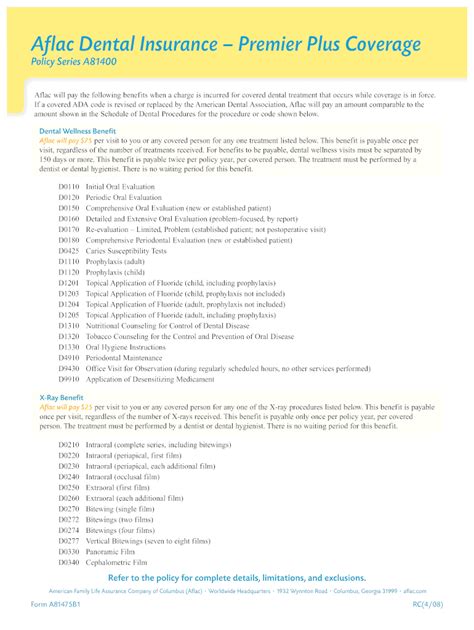

Aflac Dental Insurance Coverage

Aflac, a well-known name in the insurance industry, has expanded its range of services to include dental insurance plans. Aflac's dental insurance coverage offers individuals and families comprehensive and flexible options to cater to their unique oral health needs. This article provides an in-depth analysis of Aflac's dental insurance plans, exploring their features, benefits, and how they can help individuals maintain optimal oral health while keeping their finances in check.

Understanding Aflac’s Dental Insurance Plans

Aflac’s dental insurance plans are designed to provide coverage for a wide range of dental services, ensuring that policyholders can access the necessary treatments without breaking the bank. The plans are tailored to offer flexibility and cater to different dental needs, making them a popular choice for individuals seeking comprehensive oral health coverage.

Aflac's dental insurance plans can be categorized into several types, each offering a distinct set of benefits and coverage options. The main types include:

- Indemnity Plans: These plans provide coverage for a wide range of dental services, including preventive care, basic procedures, and major treatments. Policyholders can choose their own dentists and receive reimbursement for covered services. Aflac's indemnity plans offer flexibility and are suitable for those who prefer a more traditional approach to dental insurance.

- Preferred Provider Organization (PPO) Plans: PPO plans offer policyholders the freedom to choose their dentists but provide additional savings when they utilize in-network providers. These plans often have lower out-of-pocket costs and may include additional benefits such as discounts on certain procedures or services. Aflac's PPO plans strike a balance between choice and cost-effectiveness.

- Health Maintenance Organization (HMO) Plans: HMO plans typically require policyholders to select a primary care dentist within the plan's network. While the choice of dentists may be more limited, HMO plans often provide comprehensive coverage and can be more cost-efficient. Aflac's HMO plans are ideal for individuals seeking affordable, comprehensive dental care.

- Discount Dental Plans: Unlike traditional insurance plans, discount dental plans offer savings on dental services rather than direct coverage. Policyholders pay a monthly fee and receive discounted rates on a wide range of dental procedures. Aflac's discount plans are perfect for those on a budget or for individuals who primarily seek preventive care.

Each of these plan types has its unique advantages, and Aflac ensures that policyholders can choose the one that aligns best with their oral health needs and financial situation.

Key Features and Benefits of Aflac’s Dental Insurance

Aflac’s dental insurance plans are renowned for their comprehensive coverage and a range of benefits that go beyond traditional dental insurance. Here are some of the key features that make Aflac’s dental insurance plans stand out:

1. Comprehensive Coverage

Aflac’s dental insurance plans offer coverage for a wide array of dental services, ensuring that policyholders can access the care they need without financial strain. The plans typically cover:

- Preventive Care: Routine check-ups, cleanings, and X-rays are covered to help catch oral health issues early on.

- Basic Procedures: Services such as fillings, root canals, and extractions are covered, ensuring timely treatment for common dental problems.

- Major Treatments: More complex procedures like crowns, bridges, and dentures are often included in the plans, providing financial relief for expensive treatments.

- Orthodontic Care: Some plans offer coverage for orthodontic treatments, including braces and clear aligners, making it easier for individuals to achieve a perfect smile.

2. Affordable Premiums and Deductibles

Aflac understands that dental care can be costly, which is why their plans are designed to be affordable. Policyholders can choose from a range of plans with different premium and deductible options, allowing them to find a balance between coverage and cost. Aflac’s competitive pricing makes dental insurance accessible to a wider range of individuals.

3. Flexible Payment Options

Aflac offers flexible payment options to suit different financial situations. Policyholders can choose to pay their premiums monthly, quarterly, or annually, depending on their preferences and budget. This flexibility ensures that individuals can maintain their dental insurance coverage without straining their finances.

4. Network of Dentists

Aflac has an extensive network of dentists across the country, ensuring that policyholders have access to quality dental care regardless of their location. The network includes general dentists, specialists, and orthodontists, providing a comprehensive range of services. Policyholders can easily locate in-network providers through Aflac’s online directory or by contacting their customer service.

5. Fast Claims Processing

Aflac is known for its efficient claims processing, ensuring that policyholders receive reimbursements promptly. The company utilizes advanced technology to streamline the claims process, making it quick and hassle-free. Policyholders can track their claims online and receive updates on the status, providing transparency and peace of mind.

6. Additional Benefits and Perks

Aflac’s dental insurance plans often come with additional benefits and perks that add value to the coverage. These may include:

- Discounts on vision care services.

- Access to a 24/7 dental advice hotline for quick answers to oral health questions.

- Wellness programs and incentives to encourage regular dental check-ups and maintain good oral hygiene.

