State Farm Insurance Cards

Insurance identification cards, often referred to as "insurance cards," are essential documents that provide proof of insurance coverage. These cards are commonly issued by insurance companies and play a crucial role in various scenarios, including claiming medical services, verifying auto insurance, and proving liability coverage in various situations. State Farm, one of the leading insurance providers in the United States, offers comprehensive insurance cards that encompass multiple coverage types, making them a versatile tool for policyholders.

Understanding State Farm Insurance Cards

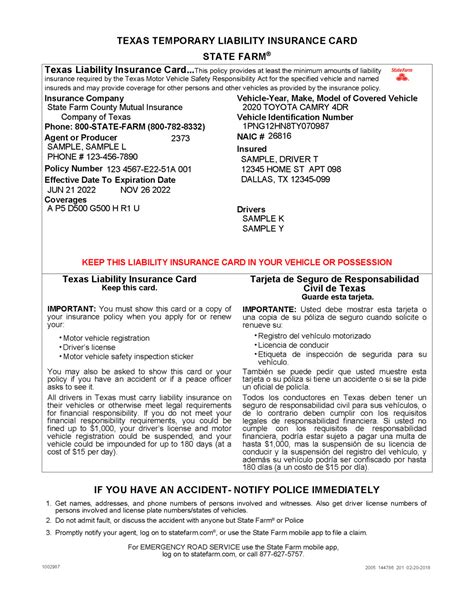

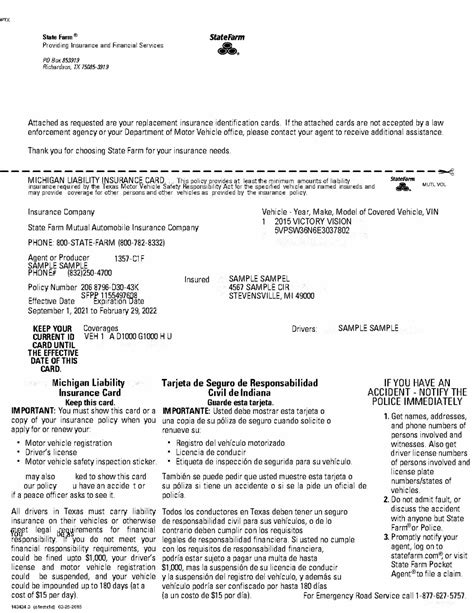

State Farm insurance cards are designed to offer a convenient and accessible way for policyholders to present their insurance information. These cards typically feature the insured individual’s name, policy number, effective dates of coverage, and a unique identification code. The front of the card often displays the State Farm logo and contact information, making it easily recognizable and providing quick access to the insurer’s support services.

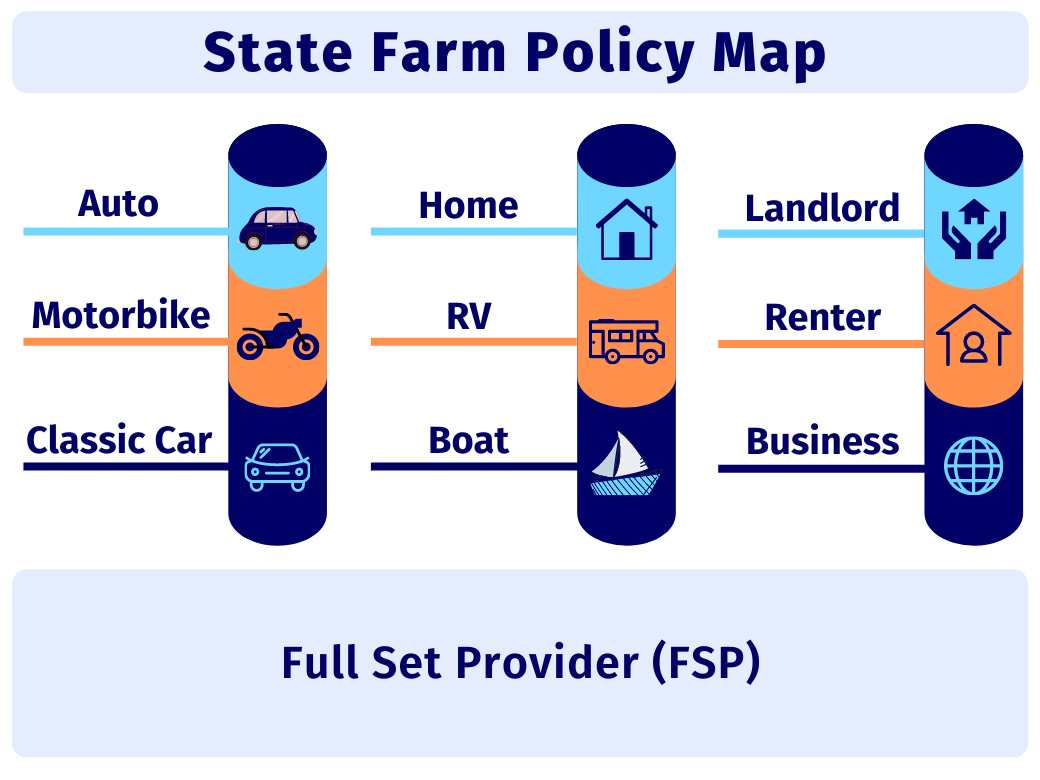

The versatility of State Farm insurance cards lies in their ability to cover various types of insurance, including auto, home, health, and life insurance. This means that policyholders can carry a single card that represents their comprehensive coverage, simplifying the process of providing proof of insurance across different scenarios.

