Insurance Paid

The world of insurance is a complex yet indispensable aspect of modern life. It provides a safety net for individuals and businesses, offering financial protection and peace of mind. Among the myriad of insurance policies, one crucial type is health insurance, which plays a pivotal role in managing healthcare costs and ensuring accessibility to medical services. This article delves into the realm of insurance paid, specifically focusing on health insurance, its significance, and its impact on individuals and the healthcare system.

Understanding Health Insurance: A Vital Necessity

Health insurance is a contractual agreement between an individual (or a group) and an insurance company. This agreement outlines the terms and conditions under which the insurer will provide financial coverage for medical expenses incurred by the insured. The scope of coverage can vary widely, from basic hospitalization and surgery costs to comprehensive plans covering preventive care, prescription drugs, and even mental health services.

The need for health insurance arises from the high costs associated with modern healthcare. Medical treatments, especially specialized ones, can be prohibitively expensive, often stretching beyond the financial means of individuals. Health insurance acts as a buffer, ensuring that individuals can access necessary medical care without facing catastrophic financial burdens.

The Mechanics of Health Insurance

Health insurance operates on a few key principles. The insured, or policyholder, pays a premium to the insurance company, which is typically a monthly or annual fee. In return, the insurer agrees to cover a portion or the entirety of the insured’s medical expenses, as outlined in the policy.

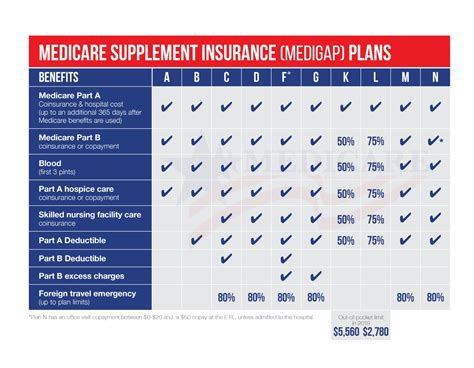

The coverage provided by health insurance policies can be comprehensive or limited, depending on the plan chosen. Comprehensive plans offer a wide range of benefits, including coverage for doctor visits, hospital stays, surgical procedures, and often, prescription medications. Limited plans, on the other hand, might only cover specific types of treatments or have restrictions on the amount of coverage provided.

Furthermore, health insurance policies may have various deductibles, co-pays, and co-insurance arrangements. A deductible is the amount the insured must pay out of pocket before the insurance coverage kicks in. Co-pays are fixed amounts the insured pays for covered services, while co-insurance is the percentage of the cost the insured shares with the insurer after the deductible is met.

| Health Insurance Terms | Definition |

|---|---|

| Premium | The amount paid by the insured to the insurer, usually monthly or annually. |

| Deductible | The amount the insured must pay before the insurance coverage begins. |

| Co-pay | A fixed amount the insured pays for covered services. |

| Co-insurance | The percentage of costs shared by the insured and the insurer after the deductible. |

The Impact of Insurance Paid: A Double-Edged Sword

Insurance paid, especially in the context of health insurance, has a significant impact on both individuals and the healthcare system as a whole. While it provides crucial financial protection, it also introduces a layer of complexity and potential challenges.

Advantages of Insurance Paid

The primary advantage of insurance paid is the financial security it offers. For individuals and families, health insurance can be a literal lifesaver, ensuring access to necessary medical treatments without the fear of overwhelming financial debt. It allows people to focus on their health and well-being without the added stress of managing medical bills.

Moreover, insurance paid plays a crucial role in improving healthcare accessibility. By covering a portion of the costs, insurance makes healthcare more affordable and thus, more accessible to a broader population. This is especially beneficial for individuals with pre-existing conditions or those requiring ongoing medical care.

From a societal perspective, insurance paid contributes to healthier communities. With more people able to access healthcare services, overall public health can improve. This leads to reduced disease burden, increased productivity, and a more resilient society.

Challenges and Considerations

Despite its benefits, insurance paid also presents certain challenges. One of the primary concerns is the cost of insurance premiums. As healthcare costs rise, insurance companies often increase their premiums, making insurance less affordable for some individuals and families. This can lead to a situation where those who need insurance the most are unable to afford it.

