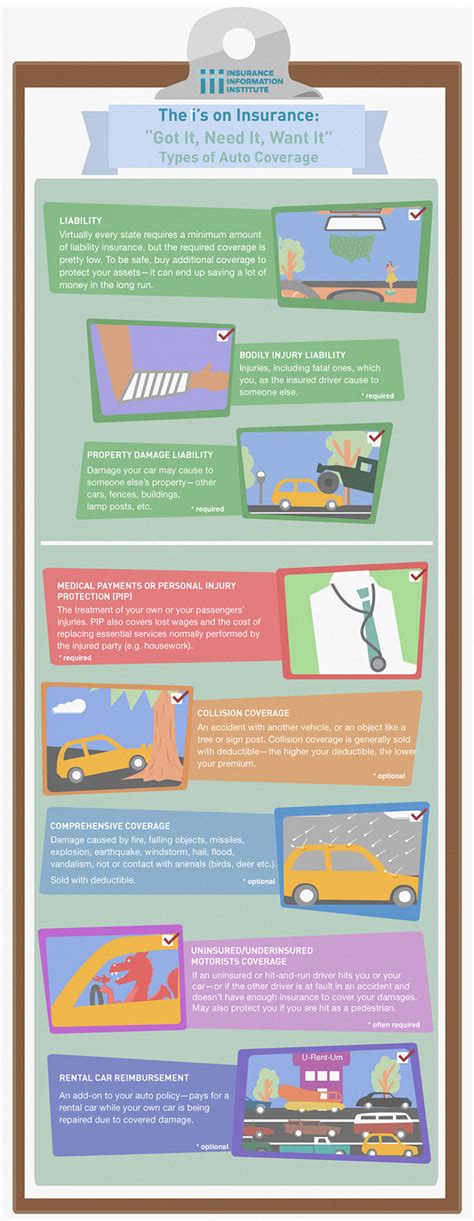

Types Of Car Insurance Coverages

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers and their vehicles. With a wide range of coverage options available, it's crucial to understand the different types of car insurance policies and how they can benefit you. This article aims to delve into the specifics of car insurance coverages, offering an in-depth analysis of each type and its unique features. By the end, you'll have a comprehensive understanding of the various options at your disposal, empowering you to make informed decisions when selecting the right car insurance coverage for your needs.

Comprehensive Car Insurance Coverage

Comprehensive car insurance is the most extensive type of coverage, offering protection against a wide array of risks and unexpected events. It goes beyond the basic liability coverage, providing financial assistance for damages to your vehicle caused by incidents other than collisions.

Covered Incidents

Comprehensive coverage typically includes damages resulting from the following:

- Natural disasters such as storms, hurricanes, floods, or earthquakes.

- Fire, whether it originates from the vehicle itself or an external source.

- Theft or vandalism, including attempts at theft.

- Collision with animals, which can cause significant damage to your vehicle.

- Falling objects, like tree branches or debris from construction sites.

| Coverage Type | Percent Covered |

|---|---|

| Natural Disasters | Up to 90% |

| Fire Damage | 85% on average |

| Theft or Vandalism | Typically 75% or more |

| Animal Collisions | Varies by insurer, often around 60% |

| Falling Objects | Up to 70% coverage |

Collision Car Insurance Coverage

Collision coverage is a specific type of insurance that comes into play when your vehicle is involved in a collision with another vehicle or object. This coverage is designed to protect you financially when the damage is your fault or when the other driver is uninsured or underinsured.

Key Benefits

Collision coverage offers the following advantages:

- Repairs or Replacement: If your vehicle is damaged in a collision, this coverage will pay for the repairs or, in severe cases, the replacement of your vehicle.

- Deductibles: You can choose the deductible amount, which is the portion of the claim you’ll pay out of pocket. Higher deductibles often result in lower premiums.

- Comprehensive Protection: Collision coverage works in tandem with comprehensive coverage, providing a robust layer of protection for your vehicle.

| Collision Scenario | Coverage Extent |

|---|---|

| At-Fault Collision | Repairs covered, less the deductible |

| Uninsured Driver Collision | Repairs paid for by your insurance |

| Underinsured Driver Collision | Coverage for the difference in value between your and the other driver's insurance limits |

Liability Car Insurance Coverage

Liability coverage is a fundamental aspect of car insurance, ensuring that you’re protected in the event that you cause an accident that results in injuries or property damage to others.

Types of Liability Coverage

Liability coverage is typically divided into two main categories:

- Bodily Injury Liability: This coverage pays for the medical expenses and lost wages of individuals injured in an accident caused by you. It also covers legal fees if you’re sued as a result of the accident.

- Property Damage Liability: This coverage reimburses the cost of repairing or replacing property that you’ve damaged in an accident, such as other vehicles, buildings, or structures.

| Liability Type | Coverage Limit |

|---|---|

| Bodily Injury | Varies by state, typically ranging from $25,000 to $100,000 per person, with a total limit of $50,000 to $300,000 per accident |

| Property Damage | Average limit of $25,000, but can be higher depending on the insurer and state regulations |

Personal Injury Protection (PIP) Coverage

Personal Injury Protection, commonly known as PIP, is a type of car insurance coverage that provides financial support for medical expenses and lost wages resulting from an accident, regardless of who is at fault.

Key Features

PIP coverage includes the following benefits:

- Medical Expenses: Covers the cost of medical treatment, including doctor visits, hospital stays, rehabilitation, and even funeral expenses if the accident results in a fatality.

