General Liability Business Insurance Cost

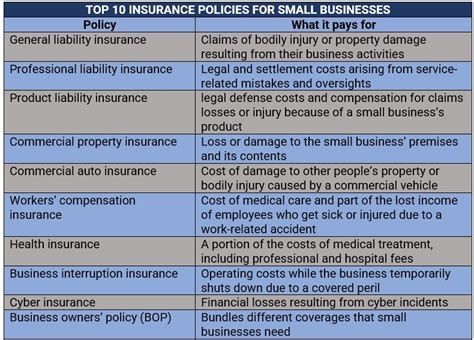

Business insurance is a vital aspect of protecting your company and its operations. Among the various types of coverage, General Liability insurance stands out as a cornerstone for many enterprises. This policy safeguards businesses from a range of risks, including property damage, bodily injury, and other common claims. Understanding the cost of General Liability insurance is essential for businesses of all sizes as it forms a crucial part of their financial planning and risk management strategies.

Unraveling the Costs of General Liability Insurance

The cost of General Liability insurance can vary significantly based on a multitude of factors. These include the nature of the business, its size, the level of risk associated with its operations, and the coverage limits chosen. For instance, a small, low-risk business might expect to pay significantly less than a large enterprise with complex operations and a higher likelihood of claims.

Factors Influencing Premium Costs

Several key factors contribute to the premium costs of General Liability insurance. These include:

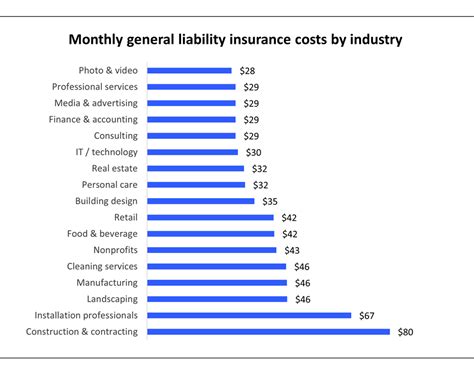

- Industry and Business Type: Different industries face unique risks. For instance, construction companies often face higher premiums due to the physical nature of their work and the associated risks.

- Business Size: Larger businesses often require higher coverage limits and, therefore, pay more for their insurance policies.

- Claims History: Insurers consider a business’s past claims when setting premiums. A history of frequent or costly claims can lead to higher premiums.

- Coverage Limits: The amount of coverage a business chooses to purchase directly affects the premium. Higher limits will typically cost more.

- Location: The geographical location of a business can impact its premium. Areas with higher rates of crime or natural disasters may see increased insurance costs.

| Factor | Impact on Premium |

|---|---|

| Industry and Business Type | Significant influence on risk profile and therefore premium |

| Business Size | Larger businesses often require higher coverage limits |

| Claims History | Frequent or costly claims can lead to higher premiums |

| Coverage Limits | Higher limits typically result in higher premiums |

| Location | Crime rates and natural disaster risks can affect insurance costs |

Example: A small retail store in a low-crime area might pay around $500 to $1,000 annually for General Liability insurance, whereas a construction company operating in the same region could pay anywhere from $2,000 to $5,000 or more, depending on the size and nature of their operations.

Understanding Policy Components

General Liability insurance policies typically consist of several key components that contribute to the overall premium:

- Bodily Injury and Property Damage Liability: This covers accidents that occur on the business premises or as a result of the business’s operations, leading to bodily injury or property damage.

- Personal and Advertising Injury Liability: This covers claims of libel, slander, or copyright infringement.

- Medical Payments: This provides coverage for medical expenses of individuals injured on the business’s premises, regardless of fault.

- Products and Completed Operations Liability: This is crucial for businesses that sell, distribute, or manufacture products, covering them for injuries or damages caused by their products after they’ve left the business’s control.

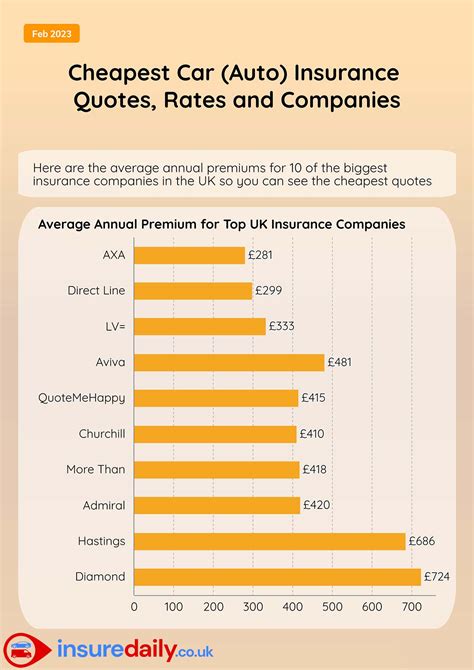

Comparing Quotes and Making Informed Decisions

When shopping for General Liability insurance, it’s essential to compare quotes from multiple insurers. This process allows businesses to understand the range of costs and coverage options available in the market. Online platforms and insurance brokers can provide a wealth of information and quotes, making it easier to find the right coverage at the best price.

In addition to the premium, businesses should also consider the insurer's reputation, financial strength, and the quality of their customer service. A reliable insurer can provide peace of mind and efficient claims handling when the need arises.

The Role of Deductibles and Excess Policies

Deductibles and excess policies are other aspects that influence the cost of General Liability insurance. A deductible is the amount a business must pay out of pocket before the insurance coverage kicks in. Higher deductibles can lead to lower premiums, but they also mean that the business will have to pay more out of its own pocket in the event of a claim.

Excess policies, also known as umbrella policies, provide additional liability coverage beyond the limits of the primary General Liability policy. They are especially useful for businesses that face high risks or require very high coverage limits. While excess policies add to the overall insurance cost, they can provide a critical safety net for businesses facing catastrophic losses.

Conclusion

General Liability insurance is a fundamental component of a business’s risk management strategy. By understanding the factors that influence the cost of this coverage, businesses can make informed decisions about their insurance needs and budgets. The process of selecting the right General Liability insurance involves a careful balance between cost, coverage, and the unique needs and risks of the business.

How much does General Liability insurance typically cost for a small business?

+For small businesses, the cost of General Liability insurance can range from 500 to 1,000 annually. However, this can vary significantly based on factors such as industry, business size, and claims history.

Can I reduce the cost of my General Liability insurance?

+Yes, there are strategies to reduce insurance costs. These include negotiating with insurers, bundling policies, and implementing risk management practices to reduce the likelihood of claims.

What happens if I don’t have enough General Liability coverage for a claim?

+If the General Liability coverage limit is insufficient for a claim, the business is responsible for paying the remaining amount out of pocket. This is why it’s crucial to choose adequate coverage limits.