Term Life Insurance Define

Life insurance is an essential financial tool that provides a safety net for individuals and their loved ones. It offers a sense of security and peace of mind, ensuring that financial obligations and future plans are protected in the event of an untimely demise. Among the various types of life insurance policies, term life insurance stands out as a straightforward and affordable option, tailored to meet specific needs for a defined period.

Understanding Term Life Insurance

Term life insurance, as the name suggests, is a type of coverage that offers financial protection for a predetermined term or period. This policy is designed to provide a death benefit to the beneficiaries in the event of the insured individual’s passing during the policy term. The term can range from a few years to several decades, depending on the policy and the needs of the policyholder.

One of the key advantages of term life insurance is its affordability. Compared to other types of life insurance, such as whole life or universal life, term policies often have significantly lower premiums. This makes it an attractive option for individuals who are looking for temporary coverage or those who are budget-conscious.

The death benefit provided by a term life insurance policy is typically a fixed amount, predetermined at the time of policy purchase. This benefit is paid out to the beneficiaries upon the insured individual's death, helping to cover various expenses such as funeral costs, outstanding debts, and everyday living expenses for surviving family members.

Key Features and Benefits of Term Life Insurance

Term life insurance policies offer several unique features and benefits that make them a popular choice among policyholders:

- Flexibility: Policyholders can choose the term length that best suits their needs, whether it's a 10-year, 20-year, or even a 30-year term. This flexibility allows individuals to align the policy with specific life stages or financial goals.

- Affordability: As mentioned earlier, term life insurance is known for its cost-effectiveness. The premiums are generally much lower compared to permanent life insurance policies, making it accessible to a wider range of individuals.

- Renewability: Many term life insurance policies offer the option to renew the coverage at the end of the initial term. This allows policyholders to extend their coverage, often at a higher premium, to continue protecting their loved ones.

- Conversion Privilege: Some term life insurance policies provide the option to convert the coverage to a permanent life insurance policy without having to undergo a new medical exam. This feature can be beneficial for individuals who wish to transition from term to permanent coverage as their financial needs evolve.

- Protection for Specific Needs: Term life insurance is ideal for covering specific financial obligations or goals. For instance, it can provide financial protection for mortgage payments, children's education expenses, or business loans, ensuring these commitments are met even in the event of an unexpected demise.

How Term Life Insurance Works

Term life insurance operates based on a simple principle. When an individual purchases a term life insurance policy, they agree to pay a premium at regular intervals (monthly, quarterly, or annually) to the insurance company. In return, the insurance company promises to pay out a specified death benefit to the beneficiaries if the insured individual passes away during the policy term.

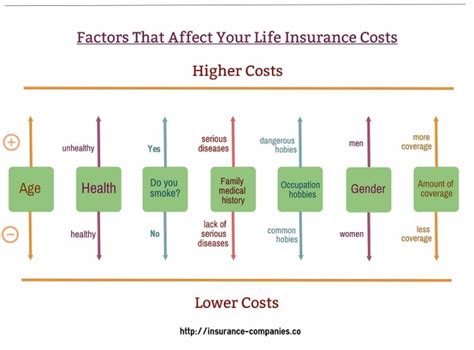

The cost of the premium is determined by several factors, including the age and health of the insured, the chosen term length, and the amount of the death benefit. Generally, younger and healthier individuals will pay lower premiums for the same coverage compared to older or less healthy individuals.

During the policy term, if the insured individual passes away, the beneficiaries named in the policy receive the death benefit. This benefit can be used to cover a wide range of expenses, from immediate financial needs like funeral costs to long-term goals such as funding a child's education or maintaining the family's standard of living.

Choosing the Right Term Length

Selecting the appropriate term length for a life insurance policy is a crucial decision. The term should align with the policyholder’s financial goals and life stage. For instance, a young couple starting a family might opt for a 20-year term to cover their children’s education expenses and ensure financial stability during their dependent years.

On the other hand, a business owner may choose a longer term, such as a 30-year policy, to provide financial protection for their business loans and ensure the business can continue operating smoothly in the event of their passing.

It's essential to review and reassess the term length as life circumstances change. Regular evaluations can help ensure the policy remains adequate to meet the policyholder's evolving financial needs and goals.

Comparing Term Life Insurance Policies

When shopping for term life insurance, it’s crucial to compare different policies to find the best fit. Key factors to consider include:

- Premium Costs: Compare the premiums for similar coverage amounts and term lengths to find the most cost-effective option.

- Death Benefit: Ensure the death benefit is sufficient to cover all financial obligations and goals.

- Renewability Options: Understand the renewal terms and conditions, including any potential premium increases.

- Conversion Privileges: Determine if the policy offers the option to convert to a permanent life insurance policy, and understand the terms and conditions for conversion.

