Term Or Life Insurance

Life insurance is a vital financial tool that provides peace of mind and security to individuals and their loved ones. Among the various types of life insurance policies available, term life insurance stands out as a popular and affordable option. In this comprehensive guide, we will delve into the world of term life insurance, exploring its definition, key features, benefits, and how it can be a valuable asset in your financial planning.

Understanding Term Life Insurance

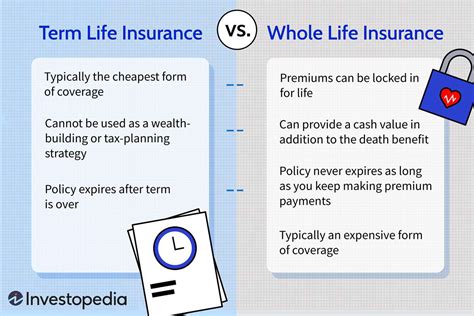

Term life insurance is a type of coverage that offers protection for a specified period, known as the policy term. Unlike permanent life insurance policies that provide coverage for the entirety of one’s life, term life insurance is designed to meet short-term needs and offers coverage for a fixed duration. This period can range from 10 to 30 years, depending on the policy and the individual’s requirements.

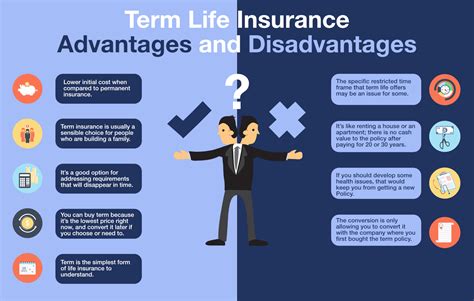

One of the defining characteristics of term life insurance is its affordability. Premiums for term life policies are generally much lower compared to permanent life insurance options. This makes term life insurance an accessible choice for individuals seeking coverage without placing a significant financial burden on their budgets. The cost-effectiveness of term life insurance makes it an attractive option for those with limited financial resources or those who wish to maximize their coverage while keeping expenses manageable.

Furthermore, term life insurance policies are straightforward and easy to understand. They provide a simple death benefit, which is the amount paid out to the beneficiary in the event of the policyholder's death during the policy term. This benefit can be used to cover a range of financial needs, such as funeral expenses, outstanding debts, or providing income for dependents.

Key Features of Term Life Insurance

Policy Term and Renewal Options

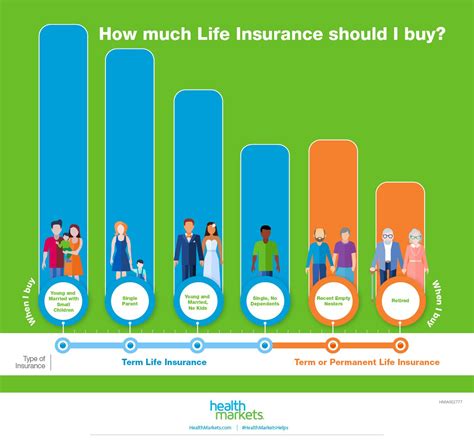

Term life insurance policies are available in various term lengths, catering to different life stages and financial goals. Common term lengths include 10, 15, 20, or 30 years. The policy term is chosen based on the individual’s specific needs and the duration for which coverage is required. For instance, a young professional may opt for a 10-year term to cover their financial obligations during their career’s early stages, while a family with young children might choose a 20-year term to provide financial security until their children become independent.

Some term life insurance policies offer renewal options, allowing policyholders to extend their coverage beyond the initial term. Renewal options can provide continued protection as individuals age and their financial circumstances change. It's important to note that renewal may result in higher premiums due to the increased risk associated with advancing age.

Death Benefit and Coverage Amount

The death benefit is the central component of term life insurance. It represents the sum of money paid out to the beneficiary in the event of the policyholder’s death during the policy term. The death benefit is chosen based on the individual’s financial needs and the level of coverage desired. It is essential to carefully consider the coverage amount to ensure it aligns with one’s financial goals and obligations.

The coverage amount can be tailored to meet specific needs, such as covering outstanding mortgages, providing income replacement for dependents, or funding a child's education. By assessing one's financial situation and identifying potential liabilities, individuals can determine the appropriate coverage amount for their term life insurance policy.

Level Premiums and Guaranteed Insurability

Term life insurance policies often offer level premiums, meaning the premium amount remains constant throughout the policy term. This feature provides stability and predictability in terms of financial planning. Policyholders can budget for their insurance expenses without worrying about premium increases during the policy term.

Additionally, some term life insurance policies provide guaranteed insurability options. This feature allows policyholders to purchase additional coverage at specific intervals during the policy term without undergoing another medical exam. Guaranteed insurability ensures that individuals can increase their coverage as their needs change, such as starting a family or purchasing a new home, without the risk of being denied coverage due to changes in health status.

Benefits of Term Life Insurance

Affordable Protection

One of the primary advantages of term life insurance is its affordability. The lower premiums associated with term life policies make it an accessible option for individuals at various income levels. By investing in term life insurance, individuals can obtain significant coverage amounts without straining their financial resources.

The affordability of term life insurance allows individuals to prioritize their financial well-being and ensure their loved ones are protected in the event of an untimely death. It provides a safety net that can help cover immediate financial obligations and provide long-term financial stability for dependents.

