Driver Insurance California

Driver insurance is an essential aspect of vehicle ownership in California, a state known for its diverse landscapes, bustling cities, and extensive road networks. With millions of vehicles on the road, understanding the ins and outs of driver insurance is crucial for all residents. This comprehensive guide will delve into the specifics of driver insurance in California, covering the unique requirements, coverage options, and strategies to secure the best policies for your needs.

Understanding California's Insurance Landscape

California has its own set of regulations and requirements when it comes to vehicle insurance. The state mandates that all drivers carry at least the minimum level of liability insurance, which covers bodily injury and property damage in the event of an accident. This is to ensure that victims of accidents are financially protected, regardless of the at-fault driver's ability to pay.

The California Department of Insurance oversees the insurance industry, ensuring that companies adhere to state laws and that consumers are protected. They also provide resources and information to help drivers navigate the complex world of insurance.

Minimum Liability Requirements

As mentioned, California requires drivers to carry a minimum amount of liability insurance. The specific limits are as follows:

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability (per person) | $15,000 |

| Bodily Injury Liability (per accident) | $30,000 |

| Property Damage Liability | $5,000 |

While these are the legal minimums, many experts recommend carrying higher limits to ensure adequate protection in the event of a serious accident. The cost of medical treatment and vehicle repairs can quickly exceed these amounts, leaving the driver financially vulnerable.

Unique Coverage Requirements

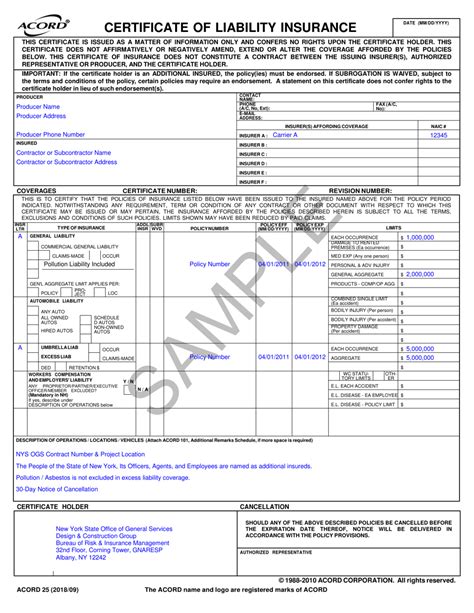

In addition to liability insurance, California has a unique requirement known as the Financial Responsibility Law. This law states that drivers must prove their ability to pay for damages caused in an accident, either through insurance coverage or other means. This is to ensure that victims can receive compensation even if the at-fault driver has no insurance.

To comply with this law, drivers have the option to purchase a certificate of self-insurance, which requires a significant financial investment and is typically only viable for businesses or individuals with substantial assets. Most drivers will opt for the more common method of purchasing insurance from an authorized insurer.

Types of Insurance Coverage

When it comes to driver insurance, there are several types of coverage to consider. Each type serves a specific purpose and can be tailored to your individual needs.

Liability Coverage

Liability coverage is the most basic and required form of insurance in California. As mentioned earlier, it provides protection for bodily injury and property damage claims made against you as the at-fault driver. This coverage pays for the other party's medical bills, vehicle repairs, and other associated costs.

It's important to note that liability coverage does not cover your own vehicle or injuries. For that, you'll need to consider additional coverage options.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional but highly recommended. Collision coverage pays for repairs to your vehicle after an accident, regardless of who is at fault. This is particularly useful in California, where the risk of accidents on busy roads and highways is higher.

Comprehensive coverage, on the other hand, protects against non-collision incidents such as theft, vandalism, natural disasters, and animal collisions. Given California's diverse climate and potential for natural disasters, comprehensive coverage is an important consideration.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a type of coverage that provides benefits for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault. It's an important safety net to have, especially in cases where you or your passengers are injured in an accident.

Uninsured/Underinsured Motorist Coverage

Given that California has a high percentage of uninsured drivers, uninsured/underinsured motorist coverage is a crucial consideration. This coverage steps in to protect you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

It's worth noting that uninsured/underinsured motorist coverage is not a substitute for your own liability insurance. It's an additional layer of protection to ensure you're not left with financial burdens after an accident with an uninsured driver.

