Who Invented Insurance

Insurance, an ancient concept that has evolved over centuries, has a rich history rooted in the fundamental human need for protection and risk management. While the precise inventor of insurance is a complex matter with no single definitive answer, we can explore the significant milestones and key figures that shaped the insurance industry as we know it today.

The Evolution of Insurance: A Historical Perspective

The origins of insurance can be traced back to ancient civilizations, where the concept of sharing risk was inherent in various practices. Early forms of insurance were evident in the maritime trade of the Babylonians, who developed a system where merchants would divide their goods among multiple ships to mitigate the risk of losing everything in a single shipwreck. This rudimentary form of insurance laid the foundation for the industry’s evolution.

In ancient Greece and Rome, the concept of bottomry emerged, where lenders provided loans to ship owners, with the loan being forgiven if the ship was lost at sea. This early form of insurance demonstrated the growing awareness of risk and the need for financial protection.

The Birth of Modern Insurance

The 17th century marked a significant turning point in the history of insurance. It was during this period that insurance began to take on a more recognizable form, with the establishment of the first insurance companies. One of the earliest known insurance companies was The Royal Exchange Assurance, founded in London in 1720. This company specialized in marine insurance, providing coverage for ships and their cargo.

Another notable figure in the development of modern insurance was Nicholas Barbon, an English economist and entrepreneur. Barbon is often credited with establishing the first fire insurance company, The Fire Office, in 1680. This company offered fire insurance policies to homeowners, a significant innovation that laid the groundwork for the comprehensive property insurance we have today.

The 18th century saw further advancements, with the emergence of life insurance. Edward Rowe Mores, an English actuary, founded the Amicable Society for a Perpetual Assurance Office in 1706. This society, considered the first life insurance company, offered life annuities and played a crucial role in shaping the life insurance industry.

The Impact of Key Figures

Several individuals have made substantial contributions to the development and refinement of insurance practices. James Dodson, an English actuary, is often regarded as the father of modern actuarial science. His work on calculating life expectancy and developing actuarial tables revolutionized the field, enabling more accurate risk assessment and pricing of insurance policies.

In the 19th century, Elizur Wright, an American mathematician and reformer, made significant contributions to the life insurance industry. He introduced the concept of non-forfeiture, ensuring policyholders would not lose their investment if they discontinued payments, a principle that is still fundamental to life insurance today.

The 20th century brought further innovations, with the rise of health insurance and the establishment of government-backed social insurance programs. Franklin D. Roosevelt, the 32nd President of the United States, played a pivotal role in this regard, with the introduction of the Social Security Act in 1935, providing a safety net for Americans in times of need.

The Modern Insurance Landscape

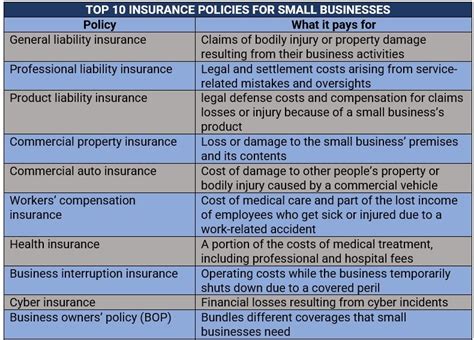

Today, the insurance industry is a global powerhouse, offering a wide range of coverage options to individuals and businesses alike. From auto insurance to health insurance, property insurance to liability coverage, the industry has evolved to meet the diverse needs of a modern society.

The rise of technology has further transformed the insurance landscape, with the emergence of insurtech companies leveraging digital tools and data analytics to enhance efficiency and customer experience. The industry continues to innovate, adapting to changing risk landscapes and consumer demands.

In conclusion, while no single individual can be credited with inventing insurance, the evolution of this industry is a testament to the collective efforts and innovations of countless individuals over centuries. From ancient maritime trade to modern digital insurance platforms, the journey of insurance is a fascinating tale of risk management, financial protection, and the ever-evolving human quest for security.

| Milestone | Date |

|---|---|

| Babylonian Maritime Trade | 2000 BCE - 600 BCE |

| Royal Exchange Assurance Founded | 1720 |

| The Fire Office Established | 1680 |

| Amicable Society for a Perpetual Assurance Office Founded | 1706 |

| Social Security Act Introduced | 1935 |

Who is considered the father of modern actuarial science?

+

James Dodson, an English actuary, is often regarded as the father of modern actuarial science due to his pioneering work in calculating life expectancy and developing actuarial tables, which laid the foundation for accurate risk assessment in insurance.

What was the first life insurance company?

+

The Amicable Society for a Perpetual Assurance Office, founded in 1706 by Edward Rowe Mores, was the first life insurance company, offering life annuities and shaping the principles of modern life insurance.

How has technology impacted the insurance industry?

+

Technology has transformed the insurance industry by introducing digital tools and data analytics, enhancing efficiency, and improving the customer experience. Insurtech companies have emerged, leveraging technology to offer innovative insurance solutions and streamline processes.