Travel Insurance Quotation

When planning a trip, whether it's a relaxing vacation or an adventurous journey, ensuring your safety and peace of mind is paramount. Travel insurance provides a crucial layer of protection, covering a range of unexpected events and potential mishaps. In this comprehensive guide, we will delve into the world of travel insurance quotations, exploring the factors that influence quotes, the process of obtaining them, and the key considerations to make an informed decision.

Understanding Travel Insurance Quotations

Travel insurance quotations are personalized estimates of the cost of travel insurance coverage. These quotes are tailored to an individual’s specific trip and needs, taking into account various factors such as destination, duration, age, pre-existing medical conditions, and the level of coverage desired. Obtaining a quotation is the first step towards securing travel insurance, allowing travelers to compare options and choose a policy that best suits their requirements.

The quotation process typically involves providing detailed information about your trip, including the dates of travel, the countries you plan to visit, and any specific activities you intend to engage in. It is essential to be accurate and honest in your declarations to ensure the quotation reflects your actual needs and to avoid any potential issues with claims in the future.

Factors Influencing Travel Insurance Quotations

Several key factors play a role in determining the cost of travel insurance quotations. Understanding these factors can help travelers anticipate the costs and make informed choices.

Destination and Duration

The destination and duration of your trip are fundamental factors in travel insurance quotations. Some countries and regions may pose higher risks due to political instability, natural disasters, or medical infrastructure. Longer trips generally result in higher premiums, as the risk of unforeseen events increases with time.

| Destination | Duration (Days) | Average Quotation |

|---|---|---|

| North America | 7 | $25 - $40 |

| Europe | 14 | $35 - $55 |

| Asia | 21 | $40 - $60 |

| South America | 30 | $50 - $75 |

Age and Health

Your age and health status are significant considerations in travel insurance quotations. Older travelers or those with pre-existing medical conditions may face higher premiums due to the increased likelihood of requiring medical assistance during their trip. Some insurance providers may require additional medical assessments or declarations for travelers with specific health concerns.

Trip Activities

The activities you plan to engage in during your trip can significantly impact your travel insurance quotation. High-risk activities like extreme sports, adventure tours, or off-road driving may require specialized coverage, often resulting in higher premiums. It is crucial to disclose all planned activities to ensure you have adequate protection.

Level of Coverage

Travel insurance policies offer varying levels of coverage, and the quotation reflects the chosen coverage type. Basic policies may provide limited coverage for medical emergencies and trip cancellations, while comprehensive plans offer broader protection, including trip interruptions, baggage loss, and liability coverage. The more extensive the coverage, the higher the premium is likely to be.

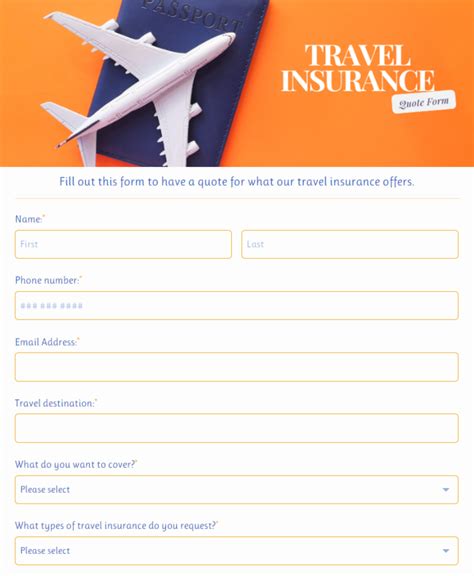

Obtaining Travel Insurance Quotations

The process of obtaining travel insurance quotations has become more streamlined and accessible in recent years. Travelers can now easily compare quotes online, leveraging comparison websites or directly contacting insurance providers.

Comparison Websites

Comparison websites aggregate travel insurance quotations from multiple providers, allowing travelers to quickly compare policies side by side. These platforms often provide filters and search tools to narrow down options based on specific criteria, making it easier to find the most suitable policy.

Directly from Insurance Providers

Travelers can also obtain quotations directly from insurance providers. Many providers offer online quotation tools, allowing individuals to input their trip details and receive an instant estimate. This method provides a more personalized approach, as travelers can directly engage with the insurance company and clarify any doubts.

Key Considerations When Choosing a Policy

When evaluating travel insurance quotations, it is essential to consider more than just the cost. Here are some key factors to keep in mind:

Coverage Details

Carefully review the coverage details of each policy. Ensure that the policy covers all the potential risks associated with your trip, including medical emergencies, trip cancellations, baggage loss, and any specific activities you plan to participate in. Look for policies that offer adequate coverage limits and consider the excess or deductible amounts.

Reputation and Reliability

Research the reputation and reliability of the insurance provider. Look for established companies with a track record of prompt claim settlements and positive customer reviews. Consider the provider’s financial stability and its ability to honor claims, especially in the event of a large-scale disaster or crisis.

Exclusions and Limitations

Every travel insurance policy has exclusions and limitations. It is crucial to understand these restrictions to avoid any surprises. Common exclusions include pre-existing medical conditions, certain adventure sports, and acts of war or terrorism. Review the policy’s fine print to ensure you are aware of any potential gaps in coverage.

Claim Process and Assistance

Inquire about the claim process and the assistance available from the insurance provider. Look for policies that offer 24⁄7 emergency assistance and a straightforward claim procedure. Consider the availability of multilingual support and the provider’s reputation for timely and efficient claim settlements.