Factors Affecting Insurance Premiums

Insurance premiums, or the cost of your insurance policy, can vary significantly based on a multitude of factors. Understanding these factors can help you make informed decisions when choosing an insurance provider and policy.

Driver Profile

Your personal driver profile plays a significant role in determining your insurance premiums. Factors such as your age, gender, driving history, and even your occupation can influence the cost of your insurance. Younger drivers, for example, are often considered higher-risk and may face higher premiums.

Additionally, your driving record is a key consideration. If you have a history of accidents or traffic violations, your insurance premiums are likely to be higher. Maintaining a clean driving record is one of the most effective ways to keep your insurance costs down.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can also impact your insurance premiums. Sports cars and luxury vehicles, for instance, often come with higher insurance costs due to their higher repair costs and increased risk of theft. Similarly, if you use your vehicle for business purposes, your insurance needs and costs may differ from those who use their vehicle solely for personal use.

Coverage and Deductibles

The level of coverage you choose and the associated deductibles also affect your insurance premiums. Higher levels of coverage and lower deductibles generally result in higher premiums. However, it's important to find the right balance between cost and adequate protection.

For example, if you choose a high deductible, you'll pay less for your insurance, but you'll be responsible for a larger portion of the costs if you need to make a claim. On the other hand, a lower deductible means you'll pay more for insurance but will have less out-of-pocket expenses if an accident occurs.

Shopping for Insurance in California

With so many insurance providers in California, it can be overwhelming to choose the right one for your needs. Here are some tips to help you navigate the process and find the best driver insurance for your situation.

Compare Multiple Quotes

One of the best ways to ensure you're getting a competitive rate is to compare quotes from multiple insurance providers. Each insurer has its own rating system and may offer different rates for similar coverage. By comparing quotes, you can identify the most cost-effective option for your needs.

Online quote comparison tools can be particularly useful, as they allow you to quickly and easily view a range of options. However, it's important to note that these tools provide estimates and may not account for all factors that could affect your premium.

Consider Discounts and Bundles

Many insurance providers offer discounts and bundles to make their policies more attractive and affordable. Common discounts include safe driver discounts, multi-policy discounts (for bundling car insurance with other types of insurance, such as home or renters insurance), and loyalty discounts for long-term customers.

Additionally, some insurers offer discounts for specific groups, such as students, seniors, or members of certain organizations. It's worth exploring these options to see if you qualify for any additional savings.

Read Reviews and Check Ratings

Before committing to an insurance provider, it's a good idea to research their reputation and customer satisfaction. Online reviews and ratings can provide valuable insights into the quality of service and claims handling. Look for insurers with a strong track record of customer satisfaction and prompt claims processing.

It's also beneficial to check the financial strength ratings of insurance companies. These ratings, provided by independent rating agencies like A.M. Best and Standard & Poor's, assess an insurer's financial stability and ability to pay claims. Choosing a company with a strong financial rating can provide peace of mind that they'll be able to meet their obligations in the event of a claim.

Tips for Saving on Driver Insurance

While driver insurance is a necessary expense, there are strategies you can employ to reduce your costs without compromising on coverage.

Maintain a Clean Driving Record

As mentioned earlier, your driving record is a significant factor in determining your insurance premiums. Maintaining a clean record by avoiding accidents and traffic violations can help keep your insurance costs down. Even a single ticket or accident can result in a substantial increase in your insurance premiums.

Increase Your Deductible

Increasing your deductible is a simple way to lower your insurance premiums. By agreeing to pay a higher portion of the costs in the event of a claim, you reduce the risk for the insurance company, which often results in lower premiums. However, it's important to choose a deductible amount that you can comfortably afford in the event of an accident.

Explore Telematics Insurance

Telematics insurance, also known as usage-based insurance, is an innovative option that uses technology to monitor your driving habits and provide personalized insurance rates. By installing a small device in your vehicle or using a smartphone app, your insurer can track your driving behavior, such as speed, braking, and time of day driven.

Telematics insurance can be a great option for safe drivers, as it rewards good driving habits with lower premiums. However, it's important to carefully consider the privacy implications and ensure that you're comfortable with the level of data collection before opting for this type of insurance.

Take Advantage of Loyalty and Renewal Discounts

Many insurance providers offer loyalty discounts to long-term customers or incentives for renewing your policy. These discounts can be substantial and are often an incentive to remain with the same insurer. It's worth exploring these options to ensure you're taking advantage of any available savings.

