Dentist Insurance Plan

Dental insurance plans are an essential aspect of healthcare coverage, offering individuals and families peace of mind and access to vital oral health services. In today's world, where dental care is often costly, having a comprehensive insurance plan can be a game-changer, ensuring that individuals can maintain optimal oral health without incurring significant financial burdens. This article delves into the intricacies of dentist insurance plans, exploring their features, benefits, and the impact they have on dental healthcare accessibility.

Understanding Dentist Insurance Plans

Dentist insurance plans, often referred to as dental insurance, are designed to cover the costs associated with dental treatments and procedures. These plans are typically offered by private insurance companies and can be purchased as standalone policies or as part of a broader health insurance package. The primary objective of dentist insurance is to make dental care more affordable and accessible, thereby encouraging individuals to prioritize their oral health.

Key Components of Dentist Insurance Plans

Dental insurance plans come in various forms, each with its unique features and coverage limits. Here are some common components of dentist insurance plans:

- Preventive Care: Most plans cover preventive services like dental cleanings, check-ups, and X-rays, which are essential for maintaining good oral hygiene.

- Basic Restorative Procedures: This includes treatments such as fillings, root canals, and extractions. These procedures are often covered at a higher percentage than major procedures.

- Major Restorative Procedures: Dental insurance plans may also cover more complex procedures like crowns, bridges, and dentures, although these are usually subject to higher out-of-pocket costs.

- Orthodontic Treatment: Some plans offer coverage for orthodontic services, which can be a significant benefit for those requiring braces or other corrective treatments.

- Maximum Annual Benefits: Every plan has a maximum annual limit, beyond which the insurance company will not cover any further expenses. This limit can vary significantly between plans.

- Waiting Periods: Certain procedures, especially major ones, may have waiting periods before they are covered by the insurance. This is to prevent individuals from taking out insurance only when they need a specific treatment.

- Network Providers: Many insurance plans have a network of preferred dentists and specialists. Visiting an out-of-network provider may result in higher out-of-pocket costs.

The Benefits of Dentist Insurance Plans

The advantages of having a dentist insurance plan are multifaceted and can significantly improve an individual’s overall health and quality of life. Here are some key benefits:

Cost Savings

One of the most obvious advantages of dentist insurance is the financial relief it provides. Dental procedures can be expensive, and without insurance, individuals may delay or forego necessary treatments due to the cost. With insurance, the cost of treatments is shared between the insured and the insurance company, making oral healthcare more affordable.

| Treatment | Average Cost | With Insurance Coverage |

|---|---|---|

| Dental Cleaning | $100 | $20 (Co-pay) |

| Root Canal | $1,200 | $300 (After Deductible) |

| Crown | $1,500 | $600 (Out-of-Pocket) |

Improved Accessibility

Dentist insurance plans make dental care more accessible to a broader population. By covering preventive and basic procedures, insurance encourages regular dental check-ups, which are crucial for early detection and treatment of oral health issues. This proactive approach can lead to better overall health outcomes.

Coverage for Emergencies

Dental emergencies can be both painful and costly. With dentist insurance, individuals are prepared for unexpected dental issues. Whether it’s a sudden toothache or a broken tooth, having insurance can ensure that the necessary treatment is accessible without causing financial strain.

Orthodontic Coverage

Many dentist insurance plans now include coverage for orthodontic treatments, which can be a significant benefit for those with misaligned teeth or bite issues. Orthodontic care can be costly, and having insurance can make the prospect of braces or other corrective treatments more feasible.

Choosing the Right Dentist Insurance Plan

Selecting the appropriate dentist insurance plan is crucial to ensure you receive the coverage you need. Here are some factors to consider when choosing a plan:

- Coverage Limits: Understand the plan’s coverage limits for various procedures. Ensure that the plan covers the treatments you anticipate needing.

- Network Providers: Check if your preferred dentist is in the insurance plan’s network. If not, you may incur higher out-of-pocket costs.

- Waiting Periods: Be aware of any waiting periods for specific procedures. This can impact your ability to receive timely treatment.

- Annual Maximum Benefits: Ensure that the plan’s annual maximum benefit is sufficient to cover your anticipated dental needs.

- Additional Benefits: Some plans offer extra benefits like dental accident coverage or discounts on cosmetic procedures. These can be valuable additions.

Performance Analysis and Future Implications

Dentist insurance plans have been instrumental in improving oral healthcare accessibility and affordability. However, there are ongoing discussions and developments in the industry that could shape the future of dental insurance.

Increasing Demand for Dental Care

As awareness of oral health’s importance grows, there is a rising demand for dental services. This trend is likely to continue, with more individuals recognizing the link between oral health and overall well-being. Dentist insurance plans will play a pivotal role in meeting this demand, ensuring that individuals can access the care they need.

Technological Advancements

The dental industry is embracing technological advancements, from digital X-rays to 3D printing for dental prosthetics. These innovations can improve treatment outcomes and patient experiences. Dentist insurance plans will need to adapt to cover these new technologies, ensuring that policyholders have access to the latest advancements in dental care.

Preventive Care Focus

There is a growing emphasis on preventive dental care, with many insurance plans now offering incentives for regular check-ups and cleanings. This shift towards prevention can lead to better oral health outcomes and potentially lower long-term costs for both individuals and insurance providers.

The Rise of Telehealth

Telehealth services have gained popularity, especially during the COVID-19 pandemic. Dental insurance plans may need to incorporate telehealth options, allowing for virtual consultations and remote monitoring. This can enhance accessibility and convenience for policyholders.

Addressing Dental Health Disparities

Dental health disparities, particularly among underserved communities, remain a significant concern. Dentist insurance plans can play a role in addressing these disparities by offering affordable coverage options and promoting oral health education in these communities.

Conclusion

Dentist insurance plans are a vital component of comprehensive healthcare coverage, ensuring that individuals have access to essential oral health services. With a range of coverage options and benefits, these plans provide financial protection and encourage proactive dental care. As the dental industry evolves, dentist insurance plans will continue to adapt, ensuring that policyholders receive the best possible care while managing their oral health needs.

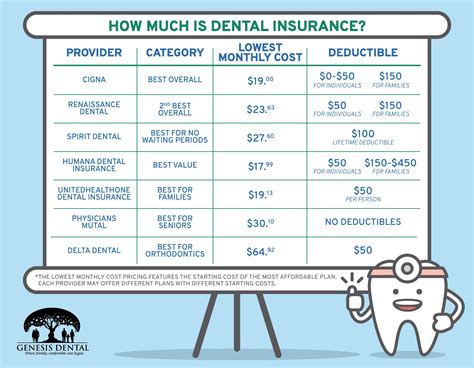

What is the average cost of a dental insurance plan per month?

+The cost of a dental insurance plan can vary significantly based on factors like the level of coverage, the provider, and the region. On average, individual dental insurance plans can range from 30 to 50 per month, while family plans can cost 100 to 200 per month.

Do all dentist insurance plans cover orthodontic treatment?

+Not all plans cover orthodontic treatment. Some plans may offer limited coverage for braces or other orthodontic appliances, while others may not cover orthodontic care at all. It’s essential to review the plan’s coverage details carefully before enrolling.

How long is the typical waiting period for major dental procedures under insurance plans?

+Waiting periods for major procedures can vary between plans but are typically between 6 to 12 months. This period is designed to prevent individuals from taking out insurance only when they need a specific treatment.