What Kind Of Insurance Is Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) is a renowned name in the healthcare industry, offering a comprehensive range of insurance plans to individuals and families across the United States. With a rich history spanning over a century, BCBS has become a trusted provider, offering security and peace of mind to millions of Americans. In this in-depth exploration, we will delve into the world of Blue Cross Blue Shield insurance, uncovering its types, coverage options, and the impact it has on the lives of its policyholders.

The Evolution of Blue Cross Blue Shield Insurance

The roots of Blue Cross Blue Shield can be traced back to the early 20th century when the concept of prepaid medical care was gaining traction. In 1929, the first Blue Cross plan was established in Dallas, Texas, with the aim of providing hospital coverage to schoolteachers. This innovative idea soon spread across the country, with various independent Blue Cross plans emerging to meet the healthcare needs of different communities.

Similarly, the Blue Shield plans originated in 1939 to offer coverage for physician services. These plans, too, flourished and became integral parts of local healthcare systems. Over time, Blue Cross and Blue Shield plans began to merge and collaborate, forming a nationwide network of trusted healthcare providers.

Today, Blue Cross Blue Shield Association (BCBSA) is a national federation of 35 independent, locally operated Blue Cross and Blue Shield companies. This unique structure allows BCBS to tailor its insurance offerings to the specific needs of each state, while still maintaining a unified brand and a strong national presence.

The Breadth of Blue Cross Blue Shield Insurance

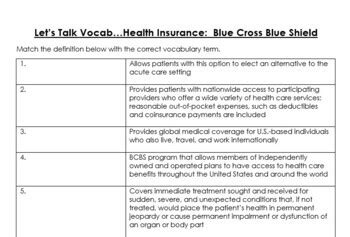

Blue Cross Blue Shield insurance encompasses a wide array of coverage options, catering to the diverse healthcare requirements of individuals, families, and businesses. Let’s explore some of the key types of insurance offered by BCBS:

Individual and Family Plans

BCBS offers a range of individual and family plans designed to provide comprehensive healthcare coverage. These plans typically include access to a network of healthcare providers, prescription drug coverage, and various preventive care services. Policyholders can choose from different plan types, such as Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), or Exclusive Provider Organizations (EPOs), depending on their preferences and healthcare needs.

| Plan Type | Description |

|---|---|

| PPO | Allows policyholders to choose any healthcare provider, with or without a referral, and offers more flexibility in terms of coverage and out-of-network benefits. |

| HMO | Requires policyholders to select a primary care physician (PCP) and obtain referrals for specialty care. HMOs often have lower premiums and out-of-pocket costs but may have more restricted provider networks. |

| EPO | Similar to PPOs, EPOs allow policyholders to choose any healthcare provider within the network. However, unlike PPOs, EPOs do not provide coverage for out-of-network care, except in emergencies. |

Employer-Sponsored Group Plans

Many employers across the United States offer Blue Cross Blue Shield insurance as part of their employee benefits packages. These group plans provide coverage to employees and their families, often at a discounted rate due to the larger pool of policyholders. BCBS works closely with employers to design customized plans that meet the unique needs of their workforce, ensuring comprehensive healthcare coverage while also considering cost-effectiveness.

Medicare and Medicaid Plans

BCBS also plays a significant role in the Medicare and Medicaid programs, offering a variety of plans to cater to the healthcare needs of older adults, individuals with disabilities, and low-income families. These plans include Original Medicare, Medicare Advantage, Medicare Supplement Insurance (Medigap), and Medicaid managed care plans. BCBS works in partnership with the federal and state governments to ensure seamless coverage and access to quality healthcare services for these vulnerable populations.

Student Health Plans

Recognizing the unique healthcare needs of students, BCBS offers specialized health plans tailored to the requirements of higher education institutions. These plans provide coverage for full-time students, often with a focus on preventive care, mental health services, and access to a network of healthcare providers near their campuses. By offering comprehensive coverage, BCBS helps ensure that students can focus on their academic pursuits without worrying about unexpected healthcare costs.

The Benefits of Blue Cross Blue Shield Insurance

Blue Cross Blue Shield insurance offers a multitude of benefits to its policyholders, contributing to their overall well-being and financial security. Let’s explore some of the key advantages:

Comprehensive Coverage

BCBS insurance plans are renowned for their comprehensive coverage, ensuring policyholders have access to a wide range of healthcare services. From routine check-ups and preventive care to specialized treatments and hospital stays, BCBS plans aim to cover all aspects of an individual’s healthcare journey. This comprehensive approach provides policyholders with the peace of mind that their healthcare needs will be met, regardless of their circumstances.

