American Farmers Insurance

American Farmers Insurance has been a trusted name in the insurance industry for decades, providing comprehensive coverage and financial protection to farmers and agricultural businesses across the United States. With a rich history rooted in understanding the unique needs of the agricultural community, American Farmers Insurance has evolved to become a leading provider of specialized insurance solutions. This article delves into the company's journey, its innovative offerings, and the impact it has had on the farming industry.

A Legacy of Agricultural Expertise

The story of American Farmers Insurance began in the early 20th century when a group of visionary farmers recognized the importance of insurance as a safeguard against the unpredictable nature of agriculture. They founded the company with a mission to offer tailored insurance products that would protect farmers’ livelihoods and ensure the continuity of their operations. Over the years, American Farmers Insurance has remained true to its agricultural heritage, continually refining its offerings to meet the evolving needs of farmers.

One of the key strengths of American Farmers Insurance lies in its deep understanding of the agricultural sector. The company's underwriters and risk management experts possess extensive knowledge of farming practices, equipment, and the various risks associated with different agricultural ventures. This expertise allows them to develop insurance policies that are not only comprehensive but also highly specialized, addressing the unique challenges faced by farmers in different regions and crop types.

Customized Coverage for Diverse Agricultural Operations

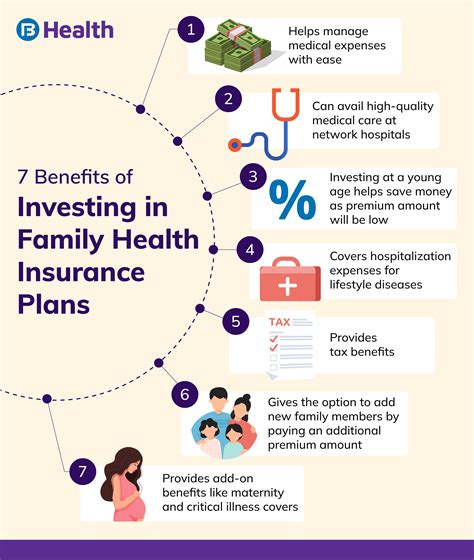

American Farmers Insurance recognizes that no two farms are alike, and thus, it offers a wide range of customizable insurance solutions. From crop insurance that protects against yield losses due to adverse weather conditions, pests, or diseases, to liability coverage for farm-related accidents, the company ensures that farmers can select the right policies to fit their specific needs.

For example, let's consider a large-scale dairy farm in Wisconsin. American Farmers Insurance can provide a tailored package that includes coverage for the farm's buildings, equipment, and livestock. Additionally, the policy can be designed to cover potential losses from milk production disruptions, such as disease outbreaks or equipment failures. This level of customization ensures that the farmer receives the financial protection necessary to sustain their operation during challenging times.

| Coverage Type | Description |

|---|---|

| Crop Insurance | Protects against yield losses due to various factors. |

| Liability Insurance | Covers accidents and legal liabilities on the farm. |

| Property Insurance | Protects farm buildings, equipment, and infrastructure. |

| Livestock Insurance | Provides coverage for animal health and mortality. |

Innovative Solutions for Modern Agricultural Challenges

In recent years, American Farmers Insurance has embraced technological advancements to enhance its services and better serve the modern farming community. The company has invested in digital tools and data analytics to improve risk assessment and claim processing, resulting in faster and more accurate responses to farmers’ needs.

One notable innovation is the development of a precision agriculture program. By partnering with agricultural technology companies, American Farmers Insurance utilizes satellite imagery, weather data, and soil analytics to assess crop health and potential risks. This program enables the company to offer more precise insurance coverage, taking into account the unique characteristics of each farm and its crops. As a result, farmers can benefit from more affordable and tailored insurance solutions.

Sustainable Practices and Environmental Initiatives

American Farmers Insurance is committed to supporting sustainable agricultural practices and environmental stewardship. The company actively promotes initiatives that reduce the environmental impact of farming operations and encourages farmers to adopt eco-friendly practices.

For instance, American Farmers Insurance offers incentives and discounts to farmers who implement sustainable farming methods, such as organic farming, precision irrigation, or renewable energy systems. By aligning its insurance policies with sustainability goals, the company not only supports farmers in their efforts to preserve the environment but also helps them reduce long-term operational costs.

Community Engagement and Education

Beyond providing insurance services, American Farmers Insurance is dedicated to giving back to the agricultural community. The company actively participates in various initiatives aimed at educating farmers about risk management, financial planning, and emerging agricultural trends.

Through partnerships with agricultural organizations and universities, American Farmers Insurance organizes workshops, webinars, and educational events. These initiatives provide farmers with valuable insights into topics such as crop insurance optimization, farm succession planning, and the latest advancements in agricultural technology. By empowering farmers with knowledge, the company contributes to the long-term success and resilience of the agricultural sector.

The Future of Agricultural Insurance

As the agricultural landscape continues to evolve, American Farmers Insurance remains committed to staying at the forefront of innovation. The company is continuously exploring new technologies, such as blockchain and artificial intelligence, to further enhance its insurance offerings and streamline processes.

Additionally, American Farmers Insurance is expanding its reach to serve a broader range of agricultural businesses, including those involved in aquaculture, apiculture, and even urban farming. By adapting to the changing needs of the industry, the company ensures that it remains a trusted partner for farmers, providing them with the financial security they need to thrive in an ever-changing market.

How does American Farmers Insurance determine insurance premiums for farms?

+American Farmers Insurance utilizes a comprehensive risk assessment process that takes into account various factors, including the type of crops grown, the farm’s location, historical weather patterns, and the farmer’s risk management practices. By analyzing these elements, the company can offer fair and competitive insurance premiums tailored to each farm’s specific needs.

What sets American Farmers Insurance apart from other agricultural insurance providers?

+American Farmers Insurance distinguishes itself through its deep-rooted expertise in the agricultural sector, its commitment to customization, and its innovative use of technology. The company’s underwriters have extensive knowledge of farming practices, allowing them to offer highly specialized insurance solutions. Additionally, the company’s investment in precision agriculture and digital tools sets it apart, providing farmers with more accurate and affordable coverage.

How can farmers benefit from American Farmers Insurance’s sustainable practices initiatives?

+By promoting sustainable farming practices, American Farmers Insurance helps farmers reduce their environmental impact and operational costs. The company offers incentives and discounts for farmers who adopt eco-friendly methods, making it more affordable for them to transition to sustainable practices. This not only benefits the environment but also contributes to the long-term financial health of farming operations.