Antique Car Insurance Companies

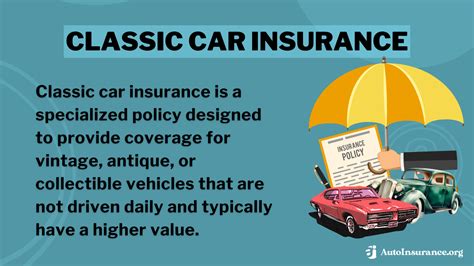

Welcome to a journey through the world of antique car insurance, a niche market that caters to the preservation and protection of vintage automotive treasures. This comprehensive guide will delve into the intricacies of insuring antique and classic cars, shedding light on the unique challenges and benefits associated with this specialized insurance sector.

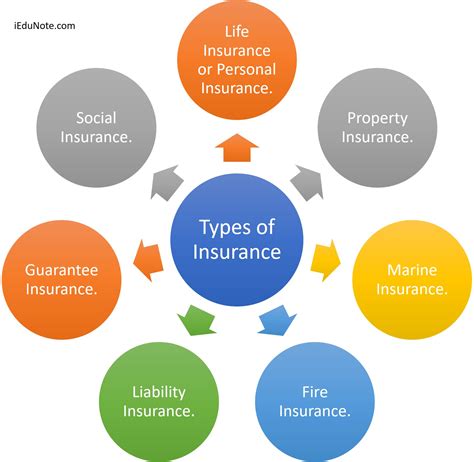

Understanding the World of Antique Car Insurance

Insuring antique cars is a complex endeavor, requiring a deep understanding of the unique needs and risks associated with these cherished vehicles. Unlike standard car insurance, antique car insurance goes beyond simple coverage; it’s about safeguarding a piece of automotive history.

The Niche Market

The antique car insurance market is a niche within the broader insurance industry, catering specifically to the needs of classic car enthusiasts and collectors. These policies are designed to provide coverage for vehicles that are typically 25 years or older and hold significant historical or sentimental value.

One of the key differences between antique car insurance and standard policies is the agreed value coverage. Unlike standard insurance, which typically offers coverage based on the vehicle's current market value, antique car insurance operates on an agreed value basis. This means that the insurance company and the policyholder agree on the value of the vehicle, taking into account factors like its rarity, condition, and historical significance.

Coverage Options and Customization

Antique car insurance offers a range of coverage options to cater to the diverse needs of collectors. Comprehensive coverage is a staple, providing protection against a wide array of risks, including theft, fire, and natural disasters. Additionally, liability coverage is crucial, as it safeguards the policyholder against legal and financial liabilities arising from accidents involving their antique vehicle.

One unique aspect of antique car insurance is the flexibility in coverage customization. Policyholders can often tailor their coverage to match their specific needs and usage patterns. For instance, if an antique car is primarily used for display at car shows and not for regular driving, the policy can be adjusted to reflect this reduced mileage, potentially resulting in lower premiums.

| Coverage Type | Description |

|---|---|

| Comprehensive | Covers a wide range of risks, including theft, fire, and natural disasters. |

| Liability | Protects against legal and financial liabilities arising from accidents. |

| Agreed Value | Policyholders and insurers agree on the value of the antique car, ensuring fair compensation in case of a claim. |

Valuation and Appraisal

The process of valuing an antique car for insurance purposes is a delicate and specialized task. It often involves the expertise of classic car appraisers who assess the vehicle’s condition, rarity, and historical significance. These appraisers play a crucial role in determining the agreed value, ensuring that the policy provides adequate coverage for the vehicle’s unique worth.

The Benefits of Antique Car Insurance

Insuring an antique car comes with a host of benefits that extend beyond the basic protection of the vehicle. These policies are designed to cater to the specific needs and concerns of classic car enthusiasts, offering a level of coverage and peace of mind that standard insurance policies often cannot provide.

Preserving Automotive Heritage

At its core, antique car insurance is about preserving a piece of automotive history. These policies recognize the sentimental and historical value of classic cars, ensuring that they are protected against the risks of modern life. By providing specialized coverage, insurance companies contribute to the preservation of vintage vehicles, allowing them to be enjoyed and appreciated by future generations.

Comprehensive Protection

Antique car insurance offers a level of protection that is tailored to the unique needs of classic vehicles. The agreed value coverage ensures that the policyholder receives fair compensation in the event of a claim, taking into account the vehicle’s rarity and historical significance. This level of protection provides peace of mind, knowing that the car is adequately insured, regardless of its age or condition.

Flexibility and Customization

One of the key advantages of antique car insurance is the flexibility it offers. Policyholders can customize their coverage to match their specific needs and usage patterns. Whether the car is a daily driver or only taken out for special occasions, the policy can be adjusted accordingly. This flexibility ensures that the insurance coverage aligns with the owner’s lifestyle and the vehicle’s intended use.

