Va Dental Insurance

Dental insurance is an essential aspect of healthcare coverage, ensuring individuals have access to necessary dental treatments and preventive care. In the state of Virginia, known as "Va" for short, understanding the intricacies of dental insurance plans is crucial for residents to make informed decisions about their oral health and financial well-being. This comprehensive guide aims to delve into the world of Va Dental Insurance, shedding light on its benefits, coverage options, and how it impacts the lives of Virginians.

The Importance of Dental Insurance in Virginia

Maintaining optimal oral health is a cornerstone of overall well-being, and dental insurance plays a pivotal role in ensuring Virginians can access the dental care they need without incurring excessive financial burdens. With a focus on preventive care and early intervention, Va Dental Insurance plans promote regular dental check-ups, cleanings, and essential treatments, helping to prevent more complex and costly dental issues down the line.

The significance of dental insurance extends beyond mere convenience. It provides peace of mind, knowing that the costs of dental emergencies, major procedures, and specialized treatments are partially or fully covered. This financial protection is especially crucial for families, individuals with pre-existing dental conditions, and those requiring ongoing orthodontic care.

Understanding Va Dental Insurance Plans

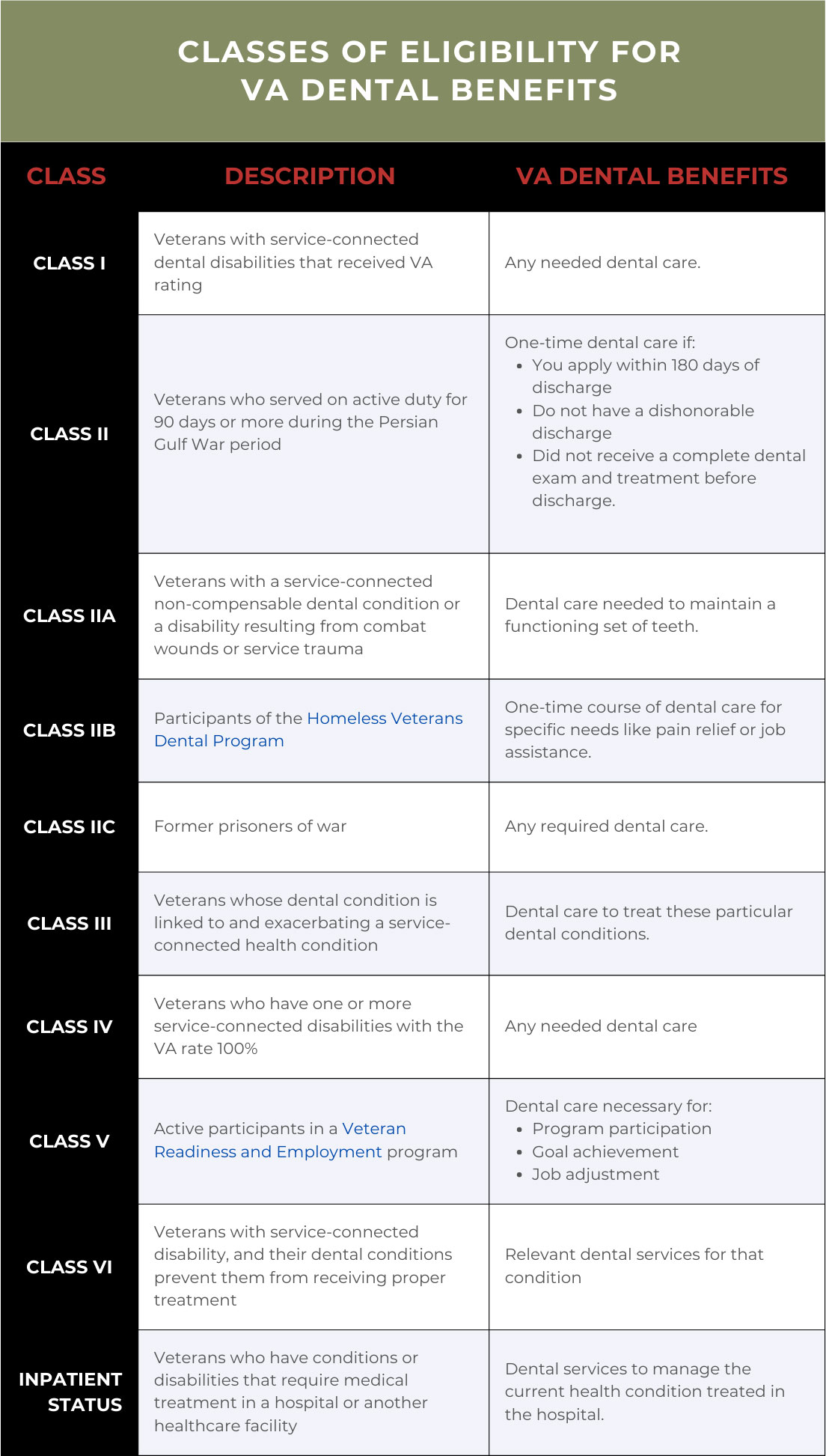

Va Dental Insurance offers a range of plan options to cater to the diverse needs of Virginians. These plans can be broadly categorized into several types, each with its unique features and coverage levels.

