How Do I Compare Auto Insurance Rates

Navigating the world of auto insurance can be a complex task, especially when it comes to understanding and comparing rates. With a multitude of factors influencing insurance costs, finding the best deal that suits your needs can be challenging. This comprehensive guide aims to demystify the process, offering you a step-by-step approach to comparing auto insurance rates effectively.

Understanding the Factors that Influence Auto Insurance Rates

Before delving into rate comparisons, it’s essential to grasp the key factors that insurance companies consider when calculating premiums. These factors include:

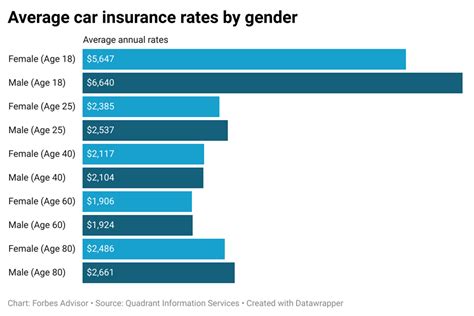

- Driver's Profile: Your age, gender, driving history, and credit score significantly impact your insurance rates. Young drivers, for instance, often face higher premiums due to their perceived risk level.

- Vehicle Type: The make, model, and year of your car play a role. Sports cars and luxury vehicles tend to have higher insurance costs.

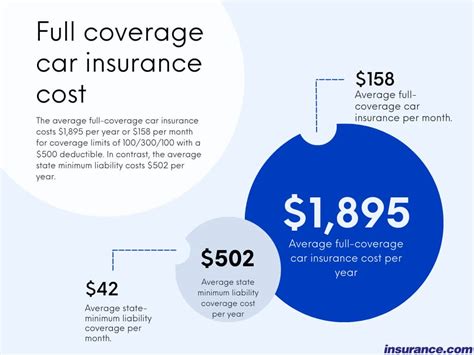

- Coverage Level: The extent of coverage you choose, such as liability-only or comprehensive coverage, affects your premium.

- Location: Insurance rates vary by state and even by city. Factors like traffic density, crime rates, and weather conditions influence rates.

- Claims History: Previous insurance claims can affect your premiums, with frequent claims potentially leading to higher costs.

- Discounts: Many insurers offer discounts for various reasons, including safe driving records, multiple policy bundles, or vehicle safety features.

Steps to Compare Auto Insurance Rates

Now that we’ve covered the fundamental factors, let’s explore a systematic approach to comparing auto insurance rates:

Step 1: Research and Identify Potential Insurers

Begin by researching reputable insurance companies. Look for those with a solid reputation and financial stability. Online reviews and industry ratings can provide valuable insights. Consider seeking recommendations from friends and family, especially if they’ve had positive experiences with a particular insurer.

Step 2: Gather Necessary Information

To obtain accurate quotes, you’ll need specific details about your vehicle, driving history, and personal information. Ensure you have the following handy:

- Vehicle make, model, year, and VIN number.

- Current insurance coverage details (if applicable)

- Your driving record, including any violations or accidents.

- Personal information such as date of birth, marital status, and occupation.

Step 3: Obtain Quotes

Contact the insurers you’ve identified and request quotes. You can do this online, over the phone, or in person. Provide accurate and consistent information to ensure you’re comparing apples to apples.

When obtaining quotes, consider the following:

- Compare similar coverage levels across insurers to ensure a fair comparison.

- Look for bundling options if you have multiple policies (e.g., home and auto insurance) to potentially save more.

- Inquire about discounts you may qualify for, such as safe driver discounts or loyalty rewards.

Step 4: Analyze the Quotes

Once you have a collection of quotes, it’s time to analyze and compare them. Here’s what to look for:

- Premium Cost: Compare the annual or monthly premium costs. Ensure you're comparing the same coverage levels and deductibles.

- Coverage Limits: Check the liability limits, collision coverage, and comprehensive coverage offered. Higher limits generally provide better protection but cost more.

- Deductibles: Consider the deductibles for collision and comprehensive coverage. Higher deductibles can lower your premium but increase the amount you pay out-of-pocket in the event of a claim.

- Additional Features: Some insurers offer unique benefits or add-ons, such as roadside assistance or rental car coverage. Evaluate if these features are valuable to you.

- Customer Service and Claims Handling: Research the insurer's reputation for customer service and claims handling. A responsive and efficient insurer can make a significant difference during a stressful situation.

Step 5: Make an Informed Decision

Based on your analysis, choose the insurer that best meets your needs and budget. Remember, the cheapest option might not always be the best. Consider factors like financial stability, customer satisfaction, and the insurer’s ability to handle claims efficiently.

Step 6: Finalize the Policy

Once you’ve selected your insurer, review the policy documents carefully. Ensure all the details, including coverage limits, deductibles, and any additional features, are as discussed. Ask questions if anything is unclear.

Consider purchasing add-ons or endorsements to customize your policy further. For instance, you might want to add rental car coverage or gap insurance to protect against depreciation.

Advanced Strategies for Lower Auto Insurance Rates

Beyond basic comparisons, there are strategies to potentially reduce your auto insurance rates:

Improving Your Driving Record

A clean driving record is a significant factor in determining insurance rates. If you have violations or accidents on your record, consider taking defensive driving courses or safe driver programs. Some insurers offer discounts for completing these courses.

Bundling Policies

If you have multiple insurance needs, such as home, auto, and life insurance, consider bundling them with the same insurer. Bundling policies often results in significant savings.

Increasing Your Deductible

While higher deductibles mean you’ll pay more out-of-pocket in the event of a claim, they can lower your premium. Evaluate your financial situation and risk tolerance before opting for a higher deductible.

Choosing the Right Coverage

Understand your coverage needs. If you have an older vehicle, you might consider dropping collision or comprehensive coverage, as the cost of repairing or replacing the vehicle might not justify the expense.

Conclusion: Take Control of Your Auto Insurance Costs

Comparing auto insurance rates doesn’t have to be a daunting task. By understanding the factors that influence rates and following a systematic approach, you can make informed decisions and potentially save hundreds of dollars annually. Remember, your insurance needs may change over time, so it’s essential to review and compare rates regularly.

How often should I compare auto insurance rates?

+It’s a good practice to compare rates annually, especially if your circumstances have changed. For instance, if you’ve recently purchased a new vehicle, moved to a new location, or turned 25 (a significant milestone for insurance rates), it’s a good time to shop around.

Can I negotiate auto insurance rates?

+While you can’t negotiate rates directly, you can explore options to lower your premium. This includes shopping around for the best deals, adjusting your coverage levels, or taking advantage of discounts.

What are some common discounts I can look for when comparing auto insurance rates?

+Common discounts include safe driver discounts, multi-policy discounts, loyalty rewards, good student discounts, and vehicle safety feature discounts. Some insurers also offer discounts for paying your premium in full or using paperless billing.