Pet Insurance Policy

Welcome to a comprehensive guide to pet insurance policies, a crucial aspect of responsible pet ownership. As pets become integral members of our families, ensuring their well-being takes on a new level of importance. This article will delve into the intricacies of pet insurance, offering a detailed analysis of policies, coverage options, and the benefits they provide. By the end of this journey, you'll have a thorough understanding of how pet insurance works and why it's an essential investment for pet owners.

Understanding Pet Insurance Policies: A Comprehensive Overview

Pet insurance policies are designed to provide financial support to pet owners in the event of unexpected veterinary costs. These policies offer a safety net, ensuring that pets receive the necessary medical care without placing a significant financial burden on their owners. With the rising costs of veterinary services, pet insurance has become an increasingly popular and necessary option for pet enthusiasts.

The Basics of Pet Insurance

Pet insurance operates on a similar principle to human health insurance. Pet owners pay a premium, typically on a monthly basis, to an insurance provider. In return, the insurance company agrees to cover a portion of the costs associated with veterinary treatment, medications, and other specified services.

The coverage provided by pet insurance policies can vary widely, depending on the chosen plan and the insurance provider. Some policies offer comprehensive coverage, including accidents, illnesses, routine care, and even alternative therapies. Others may focus primarily on accidents or specific illnesses, with limited coverage for routine care.

| Policy Type | Coverage |

|---|---|

| Comprehensive | Accidents, Illnesses, Routine Care, Alternative Therapies |

| Accident-Only | Accidents, Limited Illness Coverage |

| Illness-Only | Illnesses, Excluding Accidents |

| Customizable | Allow Pet Owners to Choose Specific Coverages |

Key Considerations When Choosing a Pet Insurance Policy

Selecting the right pet insurance policy involves careful consideration of several factors. Here are some key aspects to keep in mind:

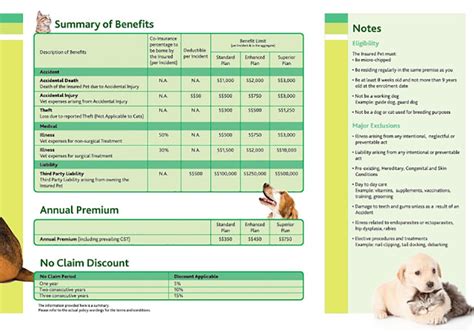

- Coverage Limits: Understand the maximum amount the insurance company will pay out for each condition and annually. Some policies may have lifetime limits, while others offer unlimited coverage.

- Deductibles and Co-pays: Deductibles are the amount you pay before the insurance kicks in, while co-pays are the percentage of the bill you pay after the deductible. Choose a policy with deductibles and co-pays that align with your financial comfort level.

- Waiting Periods: Many policies have waiting periods for certain conditions, especially pre-existing ones. Be aware of these periods to ensure you're not caught off guard.

- Reimbursement Process: Understand how the insurance company handles reimbursements. Some policies provide direct payments to the veterinary clinic, while others require you to pay upfront and then claim reimbursement.

- Network of Providers: Check if the insurance provider has a network of preferred veterinarians. If so, consider whether these providers are conveniently located and if they meet your standards of care.

The Benefits of Pet Insurance: A Closer Look

Pet insurance offers a multitude of benefits that extend beyond the financial aspect. Here’s a deeper exploration of why pet insurance is a valuable investment:

Financial Peace of Mind

The primary benefit of pet insurance is the financial protection it provides. Veterinary costs can quickly escalate, especially in emergency situations or for chronic illnesses. Pet insurance ensures that you’re not faced with the difficult choice between your pet’s health and your financial stability.

With pet insurance, you can rest easy knowing that a significant portion of your pet's medical expenses will be covered. This peace of mind allows you to focus on your pet's well-being and recovery without the added stress of financial worries.

Enhanced Veterinary Care

Pet insurance encourages pet owners to seek the best possible care for their furry companions. When you have insurance coverage, you’re more likely to opt for advanced diagnostic tests, specialized treatments, and cutting-edge therapies. This can lead to improved health outcomes and a higher quality of life for your pet.

Additionally, pet insurance often covers preventative care, such as vaccinations, spaying/neutering, and annual check-ups. By investing in these routine procedures, you can catch potential health issues early on, leading to more effective and less costly treatments.

Access to Specialized Care

Some pet insurance policies offer coverage for specialized veterinary services, including oncology, cardiology, and advanced imaging. This access to specialized care can be life-saving for pets with complex medical conditions.

For example, a policy that covers cancer treatment can provide access to state-of-the-art chemotherapy, radiation therapy, and immunotherapy. Similarly, cardiac care coverage can ensure your pet receives the latest advancements in cardiac diagnostics and treatment, improving their chances of a full recovery.