- Travel assistance for emergency dental care while away from home.

How to Enroll in Aflac’s Dental Insurance

Enrolling in Aflac’s dental insurance plans is a straightforward process. Individuals can follow these steps to secure their dental coverage:

- Visit Aflac's official website and navigate to the dental insurance section.

- Review the different plan options and choose the one that best suits your needs and budget.

- Fill out the online application form, providing all the required personal and dental information.

- Submit the application and await approval. Aflac typically processes applications within a few business days.

- Once approved, pay the initial premium to activate your coverage.

- Receive your policy documents and review them carefully. Familiarize yourself with the plan's benefits, coverage limits, and any exclusions.

- Start utilizing your dental insurance by visiting an in-network dentist or submitting claims for out-of-network services.

It's important to note that enrollment periods may vary depending on the state and the plan type. Some plans may be available for enrollment year-round, while others may have specific open enrollment periods. Aflac's customer service representatives can provide guidance on enrollment timelines and assist with any questions or concerns.

Aflac’s Dental Insurance: Real-World Success Stories

Aflac’s dental insurance plans have helped countless individuals and families access quality dental care and maintain optimal oral health. Here are a couple of real-world success stories that highlight the impact of Aflac’s dental insurance:

1. Sarah’s Story: A Smile Makeover

Sarah, a young professional, had always been self-conscious about her smile due to crooked teeth. She wanted to undergo orthodontic treatment but was concerned about the cost. After enrolling in Aflac’s dental insurance plan, Sarah discovered that her plan covered orthodontic care. She was able to access quality braces treatment at a significantly reduced cost, thanks to Aflac’s network of providers. Sarah’s smile transformation boosted her confidence, and she is now proud to flash her pearly whites.

2. John’s Story: Emergency Dental Care

John, a frequent traveler, encountered a dental emergency while on a business trip. He had severe tooth pain and needed immediate attention. Fortunately, John had enrolled in Aflac’s dental insurance plan, which included travel assistance for emergency dental care. He was able to locate an in-network dentist in the area and receive prompt treatment. Aflac’s insurance covered a significant portion of the emergency costs, ensuring that John could focus on his oral health without worrying about financial strain.

The Future of Dental Insurance with Aflac

Aflac’s commitment to innovation and customer satisfaction ensures that their dental insurance plans will continue to evolve and improve. As the company stays abreast of advancements in dental technology and patient needs, they are poised to enhance their plans further. Here’s a glimpse into the future of dental insurance with Aflac:

1. Digital Transformation

Aflac recognizes the importance of digital solutions in streamlining the insurance experience. They are investing in developing intuitive mobile apps and online platforms to make it easier for policyholders to manage their dental insurance. From submitting claims digitally to tracking coverage and benefits, Aflac aims to provide a seamless and convenient experience.

2. Enhanced Coverage for Emerging Treatments

The field of dentistry is constantly evolving, with new treatments and technologies emerging. Aflac understands the importance of staying ahead of the curve and is committed to expanding coverage for innovative treatments. This may include advancements in dental implants, laser dentistry, and even digital smile design. By staying at the forefront of dental care, Aflac ensures that policyholders have access to the latest and most effective treatments.

3. Focus on Preventive Care

Aflac understands that prevention is key to maintaining good oral health. They are dedicated to promoting preventive care and encouraging regular dental check-ups. In the future, Aflac plans to introduce incentives and rewards for policyholders who prioritize their oral hygiene. By emphasizing prevention, Aflac aims to reduce the need for costly treatments and promote overall well-being.

4. Collaboration with Dental Providers

Aflac is committed to fostering strong relationships with dental providers to enhance the overall patient experience. They are working towards developing collaborative initiatives with dentists and specialists to improve access to care and streamline the referral process. By working hand-in-hand with dental professionals, Aflac aims to create a seamless and efficient dental care ecosystem.

Can I choose my own dentist with Aflac’s dental insurance plans?

+Yes, Aflac offers both indemnity plans and PPO plans, which allow policyholders to choose their own dentists. With indemnity plans, you can visit any dentist and receive reimbursement for covered services. PPO plans provide additional savings when utilizing in-network providers, but you still have the freedom to choose your preferred dentist.

What is the enrollment period for Aflac’s dental insurance plans?

+The enrollment period for Aflac’s dental insurance plans may vary depending on the state and the plan type. Some plans may be available for enrollment year-round, while others may have specific open enrollment periods. It’s best to check with Aflac’s customer service or review their website for the most accurate information regarding enrollment timelines.

How can I locate an in-network dentist with Aflac’s dental insurance?

+Aflac provides an online directory of in-network dentists that you can access through their website. You can search for providers by location, specialty, or name. Additionally, their customer service team can assist you in finding an in-network dentist that meets your specific needs.

Are there any exclusions or limitations in Aflac’s dental insurance plans?

+Yes, like most dental insurance plans, Aflac’s plans may have certain exclusions and limitations. These can vary depending on the specific plan and coverage options chosen. It’s important to carefully review your policy documents to understand any exclusions, coverage limits, and waiting periods. Aflac’s customer service representatives can also provide clarification on any exclusions or limitations.

Can I add orthodontic coverage to my Aflac dental insurance plan?

+Yes, Aflac offers orthodontic coverage as an optional add-on to their dental insurance plans. If you have specific orthodontic needs or are considering braces or other orthodontic treatments, you can opt for this additional coverage. The orthodontic coverage typically has its own benefits and limitations, so be sure to review the details carefully.