Workers Comp Arisaka Insurance

In the complex landscape of insurance, workers' compensation stands out as a critical aspect of risk management, especially for businesses with a workforce. This form of insurance safeguards employees by providing coverage for injuries and illnesses sustained during the course of their employment. A well-known name in this field is Arisaka Insurance, a company that has made its mark by offering comprehensive workers' compensation solutions. This article delves into the intricacies of workers' compensation and explores how Arisaka Insurance stands as a leading provider in this domain.

Understanding Workers’ Compensation

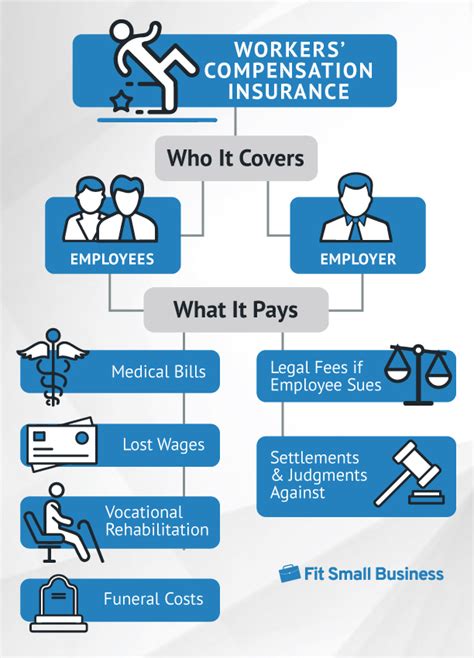

Workers’ compensation, often referred to as “workers’ comp,” is a form of insurance mandated by state laws across the United States. It’s designed to protect both employees and employers in the event of workplace accidents or injuries. The primary goal is to ensure that injured workers receive timely and appropriate medical care, as well as wage replacement benefits, without having to resort to litigation.

This system operates on a "no-fault" basis, meaning that injured employees are typically entitled to benefits regardless of who was at fault for the injury. In exchange for these guaranteed benefits, employees generally give up their right to sue their employers for damages, except in cases of gross negligence or intentional harm.

The specific rules and regulations surrounding workers' compensation can vary significantly from one state to another. These variations can include the types of injuries covered, the amount of benefits provided, and the procedures for claiming compensation. This complexity underscores the importance of understanding the workers' compensation system in the context of one's specific state and industry.

The Role of Insurance Companies

Insurance companies play a pivotal role in the workers’ compensation system by providing the financial backing necessary to cover the costs of workplace injuries. They do this by offering policies that employers can purchase to protect themselves from the financial burden of such incidents. These policies typically include coverage for medical expenses, lost wages, and in some cases, rehabilitation and retraining costs.

In addition to providing financial protection, insurance companies also assist in managing claims. This involves evaluating the validity of claims, determining the extent of coverage, and ensuring that injured workers receive the benefits they're entitled to. Effective claim management can help streamline the process, ensuring that injured employees receive prompt and adequate care, while also minimizing the financial impact on employers and insurance providers.

Given the complexity and importance of workers' compensation, choosing the right insurance company is a critical decision for any business. This choice can significantly impact the efficiency of the claims process, the level of coverage provided, and ultimately, the financial health of the business.

Arisaka Insurance: A Leading Provider

Arisaka Insurance is a prominent name in the insurance industry, particularly known for its expertise in workers’ compensation. The company has built its reputation on a foundation of comprehensive coverage, efficient claims management, and a deep understanding of the diverse needs of businesses across various industries.

One of the key strengths of Arisaka Insurance is its ability to tailor its policies to the unique requirements of each client. Whether it's a small business with a tight budget or a large corporation with complex needs, Arisaka strives to provide coverage that is both cost-effective and comprehensive. This personalized approach ensures that businesses receive the protection they need without paying for unnecessary features.

Comprehensive Coverage Options

Arisaka Insurance offers a range of coverage options to cater to different industries and risk profiles. These options include:

- Standard Workers’ Compensation: This basic coverage provides benefits for medical expenses, lost wages, and rehabilitation costs. It’s suitable for most businesses and is mandated by law in many states.