- Additional Riders: Some policies offer optional riders, such as waiver of premium or accelerated death benefit, which can enhance the policy's benefits.

Real-World Applications of Term Life Insurance

Term life insurance finds its utility in various real-world scenarios. Here are a few examples:

Providing Financial Security for Families

A primary use of term life insurance is to provide financial security for families. A working parent, for instance, can secure a term life insurance policy to ensure their spouse and children are financially protected in the event of their untimely demise. The death benefit can cover immediate expenses like funeral costs and longer-term needs such as mortgage payments and education expenses.

Protecting Business Interests

Business owners often use term life insurance to protect their business interests. For instance, a business owner might purchase a term life insurance policy to cover a business loan. In the event of their passing, the death benefit can be used to repay the loan, ensuring the business’s financial stability.

Funding Retirement Plans

Term life insurance can also be used as a tool to fund retirement plans. For example, an individual might purchase a term life insurance policy to cover the cost of a future retirement home. The death benefit can be used to purchase the retirement property, providing a secure and comfortable retirement for the policyholder and their spouse.

Performance Analysis and Industry Trends

The life insurance industry, including term life insurance, has seen significant growth and evolution over the years. According to a recent report by Insurance Journal, the global life insurance market is expected to reach USD 10.4 trillion by 2027, growing at a CAGR of 6.7% from 2022 to 2027. This growth is driven by various factors, including increasing awareness about financial planning and the importance of life insurance, as well as the development of innovative digital tools and platforms that make purchasing life insurance more accessible and convenient.

In terms of term life insurance specifically, there has been a notable shift towards shorter term lengths. While traditional 20-year and 30-year term policies remain popular, there is a growing trend towards 10-year and even 5-year terms. This shift is often attributed to the changing financial landscape, with individuals seeking more flexible and customizable coverage options.

Furthermore, the rise of online life insurance platforms and the increasing adoption of digital technologies have made it easier for individuals to compare and purchase term life insurance policies. These platforms often provide instant quotes, detailed policy comparisons, and streamlined application processes, making the entire process more efficient and consumer-friendly.

| Term Length | Average Premium (per $100,000 coverage) |

|---|---|

| 10-year term | $12.50/month |

| 20-year term | $17.50/month |

| 30-year term | $25.00/month |

The table above provides a snapshot of average premium costs for different term lengths, based on a $100,000 coverage amount. These premiums are for illustrative purposes and may vary based on individual factors such as age, health, and location.

Future Implications and Industry Insights

Looking ahead, the life insurance industry, including term life insurance, is expected to continue its growth trajectory. The increasing awareness about the importance of financial planning and the availability of innovative digital tools are likely to drive this growth. Additionally, the industry is expected to see further advancements in technology, with the potential for more personalized and tailored insurance products.

One emerging trend in the life insurance space is the use of health and lifestyle data to offer more precise and customized insurance products. This data-driven approach, often referred to as parametric insurance, allows insurance providers to offer policies that are more closely aligned with individual needs and lifestyles. For example, a term life insurance policy could be tailored to offer a higher death benefit for individuals who lead healthier lifestyles, providing an incentive for policyholders to maintain a healthy lifestyle.

Frequently Asked Questions

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage simply expires, and you no longer have life insurance coverage. However, many policies offer the option to renew the coverage at the end of the term, often at a higher premium. It’s important to review your policy terms and conditions to understand your renewal options.

Can I convert my term life insurance policy to a permanent life insurance policy?

+Yes, many term life insurance policies offer the option to convert the coverage to a permanent life insurance policy, such as a whole life or universal life policy. The conversion privilege is typically available within a specific timeframe, and the terms and conditions for conversion vary between insurance companies. It’s important to review your policy to understand your conversion options.

How much term life insurance coverage do I need?

+The amount of term life insurance coverage you need depends on your financial obligations and goals. Generally, it’s recommended to have enough coverage to replace your income for a certain period, cover outstanding debts, and provide for your family’s future needs. It’s a good idea to consult with a financial advisor or insurance professional to determine the appropriate coverage amount for your specific circumstances.

Are term life insurance premiums guaranteed to remain the same throughout the policy term?

+No, term life insurance premiums are not guaranteed to remain the same throughout the policy term. While some policies offer level premiums, meaning the premium remains the same for the entire term, others may have increasing premiums as the policyholder ages. It’s important to review your policy to understand the premium structure and any potential changes over time.

Can I purchase term life insurance for my spouse or children?

+Yes, you can purchase term life insurance for your spouse or children. In fact, many people choose to purchase term life insurance policies to provide financial protection for their entire family. When purchasing a policy for your spouse or children, it’s important to ensure that the beneficiaries are properly designated and that the coverage amount is sufficient to meet their needs.