Specialized Services

Many antique car insurance providers offer additional services that go beyond basic coverage. These can include access to a network of specialized repair shops, which can be crucial for ensuring that the vehicle is restored to its original condition using authentic parts. Some insurers also provide assistance with car shows and events, offering coverage for transportation and display, as well as providing support for organizing and participating in classic car events.

| Benefit | Description |

|---|---|

| Preserving Heritage | Antique car insurance contributes to the preservation of automotive history, ensuring that classic cars are protected for future generations. |

| Comprehensive Coverage | Agreed value policies provide fair compensation, taking into account the vehicle's rarity and historical significance. |

| Flexibility | Policyholders can customize coverage to match their specific needs and usage patterns, ensuring a perfect fit. |

| Specialized Services | Many insurers offer additional services, such as access to specialized repair shops and support for car shows and events. |

Choosing the Right Antique Car Insurance

Selecting the right antique car insurance policy is a crucial decision for classic car enthusiasts. With a wide range of options and considerations, it’s essential to approach this process with a strategic mindset. Here’s a comprehensive guide to help you navigate the world of antique car insurance and make an informed choice.

Understanding Your Needs

The first step in choosing antique car insurance is to clearly understand your needs and expectations. Consider factors such as the age and condition of your vehicle, its intended use (daily driver, weekend cruiser, or show car), and any specific requirements you may have. Are you looking for comprehensive coverage, or do you primarily need liability protection? Understanding your unique situation will help guide your insurance choices.

Researching Insurance Providers

Once you have a clear understanding of your needs, it’s time to research insurance providers. Look for companies that specialize in antique car insurance, as they are more likely to offer the tailored coverage and services you require. Consider the reputation and track record of these providers, reading reviews and seeking recommendations from other classic car enthusiasts.

When researching providers, pay attention to the specific coverage options they offer. Look for policies that provide agreed value coverage, as this is essential for accurately insuring your antique car. Additionally, consider the flexibility of the policy, ensuring it can be customized to match your unique circumstances.

Assessing Coverage Options

When reviewing antique car insurance policies, carefully assess the coverage options they provide. Ensure that the policy covers the full range of risks you are concerned about, including comprehensive coverage for theft, fire, and natural disasters, as well as adequate liability protection. Look for policies that offer additional benefits, such as access to specialized repair shops or support for car shows and events.

Consider the limits and deductibles associated with the policy. Ensure that the limits are sufficient to cover the agreed value of your vehicle, and that the deductibles are manageable in the event of a claim. It's also worth inquiring about any discounts or incentives the provider offers, such as multi-policy discounts or safe driver rewards.

Comparing Premiums and Costs

While cost should not be the sole determining factor, it is an important consideration when choosing antique car insurance. Compare premiums across different providers, ensuring that you’re getting a competitive rate for the coverage you need. Keep in mind that the lowest premium may not always be the best option, as it could indicate a lack of comprehensive coverage or higher deductibles.

Consider the overall value of the policy, taking into account the coverage, flexibility, and additional services provided. A slightly higher premium may be justified if it comes with more comprehensive coverage and specialized benefits.

Consulting Experts and Seeking Advice

When making a decision as important as choosing antique car insurance, it can be beneficial to consult experts in the field. Reach out to classic car clubs or associations, as they often have partnerships with insurance providers and can provide valuable insights and recommendations. Additionally, consider seeking advice from fellow classic car enthusiasts who have experience with antique car insurance.

Antique Car Insurance: A Niche Market with a Classic Touch

Antique car insurance is a unique and specialized sector within the insurance industry, catering to the needs of classic car enthusiasts and collectors. With its focus on agreed value coverage, comprehensive protection, and flexibility, it offers a tailored approach to safeguarding these automotive treasures. As we’ve explored, choosing the right antique car insurance involves understanding your needs, researching providers, assessing coverage options, and consulting experts.

By taking a strategic approach to choosing antique car insurance, classic car enthusiasts can ensure that their beloved vehicles are protected, allowing them to continue enjoying their passion for automotive history with peace of mind. Whether it's a vintage roadster or a classic muscle car, the right insurance policy can make all the difference in preserving these cherished machines for years to come.

How do I determine the agreed value of my antique car for insurance purposes?

+Determining the agreed value of your antique car involves a professional appraisal. This typically entails engaging a classic car appraiser who will assess the vehicle’s condition, rarity, and historical significance. The appraiser will then provide a valuation report, which forms the basis for the agreed value between you and the insurance company. It’s important to choose a reputable appraiser to ensure an accurate and fair assessment.

Can I customize my antique car insurance policy to reflect my specific usage patterns?

+Absolutely! One of the key advantages of antique car insurance is the flexibility it offers in customizing coverage. Many providers allow policyholders to adjust their coverage based on factors such as mileage, intended use, and storage conditions. This means you can tailor the policy to match your specific needs, whether you primarily use your antique car for shows or as a daily driver.

What additional services might an antique car insurance provider offer?

+Antique car insurance providers often go beyond basic coverage to offer a range of specialized services. These can include access to a network of classic car repair shops, which can be crucial for ensuring that your vehicle is restored using authentic parts. Some providers also offer support for car shows and events, providing coverage for transportation and display, as well as assistance with event organization.

Are there any discounts or incentives available for antique car insurance policies?

+Yes, many antique car insurance providers offer discounts and incentives to policyholders. These can include multi-policy discounts if you have other insurance policies with the same provider, as well as safe driver discounts for those with a clean driving record. Some providers may also offer incentives for taking additional safety measures, such as installing security devices on your antique car.