Another challenge is the complexity of insurance policies. With numerous terms, conditions, and exclusions, understanding health insurance policies can be daunting. This complexity can lead to confusion and potential financial losses if individuals are unaware of the limitations of their coverage.

Furthermore, insurance paid can sometimes lead to inefficiencies in the healthcare system. With insurers involved in the healthcare process, there is often a layer of administrative complexity, which can slow down care delivery and increase costs.

Maximizing the Benefits of Insurance Paid

Given the complexities and challenges associated with insurance paid, it is essential to maximize its benefits. Here are some strategies to navigate the world of insurance effectively:

- Choose the Right Plan: Select a health insurance plan that aligns with your healthcare needs and financial capabilities. Consider factors like coverage, deductibles, and out-of-pocket expenses.

- Understand Your Policy: Take the time to thoroughly read and understand your insurance policy. Know what is covered, what is not, and any limitations or exclusions.

- Shop Around: Compare different insurance plans and providers to find the best fit for your needs. Consider using online tools and resources to compare plans and premiums.

- Stay Informed: Keep yourself updated on changes to your insurance plan, healthcare laws, and healthcare costs. This will help you make informed decisions about your healthcare and insurance.

- Communicate with Your Insurer: If you have questions or concerns about your coverage, don't hesitate to reach out to your insurer. They can provide clarifications and guidance to help you make the most of your insurance.

The Future of Insurance Paid: Trends and Innovations

The world of insurance is evolving, and the future holds promising innovations and trends that could revolutionize the industry. Here are some insights into the future of insurance paid:

Digitalization and Automation

The rise of digital technologies is transforming the insurance industry. Digital platforms and mobile apps are making it easier for individuals to manage their insurance policies, file claims, and access healthcare services. Automation is also streamlining processes, reducing administrative burdens, and enhancing efficiency.

Personalized Insurance

With advancements in data analytics and artificial intelligence, insurance companies are moving towards personalized insurance plans. These plans are tailored to an individual’s unique healthcare needs, lifestyle, and preferences. By analyzing an individual’s health data, insurers can offer more targeted and cost-effective coverage.

Preventive Care Focus

There is a growing emphasis on preventive care in the insurance industry. Insurers are recognizing the long-term benefits of investing in preventive measures, such as wellness programs and health screenings. By encouraging and covering preventive care, insurers can help individuals maintain better health and reduce the need for costly treatments in the future.

Integrated Healthcare Models

The traditional siloed approach to healthcare is evolving. Integrated healthcare models, where insurance companies work closely with healthcare providers, are gaining traction. These models aim to improve coordination of care, reduce duplication of services, and enhance overall patient outcomes.

Conclusion

Insurance paid, particularly health insurance, is a vital component of modern life. It provides financial protection, improves healthcare accessibility, and contributes to healthier communities. While it comes with its own set of challenges, understanding the complexities and maximizing the benefits of insurance paid can ensure a more secure and healthy future.

As the insurance industry continues to evolve, embracing digitalization, personalization, and preventive care, we can look forward to a future where insurance is more accessible, efficient, and aligned with individual needs. By staying informed and engaged, individuals can navigate the world of insurance with confidence and make the most of the protections it offers.

How do I choose the right health insurance plan for me?

+Choosing the right health insurance plan involves considering several factors. First, assess your healthcare needs and any specific conditions or treatments you might require. Look for plans that offer comprehensive coverage for these needs. Also, consider the cost of premiums, deductibles, and out-of-pocket expenses. It’s beneficial to compare multiple plans and use online tools to find the best fit for your needs and budget.

What are some common challenges with health insurance claims?

+Common challenges with health insurance claims include delays in processing, denials due to policy exclusions or limitations, and confusion over what is covered. To avoid these issues, it’s important to understand your policy inside out and to keep detailed records of all medical treatments and expenses. If you encounter problems, reach out to your insurer for clarification and assistance.

How can I maximize the benefits of my health insurance plan?

+Maximizing the benefits of your health insurance plan involves several strategies. Stay informed about your policy’s coverage, exclusions, and limitations. Utilize preventive care services and wellness programs offered by your insurer. Take advantage of any discounts or incentives provided by your plan. Finally, keep a close eye on your medical bills to ensure that they are accurate and reflect the coverage you expect.