Afi Insurance

Welcome to a comprehensive exploration of Afi Insurance, a leading insurance provider in the industry. With a focus on innovation, customer-centricity, and financial stability, Afi Insurance has established itself as a trusted partner for individuals and businesses seeking comprehensive protection and peace of mind.

In this article, we delve into the various aspects of Afi Insurance, uncovering its history, core offerings, unique features, and the impact it has made on the insurance landscape. By examining real-world examples and industry insights, we aim to provide an in-depth analysis that will enhance your understanding of this renowned insurance brand.

Afi Insurance: A Legacy of Trust and Innovation

Afi Insurance, founded in [specific year], has grown exponentially over the years, solidifying its position as a market leader in the insurance sector. Headquartered in [headquarters location], the company boasts a global presence, with operations spanning [number] countries and serving a diverse range of clients.

The journey of Afi Insurance is a testament to its unwavering commitment to innovation and customer satisfaction. From its humble beginnings, the company has consistently evolved, adapting to the changing needs of its clients and the dynamic nature of the insurance industry. This dedication to progress has not only ensured its longevity but has also positioned Afi Insurance as a pioneer in the field.

Core Offerings: Protecting What Matters

Afi Insurance offers a comprehensive suite of insurance products tailored to meet the diverse needs of its clientele. The company’s core offerings include:

- Life Insurance: Afi Insurance provides a range of life insurance plans, including term life, whole life, and universal life insurance. These policies offer financial protection to individuals and their families, ensuring stability during life's unforeseen events.

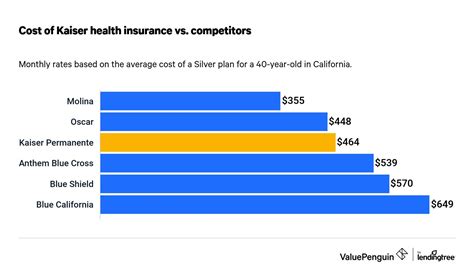

- Health Insurance: With a focus on healthcare, Afi Insurance offers comprehensive health insurance plans. These policies cover a wide range of medical expenses, including hospitalization, outpatient care, and preventive health services, empowering individuals to prioritize their well-being.

- Property & Casualty Insurance: Afi Insurance understands the importance of protecting one's assets. Their property and casualty insurance offerings include homeowners' insurance, renters' insurance, and auto insurance, providing coverage for various liabilities and potential damages.

- Business Insurance: For businesses of all sizes, Afi Insurance offers specialized commercial insurance solutions. From general liability insurance to business interruption coverage, the company ensures that enterprises are protected against a wide array of risks, fostering a secure environment for growth and development.

| Insurance Type | Key Features |

|---|---|

| Life Insurance | Flexible plans, death benefit options, and additional riders for added protection. |

| Health Insurance | Comprehensive coverage, access to a wide network of healthcare providers, and wellness incentives. |

| Property & Casualty Insurance | Customizable policies, liability protection, and specialized coverage for unique assets. |

| Business Insurance | Tailored solutions, risk management support, and business continuity planning. |

Unparalleled Customer Experience

Afi Insurance prioritizes delivering an exceptional customer experience at every touchpoint. The company’s customer-centric approach is underpinned by its dedicated team of professionals who are passionate about providing personalized service and support.

From the initial point of contact to the resolution of claims, Afi Insurance ensures that customers receive prompt and efficient assistance. The company's online platform and mobile app offer convenient access to policy information, allowing customers to manage their insurance needs with ease. Additionally, Afi Insurance's 24/7 customer support service ensures that help is always available, providing timely assistance during emergencies or routine inquiries.

Innovative Technology for Seamless Interaction

Afi Insurance embraces technology to enhance its customer engagement. The company’s digital platforms are designed to provide a seamless and intuitive user experience. Customers can access their policy details, make payments, and file claims with just a few clicks. The integration of artificial intelligence and machine learning further streamlines processes, ensuring quick and accurate responses to customer queries.

