Safe Insurance

In the realm of financial planning and risk management, Safe Insurance emerges as a vital concept, providing a safety net for individuals and businesses alike. This comprehensive guide will delve into the intricacies of Safe Insurance, exploring its definition, importance, and various facets, backed by real-world examples and expert insights.

Understanding Safe Insurance: A Comprehensive Overview

Safe Insurance is an essential financial tool designed to protect individuals, families, and businesses from potential financial risks and losses. It offers a wide range of coverage options, tailored to meet specific needs, ensuring peace of mind and financial stability during challenging times.

At its core, Safe Insurance operates on the principle of risk transfer. Policyholders pay premiums to insurance companies, which, in turn, provide financial protection against unforeseen events like accidents, illnesses, natural disasters, or business interruptions. This transfer of risk ensures that individuals and businesses can mitigate potential losses and manage unexpected financial burdens effectively.

The Importance of Safe Insurance

Safe Insurance plays a pivotal role in modern society, offering numerous benefits that extend beyond mere financial protection. Here’s a deeper look at why Safe Insurance is an indispensable component of any comprehensive financial plan:

- Financial Security: Safe Insurance provides a crucial safety net, ensuring that individuals and businesses can weather financial storms. Whether it's a sudden medical emergency, a natural disaster, or a business interruption, insurance coverage can help cover the associated costs, preventing financial ruin.

- Risk Management: By transferring risk to insurance providers, policyholders can effectively manage and mitigate potential risks. This allows individuals and businesses to focus on their primary objectives without being overwhelmed by the burden of unforeseen events.

- Peace of Mind: Knowing that you have insurance coverage in place can bring immense peace of mind. It alleviates the stress and anxiety associated with potential risks, allowing individuals and businesses to plan for the future with confidence.

- Legal Compliance: In many cases, certain types of insurance are mandated by law. For instance, auto insurance is mandatory in most jurisdictions, and business owners may be required to carry specific types of insurance to comply with regulations. Safe Insurance ensures compliance and avoids potential legal pitfalls.

- Long-Term Planning: Safe Insurance is a cornerstone of long-term financial planning. It allows individuals to protect their assets, plan for retirement, and ensure a secure future for their families. For businesses, insurance is crucial for sustainable growth and continuity planning.

Types of Safe Insurance: A Detailed Exploration

The world of Safe Insurance is vast and diverse, offering a multitude of coverage options to meet the unique needs of individuals and businesses. Let’s explore some of the most common types of Safe Insurance and their specific applications:

Life Insurance

Life insurance is a fundamental type of Safe Insurance, providing financial protection to the policyholder’s beneficiaries in the event of their death. It serves as a crucial tool for estate planning, ensuring that loved ones are financially secure even after the policyholder’s passing.

There are two primary types of life insurance:

- Term Life Insurance: This type of insurance offers coverage for a specific term, typically ranging from 10 to 30 years. It is often more affordable than permanent life insurance and is ideal for individuals with short-term financial needs, such as covering mortgage payments or providing for dependents.

- Permanent Life Insurance: Permanent life insurance, including whole life and universal life insurance, provides coverage for the policyholder's entire life. It accumulates cash value over time, which can be borrowed against or withdrawn, offering additional financial flexibility.

Health Insurance

Health insurance is essential for safeguarding individuals and families against the high costs of medical care. It covers a range of healthcare services, including doctor visits, hospital stays, prescription medications, and preventive care.

Key types of health insurance include:

- Individual Health Insurance: This insurance is purchased by individuals or families to cover their personal healthcare needs. It is particularly important for those who are self-employed or not covered by an employer-sponsored plan.

- Group Health Insurance: Many employers offer group health insurance plans as part of their employee benefits package. These plans often provide more comprehensive coverage and are typically more affordable due to the larger risk pool.

- Medicare and Medicaid: Government-sponsored health insurance programs like Medicare (for seniors) and Medicaid (for low-income individuals) play a vital role in ensuring access to healthcare for vulnerable populations.

Auto Insurance

Auto insurance is a mandatory requirement in most countries, offering financial protection in the event of car accidents. It covers a range of scenarios, including liability for injuries and property damage, as well as protection for the policyholder’s vehicle.

Key components of auto insurance include:

- Liability Coverage: This covers the policyholder's legal responsibility for injuries or property damage caused to others in an accident.

- Collision Coverage: It pays for repairs or replacements if the insured vehicle is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This covers damage to the insured vehicle caused by non-collision events, such as theft, vandalism, or natural disasters.

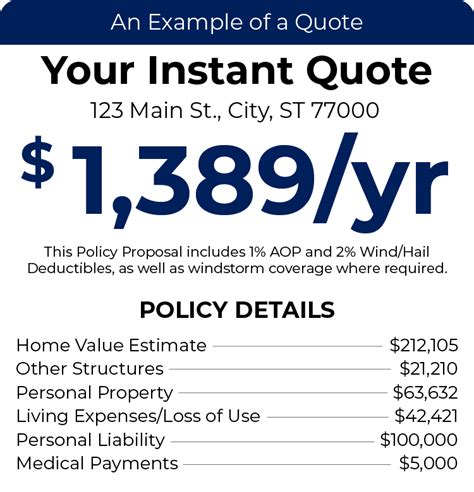

Homeowners Insurance

Homeowners insurance is designed to protect homeowners against financial losses related to their homes. It covers a wide range of risks, including damage to the property, personal belongings, and liability for injuries that occur on the premises.

