Term Whole Life Insurance Difference

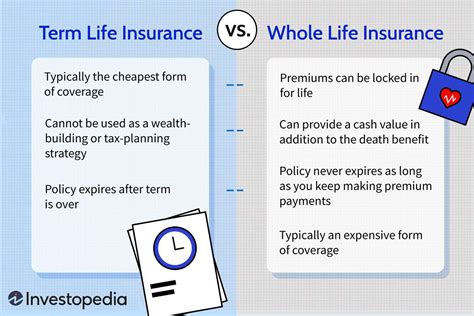

Whole life insurance is a type of permanent life insurance policy that offers coverage for the insured's entire life, providing financial protection to beneficiaries and ensuring peace of mind for policyholders. Unlike term life insurance, which provides coverage for a specific period, whole life insurance remains in force as long as the policyholder pays the premiums, even in their advanced years.

This comprehensive guide aims to delve into the key differences between whole life insurance and term life insurance, shedding light on their distinct features, benefits, and suitability for different life stages and financial goals. By understanding these differences, individuals can make informed decisions about their life insurance coverage, ensuring adequate protection for their loved ones and a secure financial future.

Understanding Whole Life Insurance

Whole life insurance, also known as permanent life insurance, is a comprehensive financial tool designed to provide lifelong coverage. This type of insurance policy remains active throughout the insured’s life, offering a range of benefits that extend beyond mere financial protection. Whole life insurance policies are tailored to meet the unique needs of individuals, taking into account their specific financial goals, family obligations, and long-term aspirations.

One of the key advantages of whole life insurance is its guaranteed death benefit. This means that, regardless of the insured's age or health condition at the time of death, their beneficiaries will receive the full sum assured, ensuring financial security and stability during a difficult time. Whole life insurance policies also accumulate cash value over time, which can be borrowed against or used for various financial purposes, such as funding retirement, paying for a child's education, or covering unexpected expenses.

The premiums for whole life insurance are typically higher compared to term life insurance, as they are designed to cover the insured for their entire life. However, the stability and predictability of whole life insurance premiums make it an attractive option for individuals seeking long-term financial planning. Whole life insurance policies often offer the flexibility to adjust coverage amounts and benefit structures as the insured's needs evolve, providing a customizable and adaptable solution for life's changing circumstances.

Term Life Insurance: A Short-Term Solution

Term life insurance, on the other hand, offers coverage for a specified period, typically ranging from 10 to 30 years. It is designed to provide temporary financial protection during specific life stages, such as when individuals have young children or significant financial obligations. Term life insurance policies are generally more affordable compared to whole life insurance, making them an attractive option for those seeking short-term coverage at a lower cost.

The primary purpose of term life insurance is to ensure that beneficiaries receive a financial payout in the event of the insured's untimely death. This payout can help cover immediate expenses, such as funeral costs, outstanding debts, or ongoing living expenses for dependent family members. Term life insurance policies often have flexible terms, allowing individuals to choose coverage periods that align with their specific needs and life stages.

While term life insurance offers cost-effective coverage, it is important to note that the premiums may increase as the policyholder ages. Additionally, if the policyholder outlives the term of the policy, they may need to purchase a new policy, which could be more expensive due to their advanced age and potential health conditions. Term life insurance policies do not accumulate cash value, making them a purely protective measure without the additional financial benefits offered by whole life insurance.

Key Differences Between Whole Life and Term Life Insurance

When comparing whole life and term life insurance, several key differences emerge that can help individuals make informed choices based on their unique circumstances and financial goals.

Coverage Period

The most significant difference between whole life and term life insurance is the coverage period. Whole life insurance, as the name suggests, provides coverage for the insured’s entire life, offering lifelong protection and financial security. On the other hand, term life insurance offers coverage for a specific term, typically ranging from 10 to 30 years, after which the coverage expires unless renewed.

Premium Costs

Whole life insurance policies generally have higher premium costs compared to term life insurance. This is because whole life insurance premiums are designed to cover the insured for their entire life, regardless of their age or health status. In contrast, term life insurance premiums are often more affordable, especially during the initial years of the policy, as they are based on the insured’s age and health at the time of purchase.

Cash Value Accumulation

Whole life insurance policies accumulate cash value over time, which acts as a savings component within the policy. This cash value can be borrowed against or withdrawn by the policyholder, providing additional financial flexibility. Term life insurance, however, does not offer cash value accumulation, as it is solely a protective measure without any associated savings benefits.

Flexibility and Customization

Whole life insurance policies offer a higher degree of flexibility and customization compared to term life insurance. Policyholders can adjust their coverage amounts, benefit structures, and even add optional riders to tailor their policy to their changing needs and financial goals. Term life insurance, on the other hand, offers less flexibility, as it is designed for a specific term and provides a fixed death benefit during that period.

Renewability and Convertibility

Whole life insurance policies do not require renewal, as they remain in force as long as the policyholder pays the premiums. This provides long-term stability and peace of mind. Term life insurance policies, however, require renewal at the end of the term, and the premiums may increase significantly with age. Some term life insurance policies offer the option to convert to a whole life policy, providing an opportunity to transition to permanent coverage if desired.

Who Should Consider Whole Life Insurance

Whole life insurance is particularly suitable for individuals seeking long-term financial protection and stability. It is ideal for those who want to ensure that their loved ones are financially secure, even in the event of their untimely death. Whole life insurance can also be beneficial for individuals with specific financial goals, such as funding a child’s education, paying off a mortgage, or supplementing retirement income.

