What Does Comprehensive Insurance Mean

Comprehensive insurance, often referred to as full coverage insurance, is a type of insurance policy that offers a broad range of protections and benefits to policyholders. It is a popular choice for individuals and businesses seeking comprehensive risk management and financial protection against a wide array of potential losses and damages. In this expert guide, we will delve into the world of comprehensive insurance, exploring its key features, benefits, and how it can provide peace of mind in various scenarios.

Understanding Comprehensive Insurance

Comprehensive insurance is designed to provide all-encompassing protection by combining multiple types of insurance coverages into a single policy. Unlike basic insurance plans that offer limited coverage for specific risks, comprehensive insurance aims to offer a more holistic approach to risk management. This type of insurance policy is tailored to meet the unique needs of the policyholder, ensuring they are adequately protected against a wide range of potential risks and liabilities.

One of the key advantages of comprehensive insurance is its flexibility. Policyholders can customize their coverage to suit their specific requirements, whether it's protecting their home, business, vehicles, or valuable assets. By bundling different types of insurance together, comprehensive insurance policies often provide cost-effective solutions and simplify the insurance process.

Key Components of Comprehensive Insurance

Comprehensive insurance typically includes the following core components, each offering distinct benefits and protections:

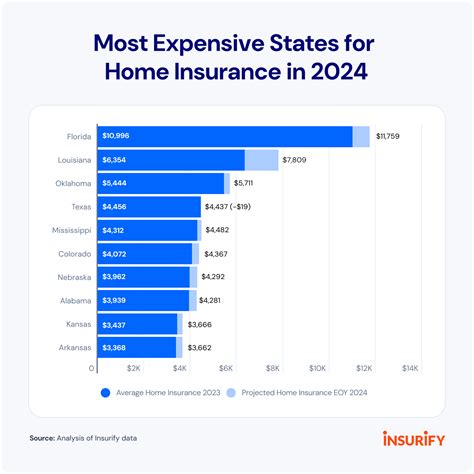

- Property Insurance: This covers physical assets such as homes, buildings, and personal belongings against damages caused by various perils, including fire, storms, theft, and vandalism.

- Liability Insurance: Provides protection against legal claims and financial liabilities arising from accidents or injuries caused to others or their property. It safeguards policyholders from potential lawsuits and associated expenses.

- Personal Injury Protection (PIP): A crucial component for individuals, PIP covers medical expenses, lost wages, and other related costs incurred due to injuries sustained in accidents, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Offers financial protection in the event of an accident involving an uninsured or underinsured driver. This coverage ensures that policyholders are not left financially burdened due to the negligence of others.

- Comprehensive Vehicle Coverage: As the name suggests, this coverage extends beyond standard auto insurance to protect against non-collision-related incidents such as theft, vandalism, and natural disasters. It provides peace of mind for vehicle owners.

- Business Insurance: For businesses, comprehensive insurance can include coverage for property damage, liability, business interruption, and more, ensuring that companies can weather various challenges and continue operations smoothly.

By combining these and other relevant coverages, comprehensive insurance policies offer a holistic risk management solution, providing policyholders with the assurance that they are protected against a wide spectrum of potential risks and uncertainties.

Benefits of Comprehensive Insurance

Opting for comprehensive insurance brings numerous advantages, making it an attractive choice for individuals and businesses alike. Here are some key benefits:

1. All-Encompassing Protection

As the name suggests, comprehensive insurance offers broad coverage across various aspects of life and business. Whether it’s protecting your home, vehicle, business, or personal belongings, this type of insurance ensures that you are covered for a wide range of potential risks and losses.

For instance, if you own a business, comprehensive insurance can cover not only your physical assets like buildings and equipment but also provide liability protection in case a customer gets injured on your premises. It can even cover business interruption, ensuring your operations can continue smoothly despite unforeseen events.

2. Customizable Coverage

Comprehensive insurance policies are highly flexible and adaptable to meet the unique needs of each policyholder. Insurers work closely with clients to understand their specific requirements and tailor the coverage accordingly. This customization ensures that policyholders only pay for the coverage they need, making it a cost-effective solution.

Suppose you're a homeowner with valuable artwork and jewelry. A comprehensive insurance policy can be tailored to include fine arts and jewelry coverage, ensuring these valuable assets are adequately protected against theft, damage, or loss.

3. Peace of Mind

One of the most significant advantages of comprehensive insurance is the peace of mind it provides. By having a single policy that covers multiple aspects of your life or business, you can rest assured knowing that you’re protected against a wide array of potential risks and liabilities.

For example, if you're involved in a car accident, comprehensive insurance can cover not only the repairs to your vehicle but also any medical expenses, lost wages, and legal fees if you're sued. This comprehensive protection ensures that you can focus on your recovery and well-being without worrying about the financial implications.

4. Cost-Effective Solution

Bundling multiple insurance coverages into a comprehensive policy often results in significant cost savings compared to purchasing individual policies. Insurance providers offer discounts and incentives for bundling, making it a financially prudent choice.

