Sipc Insurance Limit

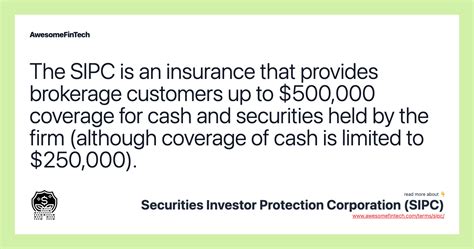

The Securities Investor Protection Corporation (SIPC) is a non-profit organization established by the US Congress to safeguard investors and maintain confidence in the securities market. One of its key roles is to provide insurance coverage for customer assets held by brokerage firms that are members of SIPC. Understanding the SIPC insurance limit is crucial for investors to comprehend the level of protection their assets have in the event of a brokerage firm's failure.

Understanding the SIPC Insurance Limit

The SIPC insurance limit is set at 500,000 per customer, including a maximum of 250,000 for cash claims. This insurance coverage protects investors’ cash and securities, such as stocks, bonds, and mutual funds, in the event that their brokerage firm becomes insolvent or encounters financial difficulties.

It's important to note that SIPC insurance is not the same as investor compensation funds or deposit insurance. SIPC insurance covers the customer's equity in their brokerage account, ensuring that investors can recover their investments if the brokerage firm fails. However, it does not protect against investment losses due to market fluctuations or poor investment choices.

The insurance limit is calculated per customer, which means that each individual or entity with a brokerage account is covered up to this amount. For joint accounts, the coverage is also $500,000, but it is calculated on a per-account basis, not per individual. This means that a married couple with a joint brokerage account would still be covered up to $500,000, even if they each have separate accounts with the same brokerage firm.

Example of SIPC Insurance Coverage

Let’s consider a scenario to illustrate how SIPC insurance works and how the insurance limit is applied.

Imagine an investor, Mr. Johnson, has the following securities and cash in his brokerage account:

| Asset Type | Quantity/Value |

|---|---|

| Stocks | 1,000 shares of Company A ($200,000) |

| Bonds | $150,000 face value |

| Mutual Funds | $75,000 |

| Cash | $100,000 |

If Mr. Johnson's brokerage firm were to become insolvent, SIPC insurance would step in to protect his assets. Here's how the insurance limit would be applied in this scenario:

- Stocks ($200,000): Mr. Johnson's stocks are fully covered by the SIPC insurance limit of $500,000.

- Bonds ($150,000): His bond holdings are also covered, as they fall within the insurance limit.

- Mutual Funds ($75,000): The mutual fund investment is covered as well, ensuring that Mr. Johnson can recover this amount.

- Cash ($100,000): The cash in his account is protected up to the maximum cash claim limit of $250,000. In this case, Mr. Johnson's cash holdings would be fully covered.

So, in this scenario, Mr. Johnson's entire brokerage account balance, including securities and cash, would be protected up to the SIPC insurance limit of $500,000.

Exceeding the SIPC Insurance Limit

While the SIPC insurance limit provides a significant level of protection, some investors may have assets that exceed this amount. In such cases, it’s important to consider additional measures to safeguard their investments.

Diversifying Assets

One strategy to mitigate risk is to diversify assets across multiple brokerage firms. By spreading investments among different firms, investors can ensure that their assets are protected up to the SIPC insurance limit at each firm. This approach minimizes the risk of losing a substantial portion of their portfolio in the event of a single brokerage firm’s failure.

Custodial Accounts

Another option for investors with substantial assets is to utilize custodial accounts. These accounts, often used for trusts or estate planning, can provide an additional layer of protection. Assets held in custodial accounts are typically not considered part of the investor’s personal estate, which means they may be treated differently in the event of a brokerage firm’s failure. However, it’s important to consult legal and financial experts to understand the specific rules and regulations surrounding custodial accounts.

Understanding Brokerage Firm Stability

Investors can also take proactive measures to assess the financial stability of their brokerage firms. While SIPC insurance provides a safety net, it’s beneficial to choose reputable and well-established firms. Monitoring financial reports, news, and industry ratings can help investors make informed decisions about the security of their brokerage relationships.

