Veteran Insurance

Veteran insurance is a vital topic that offers crucial support and protection to those who have served in the military. Understanding the intricacies of insurance policies specifically tailored for veterans is essential, as it can greatly impact their financial well-being and overall quality of life. In this comprehensive guide, we will delve into the world of veteran insurance, exploring its unique features, benefits, and how it caters to the specific needs of our military heroes.

Understanding Veteran Insurance: A Tailored Approach

Veteran insurance is designed with a nuanced understanding of the challenges and circumstances unique to military service members and their families. Unlike traditional insurance policies, veteran insurance takes into account the potential physical and mental health impacts of military service, as well as the specific financial considerations veterans may face upon their transition to civilian life.

Key Features of Veteran Insurance

Veteran insurance policies often include a range of specialized features, such as:

- Enhanced Medical Coverage: Many veteran insurance plans offer comprehensive medical coverage, including access to specialized healthcare services and treatments tailored to the unique health needs of veterans. This can include coverage for service-related injuries, post-traumatic stress disorder (PTSD), and other mental health conditions.

- Disability Benefits: Veterans with service-connected disabilities may be eligible for enhanced disability benefits through their insurance policies. These benefits can provide financial support and assistance in managing the long-term impacts of their disabilities.

- Life Insurance Options: Veteran insurance often includes flexible life insurance plans, allowing veterans to secure their family’s financial future. These policies may offer additional benefits, such as coverage for service-related deaths or discounts for veterans with certain qualifications.

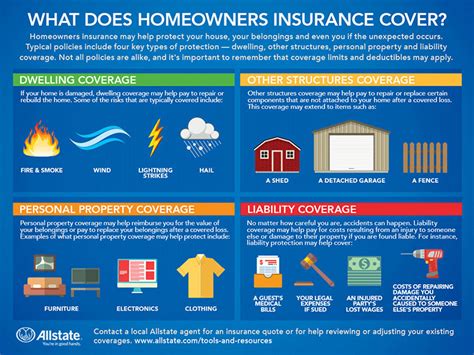

- Property and Casualty Insurance: Property and casualty insurance is an essential component of veteran insurance, providing coverage for homes, vehicles, and other assets. Many policies offer discounts or tailored coverage options for veterans, ensuring their unique needs are met.

| Insurance Type | Veteran-Specific Benefits |

|---|---|

| Health Insurance | Service-related injury coverage, mental health support, specialized healthcare access |

| Disability Insurance | Enhanced benefits for service-connected disabilities, income protection |

| Life Insurance | Discounts for veterans, coverage for service-related deaths, flexible payment options |

| Property Insurance | Veteran-specific discounts, tailored coverage for military-related risks |

Navigating the Veteran Insurance Landscape

With a wide range of insurance options available, it’s essential for veterans to understand their specific needs and research the market thoroughly. Here are some key considerations when navigating the veteran insurance landscape:

Assessing Your Needs

Every veteran’s situation is unique, and their insurance needs may vary accordingly. Consider factors such as your current health status, potential future health risks, your financial goals, and the specific challenges you may face as a veteran. For instance, veterans with service-connected disabilities may require more extensive medical and disability coverage.

Researching Insurance Providers

Not all insurance providers offer veteran-specific policies, so it’s crucial to research those that do. Look for providers with a strong track record of serving the veteran community and offering comprehensive, tailored insurance solutions. Online reviews and recommendations from fellow veterans can be invaluable in this process.

Understanding Policy Terms

When reviewing insurance policies, pay close attention to the fine print. Ensure you understand the coverage limits, any exclusions or limitations, and the renewal process. It’s also essential to clarify any questions or concerns you may have with the insurance provider before committing to a policy.

