Health Insurance Companies America

The health insurance landscape in America is a complex and multifaceted industry, playing a pivotal role in the nation's healthcare system. With a diverse range of providers, plans, and coverage options, it serves as a crucial intermediary between patients and healthcare providers, ensuring accessibility and affordability of medical services. This comprehensive guide aims to delve into the intricacies of this industry, shedding light on its historical evolution, current trends, and future prospects.

Understanding the Fundamentals: Health Insurance in America

Health insurance in the United States is a vital component of the healthcare system, providing financial protection to individuals and families against the high costs of medical care. It acts as a contractual agreement between an insurer (usually an insurance company, a government agency, or a non-profit organization) and an individual or group, where the insurer agrees to provide specified healthcare benefits in exchange for a premium.

The roots of health insurance in America can be traced back to the early 20th century when hospitals began offering prepaid plans to cover the cost of medical services. Over time, these plans evolved into more comprehensive health insurance policies, offering coverage for a wide range of medical expenses, including hospitalization, physician services, prescription drugs, and preventive care.

Key Components of Health Insurance

- Premiums: The amount an individual or employer pays to an insurance company for health coverage.

- Deductibles: The amount an individual must pay out-of-pocket before the insurance company starts paying for covered services.

- Co-payments: A fixed amount an individual pays for a covered healthcare service, typically at the time of service.

- Coinsurance: The percentage of the total cost of a covered healthcare service that an individual must pay, often after meeting the deductible.

- Out-of-Pocket Maximum: The most an individual will have to pay for covered services in a given year, after which the insurance company pays for all covered services.

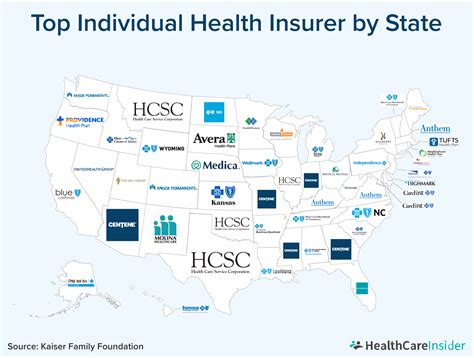

Market Overview: Major Health Insurance Companies in America

The American health insurance market is dominated by a handful of major players, each with its unique offerings and market strategies. These companies, through their various plans and policies, provide coverage to millions of Americans, ensuring their access to essential healthcare services.

UnitedHealth Group

UnitedHealth Group, often referred to as UnitedHealthcare, is one of the largest health insurance providers in the United States. With a comprehensive range of health plans, including employer-sponsored plans, individual and family plans, and Medicare and Medicaid plans, UnitedHealthcare serves millions of Americans. The company’s network includes more than 1.3 million physicians and care professionals, and over 6,500 hospitals across the nation, ensuring extensive coverage and accessibility.

| Key Metrics | UnitedHealth Group |

|---|---|

| Revenue (2022) | $305.7 Billion |

| Market Cap | $461.45 Billion |

| Number of Lives Covered | 48 Million |

Anthem

Anthem, formerly known as WellPoint, is another prominent player in the American health insurance market. The company offers a wide array of health plans, including commercial health plans, Medicare, and Medicaid plans. Anthem’s coverage extends across several states, including California, Colorado, Indiana, Kentucky, Maine, Missouri, Nevada, New Hampshire, New York, Ohio, Virginia, and Wisconsin.

| Key Metrics | Anthem |

|---|---|

| Revenue (2022) | $132.6 Billion |

| Market Cap | $75.34 Billion |

| Number of Lives Covered | 39.8 Million |

Kaiser Permanente

Kaiser Permanente is a unique player in the health insurance industry, as it operates as an integrated managed care consortium, combining its own group practice foundation with its own health plan. This integrated model allows Kaiser Permanente to provide comprehensive healthcare services to its members, including preventive care, specialty care, and hospital care. The company operates in eight states and the District of Columbia, serving over 12.5 million members.

| Key Metrics | Kaiser Permanente |

|---|---|

| Revenue (2022) | $93.2 Billion |

| Number of Lives Covered | 12.5 Million |

| Number of Medical Centers | 39 |

Cigna

Cigna is a global health service company, offering a range of health insurance products and services to individuals and employers. The company’s portfolio includes health, supplemental, and dental insurance plans, as well as pharmacy and behavioral health services. Cigna operates in the United States and over 30 other countries, providing coverage to over 182 million customers.

| Key Metrics | Cigna |

|---|---|

| Revenue (2022) | $184.4 Billion |

| Market Cap | $75.76 Billion |

| Number of Lives Covered | 182 Million |

Humana

Humana is a leading health and well-being company, focusing on providing access to care and improving the health of its members. The company offers a diverse range of health and specialty insurance products, including medical, dental, vision, and specialty plans. Humana also provides pharmacy benefit management services and health and wellness programs. The company’s coverage extends across the United States, with a focus on Medicare and Medicaid plans.

| Key Metrics | Humana |

|---|---|

| Revenue (2022) | $85.8 Billion |

| Market Cap | $55.37 Billion |

| Number of Lives Covered | 16.5 Million |

The Impact of Government Policies on Health Insurance

The American health insurance industry has been significantly influenced by government policies and initiatives, aimed at improving access to healthcare and ensuring the financial stability of the industry. One of the most significant interventions was the Affordable Care Act (ACA), often referred to as Obamacare.

