Best Insurance Rate

When it comes to finding the best insurance rate, it's important to understand that the process can be complex and highly individualized. Insurance rates are influenced by a multitude of factors, and what constitutes the "best" rate can vary significantly depending on your specific circumstances and the type of insurance you require. This article aims to provide an in-depth exploration of the key considerations and strategies to help you navigate the insurance landscape and secure the most advantageous rates for your needs.

Understanding the Factors that Impact Insurance Rates

Insurance rates are determined by a combination of personal, environmental, and policy-specific factors. These variables are used by insurance companies to assess the level of risk associated with providing coverage to an individual or entity. By understanding these factors, you can better position yourself to negotiate favorable rates and make informed decisions.

Personal Factors

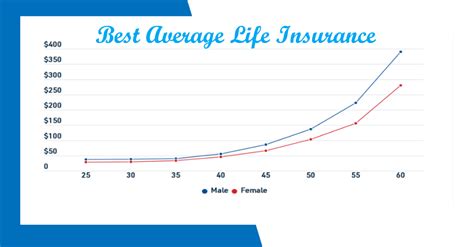

Personal factors play a significant role in insurance rate determination. Your age, gender, marital status, and credit score can all influence the rates you are offered. For instance, younger individuals may be charged higher rates for auto insurance due to their perceived higher risk of accidents. Similarly, individuals with excellent credit scores are often viewed as lower-risk candidates and may receive more competitive rates.

Your driving record is another crucial personal factor. A clean driving record with no recent accidents or traffic violations can lead to substantial savings on auto insurance. Conversely, a history of accidents or moving violations may result in higher premiums. It's essential to review your driving record regularly and take steps to improve it if necessary.

Environmental Factors

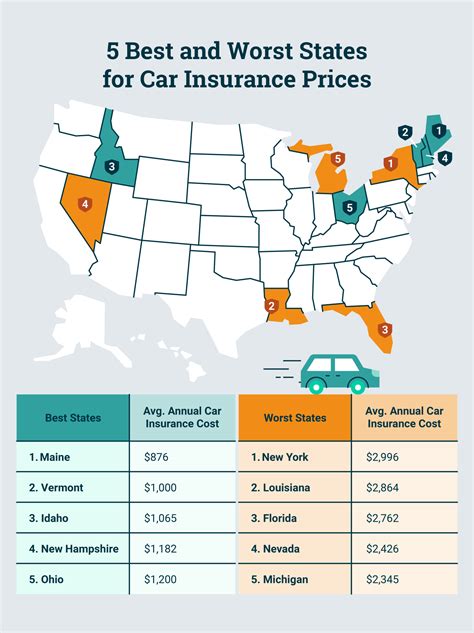

The geographic location where you live or operate your business can significantly impact insurance rates. Areas with higher crime rates or a history of natural disasters may experience higher insurance premiums. For example, homeowners in regions prone to hurricanes or wildfires may face steeper insurance costs due to the increased risk of property damage.

Environmental factors also extend to the specific location of your property. For instance, if your home is located in a flood-prone area, you may be required to purchase flood insurance at a higher rate. Similarly, businesses operating in high-crime areas may face increased commercial insurance costs.

Policy-Specific Factors

The type of insurance policy and its specific coverage options can greatly affect the rates you are offered. Insurance companies offer a wide range of policy options, and the level of coverage you choose will directly impact your premium. For example, opting for a higher deductible on your health insurance policy can lower your monthly premiums, but it also means you’ll pay more out of pocket if you need medical care.

Additionally, the length of your policy term can influence rates. Longer policy terms, such as a 10-year term life insurance policy, may offer lower average annual rates compared to shorter-term policies. However, it's important to carefully consider your long-term needs and financial situation before committing to a lengthy policy term.

Strategies for Securing the Best Insurance Rates

Now that we’ve explored the key factors that influence insurance rates, let’s delve into some effective strategies to help you secure the most competitive rates available.

Shop Around and Compare Rates

One of the most effective ways to find the best insurance rates is to shop around and compare quotes from multiple insurance providers. Different companies may offer significantly different rates for the same level of coverage, so it’s essential to obtain quotes from a variety of sources.

Online insurance marketplaces can be a convenient way to quickly compare rates from multiple providers. These platforms allow you to input your personal and policy details, and then generate a list of quotes from various insurers. However, it's important to ensure that you're comparing apples to apples; make sure the quotes you're comparing offer the same level of coverage and policy terms.

Utilize Insurance Brokers and Agents

Insurance brokers and agents can be valuable resources when seeking the best insurance rates. These professionals have extensive knowledge of the insurance industry and can provide personalized advice based on your specific needs. They can also shop around on your behalf, leveraging their relationships with multiple insurance companies to negotiate the most favorable rates.

Brokers and agents can offer insights into the coverage options that best suit your circumstances and budget. They can also help you understand the fine print of insurance policies, ensuring you're not paying for coverage you don't need.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies with them. For instance, you may be able to save money by combining your auto and home insurance policies with the same provider. This strategy can be particularly beneficial if you have multiple insurance needs, such as auto, home, and life insurance.

Bundling your policies not only simplifies your insurance management but can also result in significant cost savings. However, it's important to ensure that the bundled policies still meet your specific coverage needs and provide the best value overall.

Consider High Deductibles and Co-Pays

Opting for higher deductibles and co-pays on certain types of insurance policies can lower your monthly premiums. This strategy is particularly effective for health insurance and auto insurance. By agreeing to pay more out of pocket if you need to make a claim, you can reduce your overall insurance costs.

