Insurance Policy For Life

In today's world, where uncertainty looms over every aspect of life, securing your future with a robust insurance policy is more crucial than ever. Life insurance, in particular, plays a pivotal role in providing financial stability and peace of mind for individuals and their loved ones. This comprehensive guide aims to delve into the intricacies of insurance policies, shedding light on the key aspects that every individual should consider when investing in this vital financial tool.

Understanding Life Insurance: A Necessity, Not a Luxury

Life insurance serves as a protective shield, ensuring that your loved ones are financially secure even in the event of an unforeseen tragedy. It provides a lump-sum payment, known as a death benefit, to the named beneficiaries upon the policyholder’s demise. This benefit can prove to be a lifesaver, covering a wide range of expenses such as funeral costs, outstanding debts, daily living expenses, and even providing a foundation for long-term financial security.

Moreover, life insurance offers a host of other benefits that go beyond the immediate financial support. It can be an essential tool for estate planning, helping to minimize taxes and ensuring a smooth transfer of assets to your beneficiaries. Additionally, certain types of life insurance policies, such as whole life insurance, offer a savings component, allowing policyholders to accumulate cash value over time, which can be borrowed against or withdrawn in times of need.

Types of Life Insurance Policies

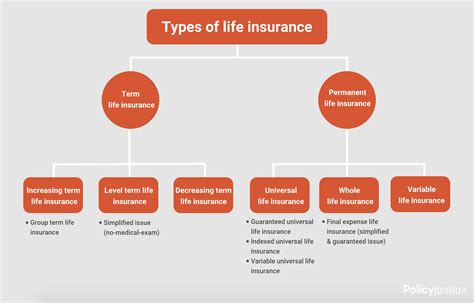

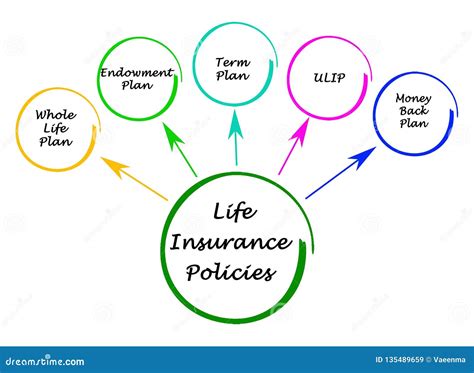

The life insurance market offers a diverse range of policies, each designed to cater to different needs and financial situations. Understanding the key differences between these policies is crucial in making an informed decision.

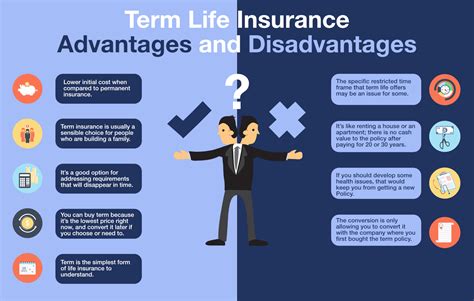

Term Life Insurance: As the name suggests, this policy provides coverage for a specified term, typically ranging from 10 to 30 years. It is often the most affordable option, offering high coverage amounts for a relatively low premium. However, it is important to note that the policy expires at the end of the term, and the coverage is not guaranteed to be renewable. Term life insurance is ideal for individuals with short-term financial needs, such as covering a mortgage or providing for dependent children during their formative years.

Whole Life Insurance: This type of policy offers lifetime coverage, ensuring that your beneficiaries receive the death benefit whenever the policyholder passes away. Whole life insurance also includes a savings component, known as the cash value, which grows over time and can be accessed by the policyholder. The premiums for whole life insurance are typically higher than term life, but they remain level throughout the policy's duration, providing long-term financial predictability.

Universal Life Insurance: A more flexible option, universal life insurance allows policyholders to adjust their premiums and death benefits over time, subject to certain limits. This policy also builds cash value, similar to whole life insurance, but the policyholder has more control over how this value is invested. Universal life insurance is often chosen by individuals who seek a balance between financial protection and investment growth.

| Policy Type | Coverage Period | Premium Flexibility | Cash Value Accumulation |

|---|---|---|---|

| Term Life Insurance | Specific Term (10-30 years) | Fixed Premiums | None |

| Whole Life Insurance | Lifetime | Level Premiums | Yes |

| Universal Life Insurance | Flexible | Adjustable Premiums | Yes |

Key Considerations When Choosing an Insurance Policy

Selecting the right insurance policy involves a careful evaluation of your unique financial situation and long-term goals. Here are some key factors to consider:

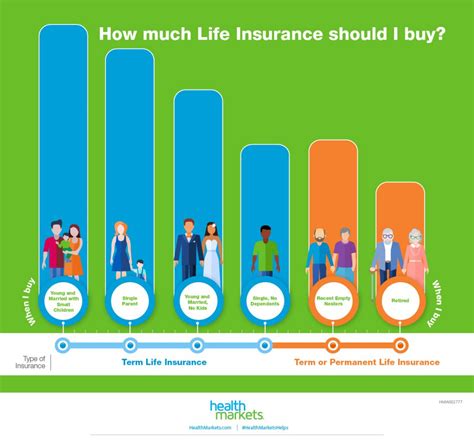

Your Financial Needs

The first step in choosing an insurance policy is to assess your financial needs. Consider the financial obligations you want to cover, such as outstanding debts, mortgage payments, or your children’s education expenses. Calculate the amount of coverage you’ll need to ensure your loved ones can maintain their current standard of living without your income.