Auto Insurance Verification

In the context of auto insurance, State Farm insurance cards are a vital tool for verifying coverage. Law enforcement officers routinely request these cards during traffic stops to ensure that drivers are complying with mandatory insurance laws. The card’s details, such as the policy number and effective dates, provide immediate confirmation of valid auto insurance coverage.

| Insurance Type | Coverage Highlights |

|---|---|

| Auto Insurance | Liability, Collision, Comprehensive, Medical Payments, Uninsured/Underinsured Motorist Coverage |

| Home Insurance | Dwelling, Personal Property, Liability, Medical Payments to Others |

| Health Insurance | Medical, Dental, Vision, Prescription Drug Coverage |

| Life Insurance | Term Life, Whole Life, Universal Life, Variable Life |

State Farm's auto insurance cards are particularly beneficial for drivers who may encounter situations where proof of insurance is required, such as after an accident or when registering a vehicle. By presenting the insurance card, individuals can quickly demonstrate their compliance with insurance regulations and avoid potential penalties or legal issues.

Health Insurance Claims

State Farm’s health insurance cards are an essential tool for policyholders to access medical services and claim reimbursements. When visiting a healthcare provider, presenting the insurance card ensures that the provider has the necessary information to process the claim efficiently. The card typically includes the policyholder’s name, member ID, and the insurer’s contact details, facilitating smooth communication between the healthcare provider and State Farm.

In addition to medical claims, State Farm health insurance cards are valuable for obtaining prescription discounts. Many pharmacies accept these cards as a form of identification, allowing policyholders to access reduced prices on medications. This benefit is particularly advantageous for individuals with chronic conditions who rely on regular prescriptions.

Liability Coverage Verification

State Farm insurance cards also serve as proof of liability coverage, which is crucial in various situations. For instance, if an individual is involved in a rental car accident, presenting the insurance card to the rental company demonstrates that they have the necessary liability coverage to address any damages. Similarly, when engaging in activities that require proof of liability insurance, such as renting recreational equipment or participating in certain sports, the insurance card provides the necessary assurance.

In the unfortunate event of a property loss or damage claim, State Farm's insurance cards play a vital role. Policyholders can use these cards to initiate the claims process, providing the insurer with the necessary information to assess and process the claim promptly. This ensures that individuals receive the financial support they need to repair or replace damaged property.

State Farm’s Digital Insurance Cards

In today’s digital age, State Farm recognizes the importance of providing convenient access to insurance information. As a result, they have introduced digital insurance cards, offering policyholders the flexibility to access their insurance details on their mobile devices.

State Farm's digital insurance cards are accessible through their mobile app, which can be downloaded from app stores. Policyholders can log in to their accounts and view their insurance cards, complete with the same vital information as the physical cards. This digital format allows individuals to easily share their insurance details with others, such as when renting a car or seeking medical treatment.

The digital insurance cards also provide added convenience by allowing policyholders to update their contact information and policy details directly within the app. This ensures that the insurance cards always reflect the most current and accurate information, making it easier to manage and maintain insurance coverage.

Benefits of Digital Insurance Cards

- Convenience: Digital insurance cards eliminate the need to carry physical cards, providing easy access to insurance information from anywhere with an internet connection.

- Real-Time Updates: Policyholders can quickly update their insurance details, ensuring that their digital cards reflect the latest coverage and policy changes.

- Secure Storage: Digital insurance cards are stored securely within the State Farm app, reducing the risk of loss or theft compared to physical cards.

- Quick Sharing: The ability to share insurance details digitally simplifies the process of providing proof of insurance, particularly in situations where physical cards may not be readily available.

State Farm's digital insurance cards represent a significant advancement in insurance technology, offering policyholders enhanced convenience, security, and accessibility. By embracing digital insurance cards, State Farm demonstrates its commitment to providing modern solutions that meet the evolving needs of its customers.

Conclusion

State Farm insurance cards are versatile tools that serve multiple purposes, ranging from auto insurance verification to health insurance claims and liability coverage demonstrations. By offering comprehensive coverage on a single card, State Farm simplifies the process of providing proof of insurance for its policyholders. The introduction of digital insurance cards further enhances convenience and accessibility, ensuring that individuals can access their insurance information securely and efficiently.

As insurance regulations and technology continue to evolve, State Farm remains at the forefront of innovation, providing its customers with reliable coverage and cutting-edge tools to manage their insurance needs effectively.

How can I obtain a State Farm insurance card?

+State Farm insurance cards are typically provided to policyholders upon purchasing an insurance policy. If you require a replacement card or have questions about your coverage, you can contact your State Farm agent or visit their official website for more information.

What information is included on a State Farm insurance card?

+State Farm insurance cards typically display the policyholder’s name, policy number, effective dates of coverage, and a unique identification code. The front of the card features the State Farm logo and contact information.

Can I use my State Farm insurance card for multiple types of insurance coverage?

+Yes, State Farm insurance cards are designed to cover various types of insurance, including auto, home, health, and life insurance. This means that policyholders can carry a single card that represents their comprehensive coverage.

How can I access my State Farm digital insurance card?

+To access your State Farm digital insurance card, you can download the State Farm mobile app from the app store. Log in to your account, and you will be able to view your digital insurance card, which contains the same information as your physical card.

What are the benefits of using State Farm’s digital insurance cards?

+State Farm’s digital insurance cards offer several benefits, including convenience, real-time updates, secure storage, and quick sharing of insurance details. These digital cards provide policyholders with enhanced accessibility and security, ensuring they can manage their insurance needs effectively.