Utilizing Veteran-Specific Resources

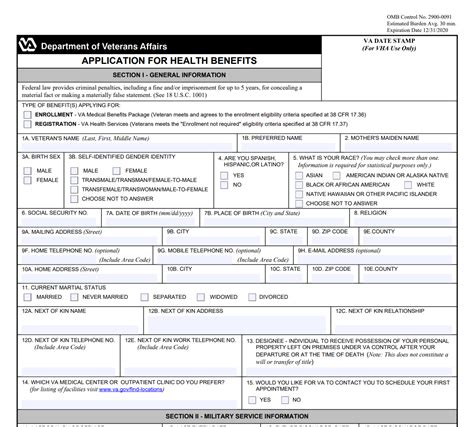

Numerous organizations and resources are dedicated to supporting veterans, including those focused on insurance and financial matters. These resources can provide valuable guidance and assistance in navigating the complex world of veteran insurance. Some notable resources include the Veterans Affairs (VA) website, Veterans of Foreign Wars (VFW), and Military.com, among others.

The Impact of Veteran Insurance: Real-Life Examples

Veteran insurance policies have had a profound impact on the lives of many veterans and their families. Here are a few real-life examples that illustrate the importance and benefits of veteran insurance:

Case Study: Medical Coverage for Service-Related Injuries

Veteran John, a retired Marine, suffered a severe injury during his service that required extensive medical treatment. His veteran insurance policy provided comprehensive coverage for his medical expenses, including specialized surgeries and ongoing physical therapy. Without this coverage, John would have faced significant financial burdens, potentially impacting his ability to recover fully.

Disability Benefits: A Lifeline for Veterans

Veteran Sarah, a former Army medic, developed chronic pain and mobility issues due to her service. Her veteran insurance policy offered enhanced disability benefits, providing her with a monthly income to support her medical needs and daily living expenses. This financial support allowed Sarah to focus on her health and well-being without the added stress of financial strain.

Life Insurance: Securing a Veteran’s Legacy

Veteran Michael, a proud Navy veteran, wanted to ensure his family’s financial security in the event of his untimely passing. His veteran insurance policy included a life insurance plan with coverage for service-related deaths. This gave Michael peace of mind, knowing that his family would be taken care of even if the worst were to happen.

The Future of Veteran Insurance: Innovations and Trends

The veteran insurance landscape is continually evolving, with providers and organizations working to enhance their offerings and better serve the veteran community. Here are some key trends and innovations to watch:

Telehealth and Digital Solutions

The rise of telehealth and digital healthcare solutions has opened up new avenues for veteran insurance providers. Many insurers are now offering virtual healthcare services, providing veterans with convenient and accessible medical care. This trend is particularly beneficial for veterans in remote areas or those with limited mobility.

Veteran-Centric Insurance Apps

Insurance providers are developing user-friendly mobile apps specifically designed for veterans. These apps offer a range of features, including policy management, claims submission, and access to veteran-specific resources. By embracing digital technology, insurers can enhance the overall insurance experience for veterans.

Collaboration with Military Organizations

Veteran insurance providers are increasingly collaborating with military and veteran organizations to gain a deeper understanding of the community’s needs. These partnerships lead to the development of more targeted and effective insurance solutions, ensuring that veterans receive the support they deserve.

Veteran Insurance FAQs

What is veteran insurance, and how is it different from traditional insurance policies?

+Veteran insurance is specifically designed to meet the unique needs of military veterans and their families. It offers enhanced medical coverage, disability benefits, and tailored life and property insurance options. Traditional insurance policies may not adequately address the specific challenges veterans face, such as service-related injuries or mental health conditions.

How can I find veteran-specific insurance providers and policies?

+You can research veteran-specific insurance providers online or seek recommendations from veteran organizations and support groups. The Veterans Affairs (VA) website and resources from organizations like Veterans of Foreign Wars (VFW) can also provide valuable guidance.

What are some key considerations when choosing a veteran insurance policy?

+When selecting a veteran insurance policy, consider your specific needs, such as medical coverage for service-related injuries, disability benefits, and life insurance options. Assess the provider’s reputation, read reviews from fellow veterans, and ensure the policy offers comprehensive coverage tailored to your circumstances.

Veteran insurance is a critical component of the support network for military veterans, providing essential financial protection and peace of mind. By understanding the unique features and benefits of veteran insurance, veterans can make informed decisions to secure their future and the well-being of their families. As the veteran insurance landscape continues to evolve, it remains a powerful tool in ensuring the long-term success and prosperity of those who have bravely served our nation.