Renters Insurance Cover

Renters insurance is an essential yet often overlooked form of protection for individuals who rent their homes. It provides financial coverage and peace of mind to renters, safeguarding them against various unexpected events and liabilities. In this comprehensive guide, we will delve into the intricacies of renters insurance, exploring its coverage, benefits, and how it can protect you and your belongings. With the right understanding, you'll be equipped to make informed decisions and ensure your rental life is as secure as it can be.

Understanding Renters Insurance Coverage

Renters insurance, also known as tenants insurance, is a policy specifically designed for individuals who rent apartments, houses, or condominiums. Unlike homeowners insurance, which covers the structure and its contents, renters insurance primarily focuses on protecting the tenant’s personal belongings and providing liability coverage.

Here's a breakdown of the key components of renters insurance coverage:

Personal Property Coverage

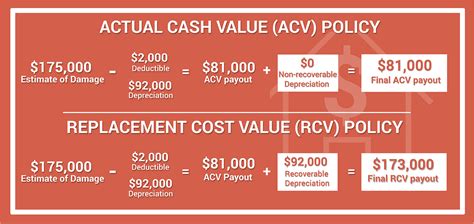

The core aspect of renters insurance is protecting your personal belongings. This includes items like furniture, electronics, clothing, and appliances. In the event of a covered loss, such as a fire, theft, or natural disaster, renters insurance will reimburse you for the cost of repairing or replacing these items.

It's important to note that renters insurance typically covers personal property on a replacement cost basis, which means you'll receive the current value of the item, not just its depreciated value. This ensures you can afford to replace your belongings without incurring significant financial loss.

Liability Coverage

Renters insurance also provides liability protection, which is a crucial aspect of any insurance policy. This coverage safeguards you against legal claims and lawsuits resulting from accidents or injuries that occur on your rental property.

For instance, if a guest trips and falls in your home, causing injury, renters insurance can help cover the medical expenses and any legal costs associated with the incident. It's a vital layer of protection, ensuring that you're not personally responsible for paying these expenses out of pocket.

Additional Living Expenses

In the event that your rental property becomes uninhabitable due to a covered loss, renters insurance can provide coverage for additional living expenses. This includes costs like temporary accommodation, meals, and other necessary expenses until you can return to your home.

This coverage is particularly valuable as it ensures you have a place to stay and can maintain your normal lifestyle while your rental property is being repaired or restored.

Optional Coverage Add-Ons

Renters insurance policies often offer additional coverage options to tailor the policy to your specific needs. These add-ons may include:

- Personal Injury Coverage: Protects you against claims of libel, slander, or invasion of privacy.

- Identity Theft Coverage: Provides resources and assistance if you become a victim of identity theft.

- Personal Articles Floater: Offers extra coverage for high-value items like jewelry, artwork, or musical instruments.

- Loss of Use: Covers expenses if you need to relocate temporarily due to a covered loss.

Benefits of Renters Insurance

Renters insurance offers a range of benefits that can provide significant peace of mind and financial security.

Protection for Your Belongings

One of the primary advantages of renters insurance is the protection it offers for your personal property. From your favorite couch to your state-of-the-art gaming console, renters insurance ensures that, in the event of a loss, you won’t be left without the means to replace these items.

Imagine coming home to a smoke-filled apartment after a fire. With renters insurance, you can rest assured that your belongings are covered, and you can start the process of rebuilding your home with confidence.

Peace of Mind

Renters insurance provides a sense of security and peace of mind. Knowing that you’re protected against unexpected events and liabilities allows you to focus on enjoying your rental life without constant worry.

Whether you're a student living off-campus or a young professional in your first apartment, renters insurance ensures that you're not left vulnerable to the financial burdens that can arise from accidents or losses.

Affordable Coverage

Renters insurance is often more affordable than many people realize. The cost of a policy depends on various factors, including the value of your personal property, the location of your rental, and any additional coverage options you choose.

On average, renters insurance policies can cost as little as $15 to $30 per month, making it an accessible and valuable investment for renters across the board.

Personalized Protection

Renters insurance policies can be customized to fit your specific needs. Whether you have high-value items that require extra coverage or you’re looking for additional protection for your unique circumstances, insurance providers can work with you to create a policy that’s tailored to your situation.

This level of personalization ensures that you're not paying for coverage you don't need while still benefiting from the protections that are most relevant to you.

Real-World Examples of Renters Insurance Claims

To illustrate the importance of renters insurance, let’s explore a few real-life scenarios where renters insurance played a critical role in protecting individuals and their belongings.