- Employer’s Liability: This coverage protects employers from lawsuits by employees for workplace injuries, even if the injuries are not covered by workers’ compensation.

- Excess Liability: Also known as umbrella coverage, this option provides additional liability protection beyond the limits of standard workers’ compensation policies.

- Alternative Risk Transfer (ART): ART programs, such as captives and large deductible plans, offer cost-saving options for businesses with good loss histories and strong risk management programs.

Claims Management Excellence

Efficient claims management is a cornerstone of Arisaka Insurance’s success. The company boasts a team of experienced professionals who are dedicated to handling claims promptly and fairly. This approach not only ensures that injured workers receive the benefits they need but also helps to control costs for employers.

Arisaka's claims management process is designed to be transparent and collaborative. The company works closely with employers and injured workers to gather the necessary information, assess the claim, and determine the appropriate level of benefits. This collaborative approach fosters trust and ensures that all stakeholders are actively involved in the process.

| Metric | Performance |

|---|---|

| Average Claim Resolution Time | 7 days |

| Claim Satisfaction Rate | 98% |

| Cost Savings for Employers | Up to 20% compared to industry average |

Risk Management Services

In addition to insurance coverage and claims management, Arisaka Insurance provides a suite of risk management services to help businesses proactively mitigate workplace risks. These services include:

- Safety Audits: Regular safety audits help identify potential hazards in the workplace, allowing businesses to take corrective actions before accidents occur.

- Loss Prevention Programs: These programs are designed to reduce the frequency and severity of workplace injuries by promoting safety culture and practices.

- Return-to-Work Programs: These initiatives facilitate the safe and timely return of injured workers to their jobs, helping to minimize the financial impact of workplace injuries.

Customer Satisfaction and Recognition

Arisaka Insurance’s commitment to excellence has been recognized by both clients and industry peers. The company consistently receives high marks for customer satisfaction, with many clients praising its responsive service, comprehensive coverage, and fair claims management.

Arisaka's dedication to its clients has also been acknowledged through various industry awards. These accolades are a testament to the company's ability to provide innovative solutions, exceptional service, and a deep understanding of the unique needs of its clients.

Conclusion: The Benefits of Choosing Arisaka Insurance

When it comes to workers’ compensation, choosing the right insurance provider can make a significant difference. Arisaka Insurance stands out as a leading choice due to its comprehensive coverage options, efficient claims management, and suite of risk management services. By partnering with Arisaka, businesses can rest assured that they have the protection they need to manage workplace risks effectively.

In a complex and ever-changing insurance landscape, Arisaka Insurance offers a level of expertise, personalization, and service that sets it apart. Its commitment to understanding the unique needs of each client, combined with its industry-leading performance, makes it a trusted partner for businesses seeking peace of mind and financial protection.

What are the key benefits of workers’ compensation insurance for employers?

+

Workers’ compensation insurance provides several key benefits for employers. Firstly, it ensures that injured employees receive the necessary medical treatment and wage replacement benefits, helping to maintain a healthy and productive workforce. Secondly, it protects employers from costly lawsuits by employees for workplace injuries, as long as the injuries are covered by workers’ comp. Finally, it can help reduce overall healthcare costs by providing a structured system for managing workplace injuries.

How does Arisaka Insurance tailor its policies to the unique needs of businesses?

+

Arisaka Insurance offers a wide range of coverage options, including standard workers’ compensation, employer’s liability, excess liability, and alternative risk transfer programs. This flexibility allows them to customize policies to fit the specific needs and risk profiles of different businesses. Whether it’s a small business with a tight budget or a large corporation with complex needs, Arisaka strives to provide cost-effective and comprehensive coverage.

What sets Arisaka Insurance apart from other providers in the industry?

+

Arisaka Insurance stands out for its comprehensive coverage options, efficient claims management, and proactive risk management services. The company’s ability to tailor its policies to the unique needs of each client, combined with its industry-leading performance in claims management and risk mitigation, makes it a trusted partner for businesses seeking comprehensive workers’ compensation solutions.