Indemnity Plans

Indemnity plans, also known as fee-for-service plans, provide the most flexibility in terms of dental care choices. With this type of plan, individuals can visit any licensed dentist without prior authorization. The plan reimburses a certain percentage of the total cost, typically ranging from 50% to 80%, depending on the specific plan and the type of dental service received. This coverage is particularly beneficial for those who prefer a broader network of dental providers and appreciate the freedom to choose their own dentist.

Indemnity plans often include annual maximums, which cap the total amount the insurance company will reimburse in a given year. These maximums can vary widely, with some plans offering coverage up to $1,500 per person, while others may extend to $2,500 or more. It's essential for individuals to understand these limits when selecting an indemnity plan to ensure it aligns with their anticipated dental needs.

Preferred Provider Organization (PPO) Plans

PPO plans in Virginia offer a balance between flexibility and cost savings. Under this arrangement, policyholders have the freedom to choose any dentist, whether in or out of the plan’s network. However, utilizing in-network providers typically results in lower out-of-pocket costs.

PPO plans often provide coverage for a wide range of dental services, including preventive care, basic procedures, and major treatments. The exact coverage levels can vary, with some plans covering 100% of preventive services, while others may offer 50% to 80% coverage for basic and major procedures. Policyholders typically pay a set copay or coinsurance amount for each service, with the insurance company covering the remainder.

One of the key advantages of PPO plans is the comprehensive network of participating dentists. Virginians can rest assured that they have access to a diverse range of dental professionals, making it easier to find a provider that suits their specific needs and preferences.

Dental Health Maintenance Organization (DHMO) Plans

DHMO plans are known for their affordability and comprehensive coverage. These plans operate on a managed care model, where policyholders are assigned a primary dentist from the plan’s network. While individuals have the freedom to choose their own dentist within the network, any treatment must be coordinated through this assigned provider.

The primary benefit of DHMO plans is the high level of coverage they offer for a wide range of dental services. Policyholders typically pay a low monthly premium and may have minimal or no out-of-pocket costs for preventive care and basic procedures. In many cases, DHMO plans cover 100% of the cost for routine check-ups, cleanings, and X-rays, promoting regular dental visits and early detection of potential issues.

DHMO plans are particularly attractive to individuals and families seeking cost-effective dental coverage without compromising on the quality of care. With a strong focus on preventive measures, these plans can significantly reduce the likelihood of more costly dental interventions in the future.

Dental Discount Plans

Dental discount plans are an alternative to traditional insurance coverage, offering savings on dental services without the typical insurance features like copays and deductibles. Instead, members pay an annual fee to access discounted rates at participating dental providers.

These plans can be especially appealing to individuals who require limited dental care or those who are looking for cost-effective options for routine check-ups and cleanings. While dental discount plans may not provide coverage for more extensive treatments, they can be a viable option for maintaining basic oral hygiene and preventing more serious dental issues.

Key Considerations for Va Dental Insurance

When navigating the world of Va Dental Insurance, several critical factors come into play, each impacting the overall value and suitability of a plan for individual needs.

Coverage and Benefits

The scope of coverage is a fundamental aspect of any dental insurance plan. Virginians should carefully review the benefits offered by different plans, considering their current and anticipated dental needs. This includes evaluating coverage for routine check-ups, cleanings, fillings, root canals, extractions, and more complex procedures like crowns, bridges, and implants.

Additionally, understanding the plan's coverage limits, such as annual maximums and lifetime benefits, is essential. Some plans may have higher maximums for certain types of procedures, while others may offer more comprehensive coverage for specific treatments. Policyholders should also be aware of any waiting periods for certain procedures, which can vary significantly between plans.

Network of Providers

The network of participating dentists is another crucial consideration when selecting a Va Dental Insurance plan. Individuals should assess whether their preferred dental providers are in-network, as this can significantly impact their out-of-pocket costs. A robust network ensures access to a diverse range of dental specialists, making it easier to find the right provider for specialized treatments.

