Progressive Insurance Home Insurance

In the ever-evolving landscape of insurance, progressive approaches are shaping the way we protect our most valuable assets. This article delves into the world of Progressive Insurance's home insurance offerings, exploring the innovative features, comprehensive coverage, and customer-centric philosophy that set them apart in the industry.

A Revolutionary Approach to Home Protection

Progressive Insurance, a pioneer in the insurance sector, has extended its innovative spirit to the realm of home insurance. With a focus on customization, transparency, and digital convenience, Progressive offers a fresh perspective on safeguarding your home and its contents.

Tailored Coverage for Unique Homes

One of the standout features of Progressive’s home insurance is its commitment to personalized coverage. Recognizing that every home is unique, they offer a wide range of coverage options to suit diverse needs. Whether you own a historic mansion, a modern apartment, or a cozy cottage, Progressive aims to provide a tailored insurance solution.

Here's a glimpse at some of the key coverage options:

- Dwelling Coverage: Protects the physical structure of your home against perils such as fire, wind, hail, and vandalism.

- Personal Property Coverage: Replaces or repairs your belongings, including furniture, electronics, and clothing, in the event of a covered loss.

- Liability Protection: Provides financial coverage in case you're found legally responsible for another person's injury or property damage that occurs on your property.

- Additional Living Expenses: Covers the cost of temporary housing and other necessary expenses if your home becomes uninhabitable due to a covered loss.

- Personal Injury Coverage: Offers protection against claims of false arrest, libel, slander, or invasion of privacy.

Progressive's coverage goes beyond the basics, with optional endorsements to further customize your policy. For instance, you can opt for:

- Water Backup Coverage: Protects against water damage from sump pump failures or sewer backups.

- Identity Theft Coverage: Provides resources and financial protection if you become a victim of identity theft.

- Scheduled Personal Property Coverage: Offers higher limits for valuable items like jewelry, art, or musical instruments.

The Progressive Advantage

What sets Progressive’s home insurance apart is its commitment to delivering a seamless, customer-centric experience. Here’s how they strive to make home insurance more accessible and beneficial for homeowners:

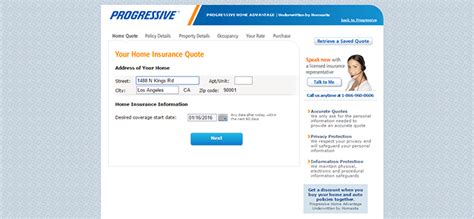

- Online Convenience: Progressive offers a user-friendly online platform where customers can easily obtain quotes, manage their policies, and file claims. The digital interface provides transparency and control over your insurance journey.

- Bundle Discounts: By bundling your home and auto insurance with Progressive, you can save significantly on your premiums. This strategy not only simplifies your insurance management but also rewards loyalty.

- Claims Satisfaction Guarantee: Progressive stands by its claims process, promising a quick and fair resolution. In the unlikely event of a claim dispute, they offer a Claims Satisfaction Guarantee, ensuring your satisfaction with the outcome.

- Discounts and Savings: Progressive understands that insurance is a significant expense. That's why they offer various discounts, including discounts for homeowners who install security systems, smoke detectors, or fire extinguishers.

Additionally, Progressive's home insurance policies are backed by a strong financial foundation, providing peace of mind that your claims will be honored.

Customer Satisfaction and Peace of Mind

Progressive’s commitment to customer satisfaction is evident in its high customer retention rate and positive feedback. The company’s focus on education and transparency ensures that homeowners understand their coverage and feel empowered to make informed decisions.

One of the standout features is Progressive's 24/7 customer support, ensuring that homeowners can access assistance whenever needed. Whether it's a question about coverage, a policy update, or a claim, Progressive's team is readily available.

| Coverage Type | Average Coverage Limit |

|---|---|

| Dwelling Coverage | $300,000 |

| Personal Property Coverage | $150,000 |

| Liability Protection | $300,000 |

| Additional Living Expenses | 60% of Dwelling Coverage |

Real-World Protection: A Progressive Story

To illustrate the benefits of Progressive’s home insurance, let’s consider a real-life scenario. Imagine a family living in a suburban home, insured with Progressive. During a severe storm, a tree branch crashes through their roof, causing significant damage to their dwelling and personal property.

Thanks to their Progressive policy, the family is covered for the repair or replacement of their roof and the damaged belongings. Progressive's Claims Advocate guides them through the process, ensuring a timely and efficient resolution. The family's peace of mind is further enhanced by the Additional Living Expenses coverage, which covers their temporary accommodation while their home is being repaired.

Conclusion: A Progressive Choice for Homeowners

Progressive Insurance’s home insurance offerings represent a modern, customer-centric approach to protecting your home. With a focus on customization, online convenience, and a strong commitment to customer satisfaction, Progressive provides a comprehensive and reliable insurance solution. As the insurance landscape continues to evolve, Progressive’s innovative spirit ensures that homeowners can rely on their policies to protect what matters most.

What is the average cost of Progressive’s home insurance?

+The cost of Progressive’s home insurance varies based on factors such as the location, size, and construction of your home, as well as your coverage limits and deductibles. On average, homeowners can expect to pay around $1,200 annually for their home insurance policy with Progressive.

Does Progressive offer discounts on home insurance?

+Yes, Progressive offers a range of discounts to help homeowners save on their insurance premiums. These include discounts for bundling home and auto insurance, installing security systems, and maintaining a claims-free history. Additionally, Progressive’s HomeAdvantage program provides further savings opportunities.

How does Progressive’s claims process work?

+Progressive’s claims process is designed to be efficient and customer-centric. You can report a claim online, over the phone, or through the Progressive app. Once reported, a dedicated Claims Advocate will guide you through the process, ensuring a timely and fair resolution. Progressive’s Claims Satisfaction Guarantee further assures homeowners of a positive claims experience.