However, it's crucial to carefully consider your financial situation and ability to pay higher deductibles or co-pays. While this strategy can lead to substantial savings, it may not be feasible for everyone. It's essential to strike a balance between affordability and risk management.

Maintain a Good Credit Score

Your credit score is a critical factor in determining insurance rates, especially for auto and homeowners insurance. Insurance companies use credit scores as a proxy for assessing risk. Individuals with higher credit scores are often viewed as lower-risk candidates and may be offered more competitive insurance rates.

Improving your credit score can be a long-term strategy for securing better insurance rates. This may involve paying down debt, making timely payments, and reducing your credit utilization. Maintaining a good credit score not only benefits your insurance rates but can also improve your financial health overall.

The Role of Technology in Finding the Best Insurance Rates

Advancements in technology have revolutionized the insurance industry, making it easier than ever to compare rates and find the best deals. Online insurance marketplaces and comparison websites have emerged as powerful tools for consumers, offering a convenient and efficient way to shop for insurance.

These platforms utilize sophisticated algorithms to analyze your personal and policy details, generating a list of tailored insurance options from multiple providers. This level of convenience and customization has empowered consumers to take control of their insurance choices and negotiate more favorable rates.

Leveraging Data Analytics for Personalized Rates

Insurance companies are increasingly using data analytics to personalize insurance rates based on individual risk profiles. By analyzing vast amounts of data, insurers can more accurately assess the level of risk associated with providing coverage to specific individuals or entities.

This shift towards personalized insurance rates can lead to more equitable pricing, as individuals with lower risk profiles may be offered more competitive rates. However, it's important to ensure that the data used to assess risk is accurate and that your personal information is being handled securely and ethically.

The Rise of Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-go or pay-per-mile insurance, is a growing trend in the insurance industry. This type of insurance policy bases your premium on your actual driving behavior, rather than traditional factors like age and gender. By installing a tracking device in your vehicle, insurance companies can monitor your driving habits and adjust your rates accordingly.

Usage-based insurance can be particularly beneficial for individuals who drive infrequently or have a low-risk driving profile. It offers a more accurate reflection of your actual risk level and can lead to substantial savings on auto insurance premiums. However, it's important to carefully review the terms and conditions of usage-based insurance policies before enrolling.

The Future of Insurance Rates: Emerging Trends and Innovations

The insurance industry is continually evolving, driven by technological advancements and changing consumer expectations. As we look to the future, several emerging trends and innovations are poised to shape the insurance landscape and impact the way insurance rates are determined.

The Rise of Telematics and IoT in Insurance

Telematics and the Internet of Things (IoT) are revolutionizing the insurance industry by providing real-time data on risk factors. Telematics devices, such as those used in usage-based auto insurance, can monitor driving behavior, vehicle performance, and even environmental conditions. This data can be used to more accurately assess risk and offer personalized insurance rates.

The IoT is also transforming the way insurance companies monitor and assess risks in other areas, such as home and commercial insurance. For example, smart home devices can provide real-time data on potential hazards, allowing insurance companies to offer more precise coverage and pricing.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are being increasingly adopted by insurance companies to streamline processes and enhance risk assessment. These technologies can analyze vast amounts of data, identify patterns, and make predictions with remarkable accuracy. This enables insurance providers to offer more precise and personalized insurance rates.

AI and ML are also being used to automate various aspects of the insurance process, from claims processing to policy underwriting. This increased efficiency can lead to cost savings, which may be passed on to consumers in the form of more competitive insurance rates.

Blockchain Technology for Secure and Transparent Transactions

Blockchain technology is poised to transform the insurance industry by enhancing security, transparency, and efficiency in transactions. Blockchain’s decentralized and tamper-proof nature can help prevent fraud and ensure the integrity of insurance contracts and claims processes.

Additionally, blockchain can facilitate the secure sharing of data between insurance companies and other entities, such as healthcare providers and auto repair shops. This seamless exchange of information can lead to more accurate risk assessment and potentially lower insurance rates for consumers.

Conclusion: Navigating the Insurance Landscape for the Best Rates

Finding the best insurance rate is a complex process that requires a comprehensive understanding of the factors that influence rates and a proactive approach to shopping for insurance. By shopping around, utilizing brokers and agents, and considering strategies like bundling policies and higher deductibles, you can position yourself to secure the most competitive rates available.

The insurance industry is continually evolving, and technology is playing a pivotal role in shaping the future of insurance rates. From data analytics to telematics and IoT, these innovations are enabling more personalized and accurate risk assessment, leading to more equitable pricing for consumers. By staying informed about these emerging trends and innovations, you can make more informed decisions and potentially unlock even greater savings on your insurance policies.

How often should I review my insurance policies and rates?

+It’s a good practice to review your insurance policies and rates annually, or whenever your personal circumstances or needs change significantly. This ensures that your coverage remains adequate and that you’re not overpaying for insurance.

Can I negotiate my insurance rates with providers?

+Yes, you can negotiate your insurance rates with providers, especially if you have a good driving or claims history, or if you’re bundling multiple policies. Insurance brokers and agents can be particularly helpful in negotiating the best rates on your behalf.

What are some common discounts available for insurance policies?

+Common discounts for insurance policies include safe driver discounts, multi-policy discounts, loyalty discounts, and good student discounts. Some providers also offer discounts for certain professions or memberships.