The General Insurance Quotes

Understanding the World of General Insurance: A Comprehensive Guide

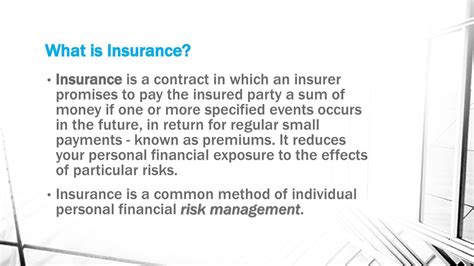

In the complex realm of insurance, general insurance stands as a fundamental pillar, offering protection and peace of mind to individuals and businesses alike. This type of insurance, often referred to as non-life insurance, covers a broad spectrum of risks, from property damage to liability and even specialized areas like marine or aviation. In this in-depth article, we will explore the intricacies of general insurance, its key components, and its vital role in modern life.

The Foundation of General Insurance

General insurance, at its core, is a contractual agreement between an insurer and a policyholder. The insurer, in exchange for a premium, agrees to compensate the policyholder for any losses or damages covered by the policy. This arrangement forms the basis of risk management, providing a financial safety net for unforeseen events.

Policy Types and Coverage

General insurance policies come in various forms, each tailored to specific needs:

Property Insurance: This covers damages to tangible assets like homes, businesses, and their contents. It protects against risks such as fire, theft, natural disasters, and accidental damage.

Liability Insurance: Crucial for businesses and individuals, liability insurance safeguards against claims arising from accidents, injuries, or negligence. It covers legal costs and any damages awarded by courts.

Marine and Aviation Insurance: Specialised policies for marine and aviation industries protect against losses related to shipping, cargo, and aircraft.

Health Insurance: While often associated with life insurance, general health insurance policies cover specific medical expenses and treatments, providing an additional layer of financial protection.

Travel Insurance: Designed for travellers, this insurance covers unforeseen events during trips, including medical emergencies, trip cancellations, and lost luggage.

The Process of Acquiring a General Insurance Policy

Obtaining a general insurance policy involves several key steps:

Risk Assessment: The insurer evaluates the risk profile of the applicant, considering factors like age, health, location, and the type of property or activity being insured.

Policy Selection: Based on the assessment, the insurer offers a policy with specific terms, conditions, and coverage limits. The policyholder chooses the level of coverage that best suits their needs.

Premium Payment: The policyholder pays a premium, typically on an annual basis, to activate the insurance coverage.

Claims Process: In the event of a covered loss, the policyholder notifies the insurer, who then evaluates the claim and provides compensation as outlined in the policy.

Case Study: A Real-Life Example of General Insurance in Action

Consider the scenario of a small business owner, Ms. Anderson, who operates a bakery in a suburban area. She recently invested in a state-of-the-art oven, but concerns about potential fire hazards led her to seek general insurance coverage.

Policy Selection

Ms. Anderson opted for a comprehensive property insurance policy that covered her bakery, its contents, and the new oven. She also included business interruption insurance to ensure financial support if her bakery had to temporarily close due to a covered event.

Risk Mitigation

Working closely with her insurer, Ms. Anderson implemented several fire safety measures, including installing fire alarms and sprinklers. This not only reduced the risk of a fire but also resulted in a lower insurance premium due to the improved safety profile of her bakery.

The Impact of Technology on General Insurance

The insurance industry has embraced technological advancements, leading to more efficient processes and enhanced customer experiences.

Digital Platforms

Many insurers now offer online platforms where customers can easily compare policies, obtain quotes, and purchase coverage. These digital tools provide convenience and transparency, empowering customers to make informed decisions.

Data Analytics

Advanced data analytics enable insurers to assess risks more accurately, leading to fairer premiums and better-tailored policies. By analyzing vast datasets, insurers can identify patterns and trends, improving their ability to price policies and manage risks effectively.

Future Trends and Innovations

The future of general insurance is set to be shaped by ongoing technological advancements and changing consumer expectations:

Artificial Intelligence (AI): AI is already being utilized to streamline claims processes and improve risk assessment. Advanced algorithms can quickly analyze vast amounts of data, enhancing efficiency and accuracy.

Blockchain Technology: Blockchain offers secure, transparent, and tamper-proof record-keeping, which could revolutionize policy administration and claims management.

Telematics: In the automotive insurance sector, telematics devices provide real-time driving data, allowing insurers to offer usage-based insurance policies. This innovation rewards safe driving behaviors with lower premiums.

FAQ

What is the difference between general insurance and life insurance?

+

General insurance, or non-life insurance, covers a wide range of risks, including property damage, liability, and specialized areas like marine and aviation. Life insurance, on the other hand, is specifically designed to provide financial protection to beneficiaries upon the policyholder’s death. It is a form of investment and risk management for long-term financial planning.

How do I choose the right general insurance policy for my needs?

+

When selecting a general insurance policy, consider your specific needs and the risks you want to mitigate. Evaluate the coverage limits, exclusions, and any additional benefits offered by different policies. It’s advisable to consult with insurance experts who can guide you based on your unique circumstances.

Can I customize my general insurance policy to suit my specific requirements?

+

Yes, many general insurance policies offer customizable options. You can often choose the level of coverage, select specific endorsements or add-ons, and tailor the policy to match your individual needs. This flexibility ensures that your insurance coverage aligns perfectly with your requirements.

Are there any tax benefits associated with general insurance policies?

+

Yes, general insurance policies often come with tax benefits. Depending on the type of policy and your country’s tax regulations, you may be eligible for tax deductions or credits on your insurance premiums. It’s important to consult with a tax professional to understand the specific benefits applicable to your situation.

What should I do if I need to make a claim on my general insurance policy?

+

If you experience a covered loss or damage, it’s crucial to promptly notify your insurance provider. They will guide you through the claims process, which typically involves submitting documentation, such as photographs or repair estimates, to support your claim. It’s beneficial to review your policy’s terms and conditions beforehand to understand the specific requirements for making a claim.