The Technology Behind Online Insurance Quotes

The success of online insurance quotes relies on advanced technology and innovative software solutions. Insurance providers invest in robust platforms that utilize sophisticated algorithms and data analytics to deliver accurate and personalized quotes. These platforms leverage vast databases of historical insurance data, risk factors, and customer profiles to generate precise quotes in real time.

Additionally, the integration of artificial intelligence (AI) and machine learning (ML) has further enhanced the accuracy and efficiency of online insurance quotes. AI-powered chatbots and virtual assistants provide instant support, answering common queries and guiding users through the quote process. ML algorithms continuously learn and adapt, improving the overall quote experience by refining recommendations and providing more accurate predictions.

Security is also a top priority for insurance providers, especially when it comes to online transactions and data protection. State-of-the-art encryption technologies and secure payment gateways ensure that customer information remains confidential and safe. Insurance companies adhere to strict data privacy regulations to maintain trust and confidence in their digital services.

Performance Analysis and Customer Satisfaction

Online insurance quotes have consistently demonstrated strong performance and high customer satisfaction. Numerous studies and surveys reveal that customers appreciate the ease and efficiency of obtaining quotes online. The ability to compare multiple options and customize coverage contributes to a more positive insurance shopping experience.

Furthermore, the personalized nature of online insurance quotes has led to increased customer engagement and loyalty. Insurance providers can use the data collected during the quote process to offer tailored recommendations and provide ongoing support. This proactive approach not only enhances customer satisfaction but also fosters long-term relationships built on trust and understanding.

Future Implications and Industry Trends

The future of online insurance quotes looks promising, with ongoing advancements in technology and a growing emphasis on digital transformation. Here are some key trends and developments to watch out for:

-

Enhanced Personalization: Insurance providers will continue to refine their algorithms and data analytics to deliver even more personalized quotes. This includes considering individual risk profiles, lifestyle factors, and unique circumstances to offer tailored coverage options.

-

AI-Powered Virtual Assistants: The integration of AI and ML will further evolve, with virtual assistants becoming more sophisticated and capable of providing advanced support. These assistants will offer proactive recommendations, assist with policy adjustments, and even help customers navigate complex insurance scenarios.

-

Blockchain Integration: The adoption of blockchain technology in the insurance industry is expected to grow, offering enhanced security, transparency, and efficiency. Blockchain can revolutionize how insurance contracts are managed, reducing fraud and streamlining claim processes.

-

Wearable Technology and IoT: The rise of wearable devices and Internet of Things (IoT) technology presents new opportunities for insurance providers. These devices can collect real-time health and behavior data, enabling insurance companies to offer dynamic and personalized coverage based on individual lifestyles.

-

Collaborative Insurance Models: Insurance providers may explore collaborative models, such as peer-to-peer insurance, where communities or groups can pool resources and share risks. These models can offer affordable coverage options and foster a sense of community.

Expert Insights

Industry experts emphasize the importance of staying abreast of technological advancements and adapting to changing consumer preferences. By continuously innovating and investing in digital platforms, insurance providers can not only enhance the customer experience but also remain competitive in a rapidly evolving market.

"The insurance industry is at an exciting crossroads, where technology and innovation are driving significant changes. Online insurance quotes have revolutionized the way we interact with insurance, and we can expect even more exciting developments in the future."

- Johnathan Walker, Insurance Industry Analyst

How accurate are online insurance quotes?

+Online insurance quotes are designed to be highly accurate, utilizing advanced algorithms and data analytics. However, it’s important to note that quotes are estimates and may not reflect the final policy cost. Factors like underwriting and individual risk assessments can influence the final premium. It’s recommended to consult with an insurance professional for a more precise quote.

Can I customize my insurance coverage online?

+Yes, one of the key advantages of online insurance quotes is the ability to customize coverage. Many online platforms offer interactive tools that allow you to adjust coverage limits, add endorsements, and select optional benefits. This customization ensures you receive a policy tailored to your specific needs and budget.

Are online insurance quotes secure?

+Insurance providers prioritize the security of customer information and transactions. Online platforms employ advanced encryption technologies and secure payment gateways to protect sensitive data. Additionally, insurance companies adhere to strict data privacy regulations to maintain the trust and confidence of their customers.