The Importance of Travel Insurance

Travel insurance is not just a financial safeguard; it provides peace of mind and essential protection during your travels. Unforeseen events such as medical emergencies, trip cancellations, or lost baggage can quickly derail your plans and incur significant costs. Travel insurance helps mitigate these risks, ensuring that you can focus on enjoying your trip without worrying about the financial implications of unexpected situations.

Travel Insurance for Different Traveler Types

Travel insurance quotations cater to a diverse range of traveler types, each with unique needs and preferences. Here’s a look at how travel insurance can benefit different types of travelers:

Adventure Seekers

Adventure travelers often engage in high-risk activities such as bungee jumping, skiing, or rock climbing. Specialized adventure travel insurance policies provide coverage for these activities, ensuring that adrenaline-fueled pursuits are protected. These policies often include higher coverage limits for medical emergencies and personal liability.

Business Travelers

Business travelers face unique challenges, often juggling work commitments with travel plans. Business travel insurance policies are tailored to cover work-related trips, including conference cancellations, missed connections, and business equipment loss. These policies often provide additional benefits such as legal assistance and travel delay coverage.

Family Travelers

Traveling with family, especially young children, presents its own set of challenges. Family travel insurance policies offer coverage for the entire family, including medical emergencies, trip cancellations due to family illness, and even coverage for pregnancy-related issues. These policies often provide flexible options to accommodate the needs of different family members.

Senior Travelers

Senior travelers may face age-related health concerns and unique travel challenges. Specialized senior travel insurance policies provide coverage for older individuals, often with higher coverage limits for medical emergencies and pre-existing condition coverage. These policies also offer assistance for mobility issues and provide peace of mind for those traveling in their golden years.

Real-Life Travel Insurance Claims

Travel insurance claims can provide valuable insights into the real-world benefits of travel insurance. Here are a few examples of how travel insurance has come to the rescue:

Medical Emergency in a Foreign Country

A traveler on a solo trip to South America experienced a severe bout of food poisoning, requiring hospitalization. Their travel insurance policy covered the medical expenses, including the cost of medication and hospital stays. Without insurance, the traveler would have faced significant financial burden and potential language barriers in accessing adequate medical care.

Trip Cancellation Due to Natural Disaster

A family planning a vacation to a tropical island had to cancel their trip due to an unexpected hurricane. Their travel insurance policy covered the cost of their non-refundable hotel bookings and flight tickets. The insurance company provided prompt reimbursement, allowing the family to plan a new trip without incurring a financial loss.

Lost Baggage and Delayed Flights

A business traveler experienced a delayed flight, resulting in missed connections and lost baggage. Their travel insurance policy covered the cost of purchasing essential items during the delay and provided compensation for the inconvenience caused. The insurance company’s assistance ensured the traveler could continue their journey without significant disruption.

Travel Insurance and COVID-19

The COVID-19 pandemic has significantly impacted the travel industry and highlighted the importance of travel insurance. Many travelers are now opting for policies that provide coverage for COVID-19-related issues, including medical expenses, trip cancellations, and quarantine expenses.

COVID-19 Coverage Options

Travel insurance providers have adapted their policies to address the challenges posed by COVID-19. Some policies now offer specific coverage for COVID-19-related medical emergencies, including treatment and evacuation. Additionally, some policies cover trip cancellations due to COVID-19-related reasons, providing financial protection in the event of unexpected travel disruptions.

The Future of Travel Insurance

As the travel industry continues to evolve post-pandemic, travel insurance is likely to play an even more crucial role. Travelers are increasingly seeking comprehensive coverage that addresses a wide range of potential risks, including pandemics, natural disasters, and political unrest. Insurance providers are expected to continue developing innovative policies to meet these evolving needs, offering enhanced protection and peace of mind for travelers worldwide.

What happens if I need to make a claim during my trip?

+If you need to make a claim during your trip, the first step is to contact your insurance provider’s emergency assistance line. They will guide you through the claim process and provide any necessary assistance. It is essential to keep all relevant documentation, including medical reports, receipts, and any other evidence related to your claim. Follow the provider’s instructions to ensure a smooth and efficient claim settlement.

Can I get travel insurance for a pre-existing medical condition?

+Yes, many travel insurance providers offer coverage for pre-existing medical conditions. However, it is important to disclose these conditions accurately when obtaining a quotation. Some providers may require additional medical assessments or may offer specific policies tailored to travelers with pre-existing conditions. It is crucial to review the policy’s terms and conditions to understand the coverage limits and any potential exclusions.

Are there any activities that are not covered by travel insurance?

+Yes, travel insurance policies often have exclusions for certain high-risk activities. These may include activities like skydiving, bungee jumping, or off-road motorcycling. It is essential to review the policy’s fine print to understand the activities that are not covered. Some providers offer optional add-ons or specialized policies for adventure seekers to ensure comprehensive coverage for their chosen activities.

How can I compare travel insurance policies effectively?

+When comparing travel insurance policies, consider the following factors: coverage limits, exclusions, claim process, and customer reviews. Use comparison websites to get an overview of different policies, but also directly engage with insurance providers to clarify any doubts and understand the nuances of each policy. Ensure that the policy aligns with your specific needs and provides adequate protection for your trip.