Understanding Claims and Policy Changes

Understanding the claims process and how to make changes to your policy is essential for managing your driver insurance effectively.

The Claims Process

In the event of an accident, it's important to understand the steps involved in the claims process. This typically involves notifying your insurance company as soon as possible, providing details of the accident, and cooperating with any investigations. Your insurer will then assess the claim and determine the appropriate course of action, which may involve repairs, settlements, or further investigations.

It's crucial to provide accurate and honest information during the claims process. Misrepresenting the facts or providing false information can result in claim denials or even legal consequences.

Making Policy Changes

Your insurance needs may change over time, and it's important to keep your policy up-to-date to ensure you have the appropriate coverage. Whether you're adding a new vehicle, changing your address, or adjusting your coverage limits, it's essential to inform your insurer to ensure your policy reflects your current situation.

Additionally, regular policy reviews can help you identify opportunities to save money or improve your coverage. Many insurers offer policy reviews as a complimentary service, providing an opportunity to discuss your changing needs and make any necessary adjustments.

Future Trends and Considerations

The world of driver insurance is constantly evolving, and keeping up with the latest trends and considerations can help you make informed decisions about your coverage.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles is set to have a significant impact on the insurance industry. As these vehicles become more prevalent, the nature of accidents and liability will change. Insurers are already exploring new models and approaches to accommodate this evolving technology.

For now, most autonomous vehicle insurance policies follow traditional liability models, with the vehicle's owner responsible for any accidents caused by the vehicle. However, as the technology matures and becomes more reliable, the insurance landscape is likely to shift towards a more complex system of shared liability and potentially lower premiums.

The Impact of Electric Vehicles

The increasing popularity of electric vehicles (EVs) is also influencing the insurance industry. EVs have unique characteristics that can affect insurance costs, such as higher repair costs due to specialized components and the need for specific training for repair technicians.

Additionally, EVs often come with advanced safety features that can reduce the risk of accidents. Insurers are beginning to recognize these safety benefits and offer discounts for EV owners, making insurance more affordable for this growing segment of drivers.

Telematics and Data Privacy

As telematics insurance becomes more prevalent, the issue of data privacy is gaining prominence. Insurers collect vast amounts of data about drivers' habits, and ensuring this data is handled securely and ethically is a key concern. As a consumer, it's important to understand the data collection practices of your insurer and ensure your privacy is protected.

Conclusion: Navigating Driver Insurance in California

Driver insurance in California is a complex but essential aspect of vehicle ownership. From understanding the state's unique requirements to navigating the myriad of coverage options and insurance providers, there's a lot to consider. By staying informed, comparing quotes, and tailoring your coverage to your needs, you can ensure you have the right insurance at the best possible price.

As the world of insurance continues to evolve with technological advancements and changing driving trends, it's important to stay engaged and informed about the latest developments. This will help you make the most of your insurance coverage and protect yourself and your loved ones on the roads of California.

Frequently Asked Questions

What happens if I’m caught driving without insurance in California?

+Driving without insurance in California is a serious offense. If caught, you may face fines, have your registration suspended, and even have your vehicle impounded. In some cases, you may also be required to file an SR-22 certificate, which is a form of high-risk insurance, for a specified period.

Can I choose my own repair shop if I have an accident in California?

+Yes, you have the right to choose your own repair shop in California. However, some insurance companies may have preferred shops that they work with regularly. While you can choose any shop, it’s important to ensure they provide quality work and that your insurance company will cover the repairs.

How often should I review and update my insurance policy in California?

+It’s a good practice to review your insurance policy annually, or whenever there are significant changes in your life or driving habits. This ensures that your coverage remains adequate and that you’re not paying for coverage you don’t need. Regular reviews also provide an opportunity to explore new discounts or coverage options.

Are there any discounts available for students in California?

+Yes, many insurance companies offer student discounts for full-time students under the age of 25. These discounts are typically based on the assumption that students are safer drivers and have a lower risk of accidents. However, the specific requirements and discount amounts can vary between insurers.

Can I cancel my insurance policy at any time in California?

+Yes, you can cancel your insurance policy at any time in California. However, it’s important to note that most insurance companies require written notice and may charge a cancellation fee. Additionally, canceling your policy could affect your future insurance rates, so it’s best to explore other options first.