Individuals with significant financial obligations, such as business owners or those with high-value assets, may find whole life insurance appealing due to its comprehensive coverage and cash value accumulation. Additionally, whole life insurance can be a valuable tool for estate planning, as it provides a way to transfer wealth to beneficiaries while minimizing potential tax liabilities.

Who Should Consider Term Life Insurance

Term life insurance is often a preferred choice for individuals who are seeking cost-effective coverage during specific life stages. It is ideal for those with young children, significant debts, or other financial obligations that require protection for a limited period. Term life insurance is particularly attractive for individuals who want to ensure their family’s financial well-being in the event of their untimely death, without the long-term commitment and higher premiums associated with whole life insurance.

Individuals with temporary financial needs, such as covering a mortgage or paying for their child's education during their dependent years, may find term life insurance sufficient for their purposes. Term life insurance can also be a suitable option for those who are healthy and can obtain coverage at a relatively low cost, as it provides a substantial death benefit for a limited term.

Choosing the Right Insurance for Your Needs

Selecting the appropriate type of life insurance depends on various factors, including individual financial goals, family obligations, and life stage. Whole life insurance offers comprehensive coverage, cash value accumulation, and long-term stability, making it an attractive option for those seeking lifelong protection and financial security. Term life insurance, on the other hand, provides cost-effective coverage for a specified term, making it ideal for individuals with temporary financial needs or those seeking protection during specific life stages.

When making a decision, it is essential to consider one's current and future financial situation, as well as any specific goals or obligations that may require financial protection. Consulting with a financial advisor or insurance professional can provide valuable insights and guidance tailored to individual circumstances. By carefully evaluating the differences between whole life and term life insurance, individuals can make informed choices that align with their unique needs and ensure the financial well-being of their loved ones.

Performance Analysis and Real-World Examples

To illustrate the differences between whole life and term life insurance, let’s consider two hypothetical individuals, John and Sarah, and their unique financial situations.

John’s Whole Life Insurance Policy

John, a 35-year-old business owner, recently purchased a whole life insurance policy with a $1 million death benefit. His policy offers a guaranteed death benefit and accumulates cash value over time. John’s primary goal is to ensure that his business and family are financially secure, even if he were to pass away unexpectedly.

With his whole life insurance policy, John can borrow against the accumulated cash value to fund business expansions or cover unexpected expenses. He can also adjust his coverage amount and add optional riders to enhance his policy's benefits as his business grows and his financial needs change. John's whole life insurance policy provides him with long-term financial stability and peace of mind, knowing that his loved ones will be protected regardless of his age or health status.

Sarah’s Term Life Insurance Policy

Sarah, a 28-year-old with young children, opted for a 20-year term life insurance policy with a $500,000 death benefit. Her policy provides temporary financial protection for her family during a critical period when her children are dependent. Sarah’s term life insurance policy is cost-effective, allowing her to secure a substantial death benefit without straining her budget.

Sarah's primary concern is ensuring that her children's education and living expenses are covered if she were to pass away during their dependent years. Her term life insurance policy provides her with the necessary financial security during this period. As her children grow older and become more financially independent, Sarah can reassess her insurance needs and consider transitioning to a whole life policy if desired.

Future Implications and Expert Insights

The choice between whole life and term life insurance depends on individual circumstances and financial goals. Whole life insurance offers lifelong protection, cash value accumulation, and flexibility, making it an attractive option for those seeking long-term financial stability. Term life insurance, on the other hand, provides cost-effective coverage for a specified term, catering to individuals with temporary financial needs or those seeking protection during specific life stages.

As individuals progress through different life stages, their financial needs and priorities may evolve. Whole life insurance can adapt to these changes, offering customizable coverage and benefit structures. Term life insurance, while providing temporary protection, may require renewal or the purchase of a new policy as individuals age, potentially resulting in higher premiums. Therefore, it is crucial to periodically review one's insurance coverage and make adjustments as needed to ensure adequate protection for oneself and one's loved ones.

Frequently Asked Questions

Can I convert my term life insurance policy to a whole life policy?

+

Yes, many term life insurance policies offer the option to convert to a whole life policy within a certain timeframe. Conversion typically involves a medical exam and may result in higher premiums. It’s advisable to review the terms of your policy and consult with your insurance provider to understand the conversion process and potential costs.

What happens if I outlive my term life insurance policy?

+

If you outlive your term life insurance policy, the coverage expires, and you will no longer have insurance protection. However, some term life policies offer a renewal option, allowing you to extend the coverage period for an additional term. Renewal may result in higher premiums due to increased age and potential health changes.

Are whole life insurance premiums guaranteed for life?

+

Whole life insurance premiums are typically guaranteed for life, meaning they remain stable and do not increase as you age. However, it’s important to review the specific terms of your policy, as some whole life policies may have premium adjustments or riders that impact the premium structure.

Can I borrow against the cash value of my whole life insurance policy?

+

Yes, one of the key advantages of whole life insurance is the ability to borrow against the accumulated cash value. This feature provides policyholders with access to funds for various financial needs, such as funding retirement, covering emergency expenses, or investing in business ventures. However, it’s important to understand the terms and potential impact on your policy’s death benefit and cash value growth.

How does whole life insurance impact my estate planning?

+

Whole life insurance can play a significant role in estate planning, as it provides a way to transfer wealth to beneficiaries while minimizing potential tax liabilities. The death benefit from a whole life policy can be used to cover estate taxes, pay off debts, or fund charitable donations, ensuring that your loved ones receive the intended inheritance.