Flexibility and Customization

Term life insurance policies offer a high degree of flexibility and customization to cater to diverse needs. Policyholders can choose the policy term, coverage amount, and optional riders to enhance their coverage. This flexibility allows individuals to tailor their term life insurance policy to align with their changing life circumstances and financial goals.

For example, individuals with young children may opt for a longer policy term to provide financial protection until their children become adults. On the other hand, those with specific financial obligations, such as a mortgage, can choose a term that aligns with the repayment period of their loan. The ability to customize term life insurance policies ensures that individuals can obtain coverage that suits their unique circumstances.

Peace of Mind and Financial Security

Term life insurance provides peace of mind and financial security to individuals and their families. Knowing that their loved ones are protected in the event of an unforeseen tragedy can alleviate financial worries and provide emotional reassurance. Term life insurance ensures that beneficiaries have the financial resources to maintain their standard of living, pay off debts, and cover essential expenses.

Moreover, term life insurance can be a valuable tool for estate planning. It can help fund trust funds, cover estate taxes, or provide liquidity to settle outstanding financial obligations. By including term life insurance as part of their overall financial strategy, individuals can ensure that their legacy is protected and their loved ones are provided for.

Choosing the Right Term Life Insurance Policy

Selecting the appropriate term life insurance policy involves careful consideration of several factors. Here are some key aspects to keep in mind when choosing a term life insurance policy:

Assessing Your Needs

Begin by evaluating your financial obligations and dependents. Consider the financial impact your death would have on your loved ones and the amount of coverage needed to provide for their well-being. Take into account outstanding debts, such as mortgages, loans, or credit card balances, and determine how much coverage is necessary to cover these liabilities.

Additionally, think about your future financial goals and how term life insurance can contribute to achieving them. For instance, if you have young children, you may want to ensure that their education is funded or that your family's lifestyle is maintained even in your absence.

Determining Policy Term

The policy term is a crucial consideration when choosing a term life insurance policy. Evaluate your life stage and financial goals to determine the appropriate term length. Consider factors such as your career trajectory, family planning, and any major financial milestones you aim to achieve during your lifetime.

For example, if you are in your early career and single, you may opt for a shorter term to cover your immediate financial obligations. On the other hand, if you have a family and are looking to provide long-term financial security, a longer policy term may be more suitable.

Comparing Premiums and Coverage

Research and compare premiums and coverage options offered by different insurance providers. While affordability is essential, it’s crucial to strike a balance between cost and the level of coverage provided. Look for policies that offer adequate coverage for your needs without compromising on financial stability.

Consider additional features such as guaranteed insurability options, waiver of premium benefits, or accelerated benefit riders. These optional riders can enhance your policy's flexibility and provide added protection in specific circumstances.

Real-Life Examples and Success Stories

Protecting Young Families

Term life insurance is often an invaluable tool for young families looking to secure their financial future. Take the case of Sarah and John, a young couple with two young children. They recognized the importance of protecting their family’s financial well-being and decided to invest in term life insurance.

Sarah and John opted for a 20-year term life insurance policy with a coverage amount sufficient to cover their mortgage, outstanding debts, and provide income replacement for their children's upbringing. By securing this policy, they ensured that their family would be financially secure even if one of them passed away unexpectedly.

Estate Planning and Legacy Protection

Term life insurance can also play a vital role in estate planning and legacy protection. Consider the story of Robert, a successful entrepreneur who built a thriving business over several decades. Robert wanted to ensure that his business and personal assets were protected and passed on to his children smoothly.

Robert chose a 10-year term life insurance policy with a substantial coverage amount. This policy provided him with the necessary funds to cover estate taxes, settle any outstanding business debts, and ensure the smooth transition of his assets to his children. By including term life insurance in his estate plan, Robert could rest assured that his legacy would be preserved and his family's financial future was secure.

Term Life Insurance: A Smart Financial Decision

Term life insurance is a wise financial decision for individuals seeking affordable and flexible protection for their loved ones. By understanding the key features, benefits, and customization options of term life insurance, individuals can make informed choices to meet their specific needs.

Whether you are starting a family, building a business, or planning for your financial future, term life insurance provides a vital safety net. It offers peace of mind, financial security, and the ability to protect your loved ones from the unforeseen. By investing in term life insurance, you can ensure that your financial obligations are met and your legacy is protected.

What happens if I outlive my term life insurance policy term?

+If you outlive the policy term of your term life insurance policy, the coverage expires, and no death benefit is payable. However, you may have the option to renew the policy or purchase a new term life insurance policy if you still require coverage. It’s important to carefully consider your needs and financial situation when deciding whether to renew or obtain new coverage.

Can I convert my term life insurance policy to a permanent life insurance policy?

+Many term life insurance policies offer a conversion option, allowing you to convert your term policy into a permanent life insurance policy, such as whole life or universal life insurance. This option provides the flexibility to transition from term coverage to permanent coverage without undergoing another medical exam. However, it’s crucial to review the terms and conditions of your policy and understand any potential limitations or restrictions on the conversion process.

How do I choose the right coverage amount for my term life insurance policy?

+Choosing the right coverage amount involves carefully assessing your financial obligations and the needs of your loved ones. Consider factors such as outstanding debts, funeral expenses, income replacement for dependents, and any specific financial goals you aim to achieve. Consulting with a financial advisor or insurance professional can help you determine the appropriate coverage amount to meet your unique circumstances.