Insurance Companies For Health Insurance

In the realm of healthcare, navigating the intricate landscape of insurance coverage is an essential yet often complex task. This comprehensive guide aims to shed light on the pivotal role of insurance companies in the health insurance ecosystem, offering an in-depth exploration of their functions, services, and impact on individuals and communities.

The Vital Role of Insurance Companies in Health Insurance

Insurance companies, also known as insurers or carriers, stand as indispensable pillars in the healthcare industry. They are pivotal in managing and distributing the risks associated with healthcare costs, thereby ensuring that individuals and communities have access to essential medical services without bearing the full financial burden.

The primary objective of insurance companies in the health insurance sector is to provide financial protection to individuals, families, and groups by offering a range of health insurance plans. These plans cover a spectrum of medical services, from routine check-ups and preventive care to more complex and costly procedures, thus mitigating the financial strain of unexpected illnesses or injuries.

The role of insurance companies extends beyond mere financial protection. They play a crucial part in promoting healthcare accessibility and quality. By negotiating rates with healthcare providers and developing comprehensive networks, insurers facilitate cost-effective healthcare delivery. Moreover, their involvement in the approval and management of treatments and services ensures that patients receive necessary care while also curbing unnecessary expenditures.

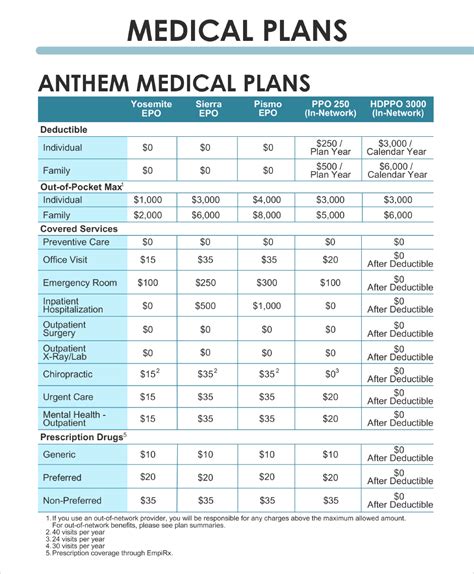

Understanding the Mechanics of Health Insurance Plans

Health insurance plans, crafted by insurance companies, serve as intricate mechanisms to provide financial security in the face of healthcare needs. These plans are meticulously designed to offer a balanced approach, considering various factors such as the policyholder’s age, health status, and desired level of coverage.

A typical health insurance plan encompasses a range of benefits, including coverage for doctor visits, hospital stays, prescription medications, and specialized treatments. It also involves the management of costs through mechanisms like deductibles, co-payments, and co-insurance. These cost-sharing measures ensure that policyholders actively participate in their healthcare decisions while also contributing to the overall sustainability of the insurance system.

The choice of a health insurance plan is not merely a financial decision; it is a strategic one that influences an individual's healthcare journey. Policyholders must carefully consider their healthcare needs, existing conditions, and the financial implications of different plans to make an informed decision. This process often involves evaluating factors such as premium costs, coverage limits, and the availability of specific healthcare providers within the insurance network.

Key Components of Health Insurance Plans

- Premiums: The amount paid regularly (usually monthly) to maintain insurance coverage.

- Deductibles: The sum an individual pays out-of-pocket before the insurance coverage kicks in.

- Co-payments (Co-pays): Fixed amounts paid by the policyholder for specific services, like a doctor’s visit.

- Co-insurance: The percentage of costs the policyholder pays after the deductible, often shared with the insurance company.

- Out-of-Pocket Maximum: The limit on the amount an individual will pay in a year for covered services.

- Network Providers: Healthcare professionals and facilities that have agreements with the insurance company, often offering discounted rates.

Types of Health Insurance Plans

Insurance companies offer a variety of health insurance plans to cater to diverse needs and preferences. Here’s a glimpse into some common types:

| Plan Type | Description |

|---|---|

| Health Maintenance Organization (HMO) | Focuses on preventive care and requires members to choose a primary care physician within the network. |

| Preferred Provider Organization (PPO) | Offers more flexibility, allowing members to choose providers inside or outside the network, though in-network services are usually more cost-effective. |

| Exclusive Provider Organization (EPO) | Similar to PPOs, but members can only access providers within the network, without out-of-network coverage. |

| Point of Service (POS) | Combines features of HMOs and PPOs, offering a choice between in-network and out-of-network providers but with cost differences. |

| High Deductible Health Plan (HDHP) | Features high deductibles, but also lower premiums, often paired with a Health Savings Account (HSA) for tax-advantaged savings. |

The Impact of Insurance Companies on Healthcare Access and Outcomes

Insurance companies wield significant influence over healthcare access and the overall patient experience. Their policies and practices can either facilitate or hinder an individual’s journey to obtaining necessary medical care.