Case Study 1: Theft and Vandalism

Mr. Johnson, a young professional, was a victim of a break-in at his rental apartment. The thieves made off with his laptop, camera equipment, and some valuable jewelry. The total value of the stolen items was estimated at $5,000.

Thanks to his renters insurance policy, which included coverage for theft, Mr. Johnson was able to file a claim and receive a reimbursement for the full value of his stolen belongings. This allowed him to replace his lost items and get back on his feet without incurring a significant financial burden.

Case Study 2: Water Damage

Ms. Smith, a student living in an off-campus apartment, experienced a plumbing issue that resulted in water damage to her personal belongings and the apartment itself. The cost of repairs and replacement of her damaged items was estimated at $3,500.

With her renters insurance policy, Ms. Smith was able to file a claim for the water damage. The insurance company covered the cost of repairs to her apartment and replaced her damaged furniture, electronics, and clothing. This allowed her to continue her studies without the added stress of financial hardship.

Case Study 3: Liability Protection

Mr. Williams, a tenant in a multi-family home, had a guest over for dinner. Unfortunately, his guest slipped on a wet floor and sustained a minor injury, requiring medical attention.

With his renters insurance policy's liability coverage, Mr. Williams was protected against any legal claims or medical expenses resulting from the incident. The insurance company handled the claim, ensuring that Mr. Williams was not held personally liable for the costs associated with his guest's injury.

How to Choose the Right Renters Insurance Policy

When selecting a renters insurance policy, it’s essential to consider your specific needs and circumstances. Here are some key factors to keep in mind:

Assess Your Belongings

Take inventory of your personal property and estimate its value. This will help you determine the amount of coverage you need for your belongings.

Understand Your Risks

Consider the risks associated with your rental location and lifestyle. For example, if you live in an area prone to natural disasters like floods or earthquakes, you may want to ensure your policy includes coverage for these events.

Compare Providers and Policies

Research and compare different insurance providers and their policies. Look for companies with a strong reputation and positive customer reviews. Compare coverage limits, deductibles, and any additional perks or discounts offered.

Consider Bundle Discounts

If you already have other insurance policies, such as auto insurance, consider bundling your renters insurance with the same provider. Many insurance companies offer discounts when you bundle multiple policies, making your coverage more affordable.

Read the Fine Print

Don’t forget to carefully read the policy documents to understand what is and isn’t covered. Pay attention to exclusions and limitations to ensure you’re fully aware of the scope of your coverage.

The Future of Renters Insurance

As the rental market continues to grow and evolve, renters insurance is likely to become even more crucial for tenants. With an increasing number of people choosing to rent rather than own, the demand for comprehensive and affordable renters insurance policies will only increase.

Insurance providers are already adapting to these changing dynamics by offering more customizable and specialized policies. This trend is expected to continue, with insurers developing innovative solutions to meet the unique needs of renters.

Additionally, advancements in technology may play a significant role in the future of renters insurance. From digital documentation and claims processes to the potential use of AI and machine learning for risk assessment, the industry is poised for exciting developments.

One thing is certain: renters insurance will remain an essential tool for protecting tenants and their belongings, providing a vital safety net in an increasingly uncertain world.

How much does renters insurance cost on average?

+The cost of renters insurance can vary depending on factors such as the value of your belongings, your location, and any additional coverage options. On average, renters insurance policies can range from 15 to 30 per month. However, it’s important to shop around and compare quotes to find the best coverage at the most affordable price.

What is not covered by renters insurance?

+Renters insurance typically does not cover certain types of losses, such as damage caused by floods, earthquakes, or poor maintenance of the rental property. It’s important to review your policy’s exclusions to understand what is and isn’t covered. Additionally, renters insurance may not provide coverage for high-value items like jewelry or artwork unless you purchase additional coverage or a personal articles floater.

Can I get renters insurance if I rent a room in a shared house or apartment?

+Yes, renters insurance is available for individuals who rent a room in a shared house or apartment. It’s important to note that your policy will only cover your personal belongings and not the shared areas or belongings of other roommates. Make sure to discuss any shared liabilities or coverage needs with your roommates and consider a shared renters insurance policy if necessary.

How do I file a renters insurance claim?

+To file a renters insurance claim, you’ll typically need to contact your insurance provider and provide them with details about the incident and any relevant documentation. This may include photographs of the damage, estimates for repairs or replacement costs, and any police reports or other supporting evidence. It’s important to act promptly and follow the claims process outlined by your insurance company to ensure a smooth and efficient resolution.