The ACA introduced a series of reforms, including the expansion of Medicaid, the creation of Health Insurance Marketplaces, and the establishment of essential health benefits. These measures aimed to increase competition among insurers, improve the affordability of coverage, and ensure that all Americans had access to a minimum level of healthcare services.

The Affordable Care Act (ACA) and Its Impact

The ACA, signed into law in 2010, brought about several key changes to the health insurance landscape in America. Some of the notable impacts include:

- Individual Mandate: The ACA introduced a requirement for most individuals to have health insurance coverage, known as the individual mandate. This mandate aimed to increase the number of insured individuals and reduce the risk pool for insurers.

- Medicaid Expansion: The ACA expanded Medicaid eligibility to include more low-income individuals and families. This expansion aimed to provide healthcare coverage to a larger portion of the population.

- Health Insurance Marketplaces: The ACA established online marketplaces, known as Health Insurance Marketplaces, where individuals and small businesses can shop for and compare health insurance plans. These marketplaces provide a transparent and competitive environment for purchasing insurance.

- Essential Health Benefits: The ACA defined a set of essential health benefits that all health insurance plans must cover. These benefits include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, and pediatric services, including oral and vision care.

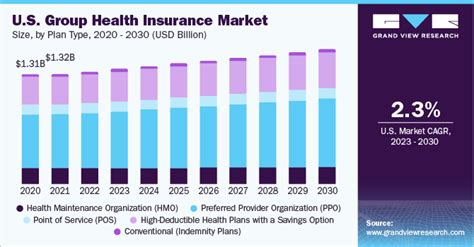

Future Prospects: The Evolution of Health Insurance

The future of health insurance in America is poised for significant evolution, driven by technological advancements, changing consumer preferences, and ongoing policy reforms. The industry is expected to undergo a digital transformation, leveraging technology to enhance customer experience, streamline operations, and improve the overall efficiency of healthcare delivery.

One of the key trends shaping the future of health insurance is the rise of value-based care models. These models shift the focus from volume-based reimbursement to value-based payment, incentivizing healthcare providers to deliver high-quality, cost-effective care. By rewarding providers for achieving positive health outcomes, value-based care models aim to improve the quality of healthcare while reducing costs.

Digital Health and Telemedicine

The integration of digital health technologies and telemedicine services is expected to revolutionize the way healthcare is delivered and accessed. With the widespread adoption of digital health tools, patients will have greater control over their health and access to care. Telemedicine, in particular, is poised to play a significant role in the future of health insurance, offering convenient and cost-effective healthcare solutions, especially for individuals in remote or underserved areas.

Consumer-Centric Approach

The future of health insurance is likely to be increasingly consumer-centric, with a focus on personalized healthcare solutions and patient-centric models. Insurance companies are expected to adopt more tailored approaches, offering customized plans and services based on individual health needs and preferences. This shift towards consumer-centricity will empower individuals to take a more active role in managing their health and healthcare decisions.

Policy and Regulatory Landscape

The policy and regulatory landscape will continue to play a crucial role in shaping the future of health insurance in America. Ongoing debates and reforms surrounding healthcare policy, including the future of the ACA and potential changes to Medicare and Medicaid, will significantly impact the industry’s trajectory. The balance between ensuring access to healthcare for all Americans and maintaining the financial stability of the industry will remain a key focus for policymakers.

FAQs

What is the primary role of health insurance companies in America?

+

Health insurance companies in America play a crucial role in providing financial protection to individuals and families against the high costs of medical care. They act as intermediaries between patients and healthcare providers, ensuring accessibility and affordability of medical services.

How has the Affordable Care Act (ACA) impacted the health insurance industry in America?

+

The ACA has brought about several key changes, including the individual mandate, Medicaid expansion, the creation of Health Insurance Marketplaces, and the establishment of essential health benefits. These reforms have increased competition, improved affordability, and expanded access to healthcare.

What are the future prospects for health insurance in America?

+

The future of health insurance in America is expected to be driven by technological advancements, changing consumer preferences, and ongoing policy reforms. Key trends include the rise of value-based care models, the integration of digital health and telemedicine, a shift towards consumer-centric approaches, and continued policy debates.