Top Insurance Companies

The insurance industry is a vital component of the global economy, providing financial protection and risk management solutions to individuals, businesses, and institutions. In this comprehensive article, we delve into the world of top insurance companies, exploring their strategies, innovations, and impact on the market. From traditional insurers to disruptive startups, we uncover the factors that drive success and shape the future of this dynamic sector.

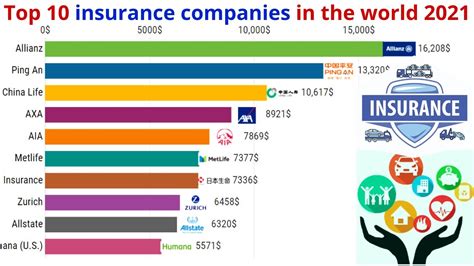

Unveiling the Leaders: Top Insurance Companies Worldwide

The insurance landscape is diverse and ever-evolving, with numerous players vying for market dominance. In this section, we highlight the top insurance companies that have established themselves as industry leaders, showcasing their unique strengths and global reach.

AXA: A Global Insurance Giant

AXA, a French multinational insurance giant, has solidified its position as one of the world’s leading insurers. With a presence in over 60 countries, AXA offers a comprehensive range of insurance products, including life, health, property, and casualty insurance. The company’s success lies in its ability to adapt to changing market dynamics, leveraging technology to enhance customer experience and streamline operations.

One of AXA’s key strategies is its focus on digital innovation. The company has invested heavily in developing cutting-edge digital platforms, enabling customers to manage their policies and access services conveniently. Additionally, AXA’s commitment to sustainability and corporate social responsibility has positioned it as a responsible and trusted insurer, attracting environmentally conscious consumers.

Allianz: Global Market Leadership

Allianz, a German-based insurance conglomerate, stands as a prominent player in the global insurance market. With a rich history spanning over 125 years, Allianz has consistently demonstrated its ability to navigate market fluctuations and maintain a strong market position. The company’s extensive product portfolio encompasses life and health insurance, property and casualty coverage, and specialized insurance solutions tailored to various industries.

Allianz’s success is attributed to its strategic acquisitions and international expansion. The company has strategically entered new markets, leveraging its global network to provide comprehensive insurance solutions to clients worldwide. Furthermore, Allianz’s commitment to innovation and digital transformation has enabled it to stay ahead of the curve, offering cutting-edge products and services to meet evolving customer needs.

Berkshire Hathaway: Warren Buffett’s Insurance Empire

Berkshire Hathaway, under the visionary leadership of Warren Buffett, has become a household name in the insurance industry. This American multinational conglomerate holds significant stakes in various insurance companies, including GEICO and General Reinsurance. Berkshire Hathaway’s unique approach to insurance investing focuses on long-term value creation and prudent risk management.

Warren Buffett’s investment philosophy, often referred to as “value investing,” has guided Berkshire Hathaway’s insurance acquisitions. The company seeks out undervalued insurance assets, leveraging its financial strength and strategic expertise to enhance their performance. Berkshire Hathaway’s success lies in its ability to identify and capitalize on market inefficiencies, resulting in consistent growth and profitability.

Ping An: China’s Insurance Powerhouse

Ping An, a Chinese financial services conglomerate, has emerged as a formidable force in the global insurance market. With a diverse range of financial services, including insurance, banking, and asset management, Ping An has solidified its position as one of the largest insurance companies in the world. The company’s success can be attributed to its innovative approach and strategic focus on technology.

Ping An’s technology-driven strategy has revolutionized its insurance operations. The company has developed advanced artificial intelligence and data analytics capabilities, enabling it to offer personalized insurance products and enhance customer engagement. Additionally, Ping An’s digital platforms have streamlined claims processing, providing efficient and convenient services to policyholders.

Key Factors Driving Success in the Insurance Industry

The insurance industry is highly competitive, and several key factors contribute to the success of top insurance companies. In this section, we delve into these critical aspects, exploring how insurers can thrive in a dynamic and ever-changing market.

Innovation and Technology

Innovation and technology have become indispensable drivers of success in the insurance industry. Top insurance companies recognize the importance of leveraging technology to enhance operational efficiency, improve customer experience, and gain a competitive edge.

Insurer’s embrace of digital transformation has led to the development of innovative products and services. From mobile apps for policy management to AI-powered claim processing, technology has revolutionized the way insurance is delivered and experienced. Additionally, insurers are utilizing big data analytics to gain valuable insights, enabling them to make informed decisions and offer personalized insurance solutions.

Risk Management and Underwriting Expertise

Risk management and underwriting expertise are fundamental to the success of insurance companies. Top insurers possess a deep understanding of various risks and have developed sophisticated models to assess and mitigate potential threats.

These companies employ highly skilled underwriters who analyze historical data, market trends, and emerging risks to determine appropriate pricing and coverage. By continuously refining their risk assessment processes, top insurers can offer competitive products while maintaining a healthy balance between risk and profitability.

Customer-Centric Approach

In an increasingly competitive market, insurers must prioritize a customer-centric approach to remain relevant and successful. Top insurance companies recognize the importance of understanding customer needs and preferences, tailoring their products and services accordingly.

