How Much Is Medical Insurance A Month

Medical insurance, also known as health insurance, is an essential financial tool that helps individuals and families manage the costs associated with healthcare. With rising medical expenses, having adequate coverage has become more crucial than ever. The monthly cost of medical insurance can vary significantly depending on several factors, including your location, age, coverage needs, and the type of plan you choose. Let's delve into the various aspects that influence the price of medical insurance and explore some real-world examples to understand the financial commitment better.

Factors Influencing the Cost of Medical Insurance

Several key factors contribute to the monthly premium you pay for medical insurance. Understanding these factors can help you make informed decisions when selecting a plan that best suits your needs and budget.

Geographic Location

The cost of healthcare services varies significantly across different regions and states. As a result, the average medical insurance premium tends to be higher in areas where healthcare costs are generally more expensive. For instance, urban areas with specialized medical facilities and a higher cost of living often have higher insurance premiums compared to rural areas.

| Location | Average Monthly Premium (Single Plan) |

|---|---|

| New York City | $500 |

| Los Angeles | $450 |

| Dallas | $380 |

| Des Moines | $320 |

Age and Gender

Age and gender play a significant role in determining insurance premiums. Generally, younger individuals pay lower premiums, as they are less likely to require extensive medical care. As you age, the risk of health issues increases, leading to higher premiums. Additionally, insurance companies may charge different rates for men and women based on historical healthcare cost data.

| Age Group | Average Monthly Premium (Single Plan) |

|---|---|

| 18-24 years | $250 |

| 25-34 years | $300 |

| 35-44 years | $350 |

| 45-54 years | $420 |

| 55-64 years | $550 |

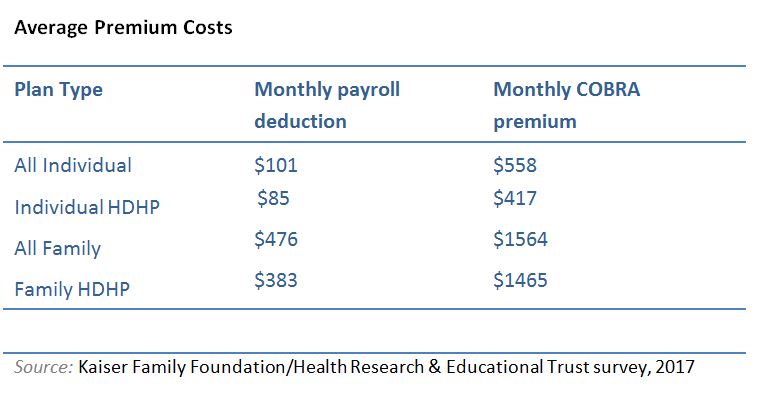

Plan Type and Coverage

The type of medical insurance plan you choose and the level of coverage it provides are major determinants of your monthly premium. There are various plan options available, each with its own set of benefits and costs. Common plan types include:

- Health Maintenance Organization (HMO): HMOs typically offer a network of healthcare providers, and you must choose a primary care physician (PCP) to coordinate your care. Premiums for HMO plans are often more affordable, but you may have limited provider choices and require a referral for specialist visits.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility, allowing you to visit healthcare providers inside or outside the network. While PPOs generally have higher premiums, they provide greater freedom in choosing your healthcare professionals.

- Exclusive Provider Organization (EPO): EPO plans are similar to PPOs but typically do not cover out-of-network care. They often have lower premiums compared to PPOs but may be more restrictive in terms of provider choices.

- Point of Service (POS): POS plans combine features of both HMOs and PPOs. You can choose a primary care physician within the network, but you also have the option to visit out-of-network providers with increased out-of-pocket costs.

Additionally, the level of coverage you opt for will impact your monthly premium. Higher coverage plans, such as those with lower deductibles and copayments, generally come with higher premiums.

Family Size and Dependents

If you’re insuring multiple family members, including dependents like children or spouses, the cost of your medical insurance will increase. Family plans often provide better value than individual plans, as the premium is shared among family members.

Pre-existing Conditions

Insurance companies may consider your health history when determining your premium. Individuals with pre-existing conditions or a history of chronic illnesses may face higher premiums or be required to enroll in specialized plans with higher costs.

Tobacco Use

Smokers and tobacco users are often charged higher premiums due to the increased health risks associated with tobacco consumption. Insurance companies may apply a surcharge to the monthly premium for tobacco users.

Real-World Examples of Medical Insurance Premiums

To better understand the range of medical insurance costs, let's look at some real-world examples of monthly premiums for different plan types and coverage levels.

Example 1: HMO Plan for a Single Individual

John, a 30-year-old living in Dallas, Texas, opts for an HMO plan with a 2,000 deductible and a 30 copayment for office visits. His monthly premium for this plan is $280.

Example 2: PPO Plan for a Family of Four

The Smith family, consisting of two parents and two children, ages 8 and 12, resides in Los Angeles, California. They choose a PPO plan with a 3,000 family deductible and a 50 copayment for specialist visits. Their monthly premium for this family plan is $1,200.

Example 3: EPO Plan for a Young Professional

Emily, a 25-year-old working professional in New York City, selects an EPO plan with a 1,500 deductible and a 40 copayment for urgent care visits. Her monthly premium for this plan is $450.

Example 4: POS Plan for an Older Couple

Henry and Sarah, a retired couple in their 60s, reside in a suburban area near Dallas. They opt for a POS plan with a 4,000 combined deductible and a 60 copayment for specialty care. Their monthly premium for this plan is $1,050.

Understanding the Trade-offs

When choosing a medical insurance plan, it's essential to consider the trade-offs between monthly premiums and out-of-pocket costs. Lower premiums may result in higher deductibles and copayments, which means you'll pay more when you need medical care. Conversely, plans with higher premiums often provide more comprehensive coverage with lower out-of-pocket expenses.

Additionally, it's crucial to assess your healthcare needs and predict potential future expenses. If you anticipate needing extensive medical care, a plan with higher premiums and lower out-of-pocket costs may be a more cost-effective choice in the long run.

Conclusion

The cost of medical insurance is a complex calculation influenced by various factors. By understanding these factors and exploring real-world examples, you can make an informed decision when selecting a plan that provides the coverage you need at a premium you can afford. Remember, medical insurance is an investment in your health and financial well-being, so choose wisely.

Frequently Asked Questions

How can I reduce my medical insurance premiums?

+

There are several strategies to lower your insurance premiums. Consider opting for a higher deductible plan, which often comes with lower monthly premiums. Additionally, maintaining a healthy lifestyle and avoiding tobacco use can lead to reduced premiums. Shopping around and comparing quotes from different insurance providers can also help you find more affordable options.

Are there any government programs that offer affordable medical insurance?

+

Yes, various government programs provide affordable medical insurance options. For example, Medicaid is a federal and state-funded program that offers low-cost or free health coverage to eligible individuals and families with limited income and resources. The Affordable Care Act (ACA) also provides subsidies and tax credits to help individuals and families purchase private health insurance plans.

What happens if I can’t afford medical insurance?

+

If you’re unable to afford medical insurance, it’s important to explore your options. Check if you qualify for government programs like Medicaid or look into community health centers that offer discounted or free medical services based on your income. Additionally, some states have high-risk pools or programs that provide coverage for individuals with pre-existing conditions at an affordable cost.