Peace of Mind for Unexpected Emergencies

Accidents and emergencies are unpredictable, and they can happen to any pet, regardless of age or breed. Pet insurance ensures that you’re prepared for these unexpected events, covering the costs of emergency room visits, surgeries, and intensive care.

Whether it's a sudden injury from a fall or an acute illness that requires immediate attention, pet insurance provides the financial support needed to get your pet the care they deserve without delay.

Real-Life Examples of Pet Insurance Claims

To illustrate the impact of pet insurance, let’s explore a few real-life scenarios where pet insurance made a significant difference:

Scenario 1: Emergency Surgery for a Dog

Meet Luna, a 3-year-old Labrador Retriever. One evening, Luna’s owners noticed she was acting strangely and refusing to eat. After rushing her to the emergency vet, they discovered she had ingested a foreign object, which required immediate surgery. The total cost of the emergency care, including surgery and post-operative treatment, amounted to $5,000.

With their comprehensive pet insurance policy, Luna's owners were reimbursed for 80% of the total cost, resulting in a significant financial relief during a stressful time.

Scenario 2: Chronic Illness Management for a Cat

Mr. Whiskers, a 10-year-old Persian cat, was diagnosed with chronic kidney disease. His owners, armed with a pet insurance policy that covered chronic conditions, were able to manage his illness effectively. Over the course of a year, they received reimbursements for specialized kidney diets, medications, and regular blood work, totaling $2,500.

Without pet insurance, the ongoing costs of managing Mr. Whiskers' condition would have been a significant financial burden.

Scenario 3: Alternative Therapy for a Senior Dog

Max, a 14-year-old Golden Retriever, was experiencing mobility issues due to arthritis. His owners opted for a pet insurance policy that covered alternative therapies. They explored acupuncture and physical therapy, which helped improve Max’s quality of life and reduced the need for more invasive treatments.

With insurance coverage, they were able to access these alternative treatments without worrying about the financial strain, ensuring Max's comfort in his golden years.

The Future of Pet Insurance: Innovations and Trends

The pet insurance industry is evolving rapidly, driven by advancements in veterinary medicine and changing consumer expectations. Here are some trends and innovations to watch out for:

Digital Innovations

Pet insurance companies are embracing digital technology to enhance the customer experience. This includes online claim submissions, real-time claim status updates, and mobile apps for policy management.

Additionally, some providers are offering telemedicine services, allowing pet owners to consult with veterinarians remotely, providing convenience and access to care outside of regular clinic hours.

Wellness and Preventative Care Coverage

There’s a growing trend towards including wellness and preventative care in pet insurance policies. This shift recognizes the importance of proactive healthcare for pets and aims to reduce the overall cost of veterinary care by catching potential issues early.

Wellness coverage may include routine vaccinations, parasite prevention, dental care, and spaying/neutering, promoting a healthier pet population.

Customizable Policies

Recognizing that every pet and pet owner is unique, insurance providers are offering more customizable policies. These policies allow pet owners to choose specific coverages, such as accident-only, illness-only, or a combination of both, tailored to their pet’s needs and their budget.

This level of customization ensures that pet owners can find a policy that fits their circumstances and provides the coverage they truly need.

Senior Pet Coverage

As pets age, they become more susceptible to chronic illnesses and age-related conditions. Insurance providers are developing policies specifically designed for senior pets, offering comprehensive coverage for the unique healthcare needs of older animals.

These policies often include higher coverage limits and specialized care options, ensuring that senior pets receive the best possible care throughout their golden years.

FAQ: Common Questions About Pet Insurance

Can I get pet insurance for my senior pet?

+Yes, many insurance providers offer policies specifically designed for senior pets. These policies typically have higher coverage limits and may include specialized care options for age-related conditions.

What happens if I switch insurance providers mid-treatment?

+Switching insurance providers during an ongoing treatment can be complex. Some providers may require a waiting period before covering pre-existing conditions. It’s crucial to understand the terms of your new policy and discuss any concerns with your veterinarian.

How do I choose the right deductible and co-pay for my policy?

+Consider your financial comfort level and your pet’s health history. If your pet has a history of medical issues, you may want to opt for a lower deductible and co-pay to minimize your out-of-pocket expenses. Discuss your options with your veterinarian and insurance provider to make an informed decision.

Pet insurance is an invaluable tool for responsible pet ownership, providing financial protection and access to the best veterinary care. By understanding the different types of policies, coverage options, and the benefits they offer, you can make an informed decision to ensure your furry friend’s health and happiness.