SIPC Insurance and the Claims Process

In the event of a brokerage firm’s failure, SIPC steps in to protect investors’ assets. The organization works to transfer customer accounts to healthy brokerage firms or liquidate the firm’s assets to pay claims. SIPC’s goal is to ensure that investors can recover their assets as quickly and efficiently as possible.

The claims process typically involves the following steps:

- Notification: SIPC and the Securities and Exchange Commission (SEC) receive a report of the brokerage firm's financial difficulties.

- Assessment: SIPC evaluates the firm's financial status and determines the need for assistance.

- Account Verification: Investors must verify their account information and the assets held within their brokerage accounts.

- Claims Filing: Investors submit claims to SIPC, providing documentation of their assets and account balances.

- Claims Review: SIPC reviews and validates the claims, ensuring they fall within the insurance coverage limits.

- Account Transfer or Liquidation: SIPC works to transfer customer accounts to another brokerage firm or liquidates the firm's assets to pay claims.

- Distribution: Once accounts are transferred or assets are liquidated, SIPC distributes the recovered funds to investors.

The entire process can take several months, and the timeline may vary depending on the complexity of the case and the number of affected investors.

Limitations and Exclusions of SIPC Insurance

While SIPC insurance provides valuable protection, it’s essential to understand its limitations and exclusions. SIPC insurance does not cover:

- Investment Losses: SIPC insurance does not protect against investment losses due to market fluctuations or poor investment choices. It covers losses resulting from the brokerage firm's insolvency, not from market risks.

- Certain Investments: Investments like life insurance policies, annuities, commodities, and certain foreign securities are not covered by SIPC insurance.

- Unauthorized Trades: If an investor's account is compromised and unauthorized trades are made, SIPC insurance may not cover the resulting losses.

- Fraudulent Activities: SIPC insurance does not protect against fraud or embezzlement by brokerage firm employees. However, investors may have other legal options to pursue in such cases.

- Corporate Collateral: SIPC insurance does not cover corporate collateral or bonds issued by the brokerage firm itself.

Future Implications and Changes

The SIPC insurance limit has remained at $500,000 since 1970, and there have been calls for an increase to reflect the increased value of investments over time. While there have been proposals to raise the limit, no changes have been implemented yet. The stability of the securities market and the financial health of brokerage firms are crucial factors that influence any potential adjustments to the insurance limit.

Additionally, the increasing popularity of online brokerage platforms and the rise of cryptocurrency investments have raised questions about the adequacy of SIPC insurance coverage in the digital age. As the financial landscape continues to evolve, SIPC and regulatory bodies may need to adapt their policies to address these emerging trends and ensure investor protection in the digital sphere.

Conclusion

Understanding the SIPC insurance limit is an essential aspect of financial literacy for investors. While SIPC insurance provides a vital safety net, investors should also take proactive measures to protect their assets by diversifying, staying informed about their brokerage firm’s financial health, and considering additional strategies to safeguard their investments, especially if their portfolio exceeds the insurance limit. By staying informed and proactive, investors can navigate the securities market with confidence and peace of mind.

How often is the SIPC insurance limit reviewed and updated?

+The SIPC insurance limit has remained at $500,000 since 1970. There have been proposals to increase the limit, but no changes have been made as of now. The limit is typically reviewed and updated based on economic factors and the financial stability of the securities market.

Are there any plans to increase the SIPC insurance limit in the future?

+While there have been discussions and proposals to increase the SIPC insurance limit, no concrete plans or timelines have been announced. The decision to adjust the limit would depend on various economic and market factors.

What happens if an investor’s assets exceed the SIPC insurance limit?

+If an investor’s assets exceed the SIPC insurance limit, they may consider diversifying their investments across multiple brokerage firms to ensure their assets are protected up to the limit at each firm. Additionally, custodial accounts can provide an extra layer of protection for substantial assets.