Key aspects of homeowners insurance include:

- Dwelling Coverage: This covers the structure of the home, including the main house, attached structures, and detached buildings like garages.

- Personal Property Coverage: It provides protection for the policyholder's personal belongings, such as furniture, electronics, and clothing.

- Liability Coverage: Homeowners insurance includes liability protection, covering the policyholder if someone is injured on their property or if their actions cause damage to others.

Business Insurance

Business insurance is essential for protecting commercial enterprises from a wide range of risks. It can include coverage for property damage, liability, business interruption, and more, depending on the specific needs of the business.

Common types of business insurance include:

- General Liability Insurance: This coverage protects businesses against claims of bodily injury, property damage, and personal and advertising injury that occur as a result of the business's operations.

- Professional Liability Insurance (Errors and Omissions): This insurance is designed to protect professionals, such as consultants, accountants, and lawyers, against claims of negligence, errors, or omissions in their work.

- Business Interruption Insurance: This coverage helps businesses recover from financial losses incurred during periods when their operations are interrupted due to covered perils, such as fires or natural disasters.

Safe Insurance in Practice: Real-World Examples

To illustrate the impact and importance of Safe Insurance, let’s explore a few real-world scenarios where insurance played a pivotal role in protecting individuals and businesses:

Case Study: Medical Emergency

Imagine a family with comprehensive health insurance coverage. One of the family members suffers a severe accident, requiring extensive medical treatment and hospitalization. The medical bills quickly mount up, but with their health insurance in place, the family can focus on the patient’s recovery without worrying about the financial burden.

Case Study: Natural Disaster

A homeowner with comprehensive homeowners insurance finds themselves in the path of a devastating hurricane. Their home is severely damaged, but with their insurance coverage, they can quickly begin the process of rebuilding. The insurance company provides the necessary funds to repair the damage, ensuring the homeowner’s financial stability.

Case Study: Business Interruption

A small business owner invests in business interruption insurance. Unfortunately, a fire breaks out in their premises, forcing them to temporarily cease operations. With their insurance coverage, they receive financial support to cover lost income and can focus on getting their business back on track without incurring significant financial losses.

Expert Insights and Recommendations

According to industry experts, Safe Insurance is an indispensable component of any financial plan. Here are some key insights and recommendations to consider:

- Tailored Coverage: It's essential to choose insurance coverage that aligns with your specific needs and circumstances. Work with a reputable insurance broker or agent to assess your risks and select the right policies.

- Regular Review: Insurance needs can change over time. Regularly review your policies to ensure they still provide adequate coverage. Life events such as marriage, the birth of a child, or starting a new business may require adjustments to your insurance portfolio.

- Understanding Exclusions: Carefully read and understand the exclusions and limitations of your insurance policies. Being aware of what's not covered can help you make informed decisions and potentially seek additional coverage if necessary.

- Claim Process: Familiarize yourself with the claim process for your insurance policies. Knowing the steps to take in the event of a claim can expedite the process and ensure a smoother experience.

💡 Expert Tip: When choosing an insurance provider, consider their financial stability and customer service reputation. A financially strong insurer can provide long-term security, while excellent customer service ensures a positive experience throughout the policy term and in the event of a claim.

The Future of Safe Insurance: Technological Innovations

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of Safe Insurance:

Digital Transformation

Insurance companies are embracing digital technologies to enhance the customer experience. From online policy management and claim submissions to AI-powered risk assessment, the industry is becoming more efficient and customer-centric.

Personalized Insurance

With the advent of big data and advanced analytics, insurance providers can offer more personalized coverage options. By analyzing individual risk profiles, insurers can tailor policies to meet specific needs, providing cost-effective and comprehensive protection.

Blockchain and Smart Contracts

Blockchain technology has the potential to revolutionize the insurance industry. Smart contracts, self-executing agreements stored on a blockchain, can automate various insurance processes, such as claim settlement, reducing fraud and streamlining operations.

Conclusion

Safe Insurance is a cornerstone of financial security, offering protection against a wide range of risks. From life insurance to health, auto, homeowners, and business insurance, the right coverage can provide peace of mind and financial stability during challenging times. As the insurance industry continues to evolve, staying informed and proactive about your insurance needs is essential to ensure you have the right protection in place.

FAQ

What is the difference between term life insurance and permanent life insurance?

+Term life insurance provides coverage for a specified term, typically ranging from 10 to 30 years, and is often more affordable. On the other hand, permanent life insurance, such as whole life or universal life insurance, offers coverage for the policyholder’s entire life and accumulates cash value over time, providing additional financial flexibility.

How can I choose the right health insurance plan for my family?

+When selecting a health insurance plan, consider your family’s specific healthcare needs, such as chronic conditions or prescription medications. Look for plans with a network of providers that includes your preferred doctors and hospitals. Compare the costs of premiums, deductibles, and out-of-pocket expenses to find a plan that fits your budget and coverage requirements.

What should I look for in a homeowners insurance policy?

+When choosing a homeowners insurance policy, ensure it provides adequate coverage for your home’s structure, personal belongings, and liability risks. Consider the policy’s deductible and any additional coverages you may need, such as flood or earthquake insurance, based on your location’s specific risks.