For those with specific preferences or existing relationships with dentists, it's essential to verify that these providers are included in the plan's network. In cases where an out-of-network provider is necessary, individuals should understand the potential out-of-pocket costs and any limitations on coverage.

Cost and Premiums

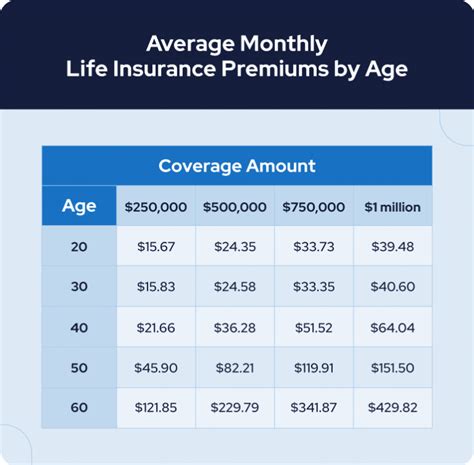

The financial aspect of dental insurance is a critical consideration for Virginians. Plans can vary significantly in terms of monthly premiums, deductibles, copays, and coinsurance amounts. It’s important to strike a balance between the cost of the plan and the coverage it provides, ensuring that the chosen plan aligns with both budgetary constraints and anticipated dental needs.

Individuals should carefully review the cost breakdown for different plans, considering not only the initial premium but also potential out-of-pocket expenses for various dental procedures. Understanding these financial implications can help Virginians make informed decisions about their dental insurance coverage.

The Impact of Va Dental Insurance on Oral Health

Va Dental Insurance has a profound impact on the oral health and well-being of Virginians. By providing access to essential dental care, these plans promote early detection and treatment of dental issues, leading to better overall health outcomes.

With the financial protection offered by dental insurance, individuals are more likely to seek regular dental check-ups and cleanings, which are fundamental for maintaining optimal oral hygiene. These preventive measures can identify potential problems early on, allowing for timely interventions that can prevent more severe dental conditions from developing.

Moreover, Va Dental Insurance plans often cover a wide range of dental treatments, including restorative procedures and orthodontic care. This comprehensive coverage ensures that individuals can address not only immediate dental concerns but also long-term oral health goals. Whether it's filling a cavity, undergoing root canal therapy, or straightening teeth with braces, dental insurance provides the necessary financial support to access these vital services.

Conclusion: Empowering Virginians with Dental Insurance

Va Dental Insurance is a powerful tool for Virginians to take control of their oral health and overall well-being. By offering a range of plan options, from flexible indemnity plans to cost-effective DHMO models, Virginians can find a plan that aligns with their unique needs and preferences.

With the right dental insurance coverage, individuals can access the preventive care and treatments they need to maintain healthy smiles. Whether it's addressing dental emergencies, undergoing complex procedures, or simply keeping up with regular check-ups, Va Dental Insurance ensures that Virginians can prioritize their oral health without financial strain.

As we conclude this comprehensive guide, we hope to have provided valuable insights into the world of Va Dental Insurance, empowering Virginians to make informed decisions about their dental care and ultimately enhancing their quality of life.

How do I choose the right Va Dental Insurance plan for my needs?

+Selecting the right Va Dental Insurance plan involves considering several factors, including your current and anticipated dental needs, the coverage and benefits offered by different plans, the network of providers, and the cost of premiums and out-of-pocket expenses. It’s important to carefully review these aspects and choose a plan that aligns with your oral health goals and financial situation.

Are there any dental insurance plans that cover cosmetic procedures?

+The coverage for cosmetic dental procedures varies among Va Dental Insurance plans. While some plans may offer limited coverage for certain cosmetic treatments, such as teeth whitening, others may exclude these procedures altogether. It’s crucial to review the specific plan details and exclusions to understand the extent of cosmetic coverage.

Can I switch my Va Dental Insurance plan if I’m not satisfied with my current coverage?

+Yes, you have the option to switch your Va Dental Insurance plan if you find that your current coverage does not meet your needs. However, it’s important to understand the enrollment periods and any potential restrictions or penalties associated with changing plans. Typically, open enrollment periods occur annually, allowing you to make changes to your coverage during that time.

What happens if I need emergency dental care while traveling outside of Virginia?

+In the event of an emergency while traveling outside of Virginia, your Va Dental Insurance plan may provide coverage for urgent dental care. However, the specific terms and conditions can vary between plans. It’s recommended to review your policy details or contact your insurance provider to understand the extent of coverage and any necessary steps to access emergency dental services while away from home.