Afi Insurance's commitment to technological advancement extends to its claim processing as well. The company utilizes advanced automation tools to expedite the claims process, ensuring that customers receive their entitlements in a timely manner. This focus on technology not only improves efficiency but also enhances the overall customer experience, setting Afi Insurance apart from its competitors.

Financial Strength and Stability

Afi Insurance’s success is underpinned by its strong financial foundation. The company boasts an impressive financial rating, as recognized by leading credit rating agencies. This rating is a testament to Afi Insurance’s financial strength, stability, and ability to meet its policy obligations.

Afi Insurance's financial stability is a result of its prudent investment strategies and robust risk management practices. The company maintains a diversified investment portfolio, ensuring a steady flow of income and minimizing exposure to market fluctuations. Additionally, Afi Insurance's rigorous risk assessment processes and strict adherence to regulatory standards further reinforce its financial stability, providing customers with the assurance that their investments are secure.

Long-Term Partnerships and Investments

Afi Insurance understands the importance of building long-lasting relationships with its clients. The company’s commitment to its customers goes beyond providing insurance coverage. Afi Insurance actively engages with its clientele, offering valuable resources and support to help them navigate life’s challenges and achieve their financial goals.

Through educational initiatives and financial planning tools, Afi Insurance empowers its customers to make informed decisions. The company's investment in community outreach programs and charitable initiatives further solidifies its commitment to social responsibility. By fostering these partnerships, Afi Insurance not only protects its clients' financial well-being but also contributes to the overall welfare of the communities it serves.

Industry Recognition and Awards

The achievements and reputation of Afi Insurance have been recognized by various industry bodies and organizations. The company has consistently been awarded for its outstanding performance, innovative approaches, and commitment to customer satisfaction.

Some of the notable accolades received by Afi Insurance include:

- The Insurance Company of the Year award from [award-giving body], recognizing its exceptional service and industry leadership.

- The Best Customer Experience award, highlighting Afi Insurance's dedication to delivering an unparalleled customer experience.

- The Innovation in Insurance award, acknowledging the company's forward-thinking approaches and product development.

These awards serve as a testament to Afi Insurance's unwavering commitment to excellence and its position as a leading insurance provider.

The Future of Afi Insurance: Expanding Horizons

As the insurance landscape continues to evolve, Afi Insurance remains poised for growth and expansion. The company’s focus on innovation and customer-centricity positions it well to adapt to changing market dynamics and emerging trends.

Afi Insurance is actively exploring new markets and opportunities, leveraging its strong brand reputation and financial stability to expand its global reach. The company's commitment to continuous improvement and its dedication to meeting the evolving needs of its customers ensure that Afi Insurance will remain a trusted partner for generations to come.

Conclusion

In conclusion, Afi Insurance stands as a beacon of trust and innovation in the insurance industry. With its comprehensive suite of insurance products, unparalleled customer experience, and strong financial foundation, the company has established itself as a market leader. As Afi Insurance continues to navigate the evolving landscape, its commitment to excellence and customer satisfaction will undoubtedly drive its success and solidify its position as a trusted partner for individuals and businesses worldwide.

How can I contact Afi Insurance for inquiries or assistance?

+You can reach Afi Insurance through various channels. The company provides a dedicated customer service hotline, accessible 24⁄7. Additionally, you can connect with their team via email, live chat on their website, or through their mobile app. For specific inquiries, you may also refer to their comprehensive FAQ section on their website.

What sets Afi Insurance apart from its competitors?

+Afi Insurance’s commitment to innovation, customer-centricity, and financial stability sets it apart. The company’s focus on delivering an exceptional customer experience, combined with its strong financial foundation, ensures that clients receive personalized service and reliable protection. Afi Insurance’s dedication to staying at the forefront of industry trends also contributes to its unique position in the market.

How does Afi Insurance ensure prompt claim processing?

+Afi Insurance utilizes advanced automation tools and streamlined processes to expedite claim processing. The company’s dedicated claims team works diligently to assess and resolve claims as efficiently as possible. Additionally, their online platform and mobile app provide convenient access for customers to track the status of their claims, ensuring transparency and timely updates.