Network of Providers

BCBS has established an extensive network of healthcare providers, including hospitals, physicians, specialists, and pharmacies. Policyholders can rest assured that they will have access to a diverse range of high-quality healthcare professionals, ensuring they receive the best possible care. The network also includes a variety of healthcare facilities, such as urgent care centers and retail clinics, providing convenient and accessible healthcare options for policyholders.

Preventive Care Focus

BCBS places a strong emphasis on preventive care, recognizing its crucial role in maintaining good health and avoiding costly treatments down the line. Many BCBS plans cover a range of preventive services, such as annual physical exams, immunizations, cancer screenings, and counseling services. By promoting proactive healthcare, BCBS helps policyholders stay healthy and catch potential health issues early on, leading to better long-term outcomes.

Pharmaceutical Benefits

BCBS insurance plans typically include prescription drug coverage, ensuring policyholders have access to the medications they need. The plans often feature a comprehensive formulary, covering a wide range of drugs and providing cost-effective options. Policyholders can benefit from reduced copays and discounts on their medications, making essential treatments more affordable and accessible.

Mental Health and Substance Abuse Coverage

Recognizing the importance of mental health and the rising prevalence of substance abuse disorders, BCBS insurance plans often include coverage for these critical areas. Policyholders can access counseling services, therapy sessions, and treatment programs for mental health conditions and substance abuse. By removing financial barriers to mental health care, BCBS aims to support the overall well-being of its policyholders.

The Future of Blue Cross Blue Shield Insurance

As the healthcare landscape continues to evolve, Blue Cross Blue Shield remains at the forefront, adapting and innovating to meet the changing needs of its policyholders. With a strong focus on digital health solutions and personalized care, BCBS is poised to enhance its offerings and improve the overall healthcare experience.

One key area of focus for BCBS is the integration of technology into its insurance plans. The company is investing in digital health platforms, telemedicine services, and health monitoring devices to provide policyholders with convenient and accessible healthcare options. By leveraging technology, BCBS aims to improve care coordination, enhance patient engagement, and reduce healthcare costs.

Additionally, BCBS is committed to addressing social determinants of health, recognizing that factors such as income, education, and social support play a significant role in an individual's overall well-being. The company is exploring partnerships and initiatives to improve access to healthy food, safe housing, and educational opportunities, ultimately reducing health disparities and improving the overall health of its communities.

Conclusion

Blue Cross Blue Shield insurance has become a trusted companion for millions of Americans, offering a wide range of coverage options and comprehensive healthcare solutions. With its rich history, extensive provider network, and commitment to innovation, BCBS continues to make a significant impact on the lives of its policyholders. As the healthcare industry evolves, BCBS remains dedicated to providing accessible, affordable, and high-quality care, ensuring a healthier future for all.

How can I find out which Blue Cross Blue Shield plans are available in my state?

+You can visit the Blue Cross Blue Shield website and use their plan finder tool to search for available plans in your state. Alternatively, you can contact your local BCBS company directly to inquire about their specific offerings.

What are the key differences between PPO, HMO, and EPO plans offered by Blue Cross Blue Shield?

+PPO plans offer the most flexibility, allowing policyholders to choose any healthcare provider, with or without a referral, and providing coverage for out-of-network care. HMO plans require policyholders to select a primary care physician and obtain referrals for specialty care, often with lower premiums and out-of-pocket costs. EPO plans, similar to PPOs, allow policyholders to choose any provider within the network, but do not provide coverage for out-of-network care, except in emergencies.

Does Blue Cross Blue Shield cover pre-existing conditions?

+Yes, Blue Cross Blue Shield insurance plans are required to cover pre-existing conditions under the Affordable Care Act (ACA). This means that policyholders can obtain coverage regardless of their health status, and their pre-existing conditions cannot be used as a basis for denial or discrimination.

How can I compare Blue Cross Blue Shield insurance plans to find the best fit for my needs?

+When comparing BCBS insurance plans, consider factors such as the provider network, coverage options, out-of-pocket costs, and any additional benefits or discounts offered. It’s also important to evaluate your specific healthcare needs and preferences to ensure the plan aligns with your requirements. You can utilize online comparison tools or consult with a licensed insurance agent for guidance.