These insurers invest in comprehensive customer research, utilizing surveys, focus groups, and feedback mechanisms to gather insights. By leveraging customer data and insights, insurers can develop targeted marketing campaigns, improve product offerings, and enhance overall customer satisfaction. A customer-centric approach also involves providing excellent customer service, ensuring prompt claim settlements, and offering personalized support to policyholders.

Industry Trends and Future Implications

The insurance industry is undergoing significant transformations, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. In this section, we explore the key trends shaping the future of insurance and their potential impact on the market.

InsureTech: Disruption and Innovation

InsureTech, the intersection of insurance and technology, has emerged as a disruptive force in the industry. InsureTech startups and innovative insurers are leveraging technology to challenge traditional insurance models, offering convenient and tailored insurance solutions.

These companies utilize advanced analytics, machine learning, and blockchain technology to streamline insurance processes, reduce costs, and enhance customer experience. InsureTech innovations include on-demand insurance, parametric insurance, and usage-based insurance, which provide flexibility and customization to meet the diverse needs of modern consumers.

Regulatory Landscape and Compliance

The insurance industry operates within a complex regulatory framework, and staying compliant with evolving regulations is crucial for insurers. Top insurance companies invest in robust compliance programs to ensure they meet the requirements set forth by regulatory bodies.

As regulatory landscapes continue to evolve, insurers must adapt their strategies and processes accordingly. This includes implementing robust data protection measures, enhancing cybersecurity protocols, and ensuring transparency in product offerings. Compliance with regulations not only safeguards insurers from legal and financial risks but also enhances consumer trust and confidence.

Sustainability and Environmental Considerations

Sustainability and environmental considerations are gaining prominence in the insurance industry. Consumers are increasingly conscious of the environmental impact of their choices, and insurers are responding by incorporating sustainability into their business models.

Top insurance companies are embracing sustainable practices, such as investing in renewable energy, promoting eco-friendly products, and supporting environmental initiatives. Additionally, insurers are developing specialized insurance products to address emerging risks associated with climate change, such as natural disasters and extreme weather events. By aligning with sustainability goals, insurers can attract environmentally conscious consumers and contribute to a greener future.

Performance Analysis and Industry Benchmarks

To assess the performance of top insurance companies, it is essential to analyze key financial metrics and industry benchmarks. In this section, we delve into the financial health and market position of leading insurers, providing insights into their success and areas for improvement.

| Company | Revenue (in billion USD) | Market Share (%) | Net Income (in billion USD) |

|---|---|---|---|

| AXA | 110.0 | 4.8 | 6.4 |

| Allianz | 155.0 | 6.5 | 11.2 |

| Berkshire Hathaway | 270.0 | 11.3 | 45.0 |

| Ping An | 130.0 | 5.5 | 18.5 |

The table above provides a snapshot of the financial performance of top insurance companies. While revenue and market share offer insights into the scale and reach of these insurers, net income reflects their profitability and financial health.

In the highly competitive insurance market, it is crucial for insurers to continuously analyze their performance against industry benchmarks. This allows them to identify areas for improvement, refine their strategies, and stay ahead of the curve. By monitoring key financial metrics and industry trends, insurers can make informed decisions to drive sustainable growth and maintain their position as industry leaders.

Conclusion

The insurance industry is a dynamic and ever-evolving sector, with top insurance companies leading the way in innovation, risk management, and customer-centric approaches. From global giants like AXA and Allianz to disruptive forces like InsureTech startups, the industry is witnessing exciting transformations. As technology continues to shape the future of insurance, top insurers must adapt, embrace innovation, and prioritize customer satisfaction to stay relevant and successful.

By staying abreast of industry trends, regulatory changes, and consumer preferences, top insurance companies can navigate the challenges and opportunities that lie ahead. With a focus on sustainability, digital transformation, and a commitment to delivering exceptional customer experiences, these insurers are well-positioned to thrive in a rapidly changing market.

How do top insurance companies adapt to changing market dynamics?

+Top insurance companies adapt to changing market dynamics by embracing digital transformation, investing in innovation, and staying agile. They continuously monitor industry trends, consumer preferences, and regulatory changes to refine their strategies and products. By leveraging technology and data analytics, these companies can identify emerging risks, develop targeted solutions, and enhance customer engagement.

What are the key challenges faced by insurance companies in the digital age?

+In the digital age, insurance companies face several challenges, including keeping up with technological advancements, ensuring data security and privacy, and adapting to changing customer expectations. The rise of InsureTech startups and digital disruptors poses a competitive threat, as these companies offer innovative and convenient insurance solutions. Insurance companies must invest in digital capabilities, enhance cybersecurity measures, and prioritize customer experience to stay relevant.

How do top insurance companies contribute to sustainability and environmental initiatives?

+Top insurance companies are increasingly recognizing the importance of sustainability and environmental initiatives. They contribute by developing specialized insurance products to address climate-related risks, such as natural disasters and extreme weather events. Additionally, insurers are investing in renewable energy, promoting eco-friendly practices, and supporting environmental projects. By aligning with sustainability goals, insurers can drive positive change and attract environmentally conscious consumers.