Your Budget and Premium Flexibility

Insurance policies come with varying premium structures. Term life insurance, for instance, offers the most cost-effective option for those on a budget. On the other hand, whole life and universal life insurance policies provide more flexibility in premium payments, allowing you to adjust your contributions based on your financial circumstances.

Policy Features and Benefits

Different insurance policies offer a range of features and benefits. Some policies may include accelerated death benefits, which allow policyholders to access a portion of their death benefit if they are diagnosed with a terminal illness. Others might offer waiver of premium benefits, waiving future premium payments if the policyholder becomes disabled.

The Insurance Company’s Reputation and Financial Strength

When choosing an insurance policy, it’s crucial to select a reputable and financially stable insurance company. Research the company’s history, customer reviews, and financial ratings to ensure they have the ability to honor their commitments over the long term.

Policy Renewal and Conversion Options

Term life insurance policies often come with the option to renew or convert to a permanent policy at the end of the term. It’s essential to understand these renewal and conversion options, as they can impact the cost and coverage of your policy in the long run.

Maximizing the Benefits of Your Insurance Policy

Once you’ve chosen the right insurance policy, it’s important to make the most of its benefits. Here are some strategies to consider:

Regularly Review and Update Your Policy

Your financial situation and needs are likely to evolve over time. Regularly review your insurance policy to ensure it still aligns with your current circumstances. Update your policy as necessary, especially if you experience significant life changes such as marriage, the birth of a child, or a change in financial status.

Utilize the Policy’s Features and Riders

Insurance policies often come with additional features and riders that can enhance your coverage. For instance, you might consider adding a long-term care rider to your policy, which provides benefits for extended care needs in the event of a chronic illness or disability.

Consider Additional Policies for Specific Needs

Depending on your unique financial situation, you might benefit from additional insurance policies. For example, if you’re a business owner, key person insurance can provide financial protection in the event of the demise of a key employee or business partner. Similarly, disability insurance can provide income protection if you’re unable to work due to an accident or illness.

The Future of Insurance: Innovations and Trends

The insurance industry is evolving rapidly, driven by advancements in technology and changing consumer expectations. Here’s a glimpse into some of the key trends and innovations shaping the future of insurance:

Digital Transformation and Insurtech

Insurtech, a fusion of insurance and technology, is revolutionizing the industry. From digital applications that streamline the policy purchase process to AI-powered chatbots that offer 24⁄7 customer support, the insurance landscape is becoming increasingly digital and customer-centric.

Parametric Insurance and Smart Contracts

Parametric insurance, a new breed of insurance, uses predefined parameters to trigger payouts based on external events. For instance, a parametric crop insurance policy might pay out based on weather data, without requiring an assessment of actual crop losses. This innovative approach is particularly beneficial in areas where traditional insurance models struggle to provide coverage.

Personalized Insurance Products

The future of insurance is moving towards highly personalized products. With the help of advanced data analytics, insurance companies can offer tailored policies that meet the unique needs of individual customers. From customized health insurance plans based on genetic data to usage-based auto insurance, the focus is on creating products that align perfectly with each customer’s risk profile.

Blockchain and Smart Contracts

Blockchain technology is set to disrupt the insurance industry by enhancing transparency, security, and efficiency. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, can automate various insurance processes, from policy issuance to claims settlement. This technology has the potential to reduce administrative costs and streamline the entire insurance lifecycle.

Focus on Customer Experience

In today’s competitive market, insurance companies are increasingly focusing on delivering a superior customer experience. From simplifying the policy purchase process to offering seamless digital claims experiences, insurance providers are leveraging technology to enhance customer satisfaction and loyalty.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your unique financial situation and goals. As a general rule of thumb, aim for a coverage amount that is at least 10 times your annual income. However, it’s important to consider other factors such as outstanding debts, mortgage payments, and future financial goals when determining your coverage needs.

What is the difference between term and whole life insurance?

+Term life insurance provides coverage for a specified term, typically ranging from 10 to 30 years. It is often the most affordable option and is ideal for individuals with short-term financial needs. Whole life insurance, on the other hand, offers lifetime coverage and includes a savings component, known as the cash value, which grows over time. Whole life insurance is typically more expensive but provides long-term financial predictability.

Can I access the cash value of my life insurance policy?

+Yes, if you have a whole life or universal life insurance policy, you can access the cash value that has accumulated over time. You can either borrow against the cash value or withdraw a portion of it. However, it’s important to note that borrowing against your policy may impact the death benefit and cash value growth in the future.