Welfare Insurance

Welcome to an in-depth exploration of Welfare Insurance, a crucial aspect of social protection and financial security. This comprehensive guide will delve into the intricacies of welfare insurance, offering insights, real-world examples, and expert analysis to help you understand its importance and impact.

Understanding Welfare Insurance

Welfare insurance, often an integral part of a nation’s social safety net, is designed to provide financial support and protection to individuals and families during times of need. It serves as a vital tool to mitigate the risks associated with various life events, ensuring a basic level of financial stability and access to essential services.

The concept of welfare insurance is rooted in the principle of social solidarity, aiming to protect society's most vulnerable members. By pooling resources and sharing risks, welfare insurance programs offer a safety net that can catch individuals when they fall on hard times, whether due to illness, unemployment, disability, or other unforeseen circumstances.

Across the globe, welfare insurance takes on various forms, reflecting the unique social, economic, and cultural landscapes of different countries. From universal healthcare systems to comprehensive social security nets, these programs play a critical role in promoting social equity and reducing poverty.

Key Components of Welfare Insurance

Welfare insurance encompasses a wide range of programs and benefits, each designed to address specific needs and risks. Here’s a breakdown of some key components:

Health Insurance

Health insurance is a cornerstone of welfare insurance, ensuring individuals have access to necessary medical care without facing financial hardship. This can include coverage for doctor visits, hospital stays, medications, and preventative services. In many countries, health insurance is provided through a combination of public and private systems, with varying levels of coverage and cost.

| Country | Health Insurance Coverage |

|---|---|

| United States | Private insurance, Medicare, Medicaid, and state-based plans |

| United Kingdom | National Health Service (NHS) provides universal coverage |

| Canada | Provincial and territorial health plans, with some private options |

Unemployment Benefits

Unemployment benefits provide financial assistance to individuals who have lost their jobs through no fault of their own. These benefits are typically administered by government agencies and aim to support individuals while they search for new employment opportunities. The amount and duration of benefits can vary based on factors like previous earnings and the length of employment.

Disability Insurance

Disability insurance ensures individuals receive financial support if they become unable to work due to a disability or long-term illness. This can include both physical and mental health conditions. Disability benefits may be provided through public programs or through private insurance policies.

Social Security

Social security programs provide financial support to individuals who have reached retirement age or those who are permanently disabled. These programs are typically funded through payroll taxes and can include benefits like retirement pensions, survivors’ benefits, and disability payments.

Family Benefits

Family benefits are designed to support families with children, often including payments to parents for child-rearing costs. These benefits can take the form of child allowances, childcare subsidies, or tax credits. They aim to reduce the financial burden of raising children and promote family well-being.

The Impact and Importance of Welfare Insurance

Welfare insurance plays a pivotal role in society, offering numerous benefits that extend beyond individual financial security.

Social Equity and Poverty Reduction

Well-designed welfare insurance programs can significantly reduce income inequality and poverty rates. By providing a basic level of financial security, these programs enable individuals and families to meet their essential needs, regardless of their employment status or income level. This can lead to improved access to healthcare, education, and other opportunities, promoting social mobility and reducing the intergenerational transmission of poverty.

Economic Stability

Welfare insurance contributes to economic stability by protecting individuals and families from financial ruin during difficult times. This, in turn, can prevent a downward spiral of debt and poverty, preserving consumer spending and supporting economic growth. Additionally, by ensuring a healthy and educated population, welfare insurance programs can enhance a country’s long-term economic prospects.

Health and Well-being

Comprehensive welfare insurance, particularly robust healthcare coverage, can lead to improved population health outcomes. Timely access to healthcare services can prevent minor health issues from becoming major, costly problems. This not only benefits individuals but also reduces the burden on the healthcare system as a whole.

Social Cohesion

Welfare insurance programs foster social cohesion by promoting a sense of shared responsibility and community. By ensuring that everyone, regardless of their circumstances, has access to essential services and financial support, these programs can strengthen social bonds and reduce social tensions.

Performance Analysis and Real-World Examples

Let’s delve into some real-world examples to understand the impact and performance of welfare insurance programs:

The Nordic Model

Countries like Sweden, Norway, and Denmark offer a prime example of effective welfare insurance. These nations have comprehensive social security systems that include universal healthcare, generous unemployment benefits, and strong family support programs. This approach has led to some of the highest standards of living and lowest poverty rates in the world.

