Progressive Phone Number Car Insurance

In the dynamic world of insurance, the concept of Progressive Phone Number Car Insurance has emerged as a groundbreaking approach, offering a unique and convenient way for individuals to access insurance services. This innovative method has gained significant traction in the industry, revolutionizing the traditional insurance landscape. As we delve into this article, we will explore the intricacies of Progressive Phone Number Car Insurance, its benefits, and its impact on the insurance sector.

Understanding Progressive Phone Number Car Insurance

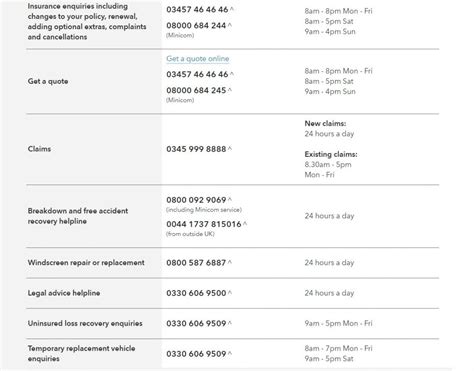

Progressive Phone Number Car Insurance is a forward-thinking insurance solution that utilizes phone numbers as a primary point of contact for policyholders. This innovative approach allows customers to easily reach their insurance provider, streamlining the entire insurance process. With a simple phone call, policyholders can access a range of services, from obtaining quotes to filing claims, all without the need for lengthy paperwork or complex online processes.

This system is designed to cater to the modern consumer, who values convenience and efficiency. By leveraging the ubiquity of phone numbers, Progressive has created a seamless and accessible insurance experience. Policyholders can now connect with their insurer quickly and easily, ensuring a swift resolution to their insurance needs.

The Benefits of Progressive Phone Number Car Insurance

1. Enhanced Accessibility

One of the key advantages of Progressive Phone Number Car Insurance is its unparalleled accessibility. With just a phone number, individuals can access a wealth of insurance services, regardless of their location or technological expertise. This is particularly beneficial for those who prefer a more personal touch or may face challenges with online platforms.

The simplicity of using a phone number as a primary contact point ensures that even individuals with limited digital literacy can navigate the insurance process with ease. This inclusive approach has the potential to bridge the gap between traditional and digital insurance services, making insurance more accessible to a wider range of consumers.

2. Improved Customer Experience

Progressive’s focus on phone-based insurance services has significantly enhanced the overall customer experience. By providing a dedicated phone line, policyholders can receive personalized attention and assistance from trained professionals. This human-centric approach fosters a sense of trust and reliability, setting Progressive apart from competitors.

Furthermore, the convenience of phone-based services allows policyholders to manage their insurance needs at their convenience. Whether it's a quick quote check or a detailed claim discussion, customers can initiate and complete these processes without the need for time-consuming appointments or complicated online forms.

3. Efficient Claim Processing

The efficiency of Progressive Phone Number Car Insurance truly shines when it comes to claim processing. By utilizing phone numbers as a primary contact method, Progressive can gather all the necessary information directly from policyholders. This streamlined approach eliminates the need for multiple back-and-forth communications, reducing the time and effort required for claim resolution.

With a dedicated team of claim specialists, Progressive can provide prompt and accurate assessments, ensuring policyholders receive the compensation they deserve in a timely manner. The phone-based system also allows for real-time updates and personalized guidance, further enhancing the overall claim experience.

Performance Analysis and Industry Impact

The implementation of Progressive Phone Number Car Insurance has had a significant impact on the insurance industry. By embracing this innovative approach, Progressive has set a new standard for customer service and accessibility. The success of this model has prompted other insurance providers to reevaluate their own processes, leading to a broader adoption of phone-based services across the industry.

Moreover, the positive feedback and high customer satisfaction rates associated with Progressive Phone Number Car Insurance have further solidified its position as a leading insurance provider. The convenience and efficiency offered by this system have not only attracted new customers but have also fostered a loyal customer base, contributing to Progressive's overall growth and success.

Real-World Case Study

To illustrate the effectiveness of Progressive Phone Number Car Insurance, let’s consider the experience of Ms. Emily Johnson, a policyholder who recently filed a claim.

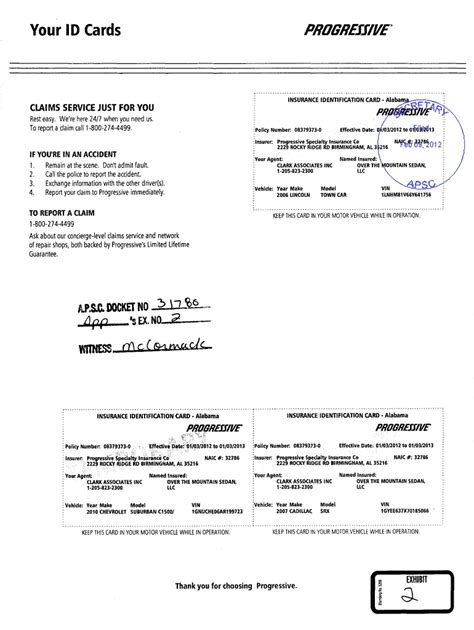

Ms. Johnson, a busy professional, found herself in a minor car accident during her morning commute. She immediately called the Progressive phone number listed on her policy, and within minutes, she was connected to a friendly and knowledgeable claim specialist. The specialist guided her through the entire claim process, from reporting the accident to arranging repairs, all over the phone.