- Lost Income: Reimburses a portion of your lost wages if you’re unable to work due to injuries sustained in the accident.

- Essential Services: Pays for essential services you may require if you’re unable to perform them yourself, such as child care or housework.

| PIP Coverage | Limit |

|---|---|

| Medical Expenses | Varies by state, typically ranging from $5,000 to $100,000 |

| Lost Income | Usually a percentage of your pre-accident income, with a maximum limit specified in your policy |

| Essential Services | Covers up to a certain amount, as outlined in your policy |

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist coverage is designed to protect you financially if you’re involved in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the damages.

Protection Offered

This coverage provides the following:

- Bodily Injury Protection: Covers medical expenses and lost wages if you’re injured in an accident caused by an uninsured or underinsured driver.

- Property Damage Protection: Reimburses the cost of repairing or replacing your vehicle if the other driver is uninsured or underinsured.

| Coverage Type | Limit |

|---|---|

| Bodily Injury | Similar to liability coverage, with limits varying by state |

| Property Damage | Typically aligned with your collision coverage limits |

Medical Payments Coverage

Medical Payments coverage, often referred to as MedPay, is a type of car insurance that specifically covers medical expenses for you and your passengers after an accident, regardless of who is at fault.

Key Benefits

MedPay offers the following advantages:

- Quick Access to Medical Care: Allows you to receive immediate medical treatment without having to wait for liability determinations or lengthy legal processes.

- Comprehensive Coverage: Covers a wide range of medical expenses, including emergency room visits, hospital stays, surgical procedures, and even chiropractic care.

- Deductible-Free Claims: Unlike some other coverages, MedPay claims are often processed without a deductible, making it a convenient and cost-effective option for medical expenses.

| Medical Payments Coverage | Limit |

|---|---|

| Medical Expenses | Varies by insurer, typically ranging from $1,000 to $10,000 per person, with a maximum limit for all occupants in the vehicle |

Rental Car Reimbursement Coverage

Rental Car Reimbursement coverage, also known as Rental Car Insurance, is an optional car insurance coverage that provides financial assistance for the cost of renting a vehicle while your own car is being repaired or replaced due to an insured incident.

Key Features

This coverage includes the following benefits:

- Rental Period: Covers the cost of renting a similar vehicle to your own for a specified number of days, typically ranging from 30 to 35 days.

- Daily Rate: Provides a daily rate to cover the cost of the rental, with some policies offering a choice of economy, standard, or premium vehicles.

- Collision Damage Waiver: May include a Collision Damage Waiver, which protects you from liability for damage to the rental vehicle.

| Rental Car Reimbursement | Coverage Details |

|---|---|

| Rental Period | Up to 35 days, depending on the policy |

| Daily Rate | Varies by insurer and policy, typically around $30 to $50 per day |

| Collision Damage Waiver | Some policies include this, waiving liability for rental car damage |

Roadside Assistance Coverage

Roadside Assistance coverage is an optional car insurance add-on that provides emergency services and support when you’re stranded on the road due to vehicle issues or other unforeseen circumstances.

Services Offered

Roadside Assistance typically includes the following services:

- Towing: Assists with towing your vehicle to the nearest repair facility or your preferred location.

- Flat Tire Changes: Provides help with changing a flat tire, ensuring you can continue your journey safely.

- Fuel Delivery: Offers fuel delivery if you run out of gas, helping you get back on the road quickly.

- Lockout Services: Assists if you lock your keys in the car, ensuring you can regain access without damage.

- Battery Jump-Start: Provides a jump-start for your vehicle’s battery if it fails to start.

| Roadside Assistance | Coverage Details |

|---|---|

| Towing | Covers towing up to a specified distance, typically around 5-10 miles |

| Flat Tire Changes | Assists with tire changes, provided you have the necessary equipment |

| Fuel Delivery | Provides fuel delivery up to a certain limit, often 2-3 gallons |

| Lockout Services | Covers lockout services, including unlocking your vehicle |

| Battery Jump-Start | Offers a battery jump-start service |

Gap Insurance Coverage

Gap Insurance, also known as Guaranteed Asset Protection, is a type of car insurance coverage that bridges the gap between the actual cash value of your vehicle and the amount you still owe on your auto loan or lease.

Key Advantages

Gap Insurance provides the following benefits:

- Protection Against Depreciation: Vehicles typically depreciate in value over time, and Gap Insurance ensures that you’re not left with a financial burden if your vehicle is totaled or stolen.

- Coverage for Loans and Leases: If you have a loan or lease on your vehicle, Gap Insurance can cover the difference between the insurance payout and the remaining balance on your loan or lease.

| Gap Insurance | Coverage Details |

|---|---|

| Depreciation Protection | Covers the difference between your vehicle's actual cash value and the amount owed on your loan or lease |

| Loans and Leases | Applies to both loans and leases, ensuring you're not left with a debt burden if your vehicle is totaled or stolen |

Custom Parts and Equipment Coverage

Custom Parts and Equipment coverage is an add-on to your car insurance policy that provides protection for any modifications, upgrades, or custom parts you’ve added to your vehicle.

Covered Items

This coverage typically includes the following:

- Custom Wheels and Tires: Covers the cost of replacing custom wheels and tires if they’re damaged or stolen.

- Audio/Visual Equipment: Provides protection for high-end audio systems, navigation systems, and other electronic devices installed in your vehicle.

- Performance Upgrades: Covers modifications such as engine enhancements, suspension upgrades, and exhaust systems.

- Custom Paint Jobs: Protects the cost