Average Price Of Home Insurance

Home insurance is an essential aspect of protecting your most valuable asset, your home. With various factors influencing the cost of coverage, understanding the average price of home insurance is crucial for homeowners. In this comprehensive article, we delve into the world of home insurance premiums, exploring the key determinants, regional variations, and strategies to secure the best rates. By examining real-world data and industry insights, we aim to provide an in-depth analysis that empowers homeowners to make informed decisions.

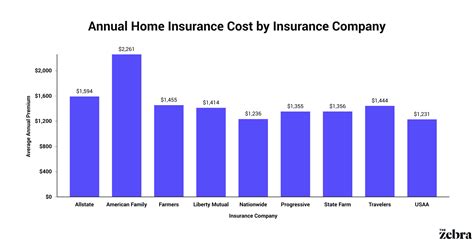

Unveiling the Average Cost of Home Insurance

The average price of home insurance can vary significantly depending on numerous factors. It’s important to note that while we aim to provide a comprehensive overview, the exact costs can fluctuate based on individual circumstances and regional differences. Let’s break down the key elements that contribute to the average cost of home insurance.

The Impact of Location

One of the primary determinants of home insurance premiums is the location of your residence. Insurance companies consider various geographical factors when assessing risk, which directly influences the cost of coverage. Here’s a glimpse at how location can impact your home insurance rates:

- Urban vs. Rural Areas: Homes located in urban areas often face higher insurance costs due to increased risks associated with dense populations, such as higher crime rates and the potential for natural disasters like hurricanes or tornadoes.

- Regional Differences: Different regions have varying weather patterns and natural disaster risks. For instance, coastal areas prone to hurricanes may experience higher premiums compared to inland regions. Similarly, earthquake-prone areas like California often carry higher insurance costs.

- Crime Rates: Regions with higher crime rates may see increased insurance premiums as insurance companies factor in the potential for property damage or theft.

Coverage Factors

The type and extent of coverage you choose play a significant role in determining your home insurance premiums. Here are some key coverage factors to consider:

- Dwelling Coverage: This refers to the coverage for the physical structure of your home. The amount of coverage required depends on the replacement cost of your home, which can vary based on factors like construction type and location.

- Personal Property Coverage: This coverage protects your personal belongings within your home. The value of your possessions and the level of coverage you opt for will impact your premiums.

- Liability Coverage: Liability insurance provides protection against lawsuits and medical expenses if someone is injured on your property. The level of liability coverage you choose can affect your overall insurance costs.

- Additional Coverages: Some homeowners may opt for additional coverage options, such as flood insurance or earthquake insurance, to protect against specific risks. These optional coverages can add to the overall cost of your home insurance policy.

Home Characteristics and Condition

The characteristics and condition of your home are essential factors that insurance companies consider when determining your premiums. Here’s how your home’s features can impact your insurance costs:

- Age of the Home: Older homes may require more extensive coverage due to potential aging infrastructure and increased risk of damage. This can lead to higher insurance premiums.

- Construction Type: The materials used in your home’s construction can affect insurance costs. Homes built with materials like brick or stone may be more resistant to certain types of damage, potentially leading to lower premiums.

- Home Improvements: Upgrades and improvements to your home, such as adding a security system or fire-resistant features, can reduce insurance risks and potentially lower your premiums.

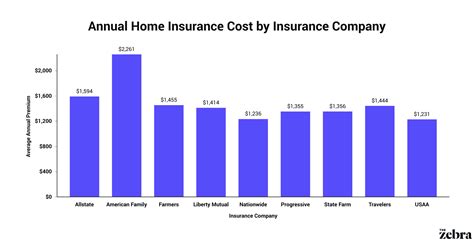

Regional Variations and Industry Insights

To provide a more detailed understanding of home insurance costs, let’s explore some real-world data and industry insights from different regions:

| Region | Average Annual Premium | Key Factors |

|---|---|---|

| Northeastern United States | 1,500 - 2,000 | High risk of natural disasters like hurricanes and nor’easters. Dense populations and higher crime rates contribute to higher premiums. |

| Southeastern United States | 1,000 - 1,500 | Prone to hurricanes and tornadoes. Coastal areas face higher risks, leading to increased premiums. |

| Midwestern United States | 800 - 1,200 | Lower risk of natural disasters, but severe weather events like tornadoes and blizzards can still impact premiums. Overall, premiums tend to be more affordable. |

| Western United States | 1,200 - 1,800 | Varies greatly due to diverse geography. Coastal areas face hurricane risks, while inland regions may experience earthquakes. Wildfires are also a concern in certain areas. |

Strategies for Securing the Best Rates

While the average price of home insurance is influenced by various factors beyond your control, there are strategies you can employ to potentially reduce your premiums. Here are some tips to consider:

- Bundle Policies: Combining your home insurance with other policies, such as auto insurance, can often result in discounted rates.

- Increase Deductibles: Opting for a higher deductible can lower your insurance premiums. However, ensure that the deductible amount is manageable in case of a claim.

- Home Security Measures: Installing security systems, smoke detectors, and fire extinguishers can reduce the risk of theft and fire-related incidents, potentially leading to lower premiums.

- Regular Maintenance: Maintaining your home in good condition can mitigate potential risks. Regular inspections and timely repairs can demonstrate to insurance companies that your home is well-maintained, which may result in lower premiums.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare rates and coverage options. This allows you to make an informed decision and potentially find the best value for your home insurance needs.

Future Implications and Industry Trends

As the insurance industry evolves, several trends and factors may influence the average price of home insurance in the future. Here are some key considerations:

- Climate Change: The increasing frequency and severity of natural disasters due to climate change may lead to higher insurance premiums, especially in vulnerable regions.

- Technology Advances: Technological advancements, such as smart home devices and AI-powered risk assessment tools, may enable insurance companies to offer more precise and tailored coverage, potentially impacting premiums.

- Regulatory Changes: Government regulations and policies can influence the insurance industry. Changes in laws related to insurance coverage or disaster relief programs may impact the cost and availability of home insurance.

- Market Competition: Increased competition among insurance providers can drive down prices as companies strive to offer competitive rates and attract customers. Keeping an eye on market trends can help homeowners make informed choices.

Conclusion

Understanding the average price of home insurance is a crucial step in ensuring you have adequate coverage without breaking the bank. By considering the factors discussed, from location and coverage choices to home characteristics and regional variations, you can make informed decisions about your home insurance policy. Remember, while averages provide a general guide, your specific circumstances and the advice of insurance professionals will be instrumental in securing the best coverage and rates for your home.

How often should I review my home insurance policy and premiums?

+It is recommended to review your home insurance policy and premiums annually or whenever there are significant changes to your home, such as renovations or additions. Regular reviews ensure that your coverage remains adequate and that you are not overpaying for unnecessary coverage.

Can I negotiate my home insurance premiums?

+While insurance premiums are generally non-negotiable, you can discuss your options with your insurance provider to explore potential discounts or alternative coverage options that align with your needs and budget.

What factors can lead to an increase in my home insurance premiums?

+Several factors can contribute to an increase in home insurance premiums, including changes in your home’s value, the addition of high-value possessions, a history of claims, or even shifts in the insurance market. Regularly reviewing your policy and staying informed about potential changes can help you manage these increases.