Auto Insurance For Cars

Welcome to this comprehensive guide on auto insurance, a topic that is vital for every car owner. In today's world, having adequate car insurance is not just a legal requirement but also a wise financial decision. With the right coverage, you can protect yourself and your vehicle from unforeseen circumstances and expensive repairs. This article will delve into the intricacies of auto insurance, offering expert insights and practical advice to help you navigate this essential aspect of vehicle ownership.

Understanding Auto Insurance: A Comprehensive Overview

Auto insurance, or car insurance as it is commonly known, is a contract between an individual and an insurance provider. This contract provides financial protection against physical damage or bodily injury resulting from traffic accidents and also covers against liability that could arise from an accident. It is a critical aspect of responsible car ownership, ensuring that drivers are prepared for the unexpected.

The auto insurance market is vast and diverse, offering a range of coverage options to suit different needs and budgets. From liability-only policies to comprehensive coverage, understanding the nuances of these options is key to making an informed decision. Here's a breakdown of the key components of auto insurance:

Liability Coverage

Liability coverage is the most basic form of auto insurance. It protects you from financial loss if you are found at fault in an accident, covering the costs of damages to the other driver’s vehicle and their medical expenses. This coverage is mandatory in most states and is a fundamental aspect of responsible driving.

| Liability Coverage Types | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for the other party involved in an accident. |

| Property Damage Liability | Pays for the repair or replacement of the other party's vehicle or property damaged in an accident. |

Collision and Comprehensive Coverage

Collision coverage and comprehensive coverage are optional but highly recommended additions to your auto insurance policy. Collision coverage pays for the repair or replacement of your vehicle after an accident, regardless of fault. On the other hand, comprehensive coverage provides protection against damage caused by non-collision events such as theft, vandalism, natural disasters, or collisions with animals.

| Coverage Type | Description |

|---|---|

| Collision Coverage | Covers repairs or replacement of your vehicle after an accident, regardless of fault. |

| Comprehensive Coverage | Protects against damage from non-collision events like theft, natural disasters, or collisions with animals. |

Additional Coverages

Beyond the basic liability, collision, and comprehensive coverages, there are several additional options to consider. These include personal injury protection (PIP) or medical payments coverage, which provide coverage for your medical expenses and lost wages after an accident, regardless of fault. Uninsured/underinsured motorist coverage protects you if you’re in an accident with a driver who doesn’t have sufficient insurance.

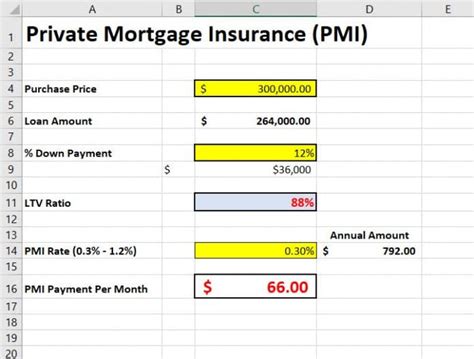

Understanding Deductibles and Premiums

When choosing an auto insurance policy, it’s essential to consider deductibles and premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. The higher the deductible, the lower the premium, and vice versa. A premium, on the other hand, is the amount you pay for your insurance policy. It can vary based on several factors, including the type of coverage, your driving history, and the make and model of your vehicle.

Factors Affecting Auto Insurance Premiums

The cost of auto insurance can vary significantly from one individual to another, and it’s influenced by a multitude of factors. Insurance providers use these factors to assess the risk associated with insuring a particular driver and vehicle. Here are some of the key factors that impact auto insurance premiums:

Vehicle Type and Usage

The type of vehicle you drive and how you use it can significantly affect your insurance premium. High-performance cars, luxury vehicles, and SUVs often come with higher insurance costs due to their increased repair and replacement costs. Additionally, vehicles that are primarily used for business or commercial purposes may also attract higher premiums.

Driver’s Profile and History

Your personal driving record and history are crucial in determining your insurance premium. A clean driving record with no accidents or traffic violations is typically rewarded with lower premiums. Conversely, a history of accidents or traffic citations can lead to higher insurance costs. Insurance providers also consider factors like age, gender, and marital status, as these can influence driving behavior and risk.

Location and Mileage

Where you live and how much you drive can impact your insurance premium. Urban areas often have higher insurance rates due to increased traffic congestion and the higher likelihood of accidents. Additionally, drivers who commute long distances or use their vehicles for business purposes may pay more for insurance, as they are on the road more frequently.

Credit Score

Believe it or not, your credit score can also play a role in determining your auto insurance premium. Many insurance providers use credit-based insurance scores to assess the risk associated with insuring a particular individual. Individuals with higher credit scores are often seen as lower risk and may benefit from lower insurance premiums.

Tips for Choosing the Right Auto Insurance

Selecting the right auto insurance policy can be a daunting task, given the multitude of options and factors to consider. Here are some expert tips to help you make an informed decision:

Assess Your Needs

Before you start shopping for auto insurance, take the time to assess your specific needs. Consider the value of your vehicle, your driving habits, and the level of financial protection you require. This will help you determine the type and amount of coverage you need.

Compare Multiple Quotes

Don’t settle for the first insurance quote you receive. It’s essential to shop around and compare quotes from multiple providers. This can help you identify the best coverage at the most competitive price. Online comparison tools can be a great starting point, but be sure to also get quotes directly from insurance companies.