The ease and efficiency of the phone-based system allowed Ms. Johnson to continue with her busy schedule while her claim was promptly processed. She received regular updates via text messages, ensuring she was always informed about the progress of her claim. Within a week, her car was repaired, and she received a full reimbursement, all without any hassle or disruption to her daily life.

Ms. Johnson's experience is a testament to the power of Progressive Phone Number Car Insurance. By providing a seamless and stress-free claim process, Progressive has not only met but exceeded her expectations, leaving her with a positive and memorable insurance experience.

Technical Specifications and Implementation

Progressive Phone Number Car Insurance is underpinned by a robust technical infrastructure. The system utilizes advanced call center technologies, including interactive voice response (IVR) systems and intelligent call routing, to ensure efficient call handling and customer support.

| Technical Feature | Description |

|---|---|

| Interactive Voice Response (IVR) | Automated system that guides callers through a series of menus, allowing them to access information and services quickly. |

| Intelligent Call Routing | Utilizes artificial intelligence to direct calls to the most appropriate department or specialist, ensuring efficient and accurate assistance. |

| Call Recording and Analytics | Records and analyzes calls to improve customer service, identify areas for improvement, and enhance overall efficiency. |

| Real-Time Updates | Provides policyholders with real-time updates on their claims via text messages or email notifications, ensuring transparency and peace of mind. |

The implementation of Progressive Phone Number Car Insurance required a comprehensive strategy, including the integration of advanced technologies, the training of specialized staff, and the development of efficient processes. This holistic approach has enabled Progressive to deliver a superior insurance experience, setting a new benchmark for the industry.

Future Implications and Industry Trends

As the insurance industry continues to evolve, the success of Progressive Phone Number Car Insurance highlights the importance of innovation and customer-centric approaches. The future of insurance is likely to see further integration of technology, with a focus on enhancing accessibility, convenience, and personalized services.

The increasing adoption of phone-based insurance services suggests that insurance providers will continue to invest in call center technologies and infrastructure. This trend is expected to lead to more efficient and effective customer support, as well as the development of innovative solutions that further streamline the insurance process.

Additionally, the success of Progressive's model may inspire other insurance sectors, such as home, health, and life insurance, to explore similar phone-based solutions. By leveraging the power of phone numbers, insurance providers can unlock new opportunities to engage with their customers and deliver exceptional experiences.

How does Progressive Phone Number Car Insurance work in practice?

+

Progressive Phone Number Car Insurance operates by providing policyholders with a dedicated phone number to contact their insurance provider. This phone number serves as a direct line to the insurer, allowing policyholders to access a range of services, including obtaining quotes, filing claims, and seeking assistance. The system is designed to be user-friendly and efficient, ensuring a seamless experience for customers.

What are the advantages of Progressive Phone Number Car Insurance over traditional insurance methods?

+

Progressive Phone Number Car Insurance offers several advantages over traditional insurance methods. Firstly, it provides enhanced accessibility, allowing policyholders to reach their insurer easily, regardless of their location or technological expertise. Secondly, it improves the customer experience by offering personalized attention and guidance from trained professionals. Lastly, the efficiency of the phone-based system simplifies claim processing, reducing the time and effort required for resolution.

Is Progressive Phone Number Car Insurance available for all types of car insurance policies?

+

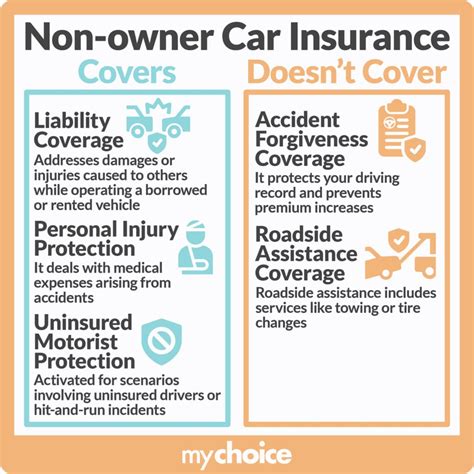

Yes, Progressive Phone Number Car Insurance is available for a wide range of car insurance policies, including comprehensive, liability, collision, and specialized coverage options. The phone-based system is designed to cater to the diverse needs of policyholders, ensuring a convenient and efficient experience for all types of car insurance policies.

How does Progressive ensure the security and privacy of policyholder information over the phone?

+

Progressive takes the security and privacy of policyholder information very seriously. The company employs advanced encryption technologies and secure data storage systems to protect sensitive information. Additionally, all call center staff undergo rigorous training on data protection protocols to ensure the highest level of security and confidentiality.