On the positive side, insurance companies play a pivotal role in broadening healthcare access. By offering a range of insurance plans, they provide financial security to individuals and families, ensuring that medical care is not solely dependent on an individual's ability to pay. This is especially crucial for those with pre-existing conditions or chronic illnesses, who might otherwise face significant financial barriers to healthcare.

Furthermore, insurance companies often incentivize preventive care, promoting regular check-ups and screenings. This proactive approach to healthcare can lead to early detection of potential health issues, improving overall health outcomes and reducing the burden of costly treatments in the long run. Many insurance plans also cover wellness programs and health education initiatives, further empowering individuals to take charge of their health.

Addressing Concerns and Barriers

Despite their critical role, insurance companies also face scrutiny for certain practices that can limit access or create financial burdens for policyholders. Issues such as prior authorization, step therapy, and formulary restrictions have been subjects of debate and reform efforts. These practices, while designed to control costs and promote appropriate treatment, can sometimes create obstacles for patients seeking timely and effective care.

Additionally, the complexity of insurance plans and the associated terminology can be daunting for many individuals. This complexity often leads to misunderstandings or misinformation, potentially impacting an individual's ability to make informed decisions about their healthcare and insurance coverage.

Future Outlook and Innovations in Health Insurance

The landscape of health insurance is continually evolving, driven by technological advancements, changing healthcare needs, and policy reforms. Insurance companies are at the forefront of these changes, actively innovating to enhance their services and better meet the needs of their policyholders.

Emerging Trends and Technologies

Insurance companies are increasingly leveraging technology to streamline processes, improve efficiency, and enhance the overall customer experience. From digital platforms that simplify plan selection and claims processes to the use of artificial intelligence for predictive analytics, technology is transforming the way insurance companies operate and engage with their customers.

For instance, the integration of blockchain technology is gaining momentum in the health insurance sector. Blockchain offers a secure and transparent way to manage health records, ensuring data integrity and privacy while also facilitating efficient claims processing. Additionally, the use of wearables and health tracking devices is opening up new avenues for insurance companies to promote healthier lifestyles and offer tailored incentives to policyholders.

Focus on Value-Based Care

There is a growing shift towards value-based care models in the health insurance industry. This approach prioritizes the quality of care over the quantity of services provided, aiming to improve health outcomes while controlling costs. Insurance companies are increasingly partnering with healthcare providers to develop strategies that focus on preventative care, chronic disease management, and coordinated care initiatives.

By incentivizing healthcare providers to deliver high-quality, cost-effective care, insurance companies are driving a transformation in the healthcare delivery system. This shift not only benefits patients by improving their health outcomes but also helps to contain rising healthcare costs, making healthcare more accessible and sustainable.

Collaborative Initiatives

Insurance companies are also recognizing the importance of collaboration across the healthcare ecosystem. They are actively engaging with various stakeholders, including healthcare providers, pharmaceutical companies, and patient advocacy groups, to develop innovative solutions that address the complex challenges in healthcare.

For instance, collaborative initiatives are being explored to improve medication adherence, address social determinants of health, and enhance patient education. These initiatives aim to create a more holistic and patient-centric healthcare system, where insurance coverage is just one aspect of a broader strategy to improve health and well-being.

Conclusion

Insurance companies are integral to the healthcare ecosystem, playing a multifaceted role in managing risks, promoting access to healthcare, and shaping the overall patient experience. Their impact extends beyond financial protection, influencing the way healthcare is delivered and experienced.

As the health insurance landscape continues to evolve, insurance companies are at the forefront, adapting to changing needs and leveraging innovative solutions. Their commitment to improving health outcomes, broadening access, and enhancing the customer experience underscores their pivotal role in shaping the future of healthcare.

FAQ

How do insurance companies determine premiums for health insurance plans?

+Insurance companies use a combination of factors to determine premiums, including the policyholder’s age, health status, location, and the chosen level of coverage. They also consider historical claim data and trends to assess the risk associated with insuring an individual or group.

What is the significance of an insurance company’s network of providers?

+The network of providers refers to the healthcare professionals and facilities that have agreements with the insurance company. Choosing an in-network provider typically results in lower out-of-pocket costs, as these providers have negotiated discounted rates with the insurer. Out-of-network providers may result in higher costs for the policyholder.

How do insurance companies promote preventive care and wellness?

+Insurance companies employ various strategies to encourage preventive care and wellness. This includes offering incentives like reduced premiums or rewards for maintaining healthy habits, providing access to wellness programs and health education resources, and covering the cost of preventive services like annual check-ups and screenings.

What are some common challenges individuals face when interacting with insurance companies?

+Individuals may face challenges such as navigating complex insurance terminology and plan structures, understanding the approval process for treatments and services, and dealing with denials or delays in claims processing. Additionally, prior authorization requirements and formulary restrictions can sometimes create barriers to timely care.