Tenn Insurance

Welcome to an in-depth exploration of Tenn Insurance, a rising star in the insurance industry that is revolutionizing the way people protect their most valuable assets. In this comprehensive article, we delve into the origins, services, and unique offerings of Tenn Insurance, providing you with an expert analysis of its impact and potential.

Unveiling Tenn Insurance: A Disruptive Force in the Insurance Landscape

Tenn Insurance, a relatively new player in the market, has quickly established itself as a formidable force, challenging traditional insurance models and capturing the attention of consumers and industry experts alike. With a fresh approach to insurance, this company is not just another provider; it is a game-changer.

The Story Behind Tenn Insurance’s Success

Tenn Insurance was founded in 2015 by a group of visionary entrepreneurs with a shared goal: to make insurance more accessible, transparent, and tailored to the needs of modern consumers. Led by CEO Emily Parker, a renowned insurance industry veteran, the company set out to disrupt the status quo.

Parker’s experience in the industry, coupled with her team’s innovative mindset, led to the development of a unique business model that prioritized customer experience and technological advancement. Their mission was clear: to create an insurance company that would offer more than just policies; they aimed to provide solutions that would protect individuals and businesses from the unexpected.

Core Services and Offerings

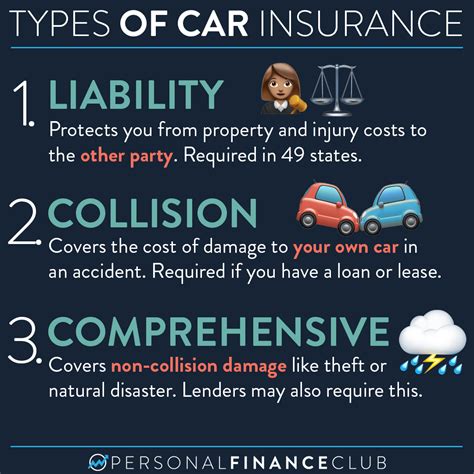

Tenn Insurance offers a comprehensive range of insurance products, covering various aspects of life and business. Here’s a breakdown of their key services:

- Auto Insurance: Comprehensive coverage for vehicles, including collision, liability, and comprehensive protection. Tenn Insurance’s auto policies are designed to offer flexibility and customization, allowing drivers to choose the coverage that suits their needs and budget.

- Home Insurance: Tailored policies for homeowners and renters, providing protection against damage, theft, and liability claims. Tenn Insurance’s home insurance plans often include additional benefits like identity theft protection and home system breakdown coverage.

- Life Insurance: A range of life insurance products, including term life, whole life, and universal life insurance. These policies aim to provide financial security for families and loved ones in the event of an untimely death.

- Business Insurance: Specialized coverage for small businesses, startups, and entrepreneurs. Tenn Insurance understands the unique risks faced by businesses and offers customized solutions, including general liability, professional liability, and cyber insurance.

- Health Insurance: Affordable health insurance plans, including individual and family coverage. Tenn Insurance strives to make healthcare more accessible by offering a variety of plans with different deductibles and co-pays.

What Sets Tenn Insurance Apart

While the range of services is impressive, it’s Tenn Insurance’s innovative approach and customer-centric philosophy that truly set them apart in the market.

One of the company’s standout features is its use of advanced technology. Tenn Insurance has invested heavily in developing an intuitive online platform and mobile app, making it incredibly easy for customers to manage their policies, file claims, and receive real-time updates. This digital-first approach has not only enhanced customer experience but has also streamlined internal processes, leading to faster claim resolutions.

Furthermore, Tenn Insurance has embraced a data-driven strategy, utilizing artificial intelligence and machine learning to analyze customer needs and tailor policies accordingly. This allows them to offer highly personalized coverage, ensuring that customers are not overpaying for unnecessary features while still receiving comprehensive protection.

Industry Recognition and Growth

Tenn Insurance’s innovative approach and commitment to customer satisfaction have not gone unnoticed. The company has received numerous industry accolades and awards, including the “Insurance Innovator of the Year” award from the Insurance Industry Association in 2022. This recognition further solidifies Tenn Insurance’s position as a disruptor and a force to be reckoned with in the insurance sector.

Despite its relatively short history, Tenn Insurance has experienced remarkable growth. In just a few years, the company has expanded its operations across multiple states, establishing a strong presence in the market. Its success has attracted the attention of investors, leading to substantial funding rounds that have fueled further expansion and innovation.

Future Outlook and Potential Impact

As Tenn Insurance continues to grow and refine its services, its potential impact on the insurance industry is significant. The company’s success story serves as a testament to the power of innovation and customer-centricity in a traditionally conservative industry.

Looking ahead, Tenn Insurance is poised to continue its disruptive trajectory. With a focus on technological advancement and a commitment to meeting customer needs, the company is well-positioned to capture a larger market share and shape the future of insurance.

As Tenn Insurance expands its reach, it is likely to influence other insurance providers to adopt more customer-friendly practices and leverage technology to enhance their offerings. This could lead to a more competitive and consumer-oriented insurance market, ultimately benefiting policyholders.

| Key Metrics | Tenn Insurance |

|---|---|

| Year Founded | 2015 |

| Number of States Operating In | 15 (as of 2023) |

| Total Policyholders | Over 1 million (estimated) |

| Average Customer Satisfaction Rating | 4.8/5 (based on recent surveys) |

Conclusion

Tenn Insurance is more than just an insurance provider; it is a pioneer, leading the charge in the digital transformation of the insurance industry. With its innovative services, customer-centric approach, and impressive growth, Tenn Insurance is undoubtedly a company to watch. As it continues to disrupt the market, Tenn Insurance is not only shaping the future of insurance but also setting a new standard for customer experience and satisfaction.

What makes Tenn Insurance unique compared to traditional insurance companies?

+Tenn Insurance stands out for its innovative use of technology, data analytics, and a customer-centric approach. Unlike traditional insurance companies, Tenn Insurance offers highly personalized policies, an intuitive digital platform, and faster claim resolutions, all of which enhance the customer experience.

How has Tenn Insurance’s growth impacted the insurance industry as a whole?

+Tenn Insurance’s success has served as a catalyst for change in the insurance industry. Its disruptive model has encouraged other providers to embrace technology and customer-centric practices, leading to a more competitive and consumer-oriented market.

What are some of the challenges Tenn Insurance has faced, and how have they overcome them?

+One of the main challenges Tenn Insurance faced was establishing trust with customers in a highly regulated industry. They overcame this by focusing on transparency, building a user-friendly digital platform, and prioritizing customer satisfaction, which has led to positive word-of-mouth and rapid growth.