For instance, in Sweden, the social security system includes a universal healthcare program, with all residents having equal access to healthcare services regardless of income. The country also has a robust system of unemployment benefits, with a high replacement rate and long duration, ensuring financial security during job searches. Additionally, Sweden's parental leave policies are among the most generous in the world, promoting family well-being.

Germany’s Social Security System

Germany’s social security system is often cited as a model for other countries. It includes a comprehensive set of benefits, including health insurance, pension plans, unemployment benefits, and family support. The system is funded through a combination of employer and employee contributions, with the government playing a role in regulating and overseeing the programs.

One notable feature of Germany's system is its health insurance, which is largely funded through a combination of employer and employee contributions. This ensures that even those with lower incomes can access high-quality healthcare services. The country also has a strong social safety net for the elderly, with pension benefits that are relatively generous compared to many other countries.

The United States: A Mixed Approach

The United States takes a more mixed approach to welfare insurance. While it has a robust social security system for retirement and disability benefits, healthcare coverage is more fragmented, with a mix of public and private insurance options. Unemployment benefits also vary widely by state, and there is no universal child benefit program.

Despite these variations, the U.S. has made significant strides in expanding healthcare coverage through the Affordable Care Act (ACA), often known as Obamacare. The ACA has led to a substantial increase in the number of insured Americans, reducing the rate of uninsured individuals from 16% in 2010 to around 8.5% in 2019. This has had a positive impact on access to healthcare services and overall population health.

Future Implications and Trends

As societies evolve and face new challenges, welfare insurance programs must adapt to remain effective. Here are some key trends and considerations for the future:

The Rise of Automation and AI

With the increasing automation of jobs and the potential impact of artificial intelligence on the workforce, welfare insurance programs may need to adapt to support individuals transitioning between jobs or facing long-term unemployment due to technological changes.

Aging Populations

Many countries are facing an aging population, which can put increased pressure on pension and healthcare systems. Welfare insurance programs will need to ensure the sustainability of these systems while also addressing the unique needs of an aging population, such as long-term care and support for those with age-related disabilities.

Climate Change and Natural Disasters

The increasing frequency and severity of natural disasters due to climate change may lead to greater demand for welfare insurance programs. These programs may need to expand their coverage to include support for individuals and communities affected by climate-related events, such as floods, wildfires, and extreme weather conditions.

Global Pandemics

The COVID-19 pandemic has highlighted the importance of robust welfare insurance programs, particularly in terms of healthcare coverage and income support. As the world continues to grapple with the aftermath of this and potential future pandemics, welfare insurance will play a critical role in protecting public health and economic stability.

Technological Advancements

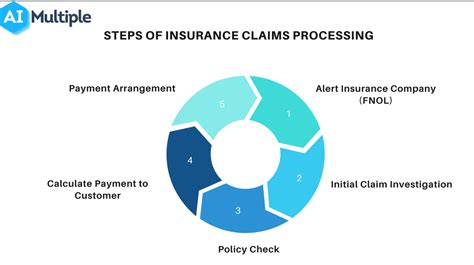

Advancements in technology can also impact welfare insurance programs. For instance, digital platforms can enhance the efficiency and accessibility of these programs, making it easier for individuals to apply for and receive benefits. Additionally, data analytics can help identify areas of need and potential fraud, improving the overall effectiveness of welfare insurance systems.

Conclusion

Welfare insurance is a critical component of a functioning society, providing a safety net for individuals and families during challenging times. As we’ve explored, effective welfare insurance programs can have a profound impact on social equity, economic stability, health outcomes, and social cohesion.

While there is no one-size-fits-all approach to welfare insurance, the real-world examples we've examined offer valuable insights into what works and what can be improved. As societies continue to evolve and face new challenges, the adaptability and resilience of welfare insurance programs will be key to ensuring the well-being and financial security of their citizens.

What is the primary purpose of welfare insurance?

+Welfare insurance serves as a safety net, providing financial support and protection to individuals and families during times of need. Its primary purpose is to ensure basic financial stability and access to essential services, such as healthcare, in order to reduce poverty and promote social equity.

How does welfare insurance benefit society as a whole?

+Welfare insurance programs have wide-ranging societal benefits. They reduce income inequality, promote social mobility, and strengthen social cohesion. By providing a basic level of financial security, these programs can also enhance economic stability and population health, leading to a more prosperous and resilient society.

What are some challenges faced by welfare insurance programs?

+Welfare insurance programs can face challenges such as rising healthcare costs, increasing unemployment due to economic downturns or technological advancements, and the need to adapt to changing demographics, like an aging population. Additionally, ensuring the financial sustainability of these programs can be a significant challenge.