Understand Policy Exclusions

When reviewing auto insurance policies, pay close attention to the exclusions. These are the situations or circumstances not covered by the policy. Understanding the exclusions can help you determine if a particular policy meets your needs and ensures you’re not caught off guard in the event of an accident or other incident.

Consider Bundling and Discounts

Many insurance providers offer discounts for bundling multiple policies, such as auto and home insurance. Additionally, you may be eligible for discounts based on your profession, educational background, or membership in certain organizations. Don’t hesitate to ask your insurance provider about potential discounts to reduce your premium.

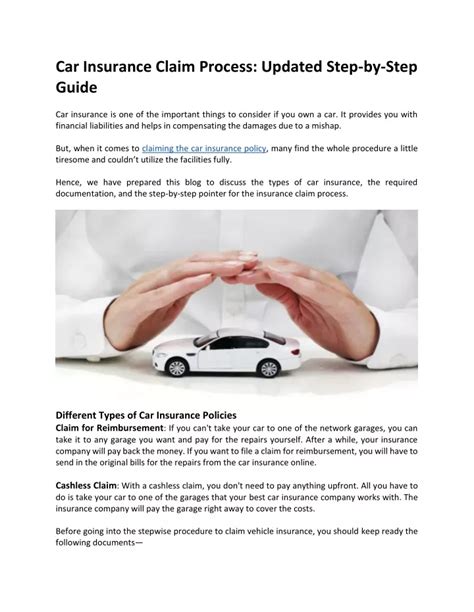

Filing an Auto Insurance Claim

In the unfortunate event of an accident or other incident, knowing how to file an auto insurance claim is crucial. Here’s a step-by-step guide to help you through the process:

- Contact your insurance provider as soon as possible after the incident. Most providers have a 24-hour claims hotline, making it easy to report the claim promptly.

- Provide accurate and detailed information about the incident, including the date, time, location, and any relevant details about what happened.

- Take photographs of the damage to your vehicle and the accident scene. These can be valuable evidence when processing your claim.

- If there were any injuries, seek medical attention immediately and provide your insurance company with the relevant medical reports.

- Cooperate with your insurance provider's investigation. This may involve providing additional documentation or answering questions about the incident.

- Once your claim is approved, your insurance provider will either arrange for repairs to be made or provide you with the funds to cover the necessary repairs or replacement costs.

Future Trends in Auto Insurance

The auto insurance industry is evolving, driven by technological advancements and changing consumer needs. Here are some of the key trends that are shaping the future of auto insurance:

Telematics and Usage-Based Insurance

Telematics technology allows insurance providers to track and analyze driving behavior in real-time. This data is then used to determine insurance premiums, rewarding safe drivers with lower rates. Usage-based insurance (UBI) takes this a step further, offering policies that are tailored to an individual’s actual driving habits and mileage.

Artificial Intelligence and Machine Learning

AI and machine learning are being increasingly used in the auto insurance industry to improve risk assessment and claim processing. These technologies can analyze vast amounts of data, including driving behavior, weather conditions, and accident history, to make more accurate predictions and improve the overall efficiency of insurance operations.

Connected Car Technology

The rise of connected car technology, which allows vehicles to communicate with each other and their surroundings, is set to revolutionize auto insurance. This technology can provide real-time data on vehicle performance, maintenance needs, and driving behavior, offering insurance providers a more accurate picture of risk and enabling more personalized insurance offerings.

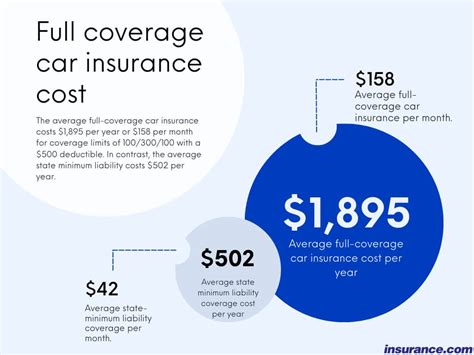

What is the average cost of auto insurance in the United States?

+The average cost of auto insurance in the U.S. varies widely depending on factors like location, driving history, and vehicle type. According to recent data, the national average for auto insurance premiums is around 1,674 per year, or about 139 per month. However, this average can range from under 1,000 to over 2,000 depending on the state and individual circumstances.

How can I lower my auto insurance premium?

+There are several strategies you can employ to lower your auto insurance premium. These include maintaining a clean driving record, shopping around for the best rates, increasing your deductible, taking advantage of discounts (such as safe driver or multi-policy discounts), and considering usage-based insurance programs. Additionally, regularly reviewing your coverage and adjusting it to reflect your current needs can help keep costs down.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Call the police to report the accident and seek medical attention if necessary. Then, contact your insurance provider to report the incident. Be prepared to provide details about the accident, including the date, time, location, and any relevant information about the other driver and their vehicle. Take photographs of the accident scene and any damage to your vehicle, and gather contact information from any witnesses.

What happens if I’m at fault in an accident?

+If you’re found at fault in an accident, your insurance provider will cover the costs of damages and injuries sustained by the other party, up to the limits of your liability coverage. However, you may also face increased insurance premiums, as at-fault accidents are typically considered a higher risk by insurance providers. It’s important to review your policy to understand your coverage limits and any potential increases in premiums.