Consider a business owner who opts for comprehensive insurance. By having a single policy that covers property damage, liability, and business interruption, they can save on administrative costs and enjoy the convenience of a single point of contact for all their insurance needs.

5. Simplified Insurance Process

Comprehensive insurance streamlines the insurance process by combining multiple coverages into one policy. This consolidation reduces the administrative burden and simplifies the management of insurance policies, making it easier for policyholders to keep track of their coverage and make timely payments.

Imagine a homeowner who previously had separate policies for their home, auto, and personal liability. By switching to comprehensive insurance, they can now manage all these coverages through a single policy, reducing paperwork and simplifying the renewal and claims processes.

Real-World Examples of Comprehensive Insurance

To illustrate the versatility and benefits of comprehensive insurance, let’s explore a few real-world scenarios:

Scenario 1: Homeowner’s Peace of Mind

Sarah, a proud homeowner, recently purchased a comprehensive insurance policy for her new home. This policy includes coverage for her home, personal belongings, and liability. While enjoying a peaceful evening at home, a sudden storm hits, causing extensive damage to her roof and flooding her basement. Fortunately, with her comprehensive insurance, Sarah is covered for both the roof repairs and the water damage restoration, ensuring her home is quickly restored to its pre-storm condition.

Scenario 2: Business Continuity

John, the owner of a thriving bakery, understands the importance of business continuity. He opts for a comprehensive insurance policy that covers his bakery’s physical assets, including ovens and equipment, as well as liability and business interruption coverage. One day, a fire breaks out in the kitchen, causing significant damage. Thanks to his comprehensive insurance, John’s bakery is able to continue operations with minimal disruption while the insurance company covers the costs of repairs and temporary relocation.

Scenario 3: Vehicle Protection

Emily, a young professional, values her car and wants to ensure it’s well-protected. She chooses a comprehensive insurance policy that covers not only standard collision and liability but also comprehensive vehicle coverage. One morning, while driving to work, a large tree branch falls on her car, causing extensive damage. With her comprehensive insurance, Emily is covered for the repairs, giving her peace of mind and ensuring her vehicle is quickly restored to its pre-accident condition.

Performance Analysis and Future Implications

Comprehensive insurance policies have consistently demonstrated their value and effectiveness in providing robust protection to policyholders. Over the years, these policies have evolved to meet the changing needs and risks of individuals and businesses, ensuring that coverage remains relevant and comprehensive.

Looking ahead, the future of comprehensive insurance is promising. With advancements in technology and data analytics, insurance providers are better equipped to offer tailored coverage solutions that address specific risks and vulnerabilities. This personalized approach enhances the value proposition of comprehensive insurance, making it even more appealing to policyholders seeking comprehensive protection.

Moreover, the increasing awareness and understanding of comprehensive insurance among consumers have led to a growing demand for this type of coverage. Policyholders recognize the benefits of having a single, all-encompassing policy that simplifies their insurance needs and provides peace of mind. As a result, insurance providers are investing in innovative products and services to meet this demand, further enhancing the appeal and accessibility of comprehensive insurance.

| Coverage Type | Key Benefits |

|---|---|

| Property Insurance | Protects physical assets like homes and businesses against damages caused by various perils. |

| Liability Insurance | Safeguards policyholders against legal claims and financial liabilities arising from accidents or injuries. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for injuries sustained in accidents, regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | Provides financial protection in the event of an accident involving uninsured or underinsured drivers. |

| Comprehensive Vehicle Coverage | Extends protection beyond standard auto insurance, covering non-collision incidents like theft and natural disasters. |

Frequently Asked Questions

What is the difference between comprehensive insurance and basic insurance plans?

+Comprehensive insurance offers a broader range of coverages, combining multiple types of insurance into one policy. Basic insurance plans, on the other hand, provide limited coverage for specific risks. Comprehensive insurance is more flexible and customizable, allowing policyholders to tailor their coverage to their unique needs.

How can I customize my comprehensive insurance policy to meet my specific needs?

+When purchasing comprehensive insurance, work closely with your insurance provider to understand your specific requirements. They can guide you in selecting the right coverages and limits to ensure your policy adequately protects your assets, liabilities, and personal circumstances.

Are there any limitations or exclusions in comprehensive insurance policies?

+Yes, like any insurance policy, comprehensive insurance policies may have certain limitations and exclusions. It’s important to carefully review the policy documents to understand what is and isn’t covered. Common exclusions may include intentional acts, war, nuclear incidents, and specific high-risk activities.

Can I add additional coverages to my comprehensive insurance policy over time?

+Absolutely! Comprehensive insurance policies are designed to be flexible and adaptable. As your needs change or you acquire new assets, you can discuss with your insurance provider to add additional coverages to your policy. This ensures that your protection remains up-to-date and comprehensive.

How often should I review and update my comprehensive insurance policy?

+It’s recommended to review your comprehensive insurance policy annually or whenever there are significant changes in your life or business. This ensures that your coverage remains aligned with your current needs and that you’re not overpaying for unnecessary coverages or underinsured for potential risks.